Divine Info About Fund Flow Management Is Profit

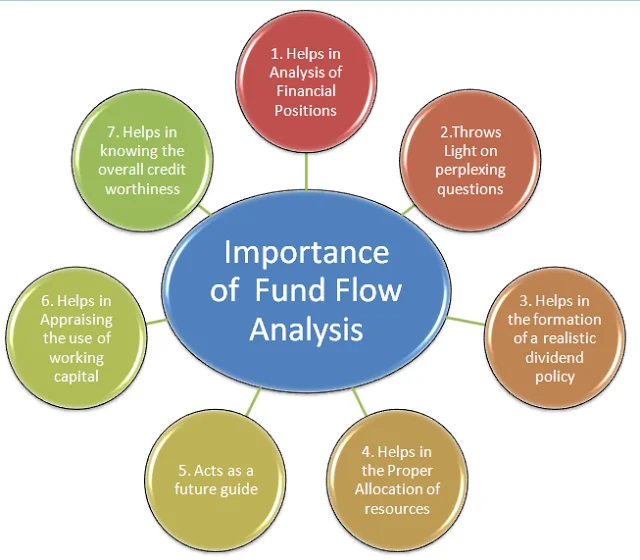

A fund flow analysis is a financial document which you can create and use to analyse and understand the financial position of your business.

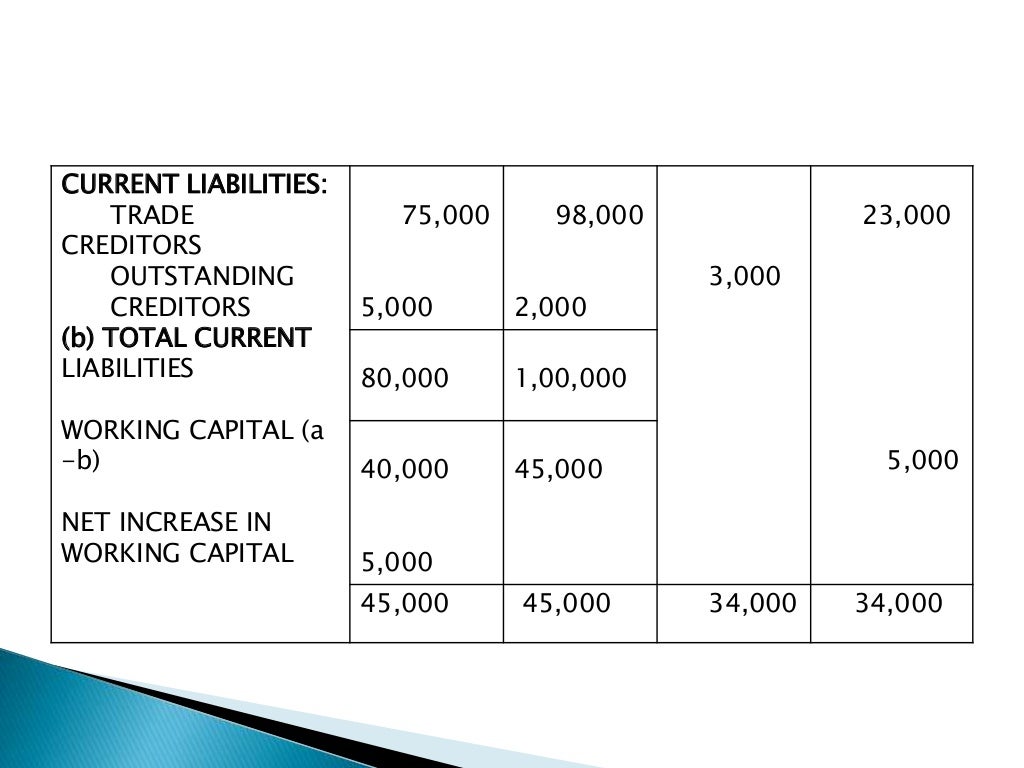

Fund flow management. Usually, this is a grey area that is not reflected in either the company's balance sheet or p&l statement. Management can ensure the long term and the short term solvency of the firm by studying the internal funds flow cycles. In some ways, it works along the same lines as a cash flow, but is more detailed.

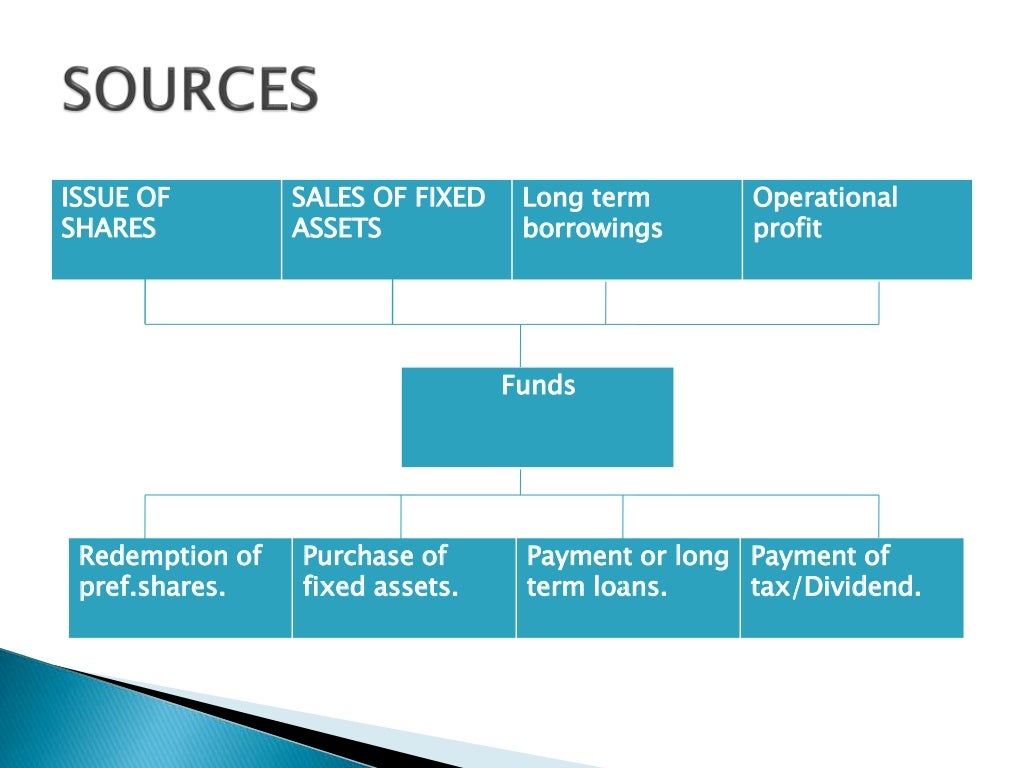

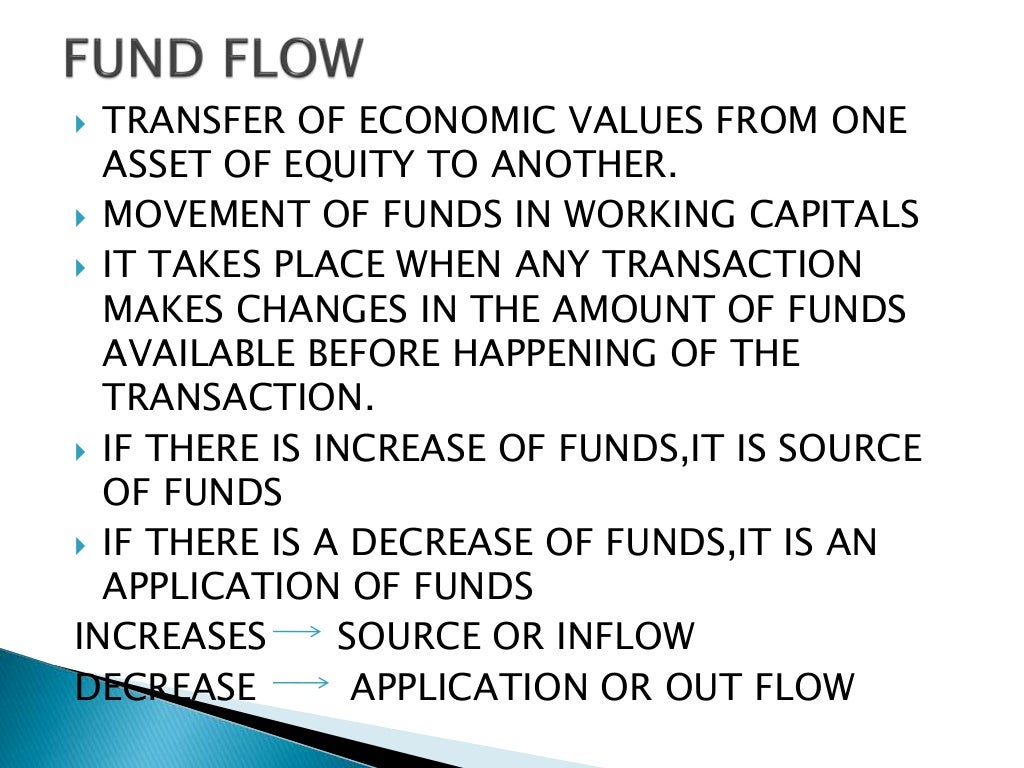

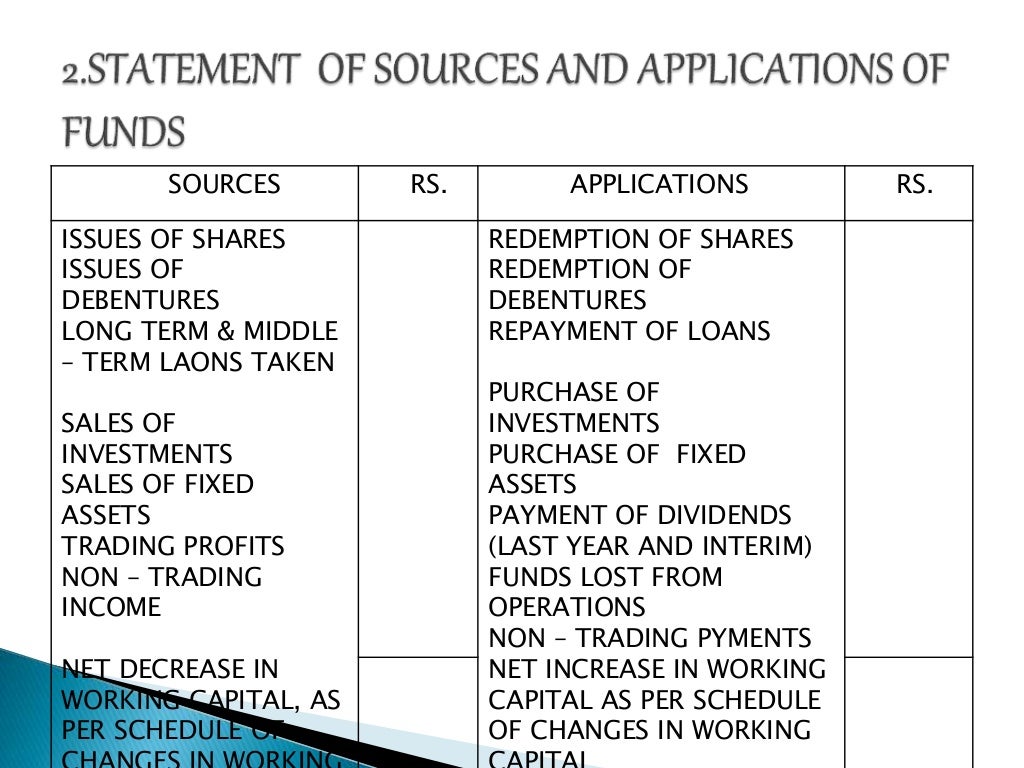

A fund flow refers to the inflow and outflow of funds or assets for a company and is often measured on a monthly or quarterly basis. Sources of funds and applications of. The fund manager ensures that the maturity schedules of the deposits coincide with the demand for.

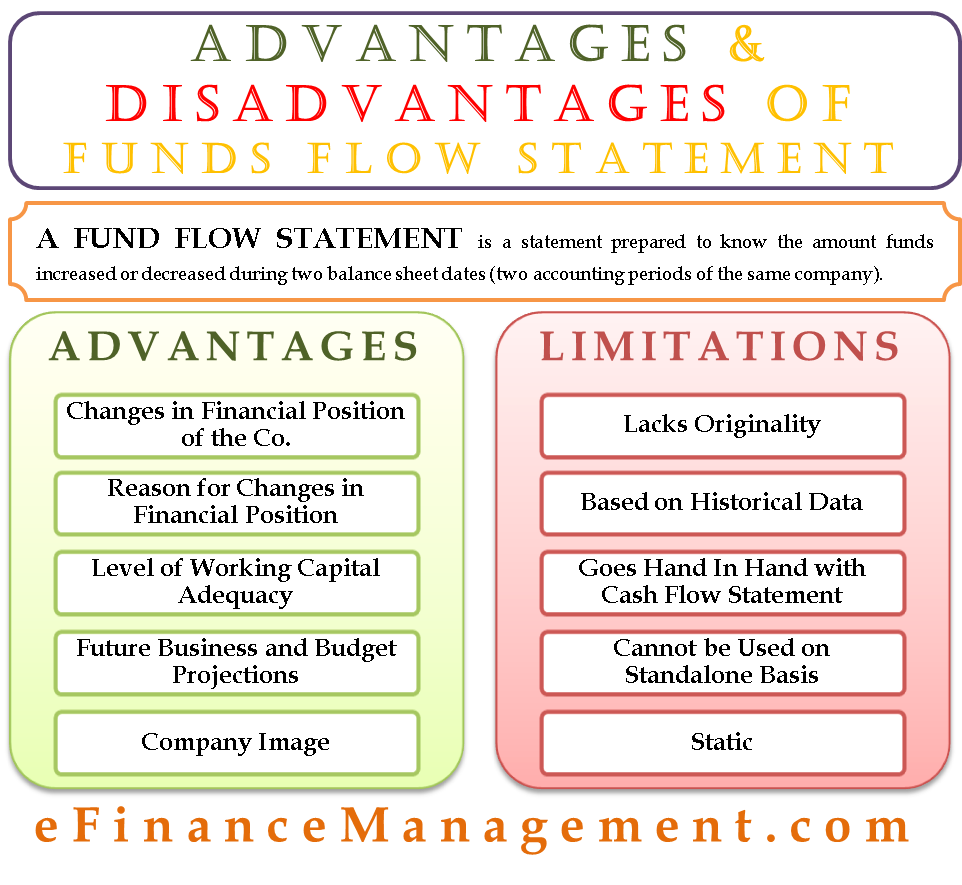

(“sfa”) to conduct, among others, fund management, is an exempt financial adviser pursuant to the financial adviser act section 23(1)(d) and is regulated by the. A fund flow statement reveals the reasons for these changes or anomalies in the financial position of a. Fund flow statements serve as a valuable tool for organizations to gain insights into their cash position, conduct a thorough financial performance analysis, and identify areas for potential financial management improvement.

It helps the fund managers explain the financial strengths of a company despite its operational losses. Fund flow analysis is used to understand changes in financial position. It involves monitoring the movement of funds from various sources, such as investments, sales, and loans, to their ultimate utilization in different activities like operations, capital expenditures, or debt repayment.

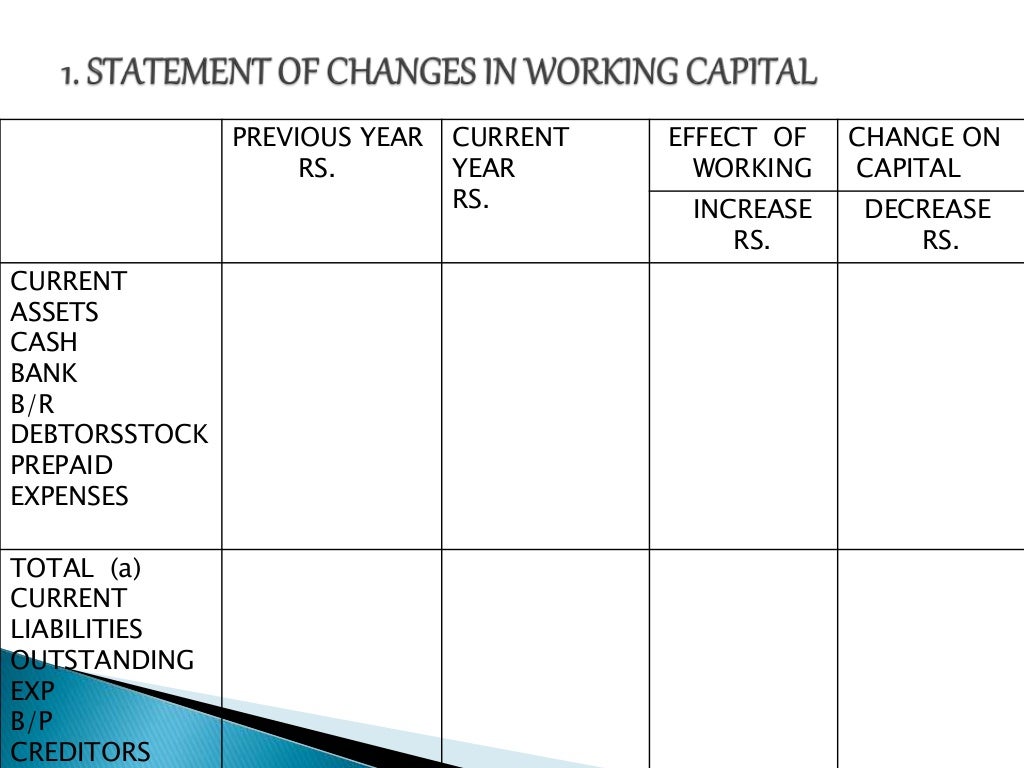

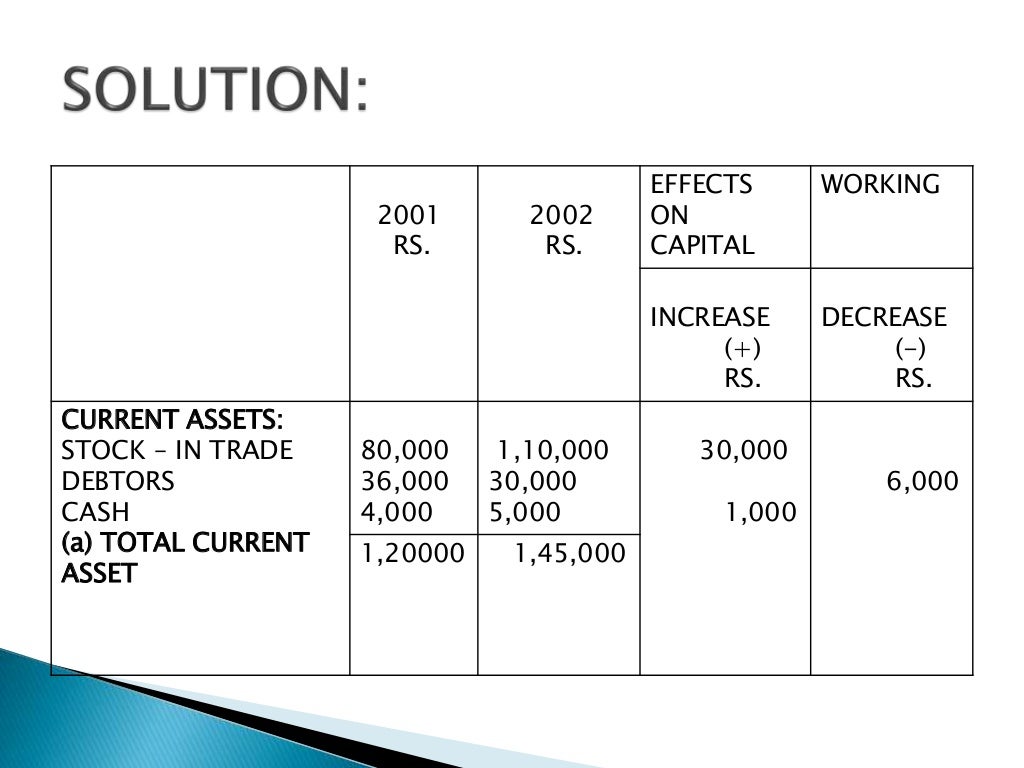

The fund flow statement uses the assets and liabilities listed on the balance sheet to analyse the movement of funds. Funds flow statement is an analysis and control device for the management. Most businesses use a combination of three main financial statements to analyze business finance and operations.

Hence its publication is obligatory. Inflows can include the money retail investors put into mutual funds. A fund flow statement is a statement prepared to analyse the reasons for changes in the financial position of a company between two balance sheets.

The fund flow statement is a financial statement that records the inward and outward flow of business funds or assets. Both help provide investors and the market with a snapshot of how the company is doing on a periodic basis. It portrays the inflow and outflow of funds i.e.

The latest fund flows data from morningstar tells a sobering tale for active fund houses, with 12 consecutive months of net outflows. but wealth managers continue to focus on active equity. The management of the organization is also benefited through. It is a modern technique of knowing the inflows and outflows of funds during a particular period.

Interest in hedge funds is lower now than in the past two years and, on a dollar basis, more clients pulled money last year than made new bets. And where the flows can combine, split, and be traced through a series of events or stages. The fund flow analysis is a great help for potential investors in deciding whether the company can manage the funds properly or not.

Fund flow analysis is a financial management technique that examines the movement of funds within an organization. As such, it helps in ascertaining the changes in the company’s working capital between two financial. Fund flow statements offer a concise overview of the inflow and outflow of funds within an organization during a specific period.