Peerless Tips About Form T2125 Guide Profit Loss Balance Sheet

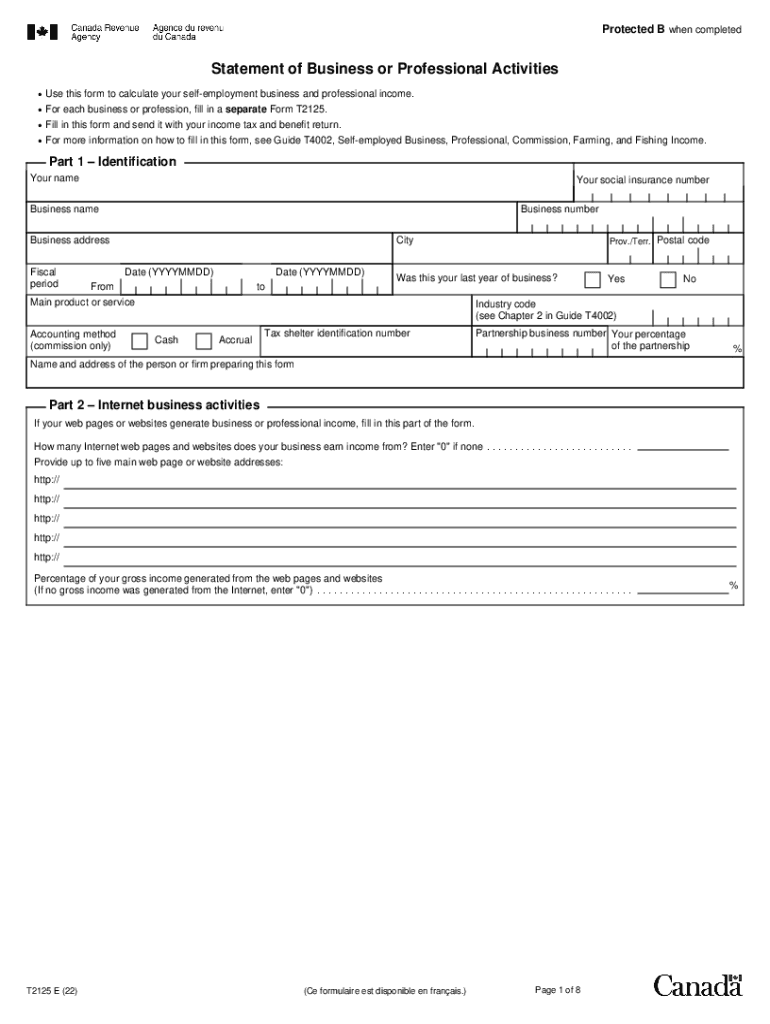

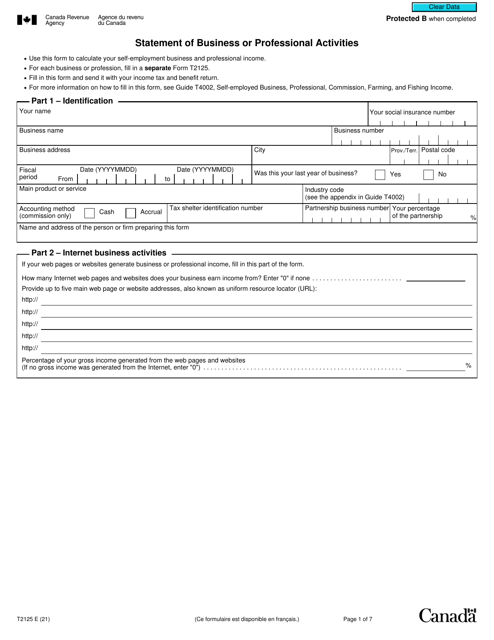

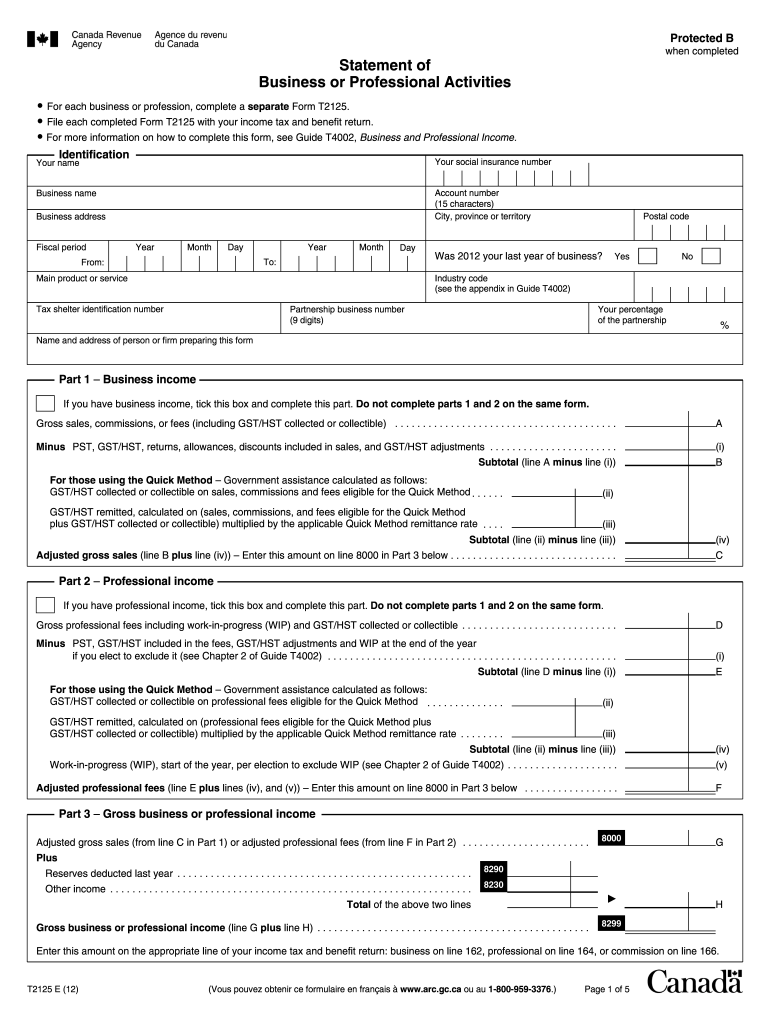

Fill in this form and send it with your income tax and benefit return.

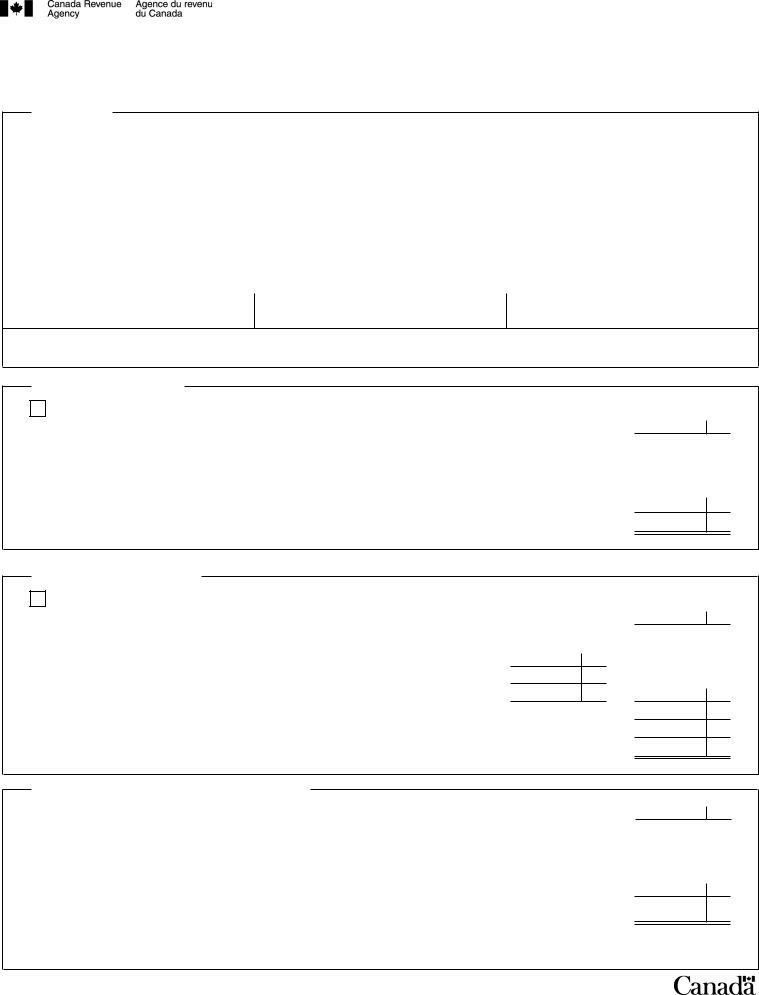

Form t2125 guide. You can use form t2125, statement of business or professional activities, to report your business and professional income and expenses. Interest and penalties you paid on your income tax. This form combines the two previous.

The t2125 form is available online via the canada revenue agency (cra) website. What is form t2125? Use the t2125 form to report either business or professional income and expenses.

This form can help you calculate your. For each business or profession, fill in a separate form t2125. The cra t4002 guide provides relatively lengthy instructions for how individuals should go about reporting their income.

It should be filed with form t1 for your. This t2125 form guide will help professional accountants and bookkeepers generate and file their client’s small business income tax returns for the upcoming tax. Declare income and expenses from a business or profession turbotax canada october 29, 2020 | 3 min read file your taxes with.

T2125 statement of business or professional activities. The t2125 form is part of the canadian government’s t1 income tax package. Topics completing form t2125 industry codes identify the industry.

The t2125 statement of business or professional activities form is used by sole proprietors or partnerships to report the income they earn from their business in a. It enables the canada revenue agency (cra) to accurately evaluate how much money you made.

:max_bytes(150000):strip_icc()/CRAFormT2125-a3f2076202c546f1b72af673d094e89b.png)

/delipaperworktax-56a82fab3df78cf7729ce02e.jpg)