Impressive Info About Is Dividends On The Income Statement What Are Financial Statements Prepared From

![[Solved] Following are the statement for 2018 and the](https://media.wallstreetprep.com/uploads/2021/10/09182412/Retained-Earnings-Example-Apple-AAPL.jpg)

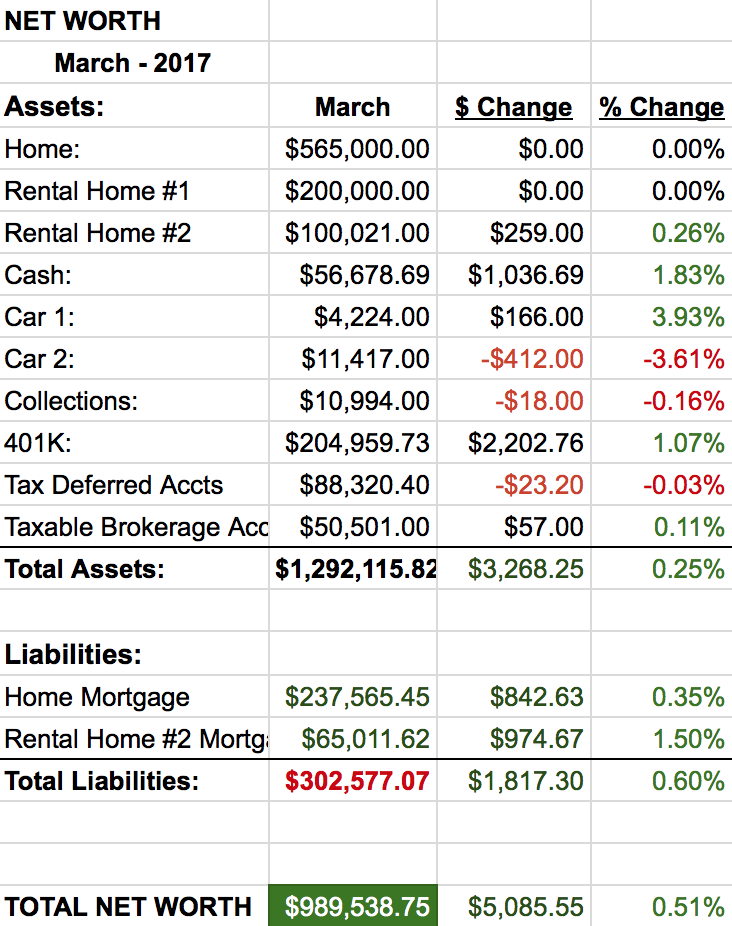

Cash or stock dividends distributed to shareholders are not recorded as an expense on a company's income statement.

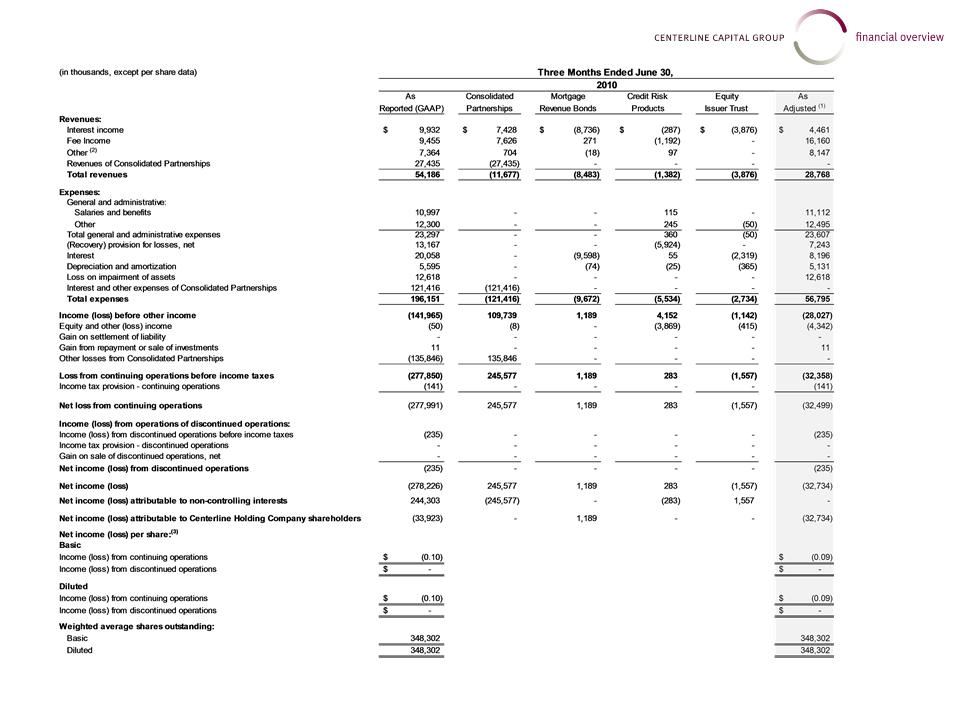

Is dividends on the income statement. While they are usually cash, dividends can also be in the. Dividends do not go on the income statement at all. Instead, it affects the other financial statements.

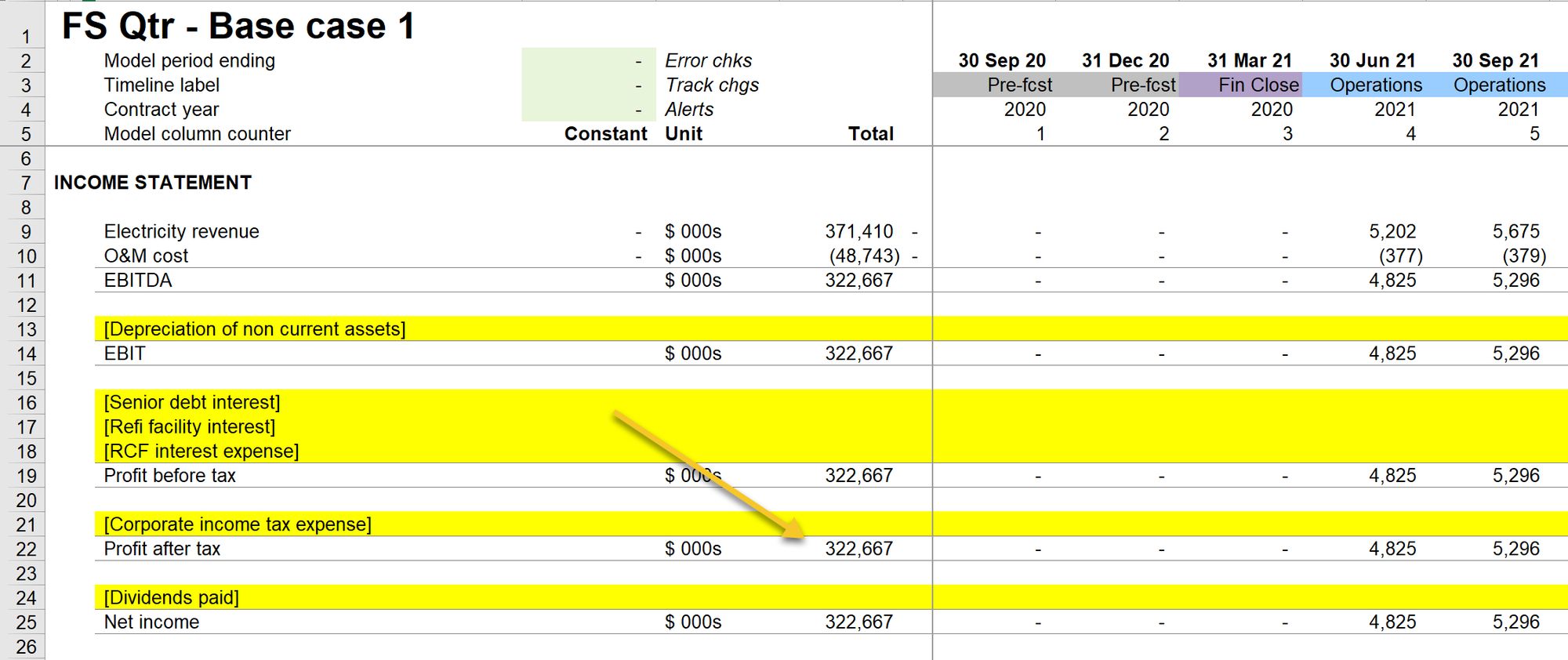

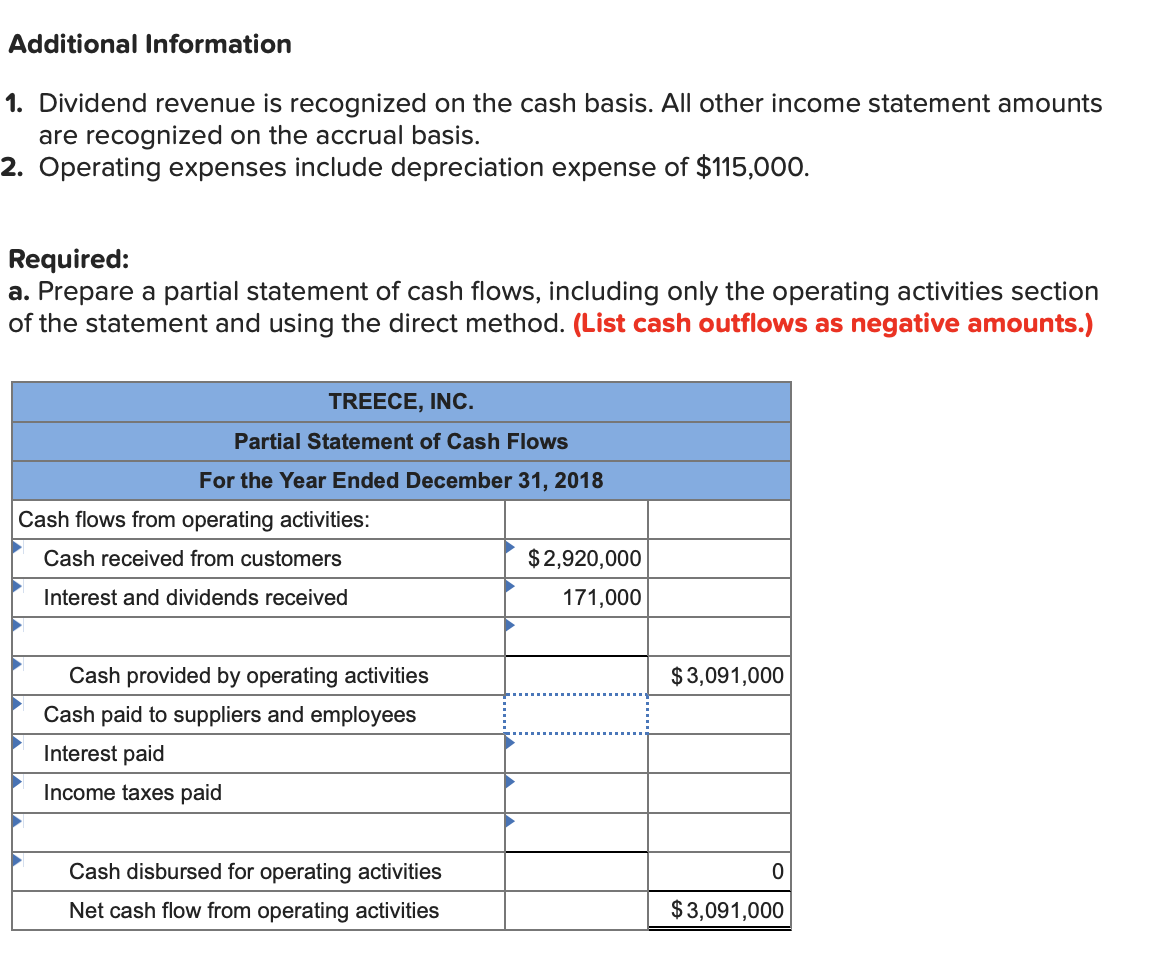

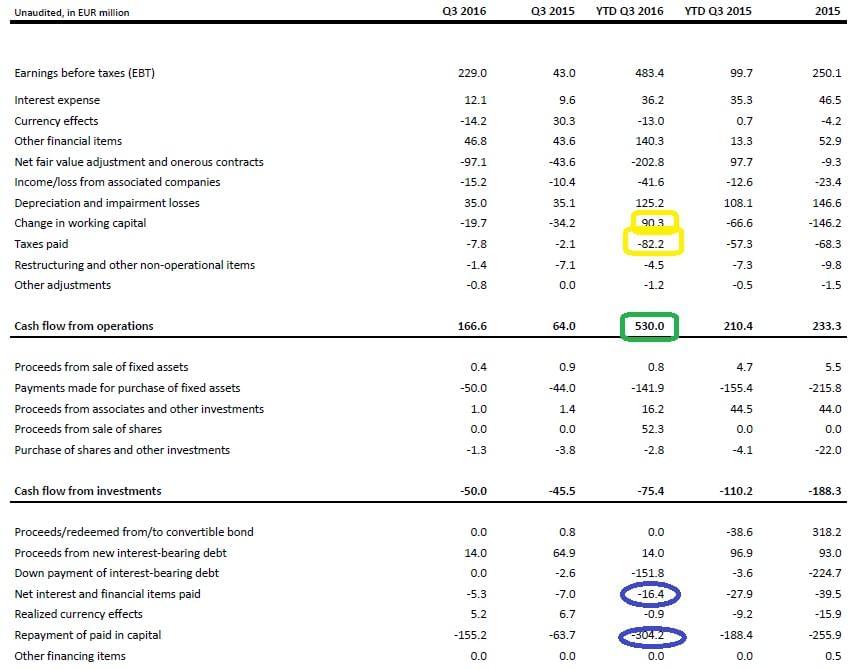

Dividends paid will appear in the financing activities section of the cash flow statement. Dividends are not an expense (or loss) of the corporation, and will not be reported as one of the expenses on the corporation's income statement. Feb 21, 2024, 3:00 am est.

Assuming you retire today at 65, the average cpp is. Before understanding why dividends don’t go on the income statement, one must study its elements. Statement of retained earnings / statement of changes in.

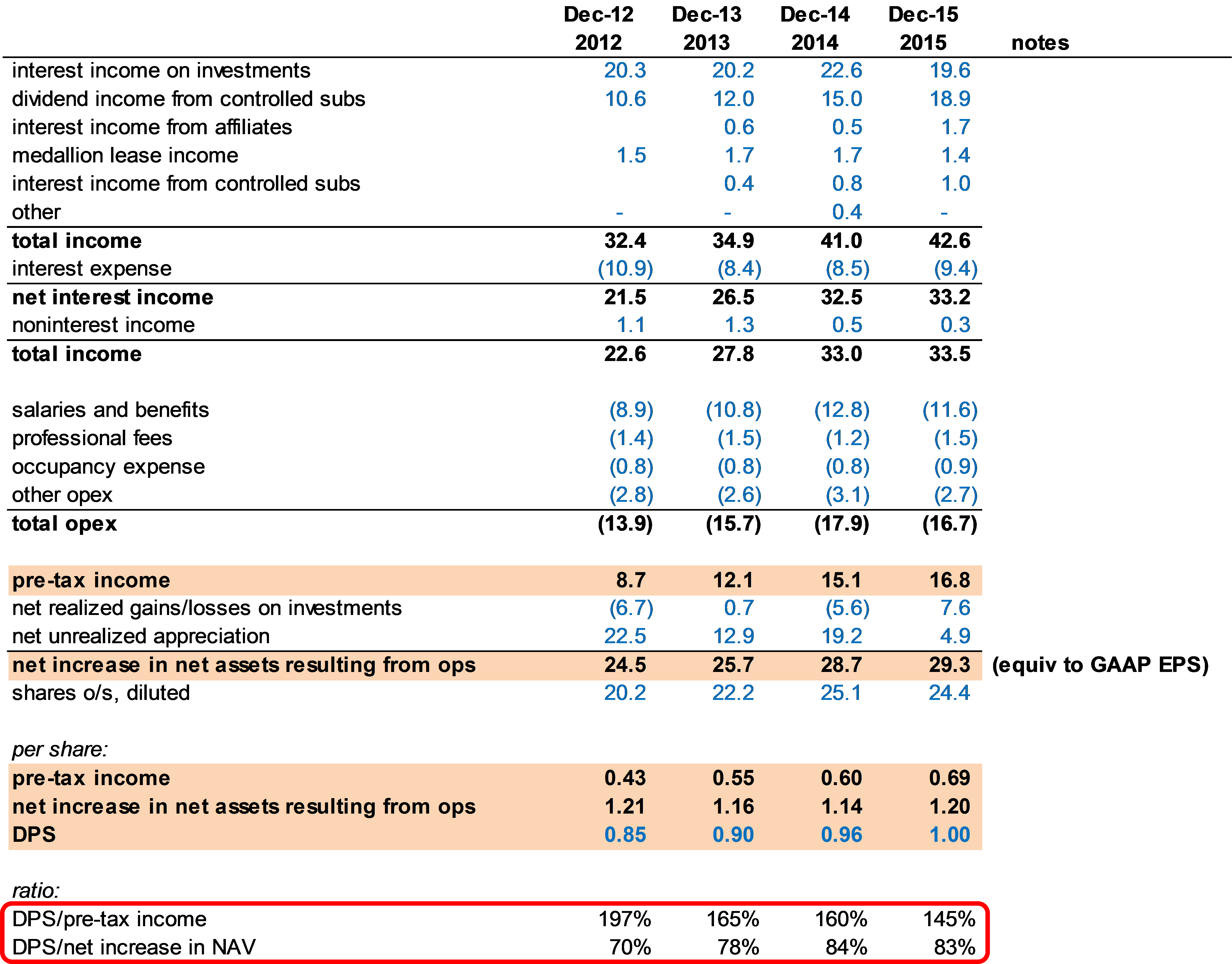

Consolidated net income (2) was € 3,789 million (2022: Finance where is dividends on financial statements published: The total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders.

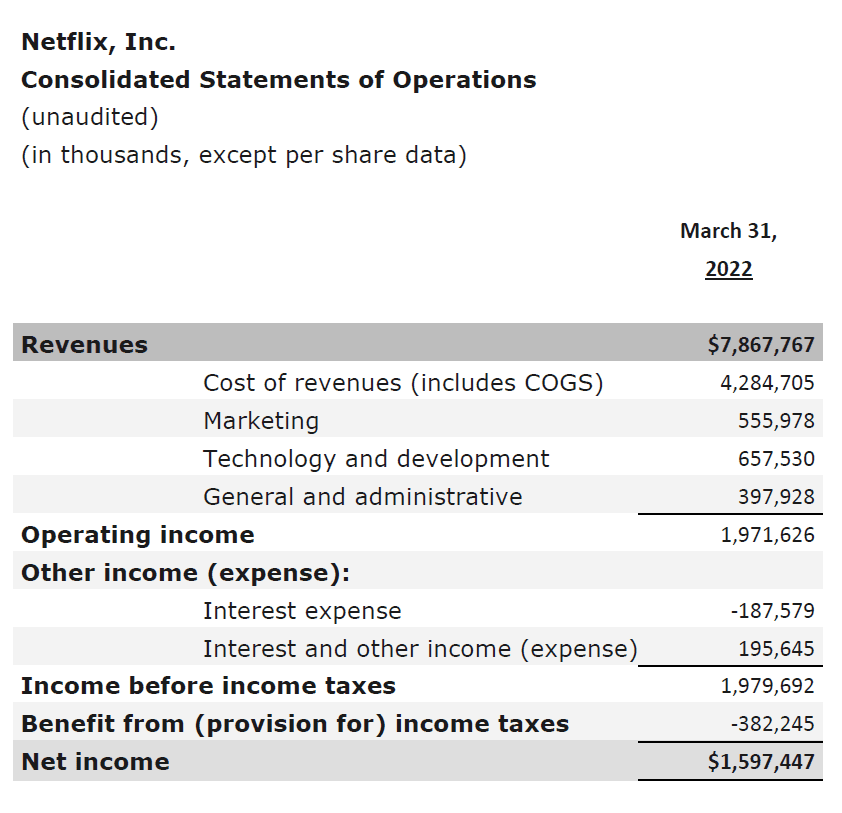

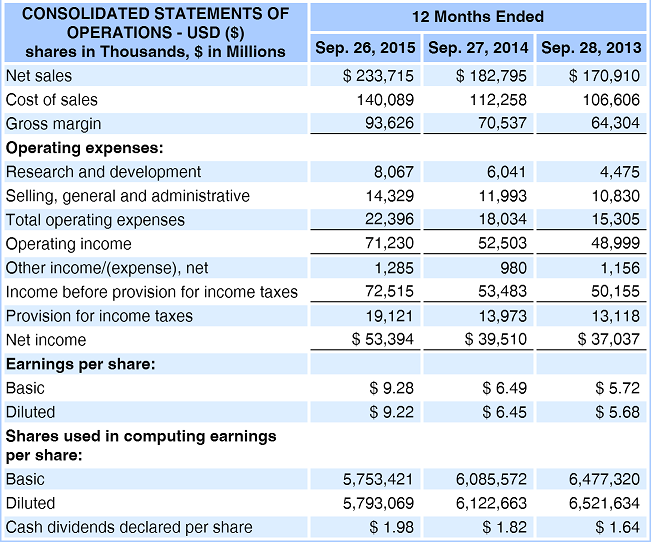

The income statement reports three components, revenues, expenses, and profits. Stock and cash dividends do not affect a. However, dividends on preferred stock will appear on the income statement.

The indirect method of disclosing dividends on the cash flow statement involves adjustments to net income. Regular cash dividends paid on common stock are not deducted from the income statement. December 23, 2023 learn where dividends are reported on financial statements and.

While a balance sheet provides the snapshot of a company’s financials as of a particular date, the income statement reports income through a specific period,. However, they do decrease shareholders' equity and the company's cash balance by the. The income statement is not affected by the declaration and payment of cash dividends on common stock.

For example, suppose a company made $10 million in profit and. Dividend income is defined by the irs as any distribution of an entity's property to its shareholders. Traditional ira income increased by 3.24% compared to.

Paying the dividends reduces the amount of retained. Dividend of € 1.80 per share; Cash dividends have no effect on a company's overall income statement.

The article discusses the importance of dividends and cash flows in retirement portfolios for risk reduction. Statement of cash flows: The first step in calculating dividends from the income statement is to obtain a copy of the company’s income.