First Class Tips About Net Financing Cash Flow Formula Direct Statement Template

You can calculate the net cash flow for each of the above activities using the following formula:

Net financing cash flow formula. Cash flow from financing activities (cff) is a section of a company’s cash flow statement,. The direct method compares expenditure and income within a certain period of time. Cash flow from financing activities formula debt issuances → cash inflow equity issuance → cash inflow share buybacks → cash outflow debt repayment → cash outflow dividends → cash outflow

Taking stock of your investments.unless you went to business school—or at least took an accounting or finance course—you’ve probably never given much thought to financial statements such as balance sheets, income statements, or statements of cash flow, right? Npv is used in capital. Cash flow formula:

Y11 into y12 checklist business; For investors and financial analysts, the net cash flow formula is an essential tool for evaluating the financial performance of a company and making informed investment decisions. By providing a means to unlock cash flow and improve working capital, credit cards effectively allow corporations to bridge the gap between when they have to pay their suppliers and when they get paid.

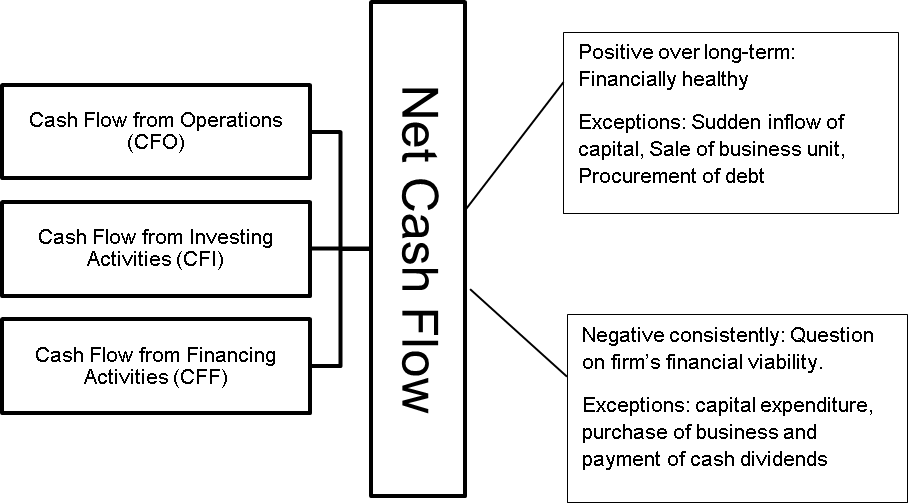

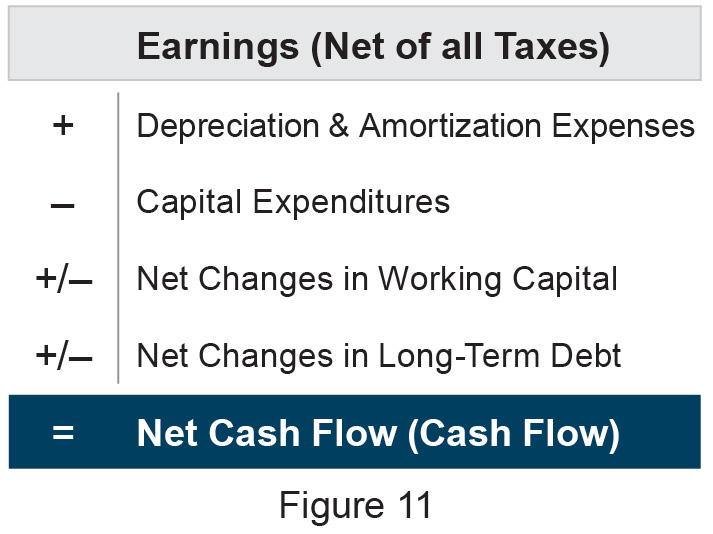

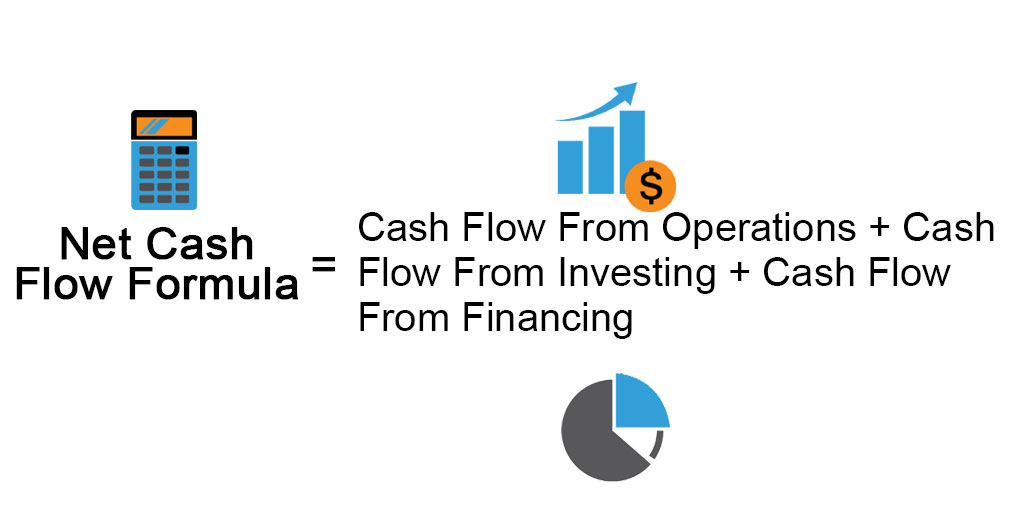

The net cash flow formula is figured out after adding the net cash flow from operating activities, net cash flow from investing activities, and net cash flow from financing activities. The same can also be calculated by subtracting the company’s cash payments from the cash receipts. The net cash flow of a company is calculated by subtracting all operation, financial, and capital dues from the cash earned by the company.

For a net book value of $32,000. Net present value (npv) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. Operating activity cash flow (cfo) + financing activity cash flow (cff) + investment activity cash flow (cfi) = net cash flow.

The basic net cash flow formula is straightforward and easy to use: To calculate net cash flow. Put simply, ncf is a business’s total cash inflow minus the total cash outflow over a particular period.

Direct method the cash flow formula according to the direct method is one way of calculating the cash flow balance so that other cash flow ratios can be determined later. Net cash flow is a financial metric businesses use to indicate how much cash is coming in and going out of the business during a given period. Net cash flow is commonly tracked on a monthly basis, but it can also be measured quarterly or annually.

Finance activities include the issuance and repayment of equity, payment of dividends, issuance and repayment of debt, and capital lease obligations. Net cash flow represents the amount of money your company produced (or lost, in the case of negative cash flow) during a given period. The formula looks as follows:

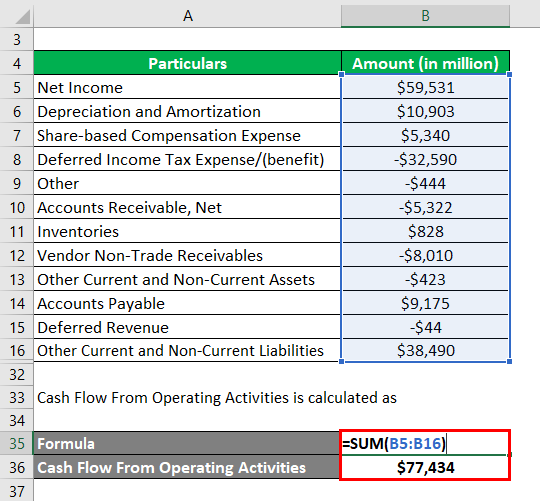

Then, to calculate your business’s net. Calculating the net cash flow of company x on the upper part of the balance sheet: Corporations can easily leverage their credit cards to.

Net income is the amount of revenue you have earned, calculated using the following formula: Net cash, a figure that is reported on a company's financial statements, is calculated by subtracting a company's total liabilities from its total cash. After two years, its net book value would.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)