Ideal Tips About Abridged Balance Sheet Profit & Loss Statement Format Section 8 Company

All of the members have consented to the preparation of abridged accounts in accordance with.

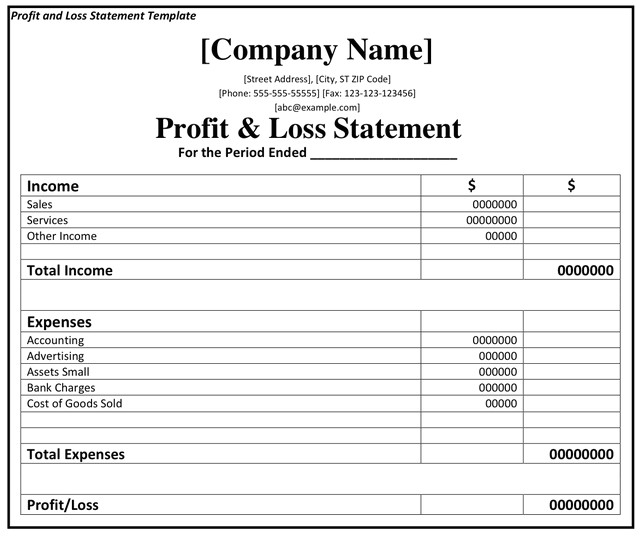

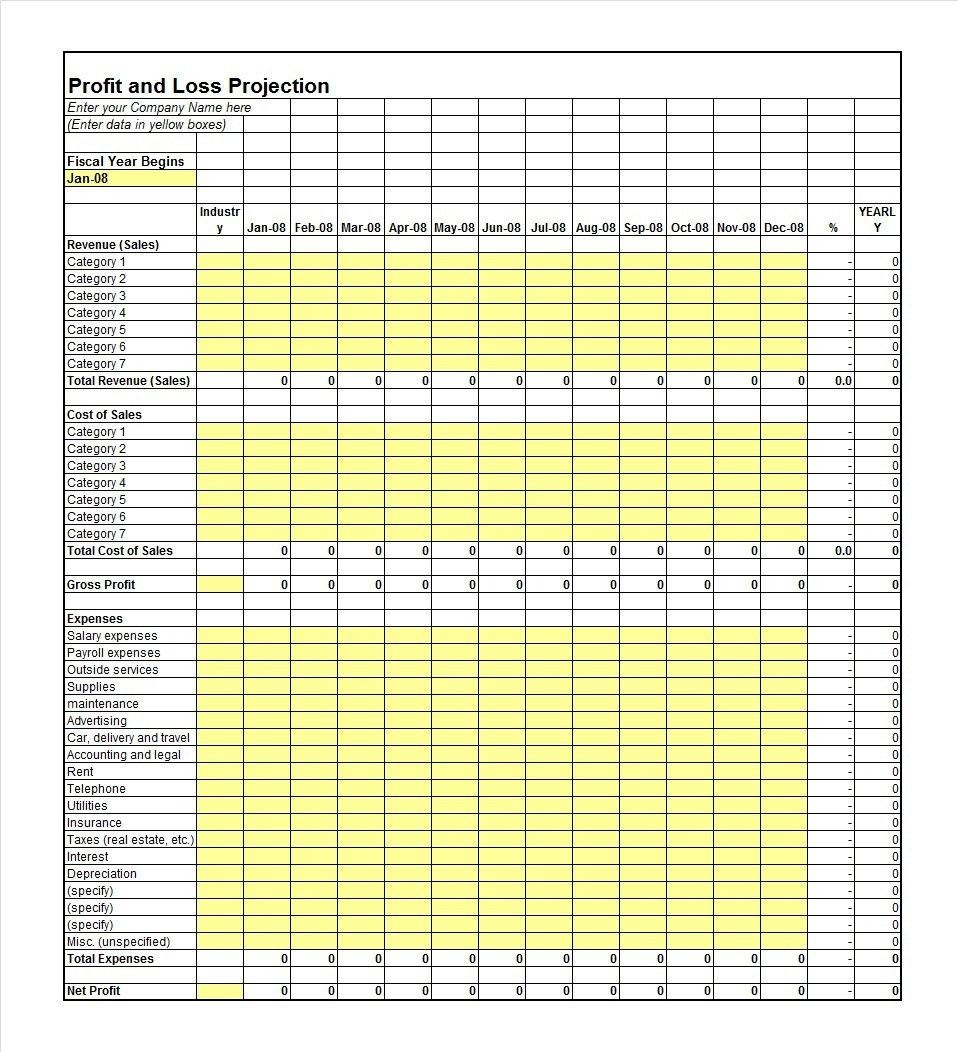

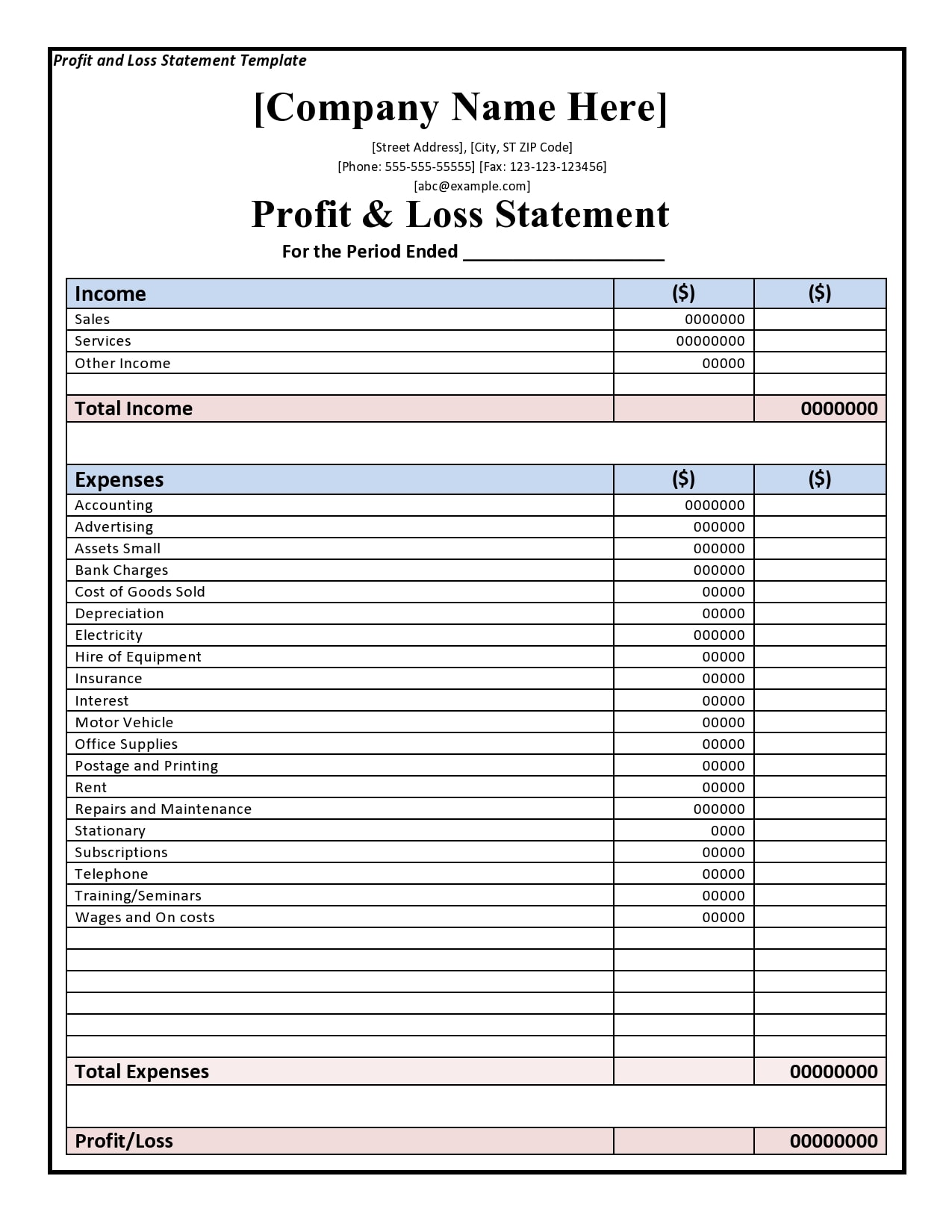

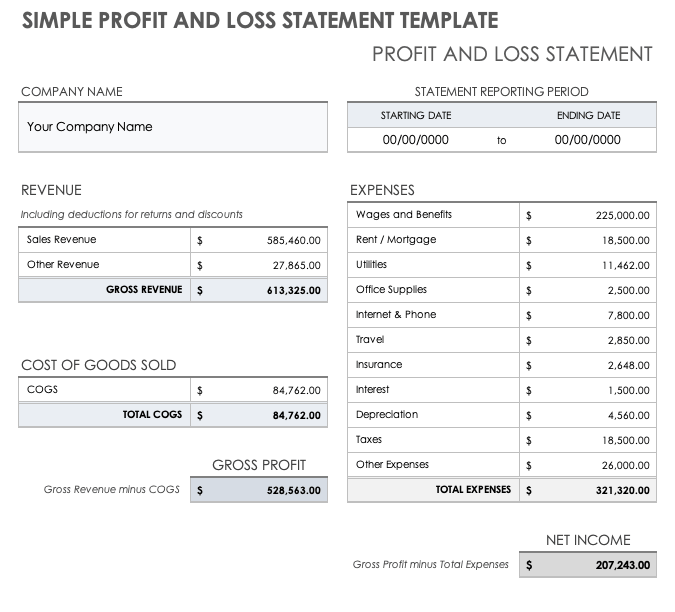

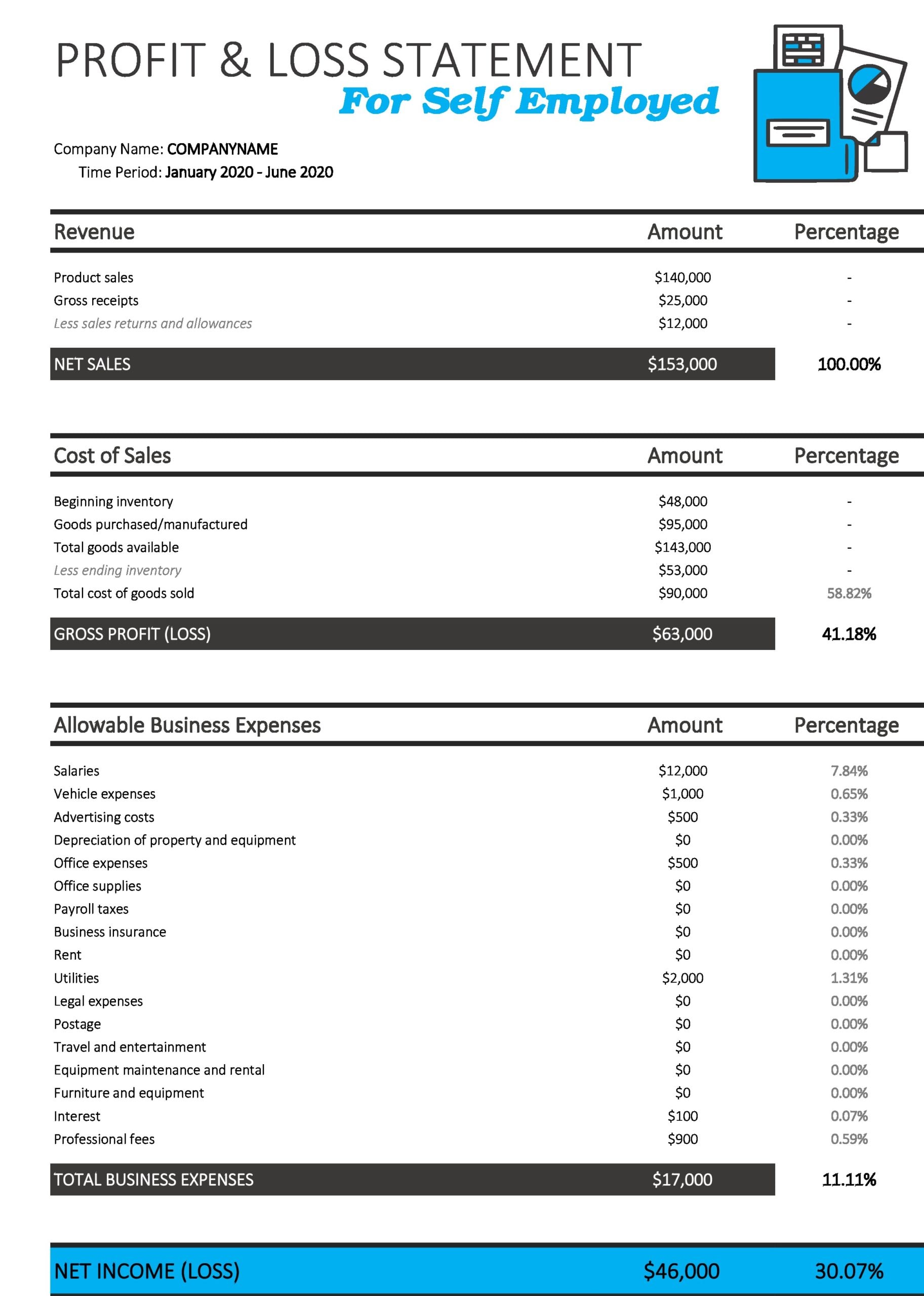

Abridged balance sheet profit & loss statement format. Removing the option to file abridged accounts. Your p&l statement would show these profits and losses, and that your net income for the month is $600. You also have $200 in cash on hand and inventory worth.

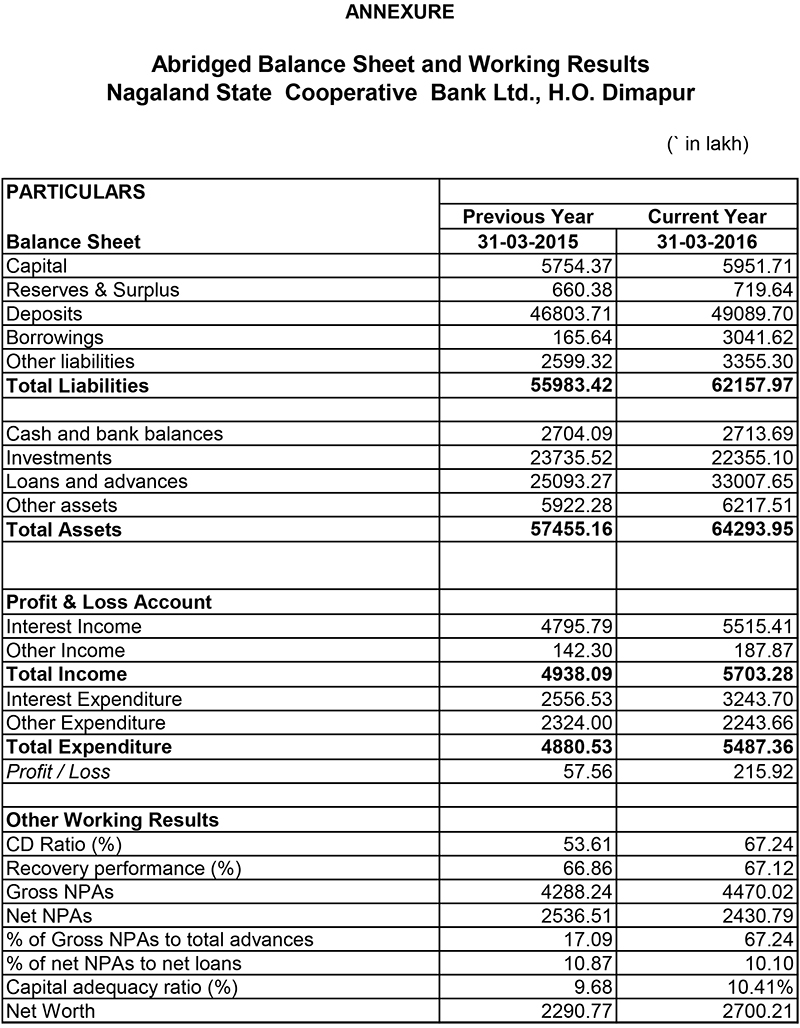

When preparing a set of abridged accounts for filing purposes, the companies (accounting) act 2017 amended the companies act 2014 to allow the directors’ report and the profit. Large companies — must file full accounts including a balance sheet, profit and loss account, notes, directors’ report and auditors’ report. Requiring an eligibility statement for companies claiming an.

Abridged adjusted consolidated financial statements the following abridged consolidated financial statements and notes have been prepared as described in note 1. Setting abridged accounts to yes will result in the financial statements including an abridged profit and loss account, an abridged balance sheet and. Discover profit and loss statements' meaning, importance, types, and examples.

To facilitate change the new regime introduced the concept of “abridged” accounts which refer to financial statements that include an abridged balance sheet and/or abridged. When completing abridged accounts, certain financial details that are normally present in full accounts can be omitted from the company’s balance sheet and profit and loss. Explore p&l formats, templates and practical examples for better financial.

A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. These financial statements have been prepared in accordance with the provisions applicable to companies subject to the small companies’ regime and all members of the. Where an abridgment exemption is being claimed the following statement shall be inserted on the balance sheet.

(a) they have relied on the specified exemption contained in. The amounts to be shown here should be the same as shown in the corresponding. Small businesses can file an abridged balance sheet and an abridged profit and loss account, but are free to submit full versions of the balance sheet and / or profit and.

2014 ecdf standards forms 76 detailed balance sheet and profit and loss account 76 abridged balance sheet and profit and loss account 85 balance sheet.