Favorite Info About Prepare A Contribution Format Income Statement Starbucks 2019 Balance Sheet

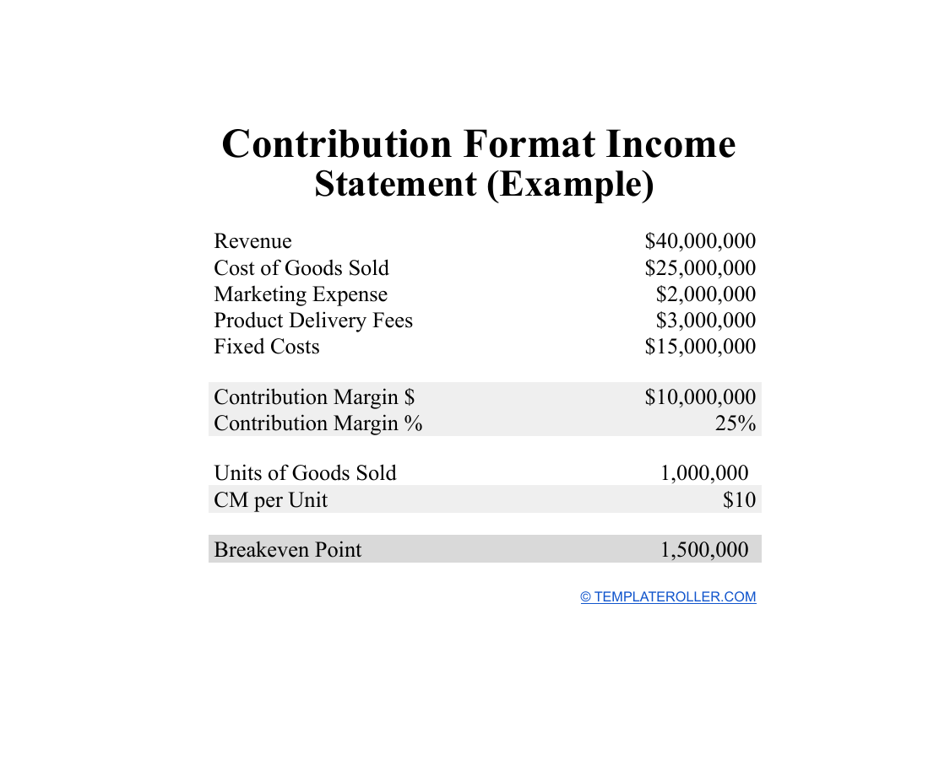

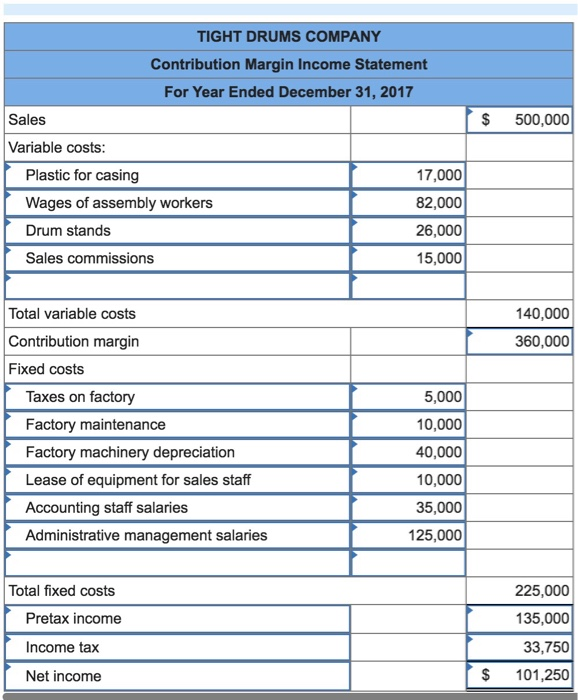

A contribution income statement is an income statement that separates the variable expenses and fixed costs of running a business.

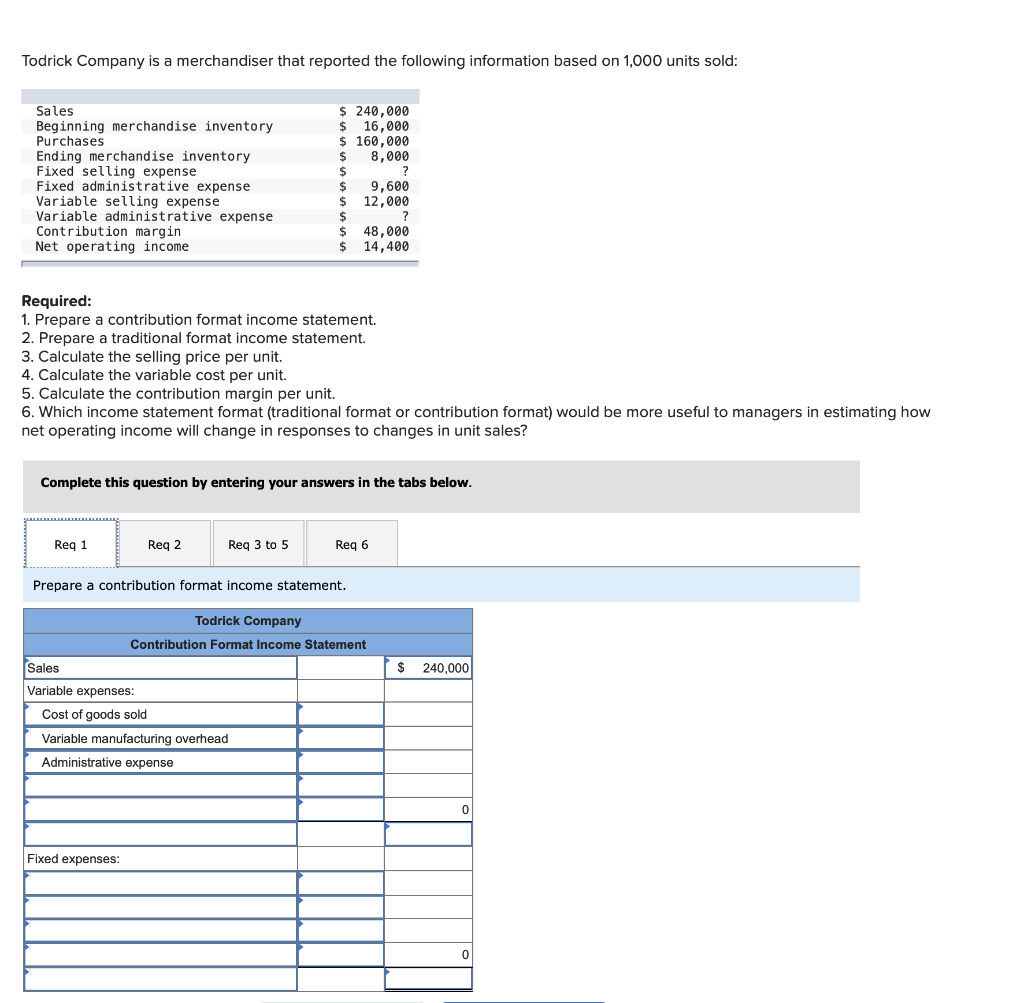

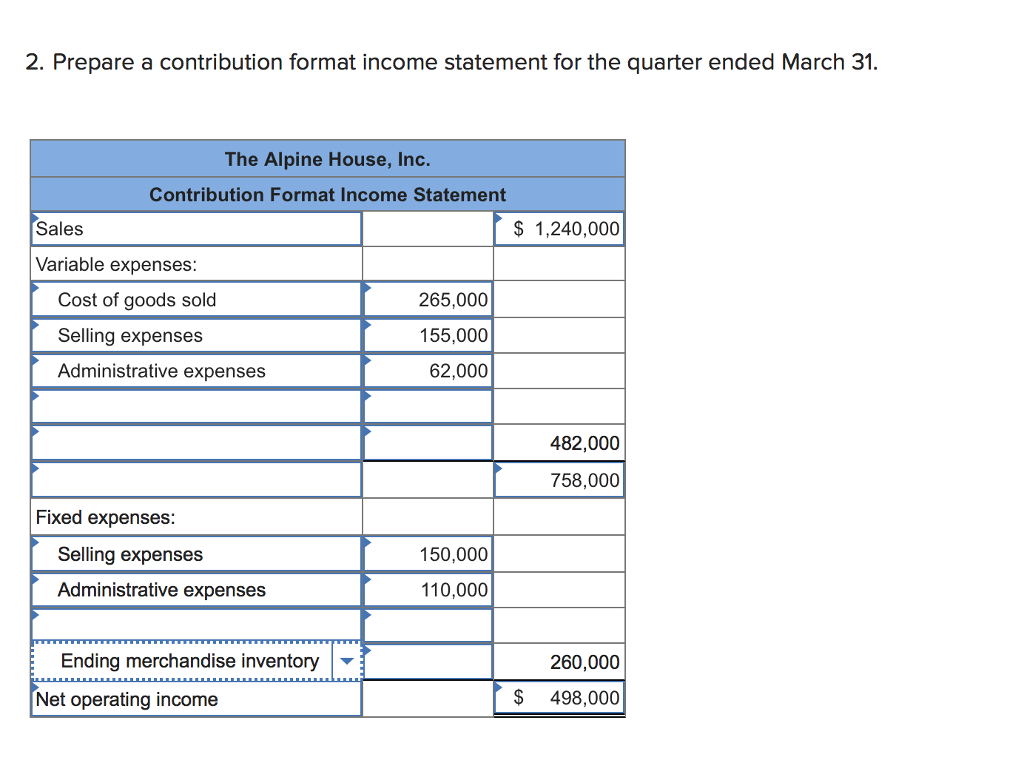

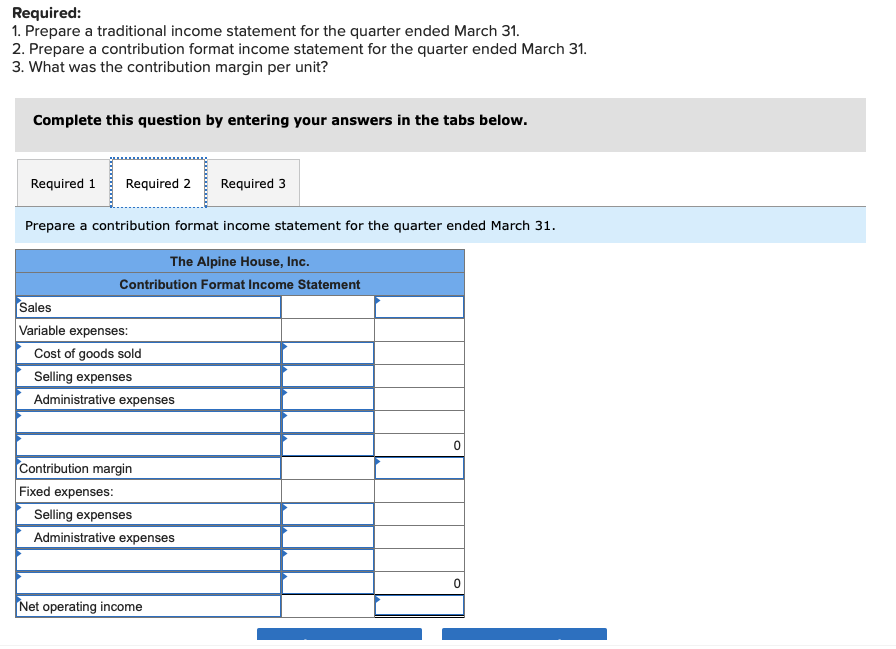

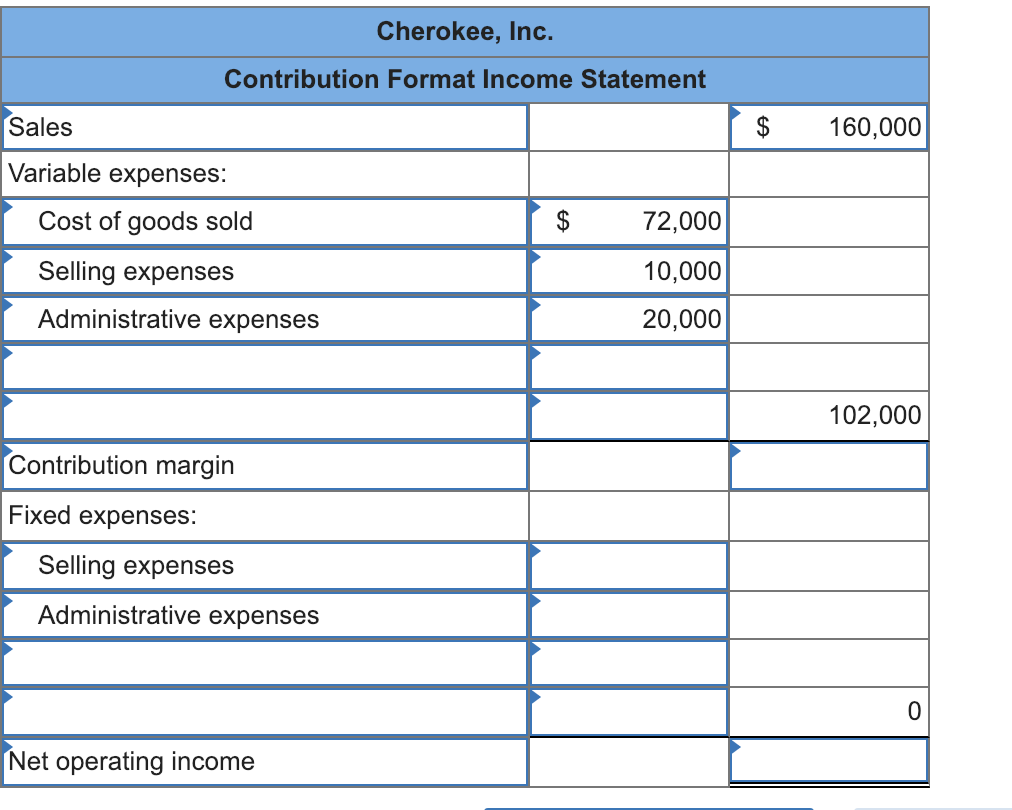

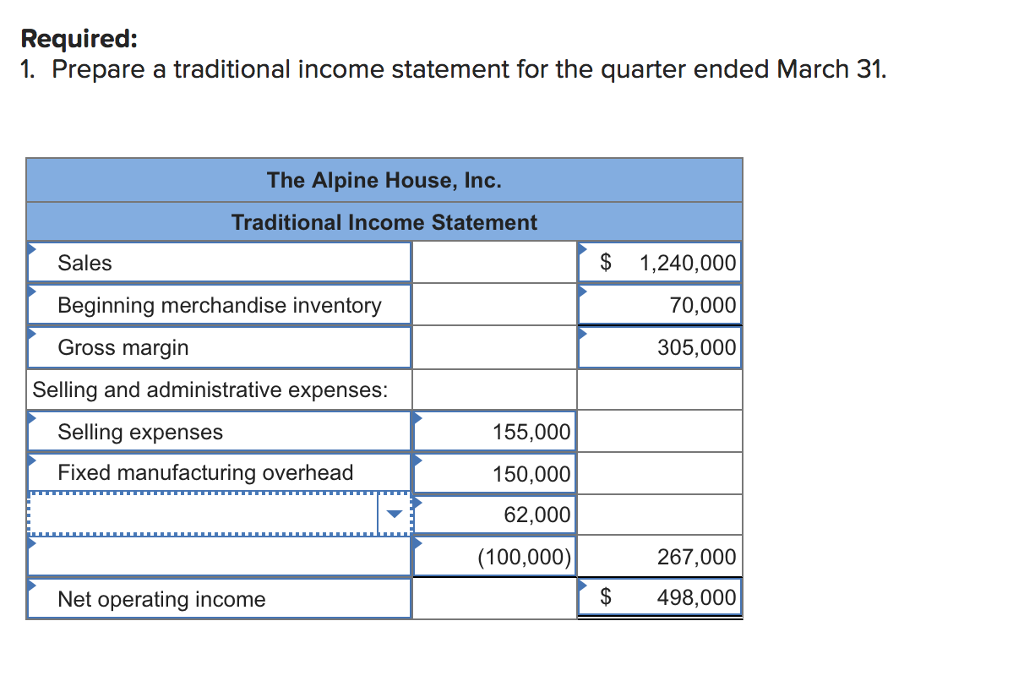

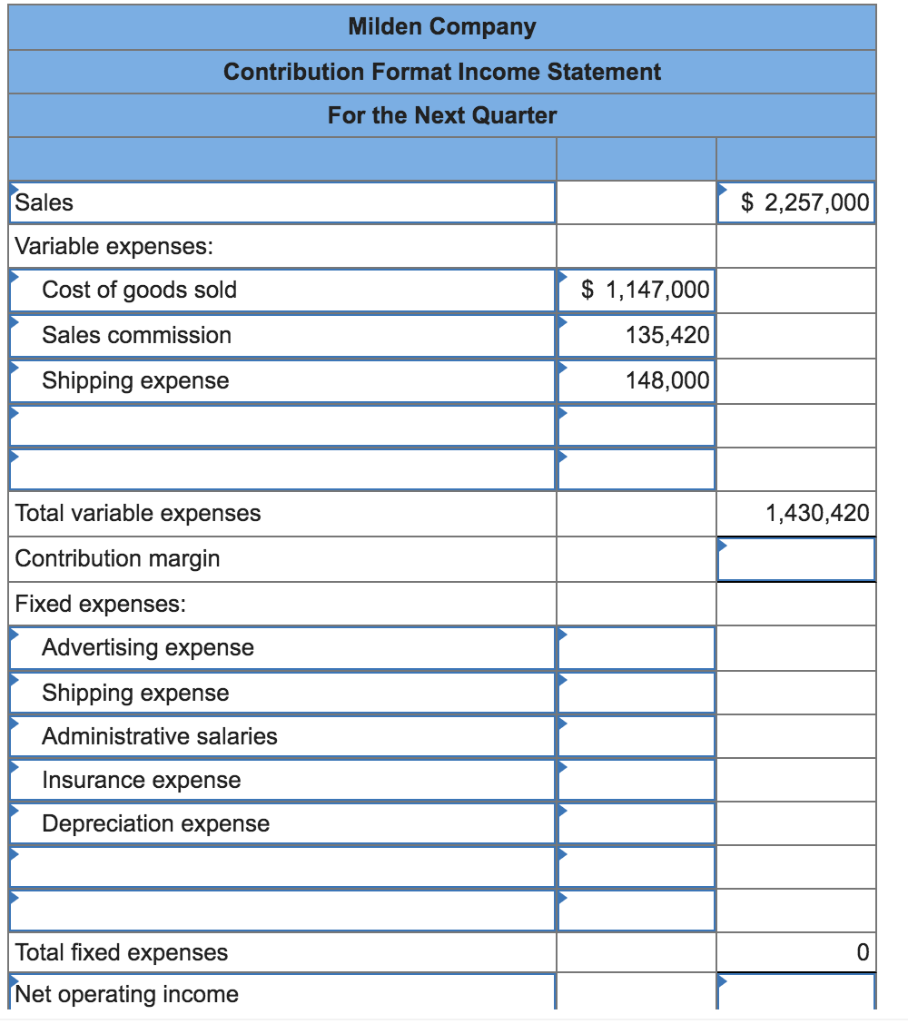

Prepare a contribution format income statement. A traditional income statement uses absorption or full costing, where both variable and fixed manufacturing costs are included when calculating the cost of goods sold. An effective tax rate is a rate used if the company applied the same tax rate consistently over the accounting period. This income statement is known as the contribution margin income statement or simply the contribution income statement.

This video discusses the contribution format income statement in managerial accounting. Calculate the contribution margin per unit. The contribution margin format also starts with revenue as the top line.

Present the income statement in the format shown above. Variable costing income statements separate costs from expenses; How do you fill out a contribution margin income statement?

A contribution margin format income statement is a financial tool that highlights variable costs and the contribution margin. In many cases, direct labor is categorized as a fixed expense in the contribution margin income statement format, rather than a variable expense, because this cost does not always change in direct proportion to the amount of revenue generated. The estimated tax amount comes from using an effective tax rate.

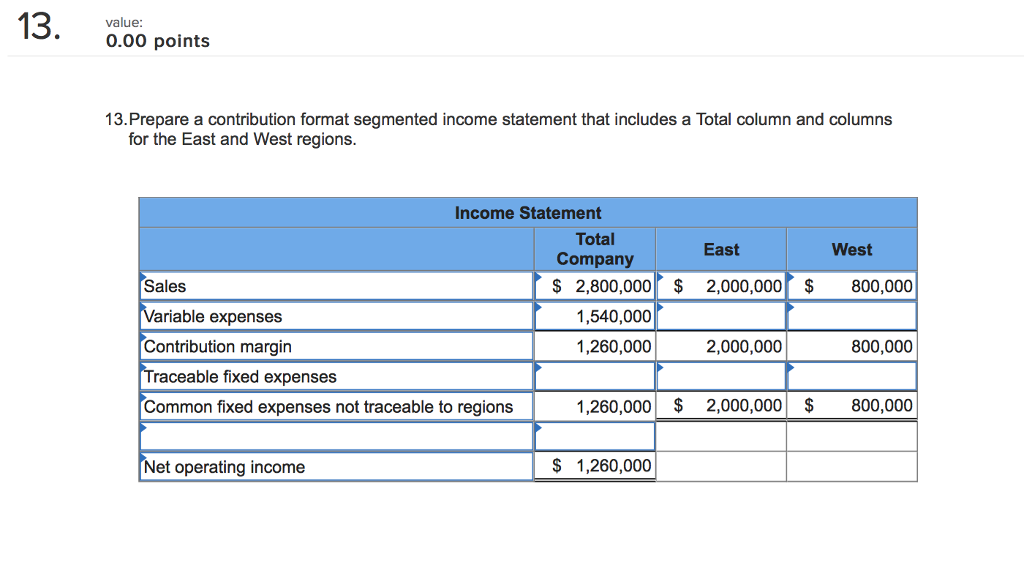

Here we discuss components, the format of contribution margin income statement along with an example, advantages, and disadvantages. The contribution margin income statement organizes the data in a way that makes it easier for management to assess how changes in production and sales will affect operating profit. Prepare a contribution format income statement segmented by divisions.

It separates fixed and variable expenses, providing clear insight into profitability. Variable expenses are subtracted from sales to calculate the contribution margin. To do this, you'll need your sales revenue and variable cost information.

Prepare a contribution format income statement for the month based on actual sales data. This has been a guide to contribution margin income statement. The contribution margin represents sales revenue left over after deducting variable costs from sales.

How to calculate contribution margin? However, instead of showing cost of goods and operating expenses, a contribution. The marketing department has proposed increasing the west division's monthly advertising by $\$ 15,000$ based on the belief that it would increase that division's sales by $20 \%$.

The formula for your contribution margin is: The contribution margin format is used to prepare segmented income statements. The marketing department has proposed increasing the west division's monthly advertising by $27,000 based this problem has been solved!

Cost behavior is how a cost reacts to changes in production or sales quantity. The first step in creating your contribution margin income statement is to calculate the contribution margin. What is net income and.