Build A Info About Adjustments For Unearned Revenues Contoh Profit And Loss Statement

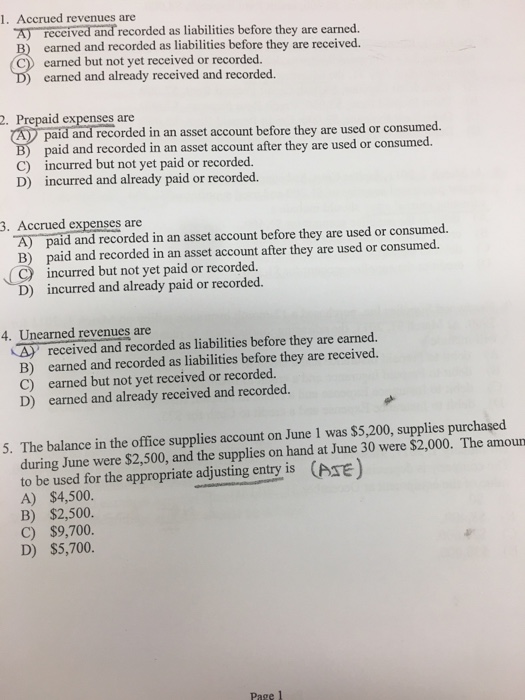

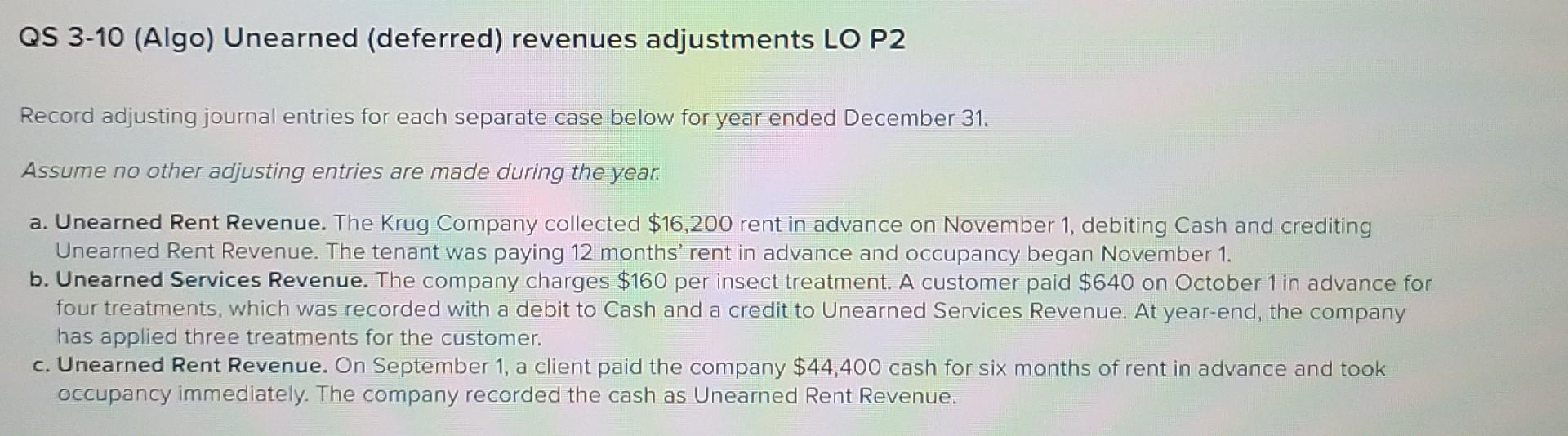

Since some of the unearned revenue is now earned, unearned revenue would decrease.

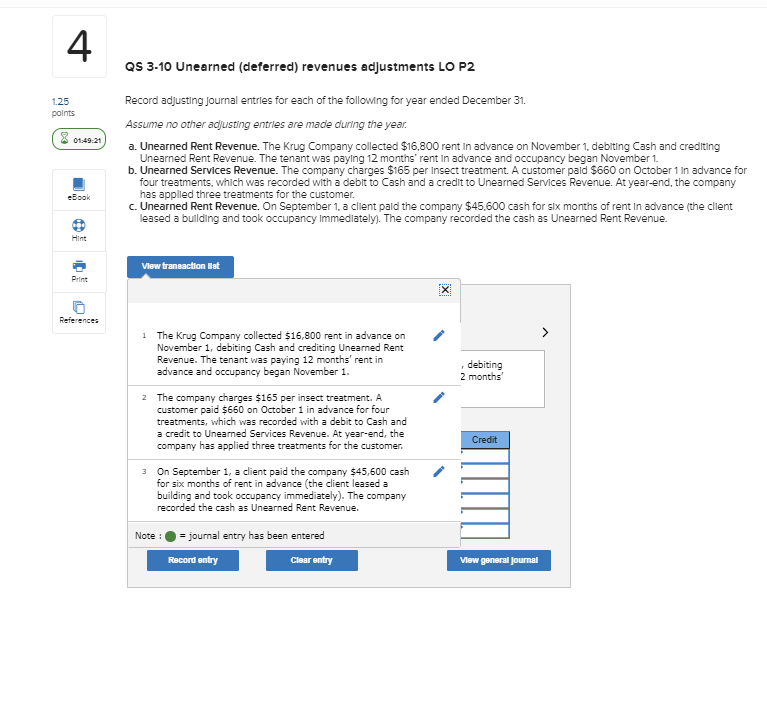

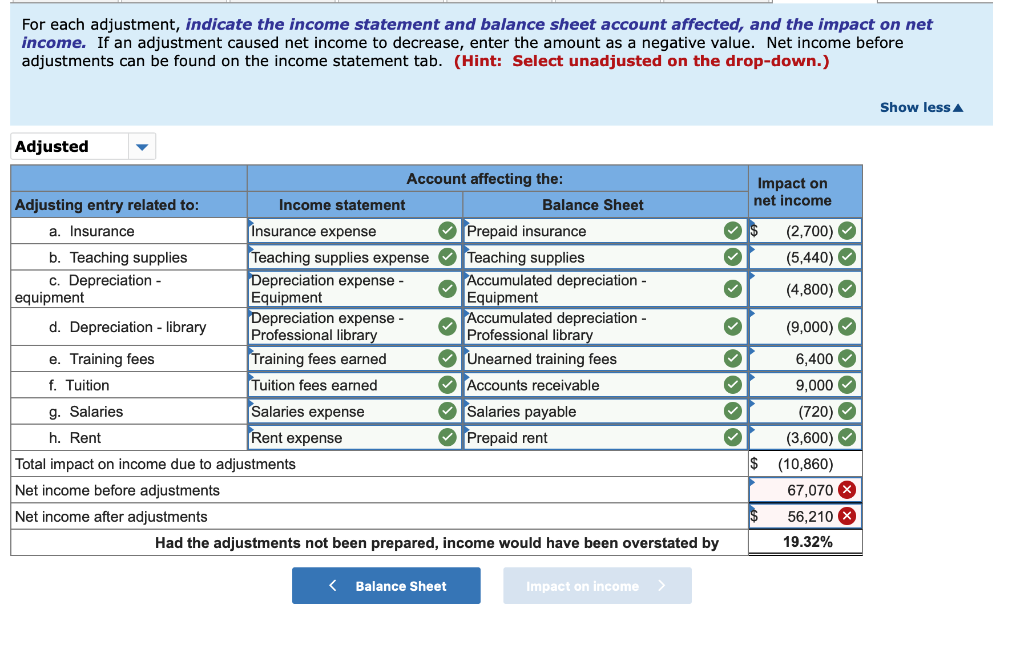

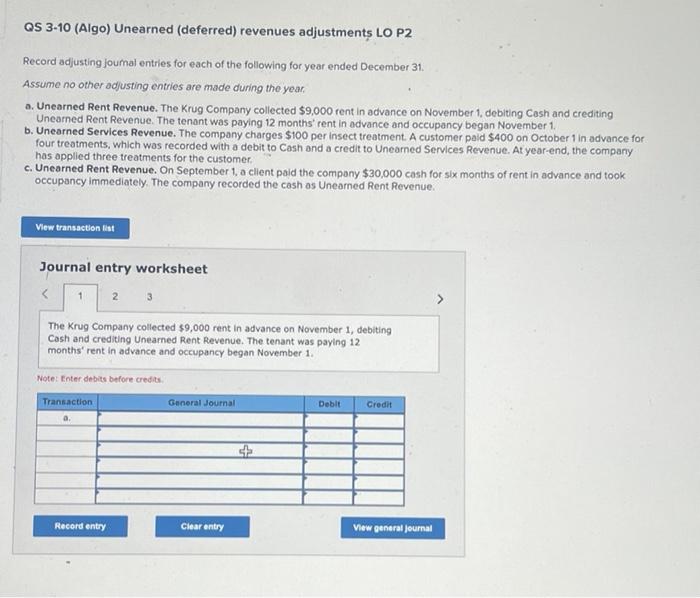

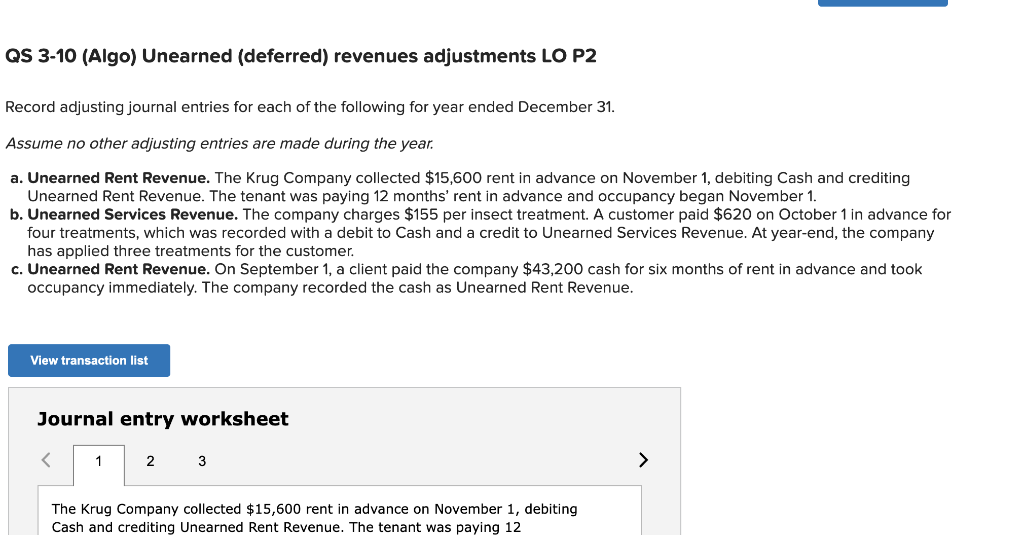

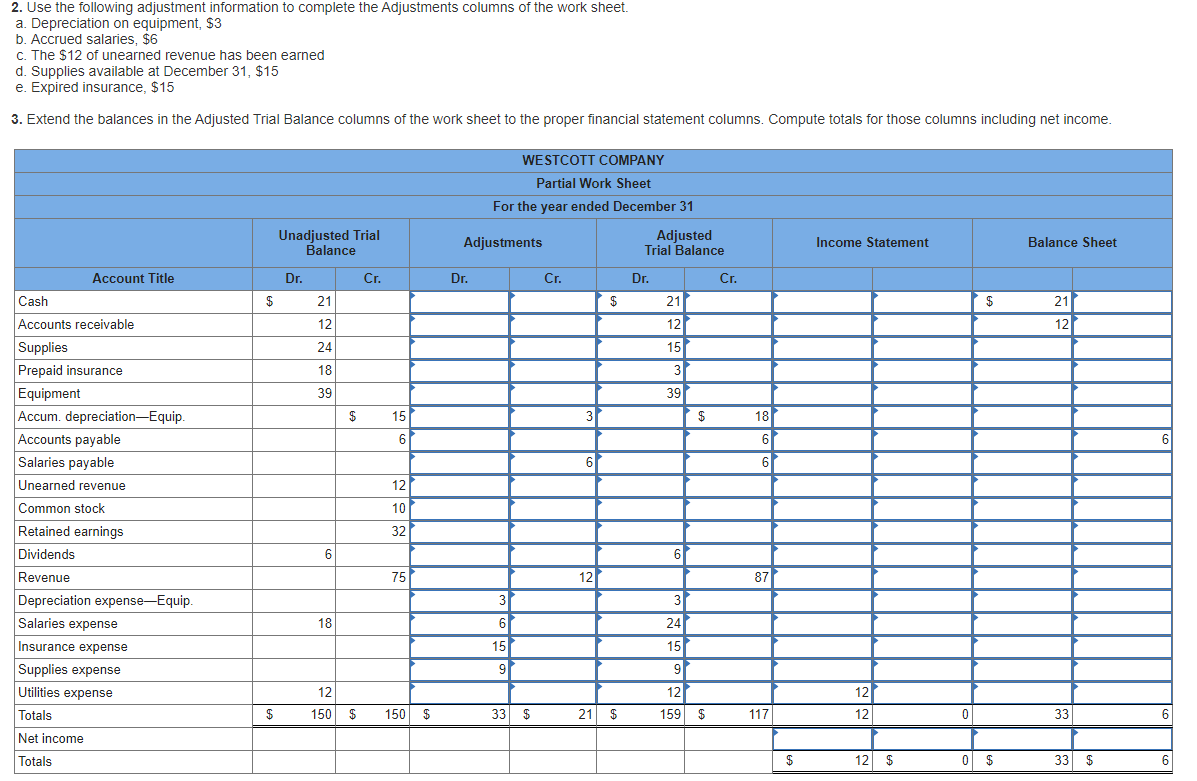

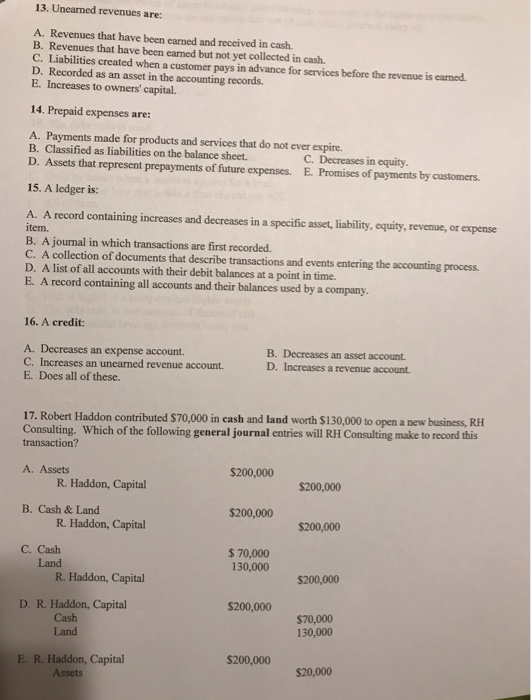

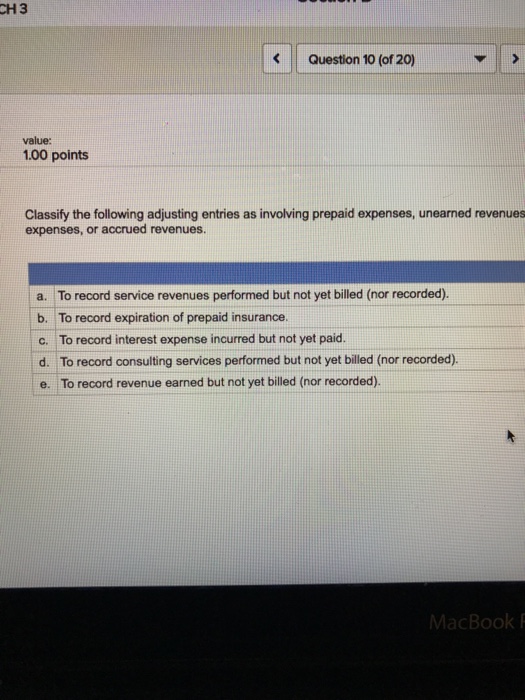

Adjustments for unearned revenues. A typical example would be the unearned rent revenue adjusting entry. (b) increase liabilities and increase revenues. At the end of the year after analyzing the unearned fees account, 40% of the unearned fees have been earned.

Unearned revenue represents a liability. Image from amazon balance sheet. Adjusting unearned liability accounts.

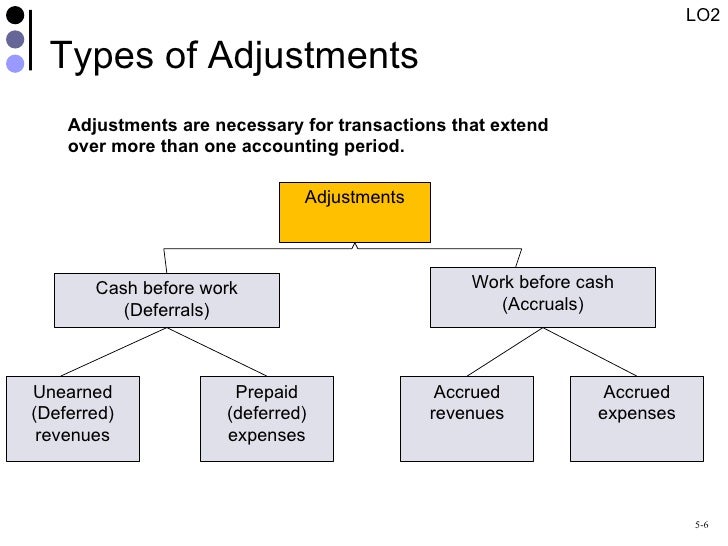

Income method under the income method, the entire amount received in advance is recorded as income using the following journal entry: Making an adjusting entry for unearned revenue requires making a debit to the unearned revenue account and a credit to the revenue account. Okay, so unearned revenue is going to be a deferral type adjusting entry.

Credit unearned revenue $4,000 b credit revenue $4,000; If it is a monthly publication, as each periodical is delivered, the liability or unearned revenue is reduced by $100 ($1,200 divided by 12 months) while revenue is increased by the same amount. 2% interest per month (24%÷12 months) $7,200 x 2%= 144.

At the end of the accounting period, the following adjusting entry is made to convert a portion of the unearned revenue into earned revenue. The company can now recognize the $600 as earned revenue. Accrued expenses representing expenses which have been incurred (used and consumed) but not yet paid or recorded and need to be allocated and accrued to.

An asset/revenue adjustment may occur when a company performs a service for a customer but has not yet billed the customer. Dr unearned revenue account cr income account for the amount earned. Sri lanka increased power prices by 75% in september 2022 and by another 66% in february 2023 to fall in line with energy price adjustments required under a $2.9 billion bailout from the.

In march, your catering company agrees to cater a wedding in june, and the couple gives you a $6,500 deposit in march to ensure your business. At the end of the year after analyzing the unearned fees account, 40% of the unearned fees have been earned. March 28, 2023 in accounting, unearned revenue is prepaid revenue.

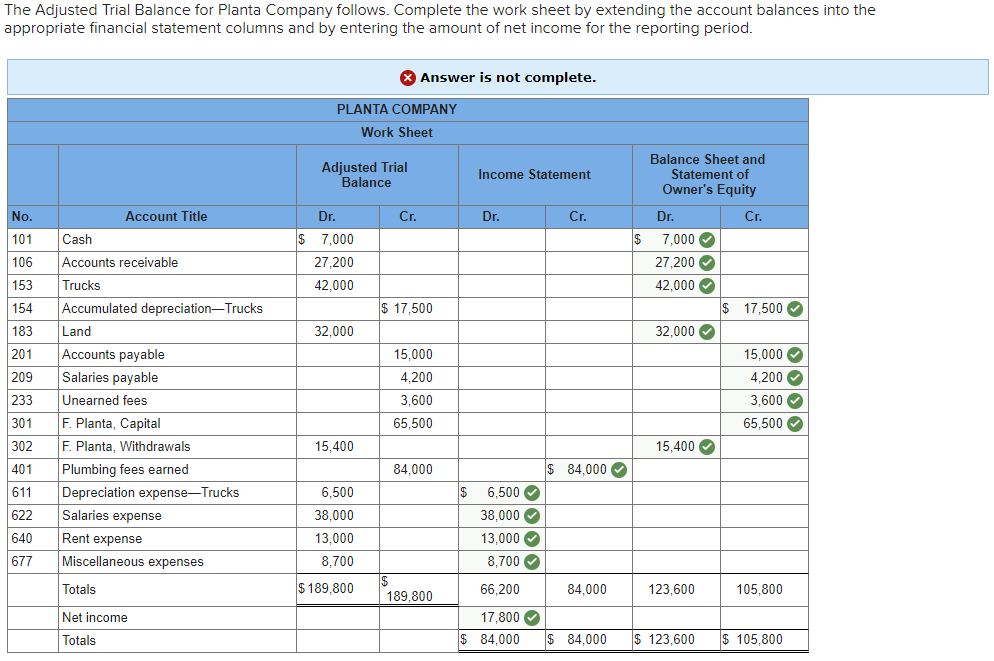

Total revenue recorded is $19,200 ($48,000 × 40%). Advance customer payments for newspaper subscriptions or extended warranties are unearned revenues at the time of sale. Total revenue recorded is $19,200 ($48,000 × 40%).

We're still talking about deferrals at this point. Businesses sometimes need to make an unearned revenue adjusting entry to their balance sheet. The adjusting entry if the liability method was used is:

Gavin newsom gallivants around the country as a campaign surrogate for president joe biden — and to. (d) decrease revenues and decrease assets. These entries reflect goods and services that the company has been paid for but not yet provided.

![What Is Unearned Revenue [Definition Examples Calculation]](https://www.realcheckstubs.com/media/Is Unearned Revenue a Liability.jpg)