Awe-Inspiring Examples Of Info About Interim Period Accounting 3 Month Profit And Loss Statement

In the context of accounting cycles, it is the time between these designated reporting periods.

Interim period accounting. Feb 21, 202407:31 pst. The “interim period” is the period beginning on january 1, 2022, and endingon june 30, 2024.1 2. This whitepaper addresses income tax reporting for interim periods within an annual period.

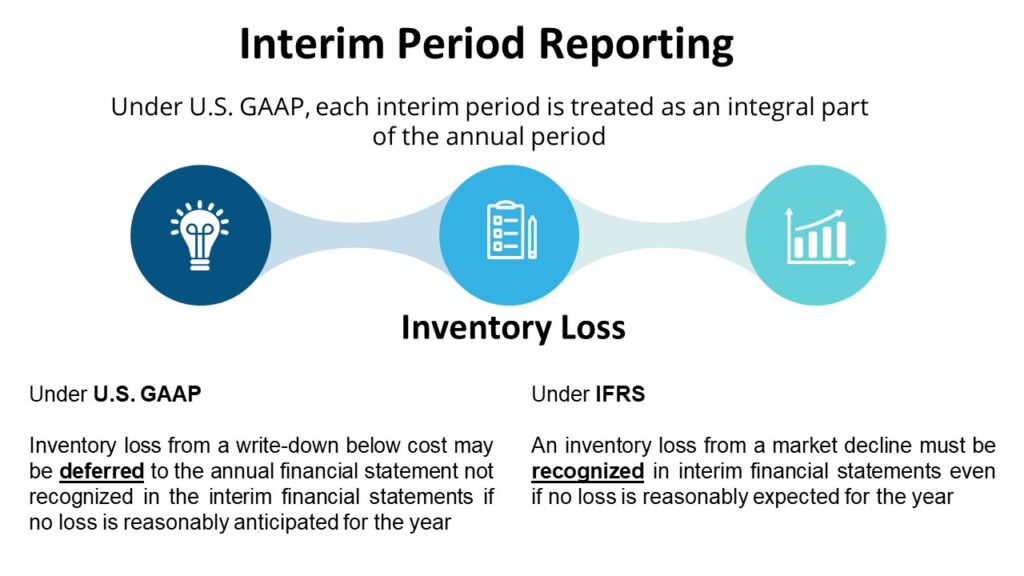

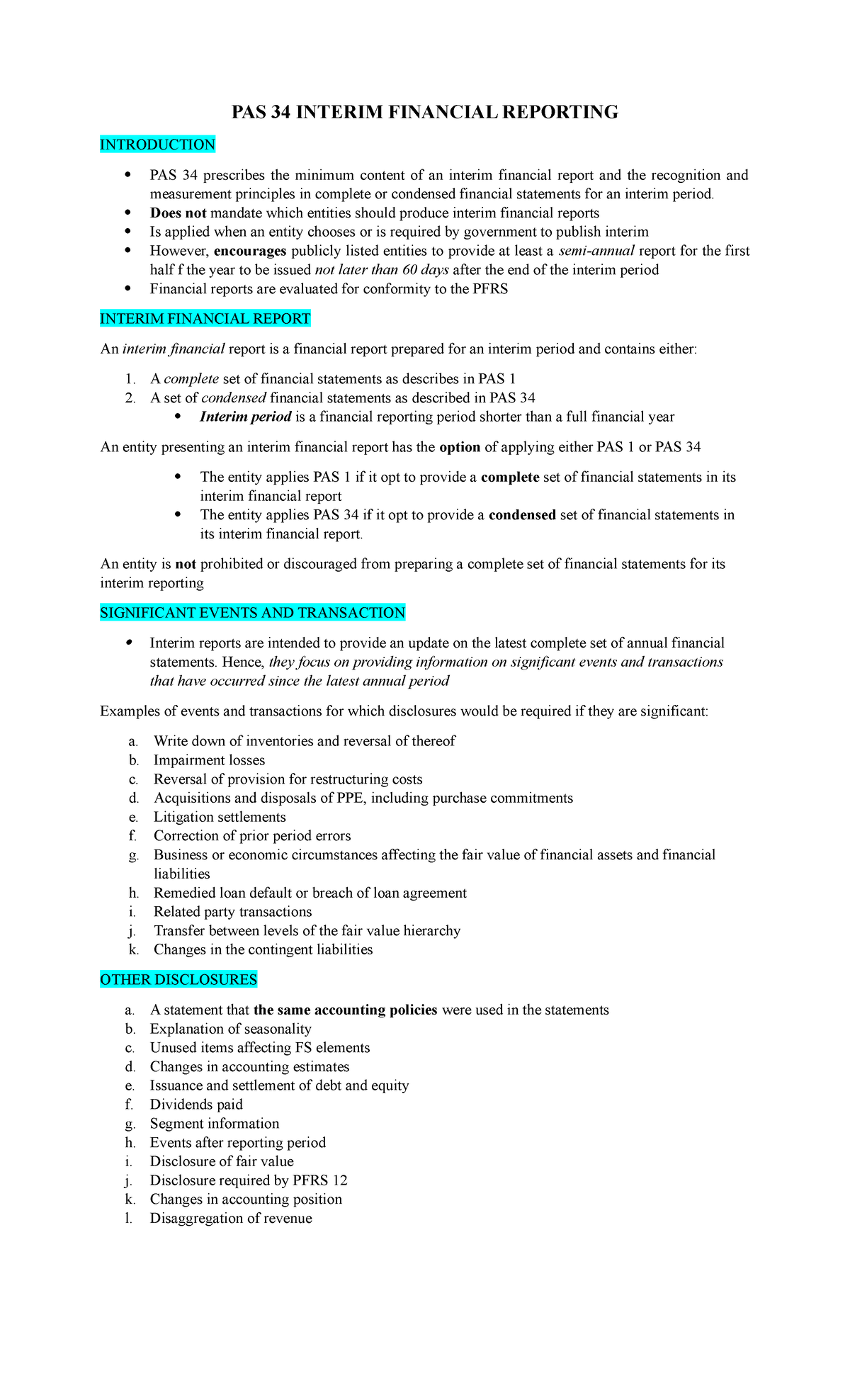

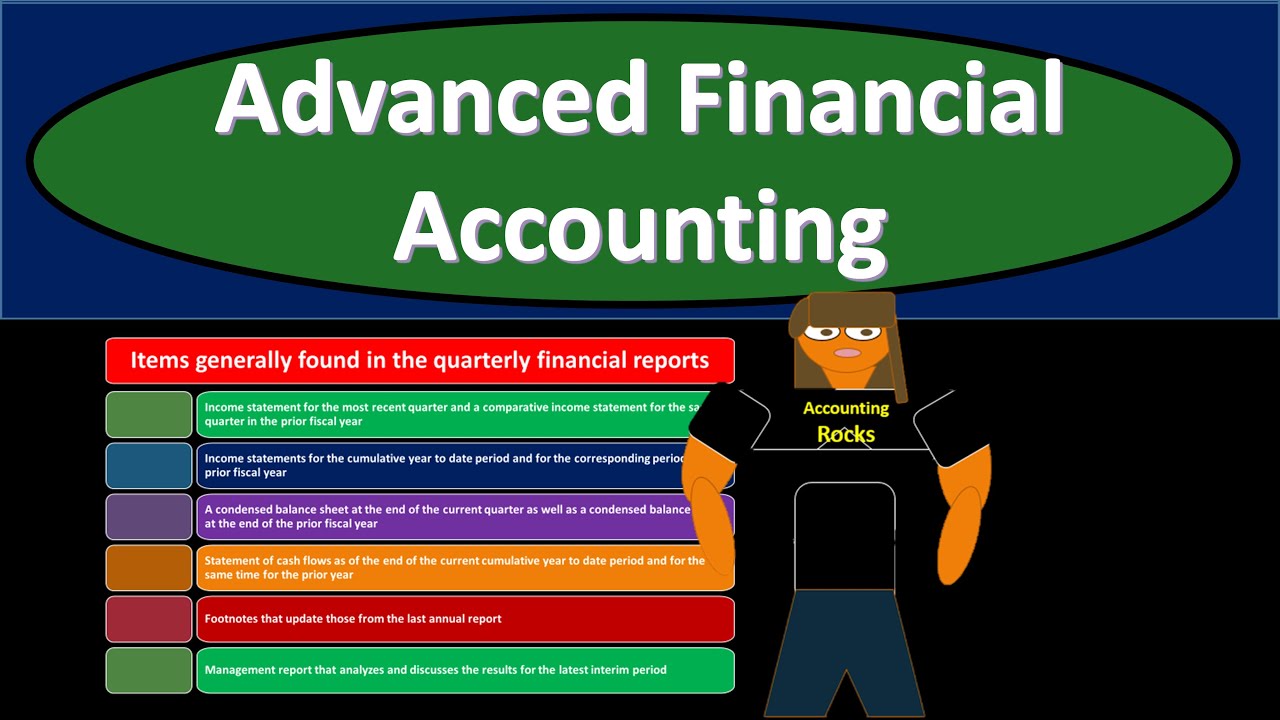

[ias 34.4] interim financial report:a financial report that contains either a complete or condensed set of financial statements for an interim period. Under us gaap, each interim period is viewed as an integral part of the annual period to which it relates. Interim reporting is usually required of any company that.

16.1 overview—accounting for income taxes in interim periods. Ifrs 16 must first be applied to. In april 2001 the international accounting standards board adopted ias 34 interim financial reporting, which had originally been issued by the international accounting.

Interim reporting is the reporting of the financial results of any period that is shorter than a fiscal year. Interim financial report means a financial report containing either a complete set of financial statements (as described in ias 1 presentation of financial statements (as revised in. [ias 34.4] interim financial report:

What is an interim period? This requires an understanding of how to calculate an estimated. Interim refers to the intervening time between set periods.

The content of annex to the october 21 the joint. This gives rise to multiple differences in practice. Interim accounting methods can be integral, discrete or a combination of the two.

The objective of this standard is to prescribe the minimum content of an interim financial report [refer: An interim period is defined as any financial reporting period that is shorter than a full financial year. A financial reporting period that constitutes a part of a full accounting year.

It is a part of the current accounting year that has passed by or is reportable for the time being. An accounting change that affects only interim periods (such as in the method of recognizing advertising expenses in interim periods) is acceptable only if it is preferable. Accounting policy choice applies for interim reporters.

The integral method stems from the view that interim accounting periods help. Ias 34 mandates the presentation of only condensed financial. Sees loss for 2023 interim period of hk$18 million.