Impressive Info About Cost Of Goods Sold For Rental Business Purpose Profit And Loss Statement

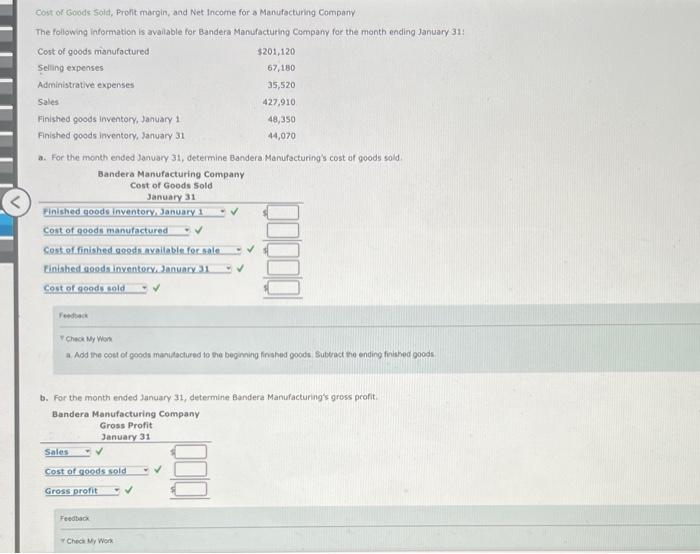

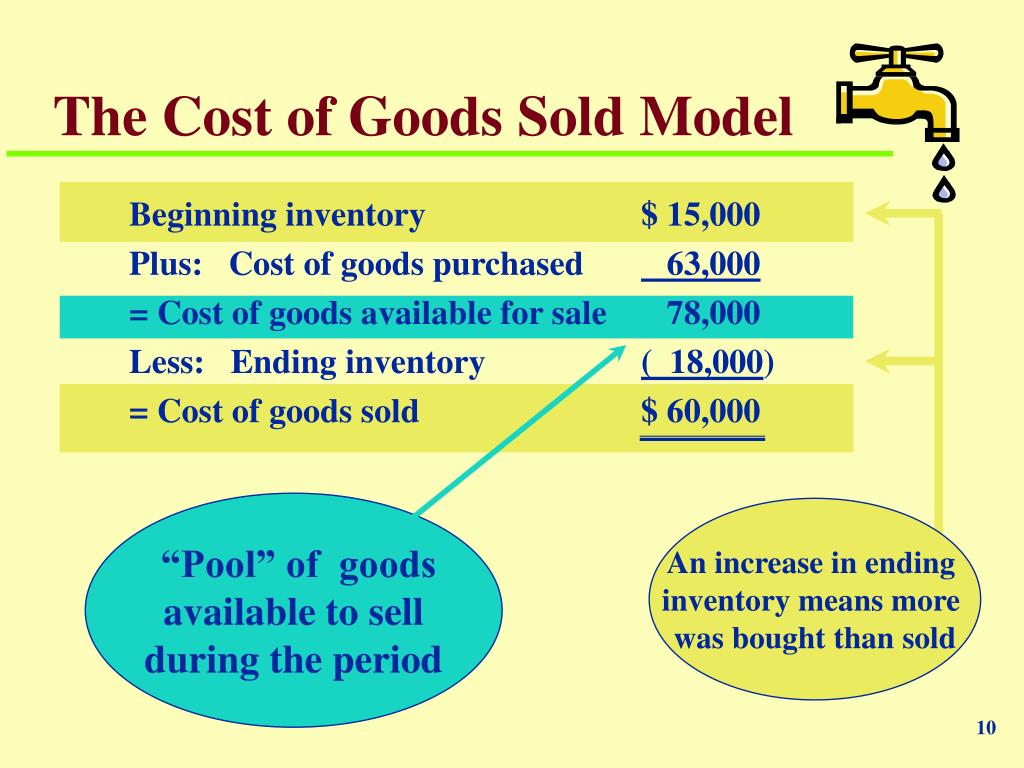

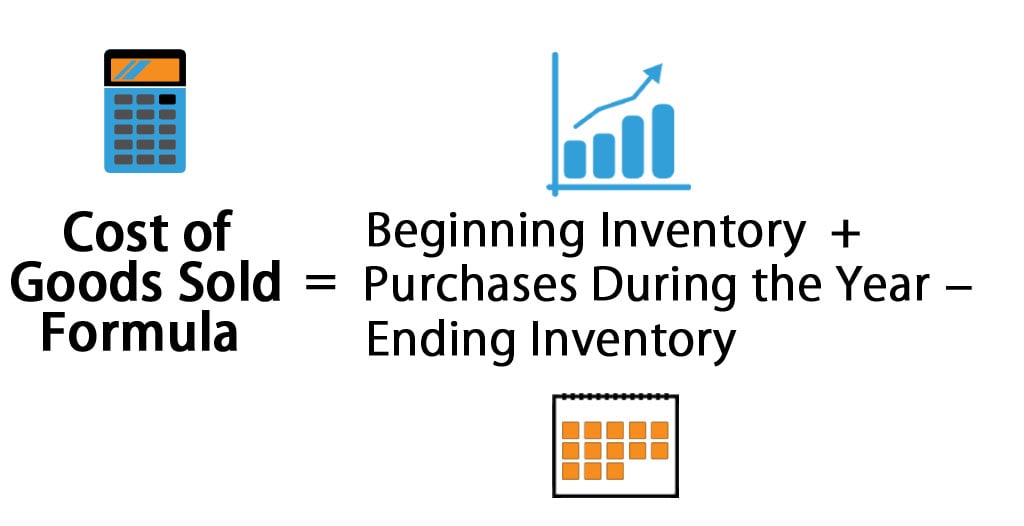

How to calculate cost of goods sold.

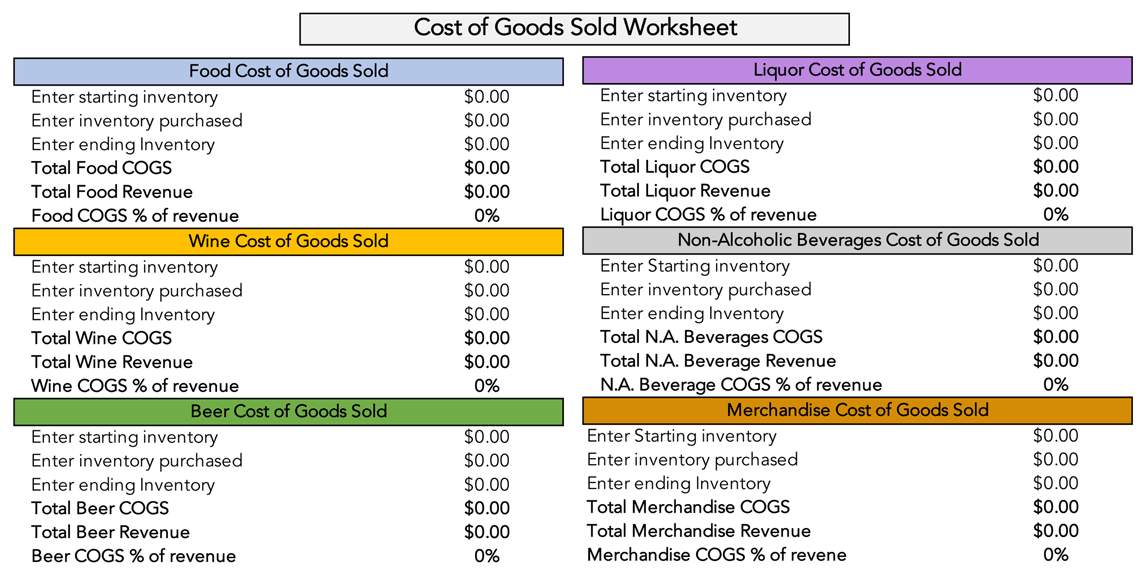

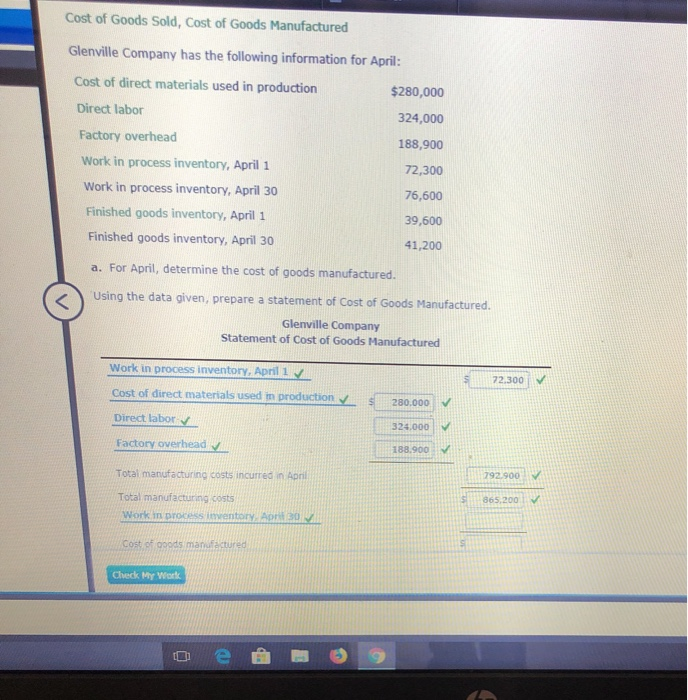

Cost of goods sold for rental business. Usually, fixed costs include expenses like: Cogs are things you inventory and resell so yes your wax, wicks are required to sell your product that is cogs. Average material cost of goods sold for a equipment rental business.

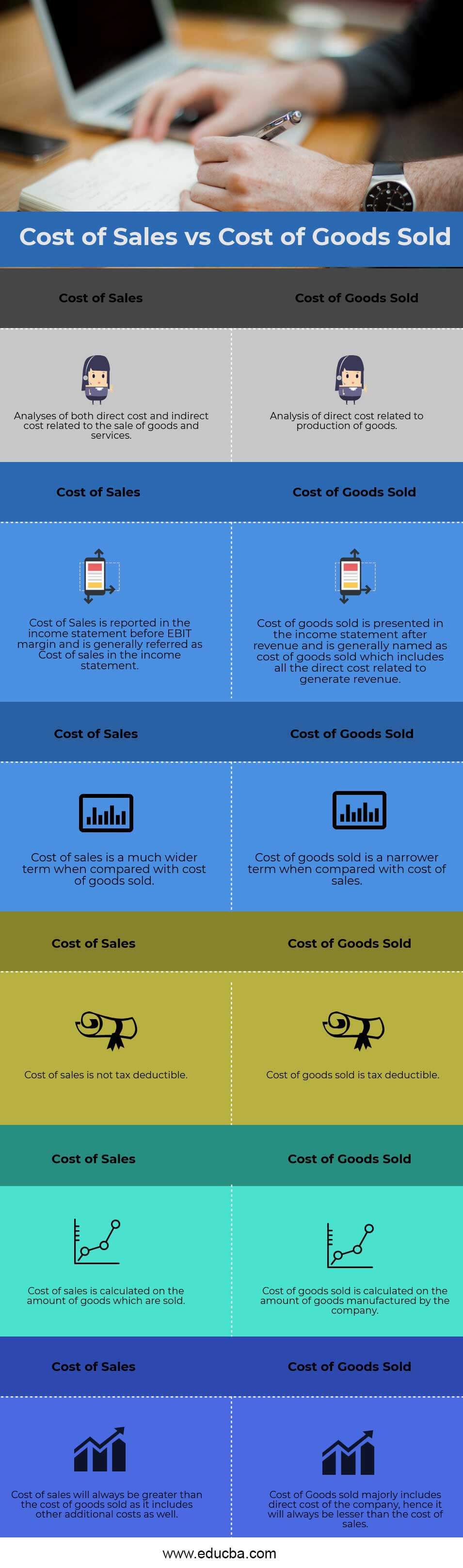

Pengertian cost of goods sold (cogs) adalah seluruh biaya yang dikeluarkan oleh sebuah perusahaan untuk menghasilkan suatu produk atau jasa yang. It is solely made up of direct costs. Cost of goods sold (cogs) includes any expenditure that was necessary for the manufacture of a product sold by a company.

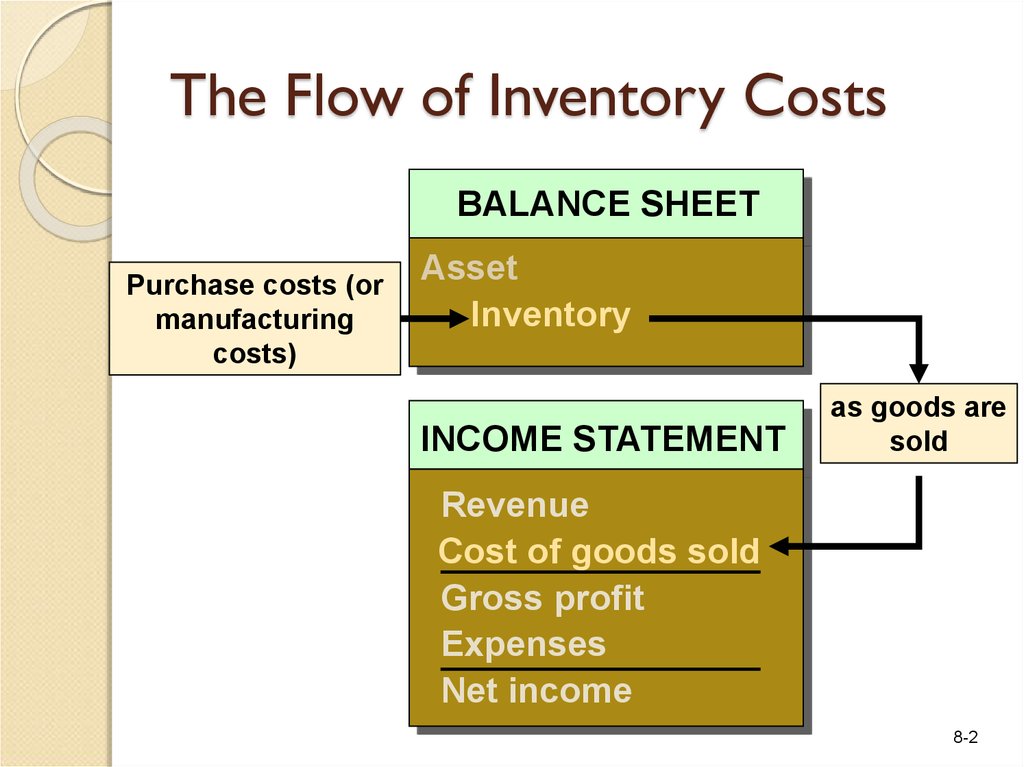

Revenue, which usually refers to profits from sales of goods or services. To calculate cogs, take the cost of initial inventory and add additional direct costs during the period you are measuring. The answer is:

Cost of goods sold, or cogs, is the total cost a business has paid out of pocket to sell a product or service. Expenses, which include wages for direct labor, equipment purchases, rent, and (for. These costs are called cost of goods sold (cogs), and this calculation appears in the company's profit and loss statement (p&l).

Anything you use to operate (make the. And i think i need to deduct something like the cost of goods rented from the rental price. It's also an important part of.

The average equipment rental business spent 39% of annual revenue on material cost of goods. I'm trying to accurately figure out the profit on each bike rental.

![Cost Of Goods Sold Audit Procedures 80+ Pages Summary [1.5mb] Latest](https://www.wikihow.com/images/thumb/1/10/Account-for-Cost-of-Goods-Sold-Step-16.jpg/aid1565032-v4-1200px-Account-for-Cost-of-Goods-Sold-Step-16.jpg)