Have A Info About Inventory Loss Journal Entry Financial Ratios For Churches

1 how to adjust journal entries for remaining inventory ;

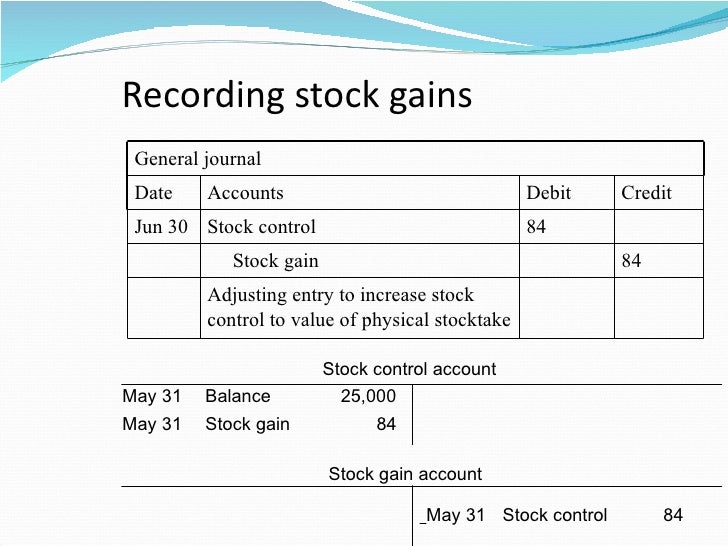

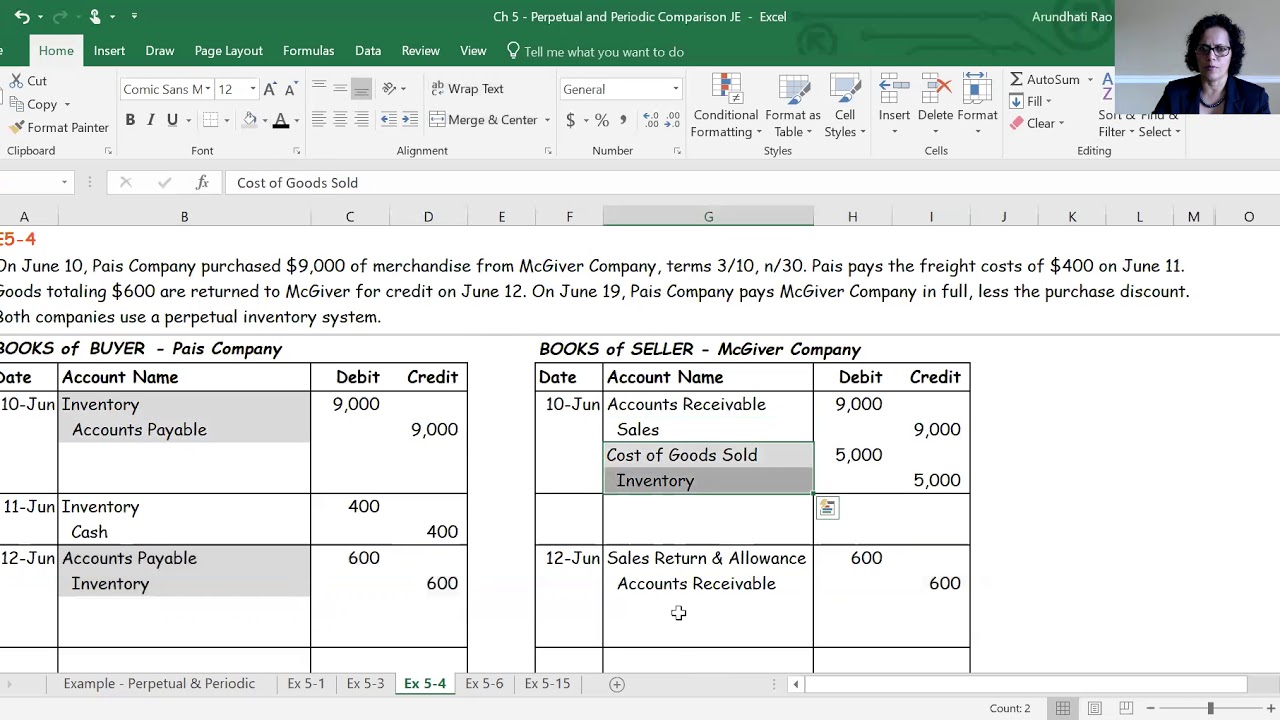

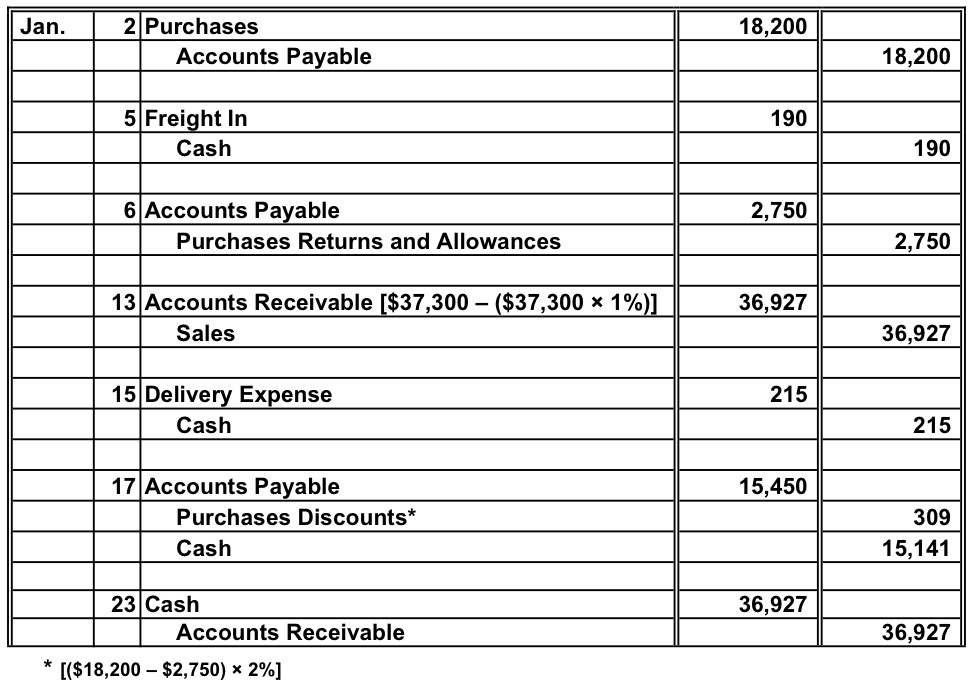

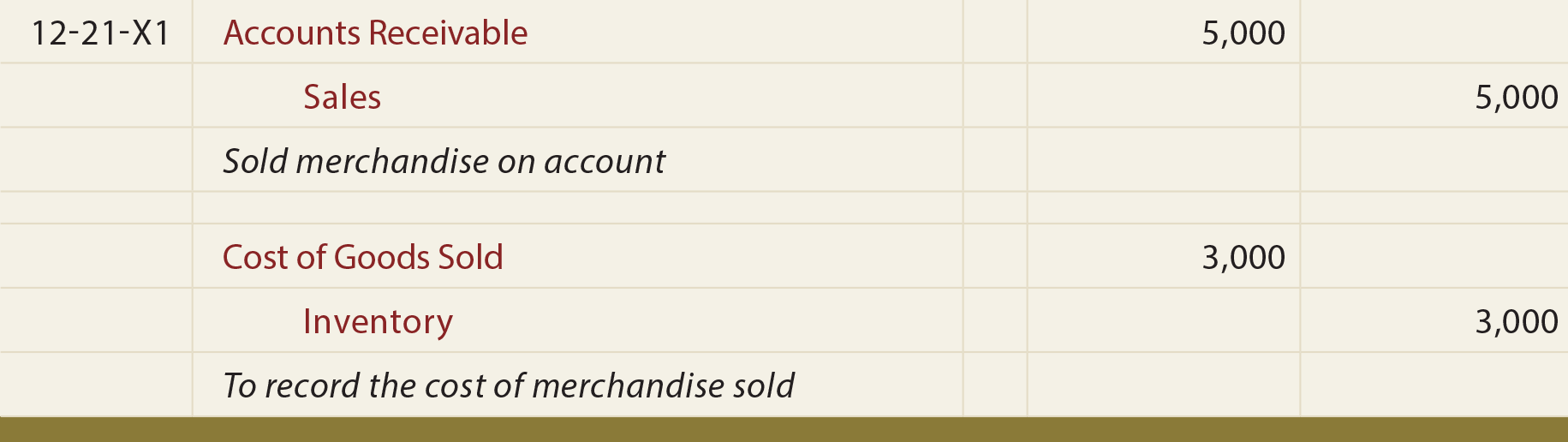

Inventory loss journal entry. Inventory is written down when goods. Actual loss is higher or lower than inventory reserve. Can make the journal entry for inventory sale on october 15, 2020, as below:

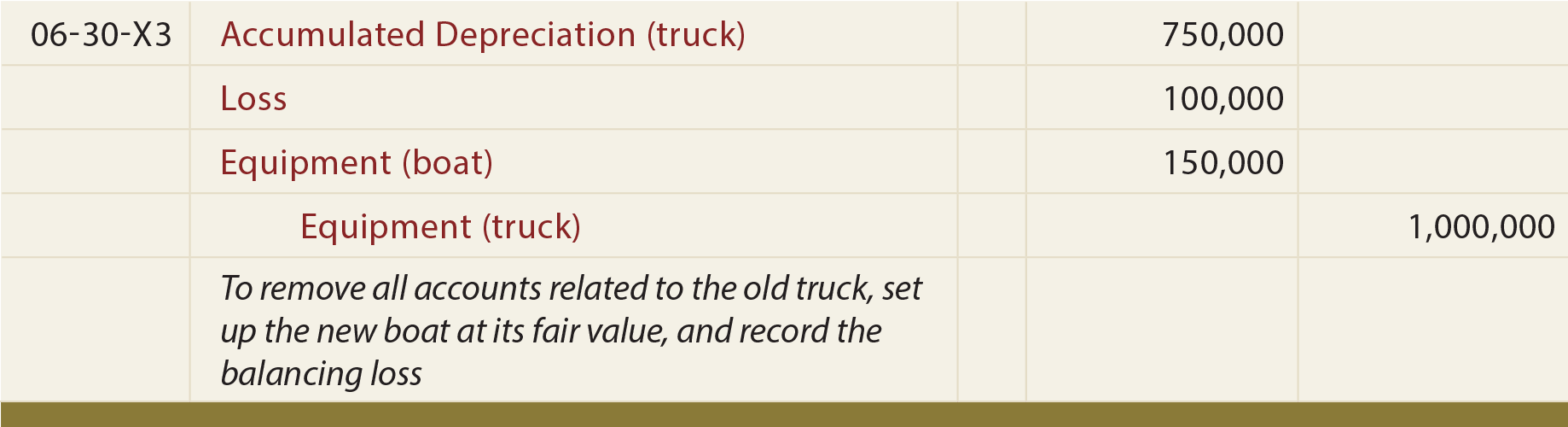

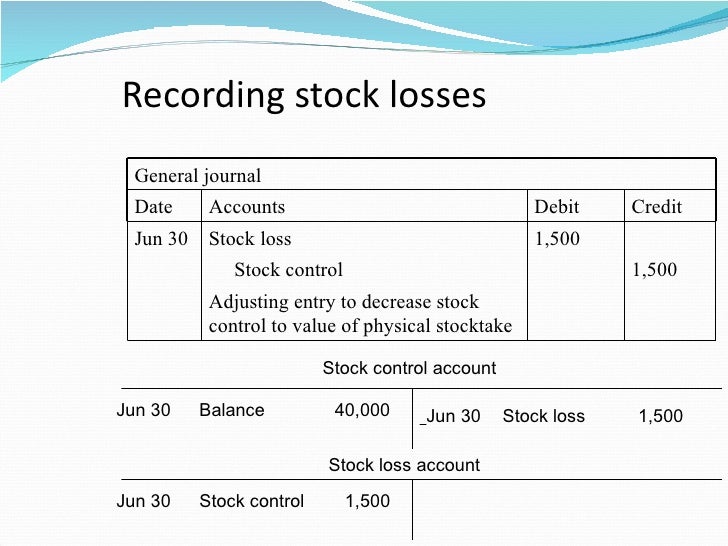

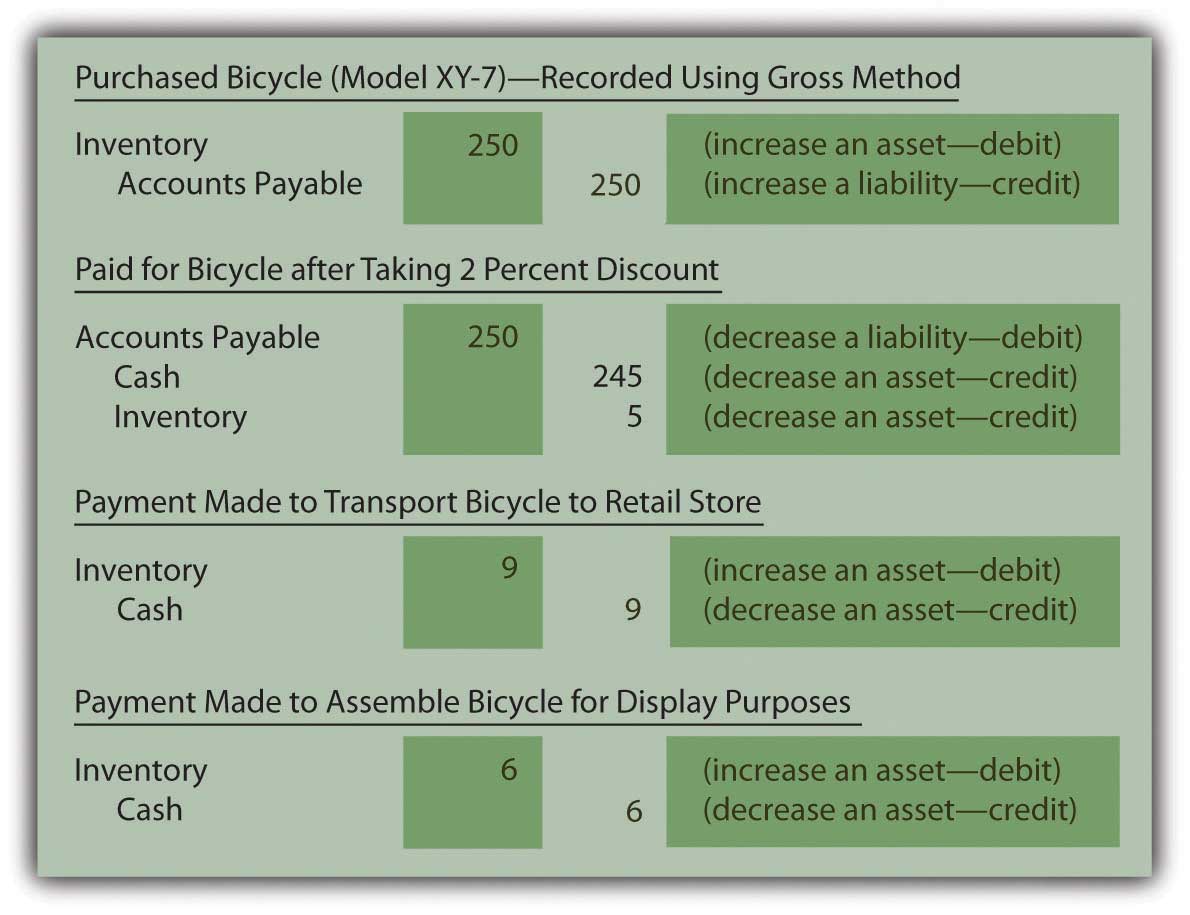

The write down of inventory involves charging a portion of the inventory asset to expense in the current period. Click the plus ( + ) icon and choose journal entry,. When the inventory loses its value, the loss impacts the balance sheet and income statement of the business.

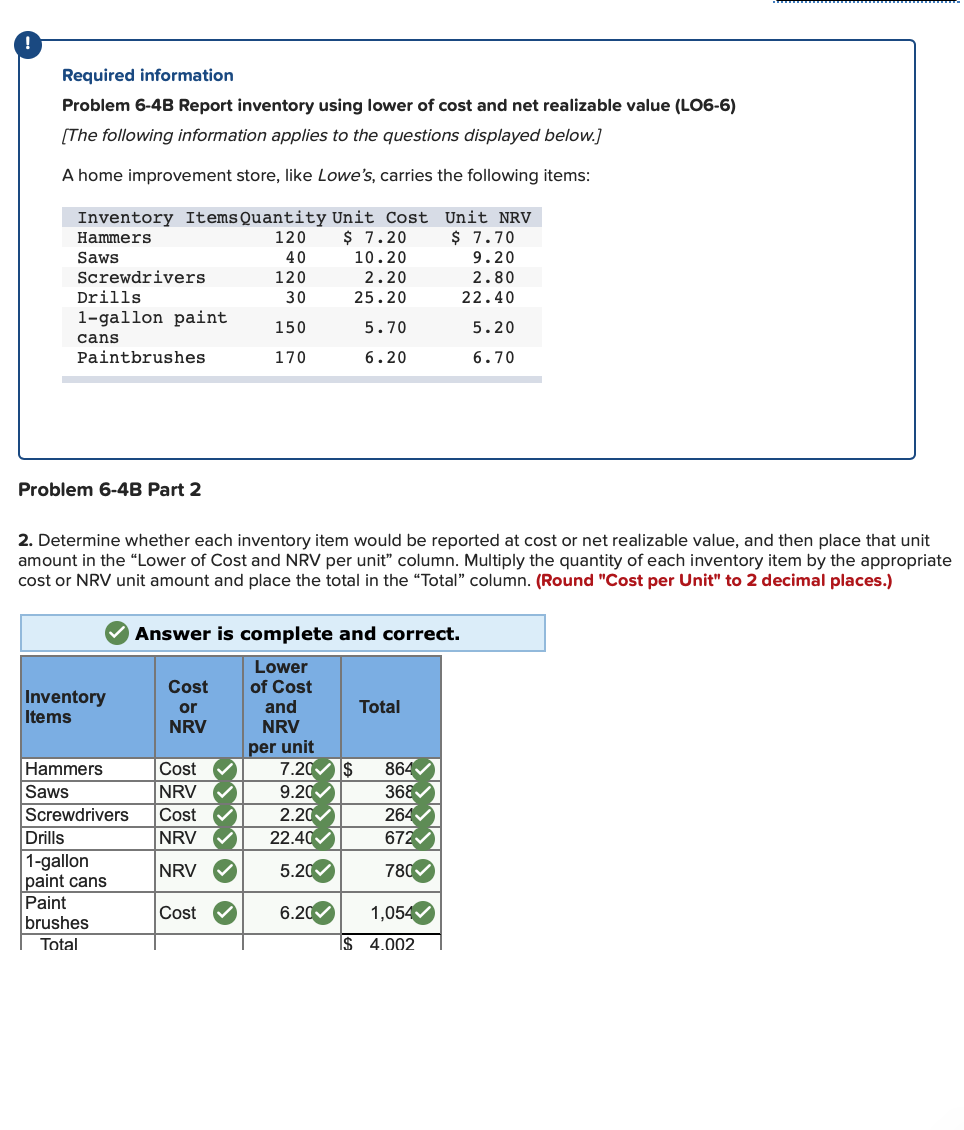

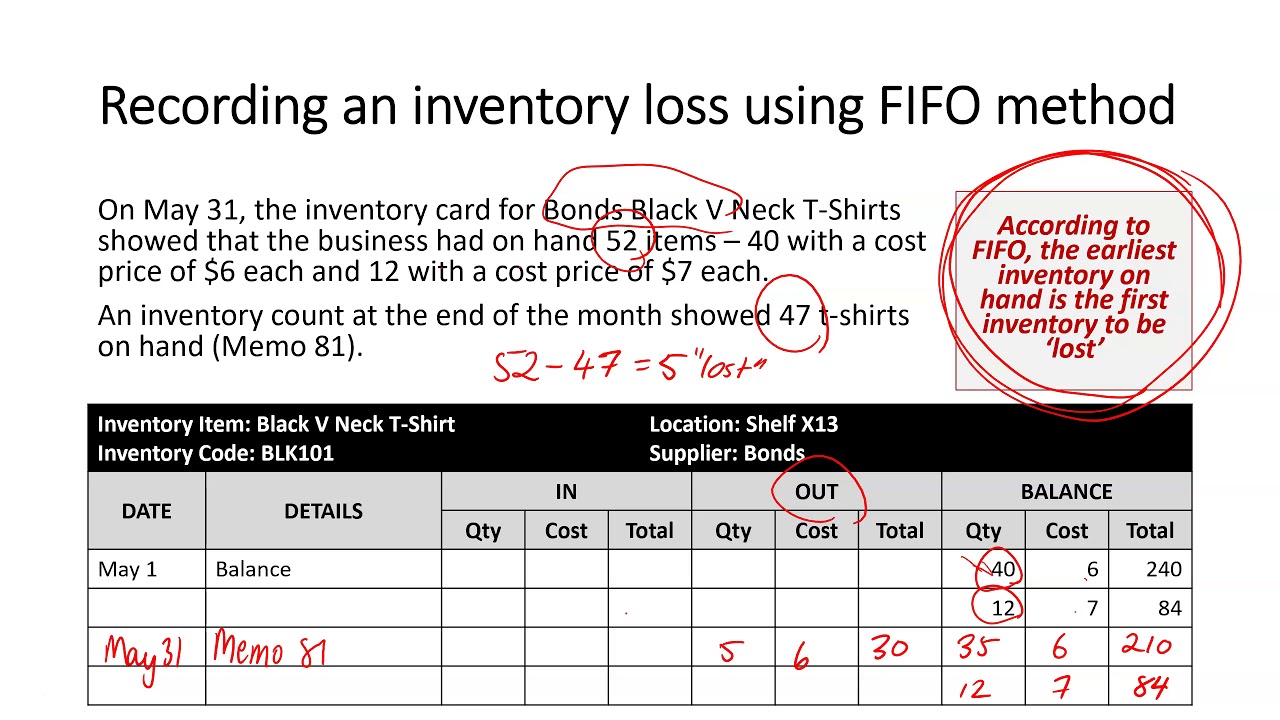

Inventory loss can occur if an item or. Inventory can be expensive, especially if your business is prone to inventory loss, or inventory shrinkage. Identify the obsolete inventory items with no value appraise the value attributed to the inventory.

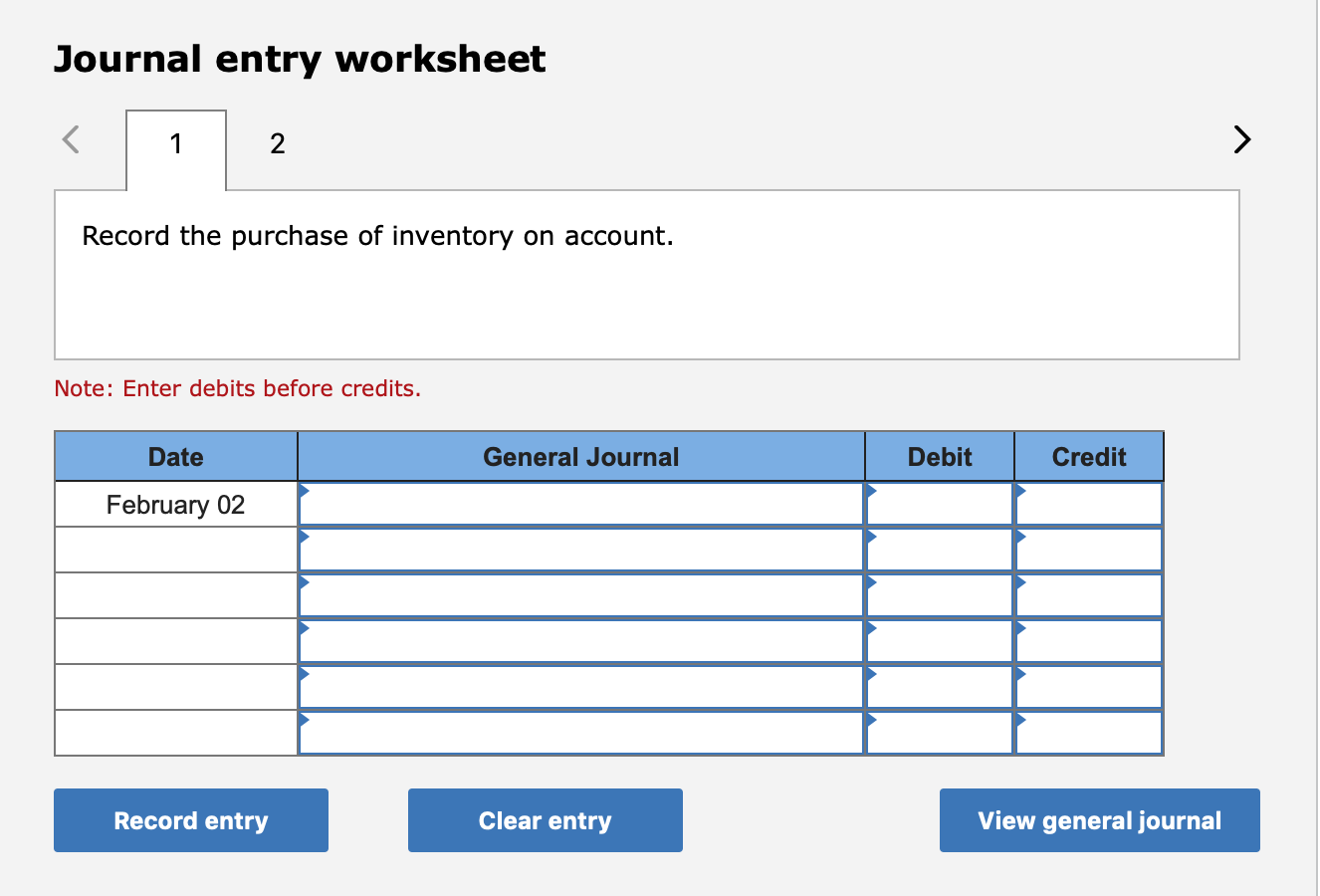

A journal entry for inventory is a record in your accounting ledger that helps you track your inventory transactions. Businesses have to account for inventory loss due to damage, theft and obsolete merchandise. As a result, you may need to reduce the carrying amount of the inventory item to its market value, and charge the loss on inventory valuation expense for the.

In this journal entry, the company. 3 how to adjust entries ending. 2 how to account for lost inventory on an income statement ;

Learn how to make the journal entry to write off the lost inventory in accounting. Under the perpetual system, the company abc ltd. Depending on the type of inventory and how.

You have to periodically test inventory to see if the market cost of any inventory item is lower than its cost under the lower of cost or market rule. After this journal entry, the value of inventory on the balance sheet reduces by $100,000 while the total expenses. The amount to be written off is the cost of the.

This requires counting all the inventory and then making the. Since you don’t have the inventory tracking turned on, you'll want to create a journal entry to record the loss.