Spectacular Info About Differentiate Between Income Statement And Balance Sheet Increase Accounts Receivable Cash Flow

The topline of your business.

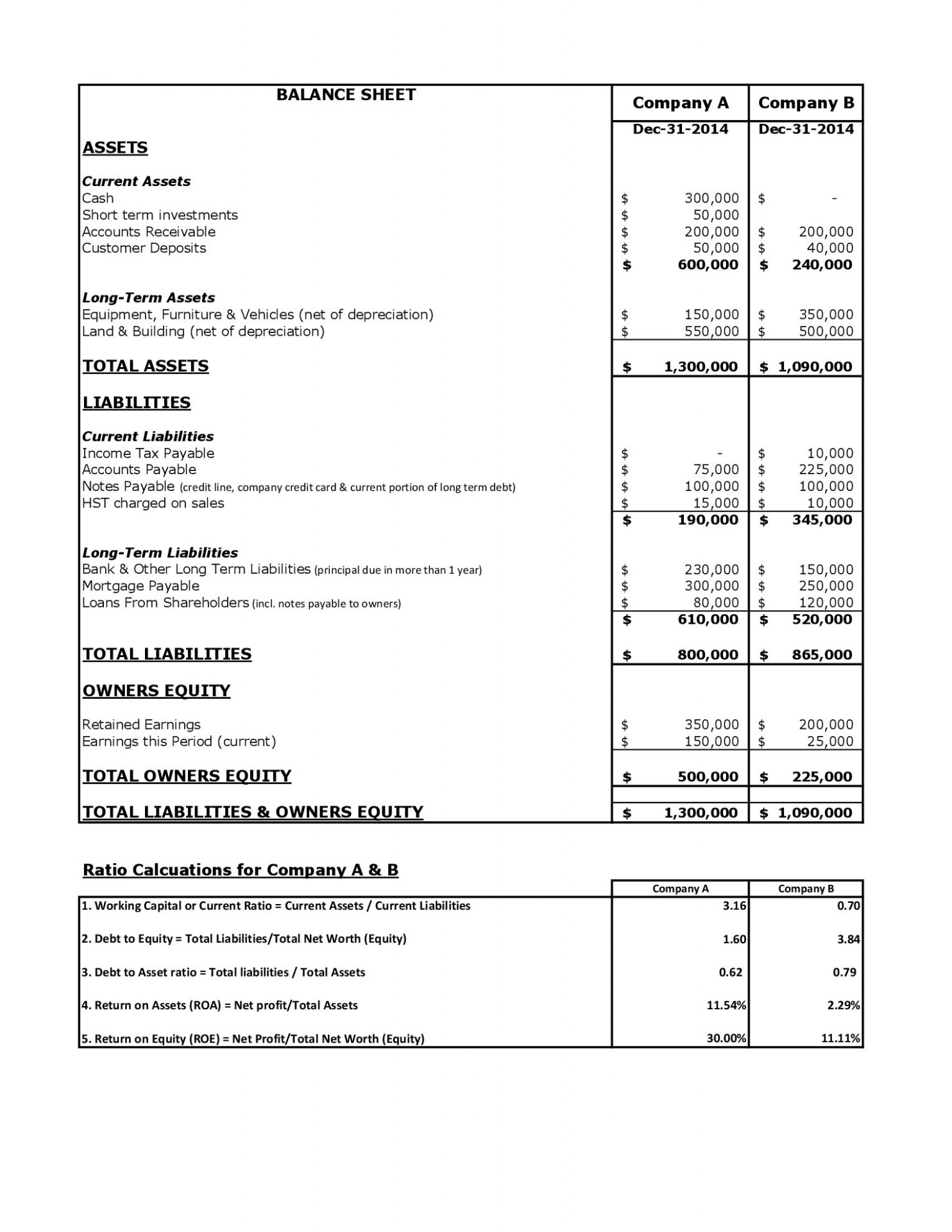

Differentiate between income statement and balance sheet. The income statement also notes any tax expense, while the balance sheet contains any unpaid tax liabilities. What are the differences between a balance sheet and income statement? The balance sheet shows a company’s total value while the income statement shows whether a company is generating a profit or a loss.

Balance sheets show the value of a company. Let’s define the terms that make up your income statement. In this article, we explain the income statement and the balance sheet and discuss key differences between them.

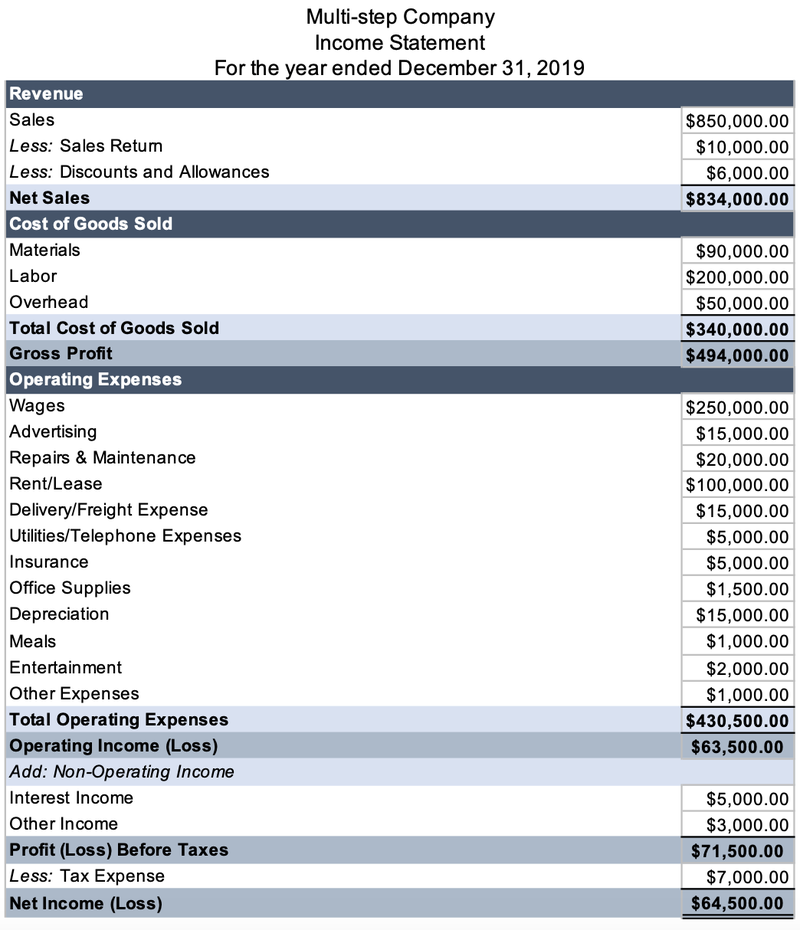

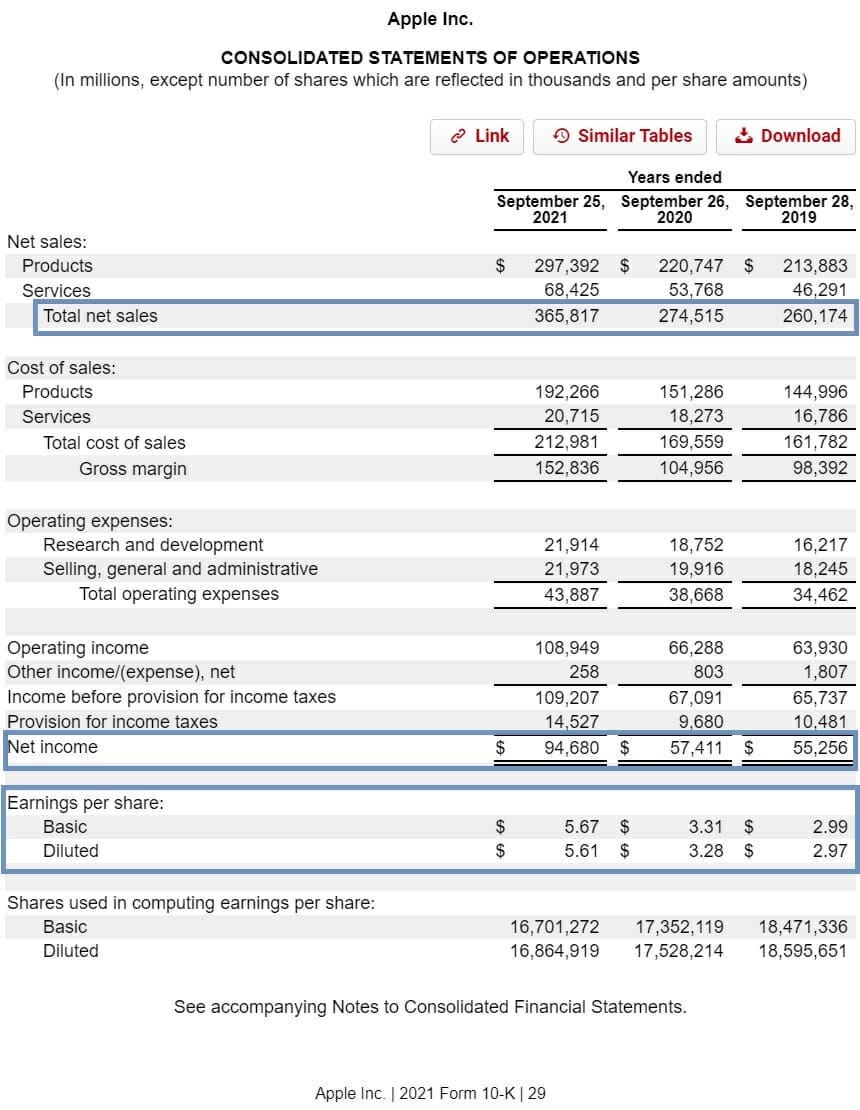

An income statement shows a company’s revenue, expenses, gains and losses over a longer period of time. Income statement vs balance sheet an income statement and a balance sheet are two significant financial statements in accounting, and both statements have their own individual purpose and identity. In this article, we discuss what these two financial reports are and share the differences between a balance sheet versus an income statement.

They are important, yet very different. Discover the importance and how to read them. Here's an overview of what you can find on.

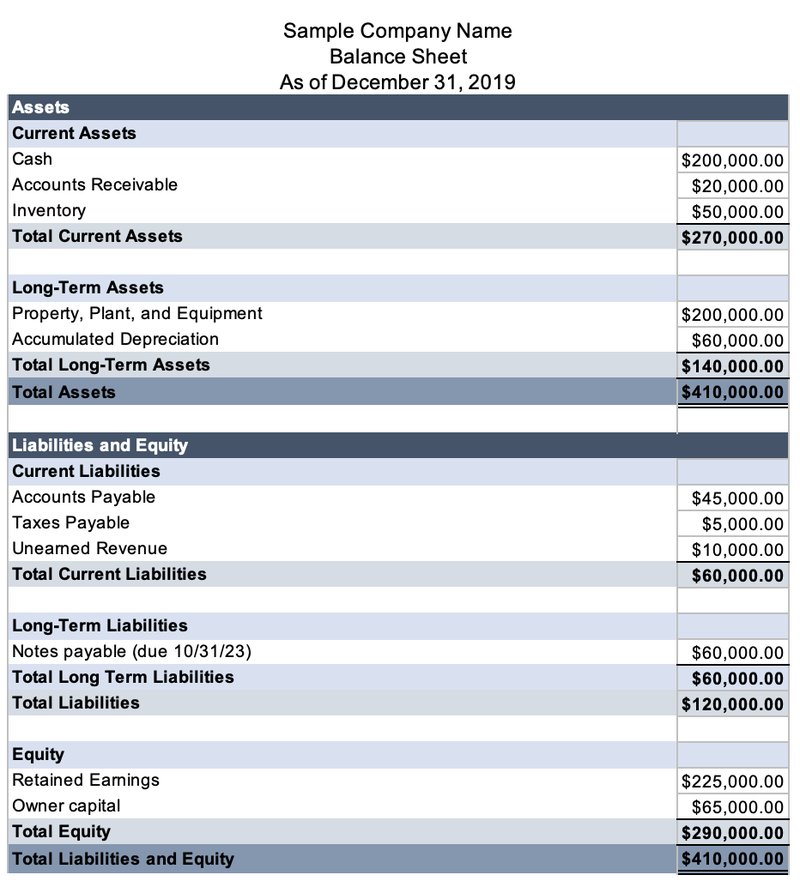

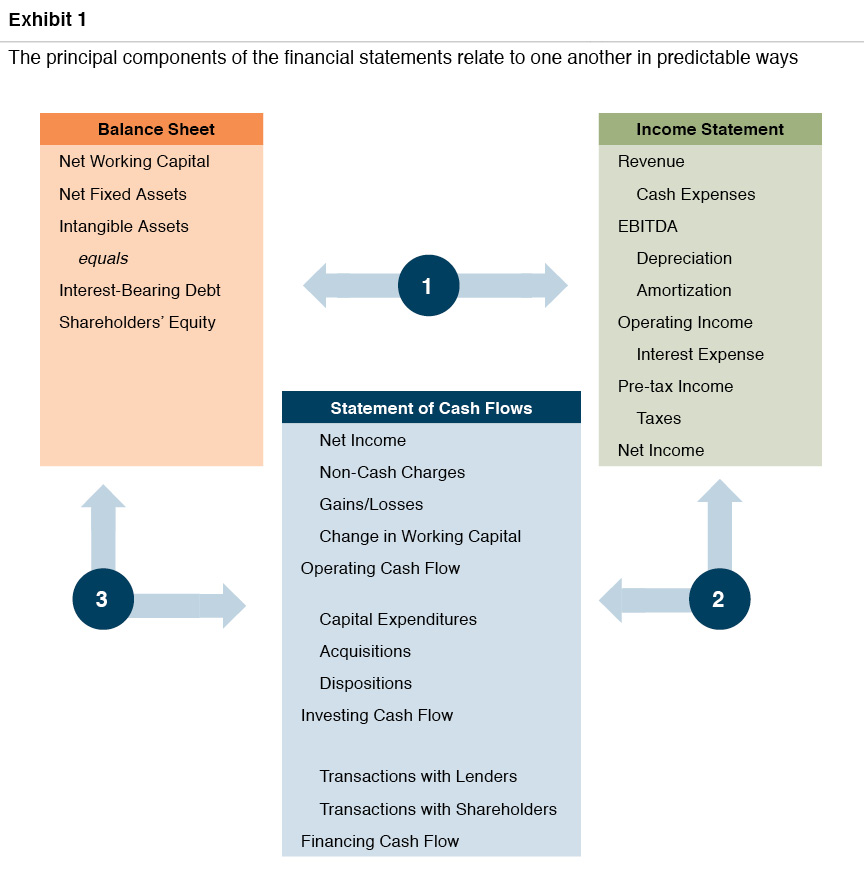

The cash flow statement reports cash received or paid. The balance sheet reports assets, liabilities, and equity, while the income statement reports revenues and expenses that net to a profit or loss. Income statement diffen › business › accounting in financial accounting, the balance sheet and income statement are the two most important types of financial statements (others being cash flow statement, and the statement of.

The balance sheet and income statement are both part of a suite of financial statements that tell the story of a business’s history. We’ll clarify the differences between the two and cover why and when you need to utilize the pair together. An income statement, also called a profit and loss statement, reports a company's financial performance over a particular period of time.

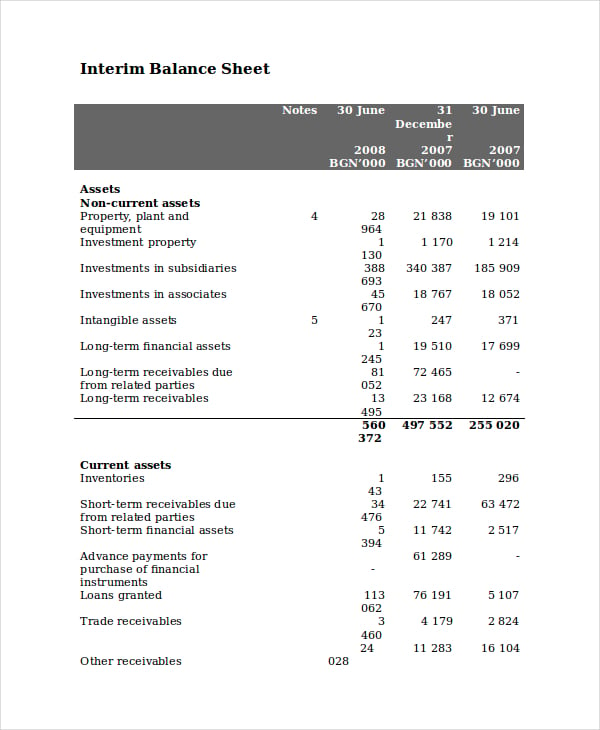

A balance sheet shows a company’s assets, liabilities and equity at a specific point in time. On the other hand, the income statement shows the company’s total income and expenditure over some time. Net income and retained earnings as mentioned earlier, the financial statements are linked by certain elements and thus must be prepared in a.

Differentiate between expenses and payables. Income statements focus on revenue and expenses. During the period close process, all temporary accounts are closed to the income summary account, which is then closed to.

Financial statements report a company's financial information. And the balance sheet gives you a snapshot of your assets and liabilities. Together, they’re a financial force to reckon with.

The difference between a balance sheet and an income statement is the information they show and the period of time they cover. Identify connected elements between the balance sheet and the income statement. Your income statement shows your profits and losses over time, outlining your revenues and expenses.

.png)