Ideal Info About Income Statement For Absorption Costing Gaap Regarding Accounting Taxes

1,30,000) is due to difference in valuation of closing stock.

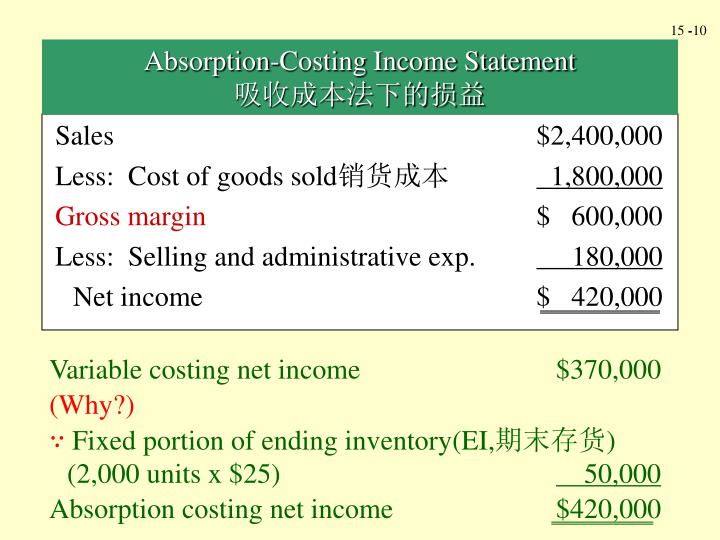

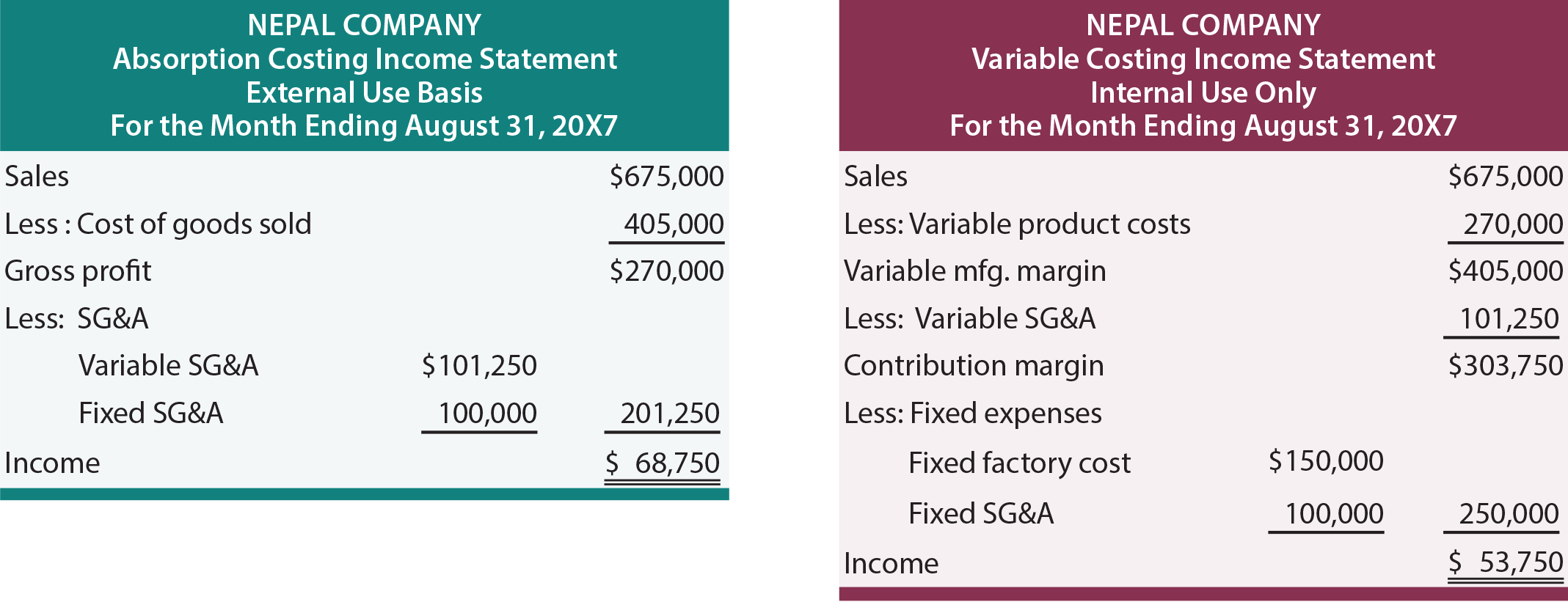

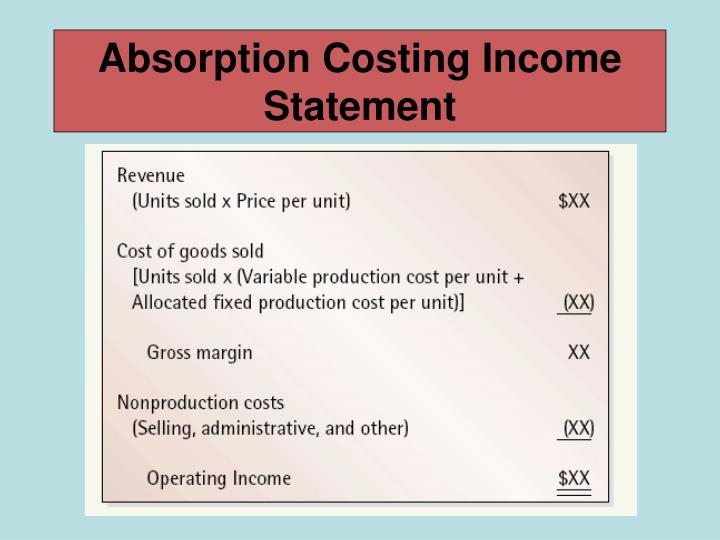

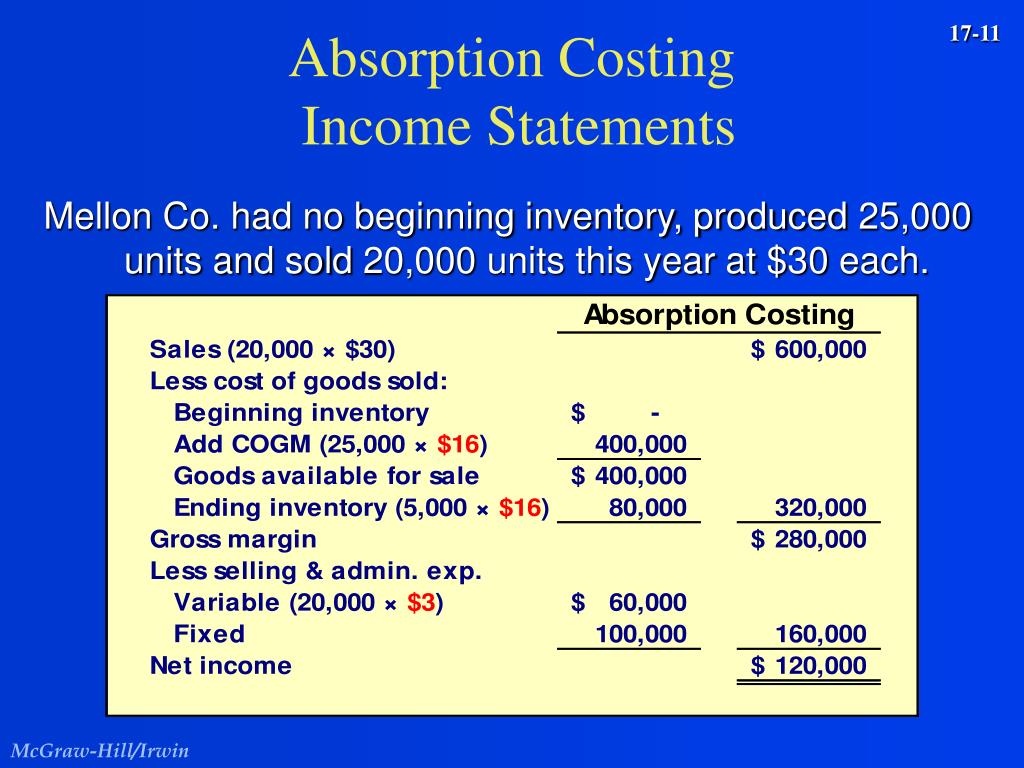

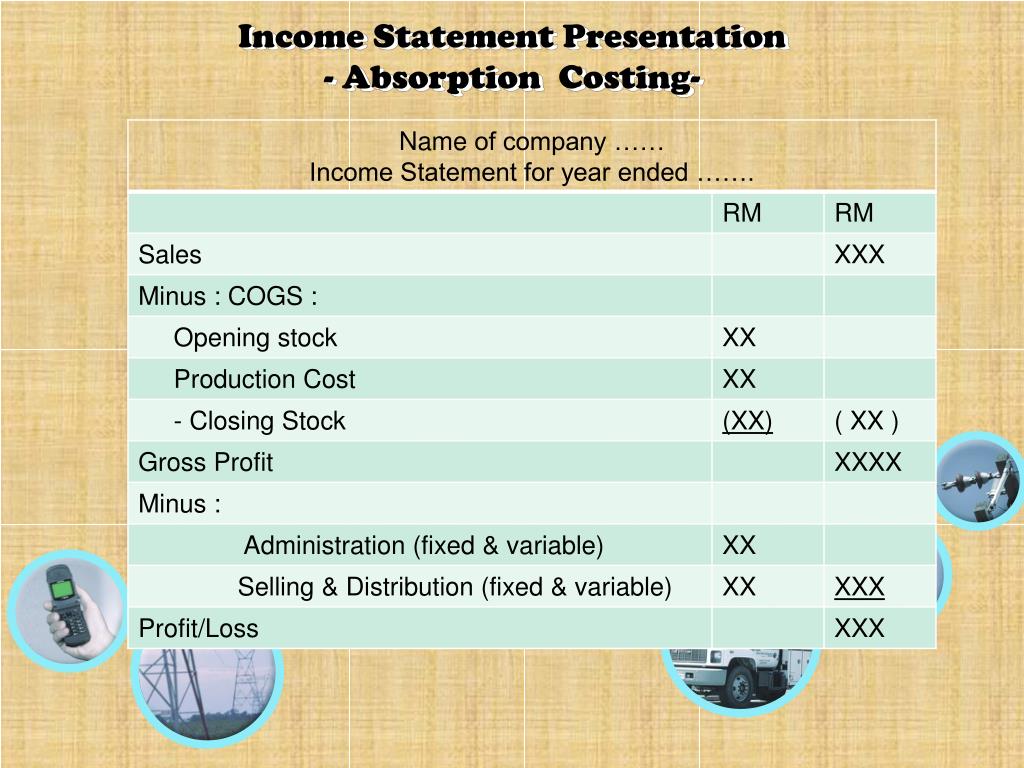

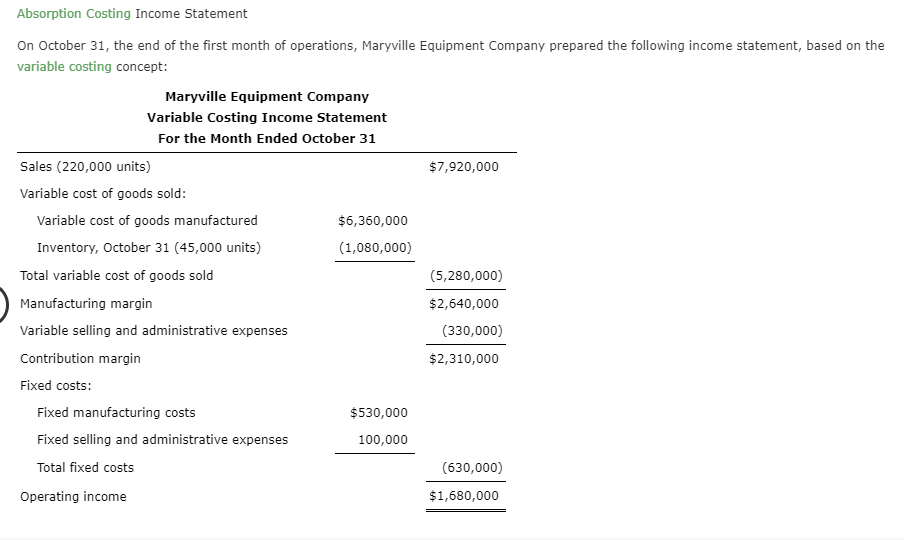

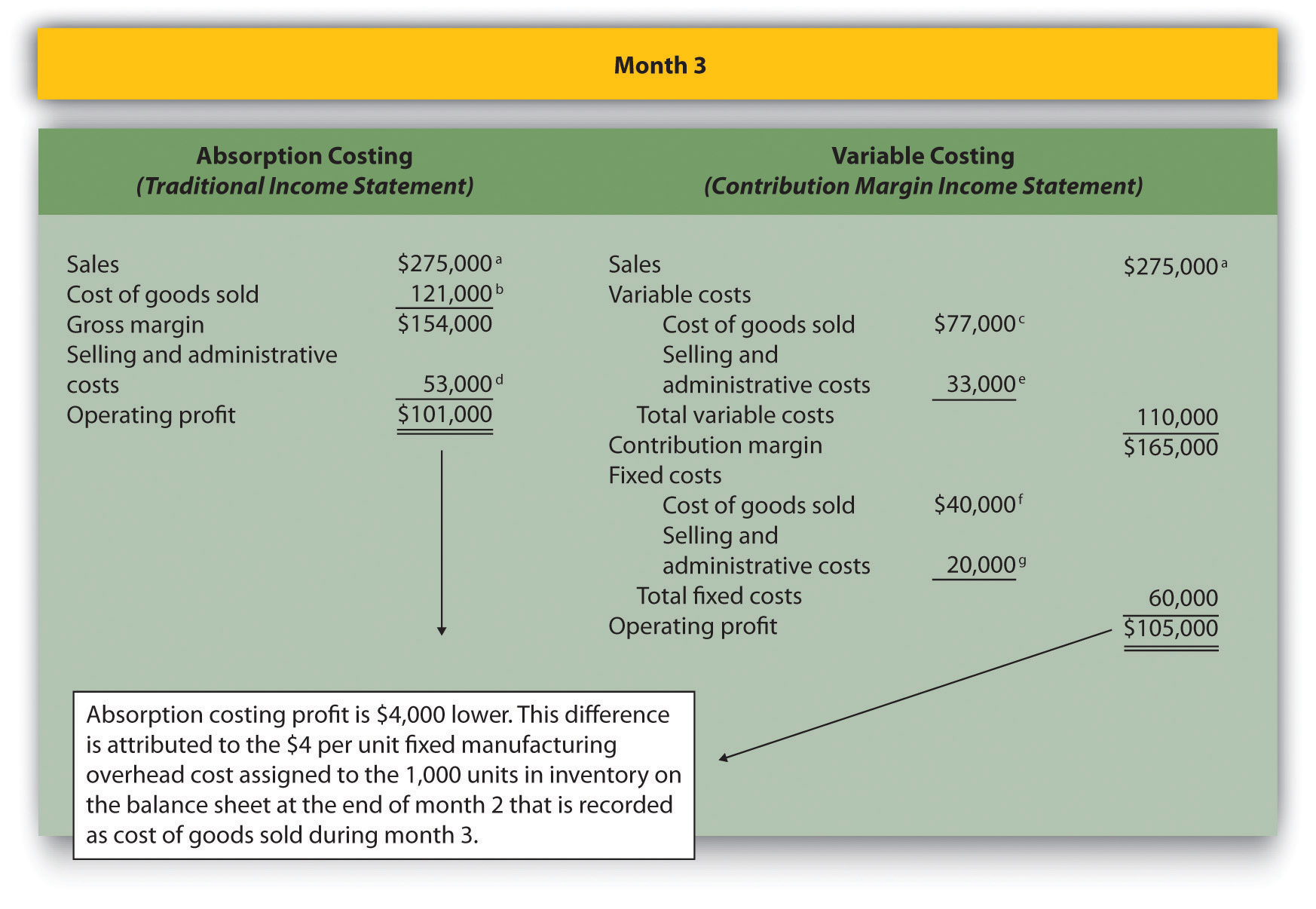

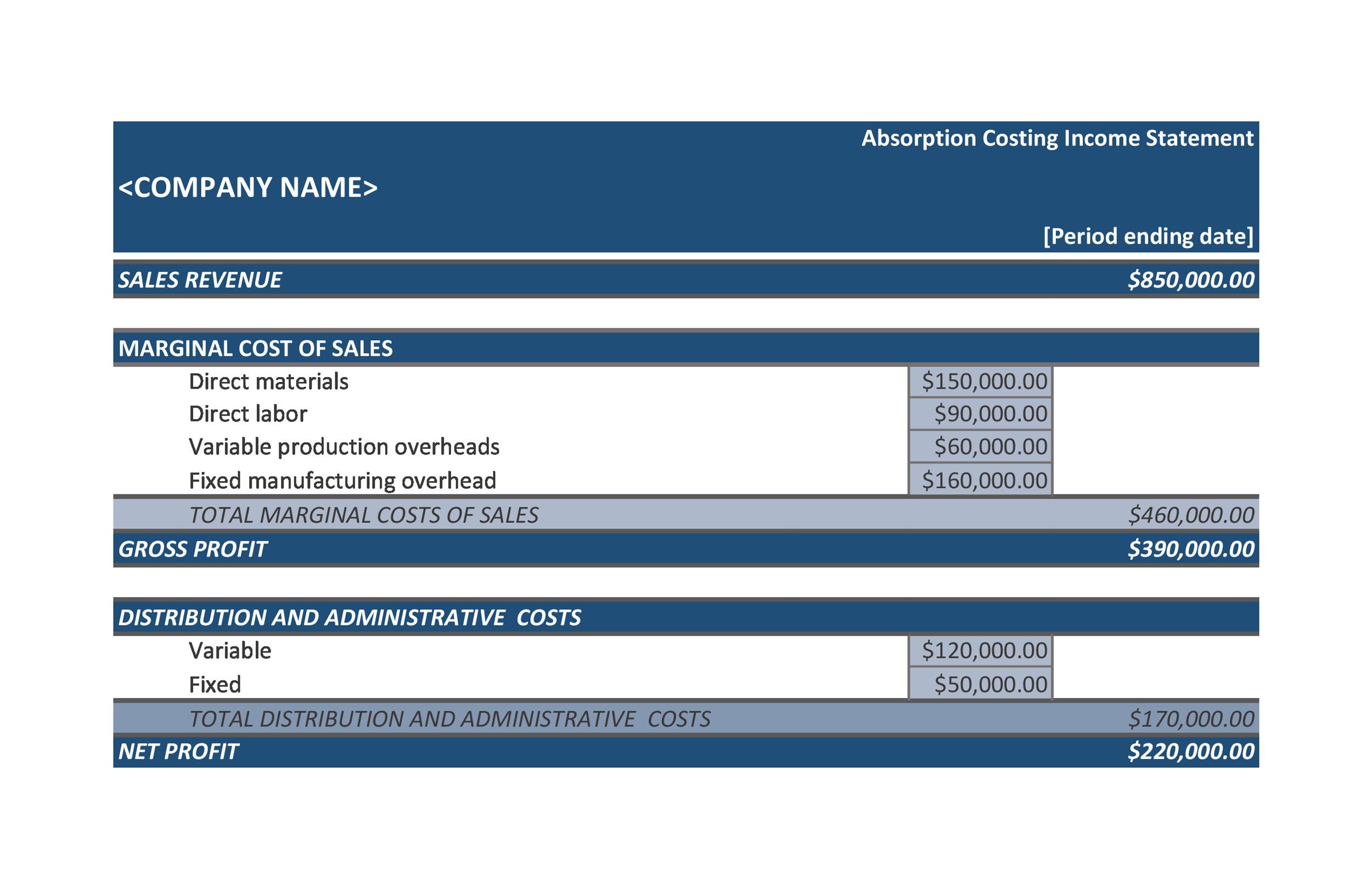

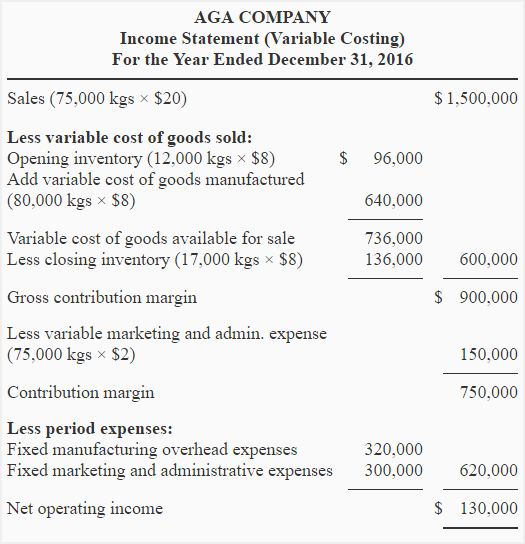

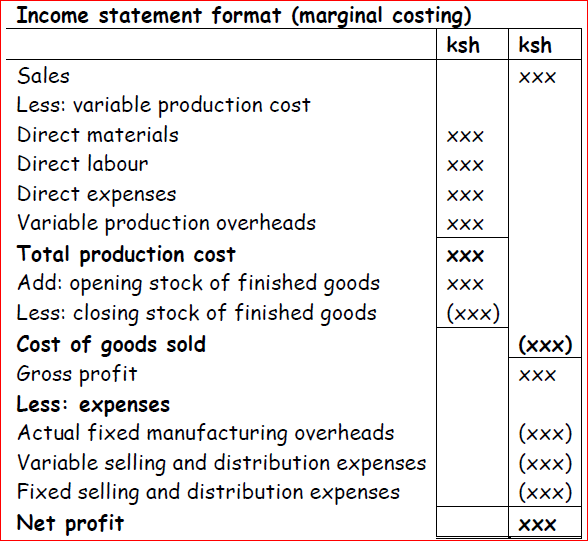

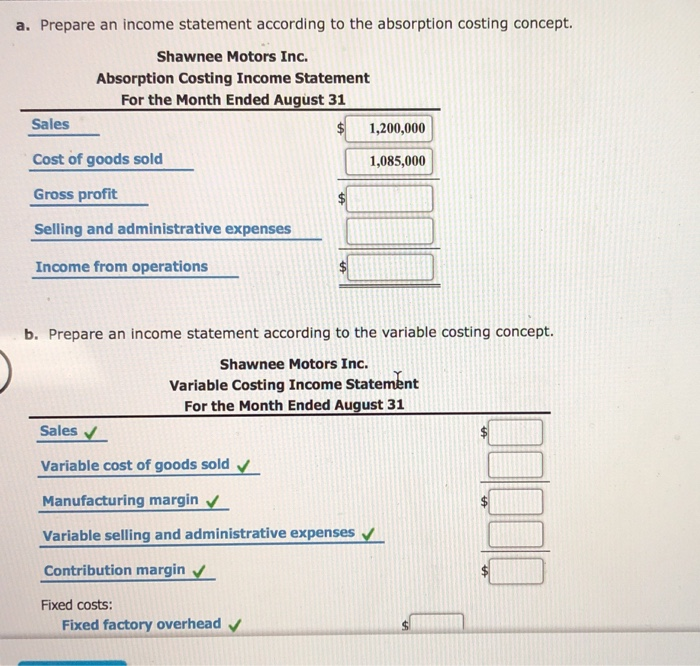

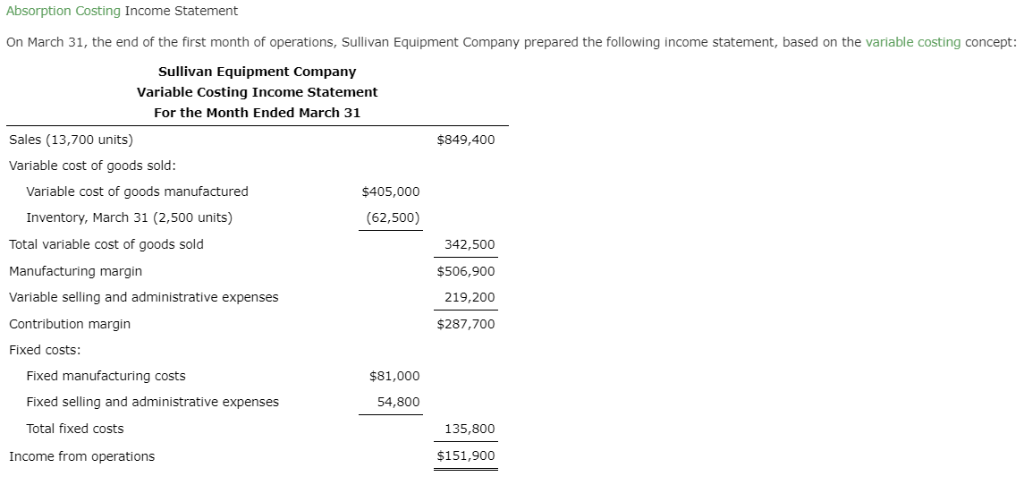

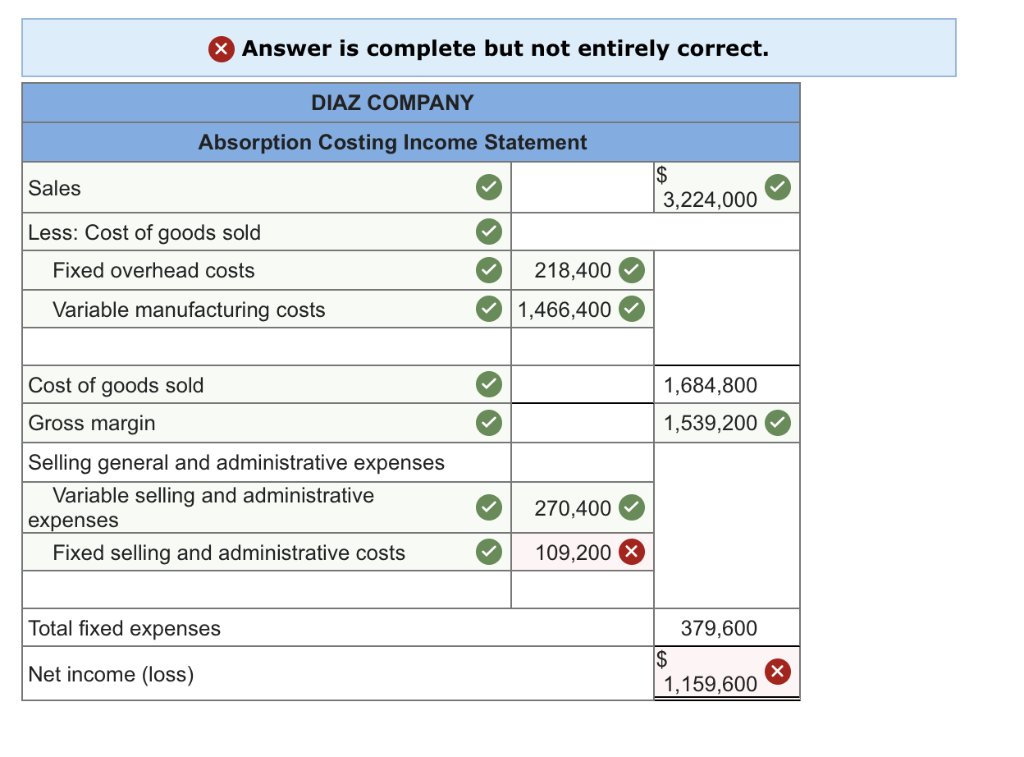

Income statement for absorption costing. The traditional income statement, also known as the absorption costing income statement, is created using absorption costing. The absorption costing and marginal costing income statements differ significantly in format. Net income is derived by subtracting all expenses (cogs and operating expenses) from total sales revenue.

The company began operations on july 1 and operated at 100% of capacity during the first month. The net income formula is: Points to remember the variable costs are directly charged in this costing method.

You are required to present income statements using (a) absorption costing and (b) marginal costing account briefly for the difference in net profit between the two income statements. Hence, absorption costing can be used as an accounting. (2,900), operating income under absorption costing is the same as it is under variable costing, $1,530.00.

Key takeaways absorption costing incorporates all direct costs and overhead associated with manufacturing a product. Assembles and sells snowmobile engines. Both begin with gross sales and end with net operating income for the period.

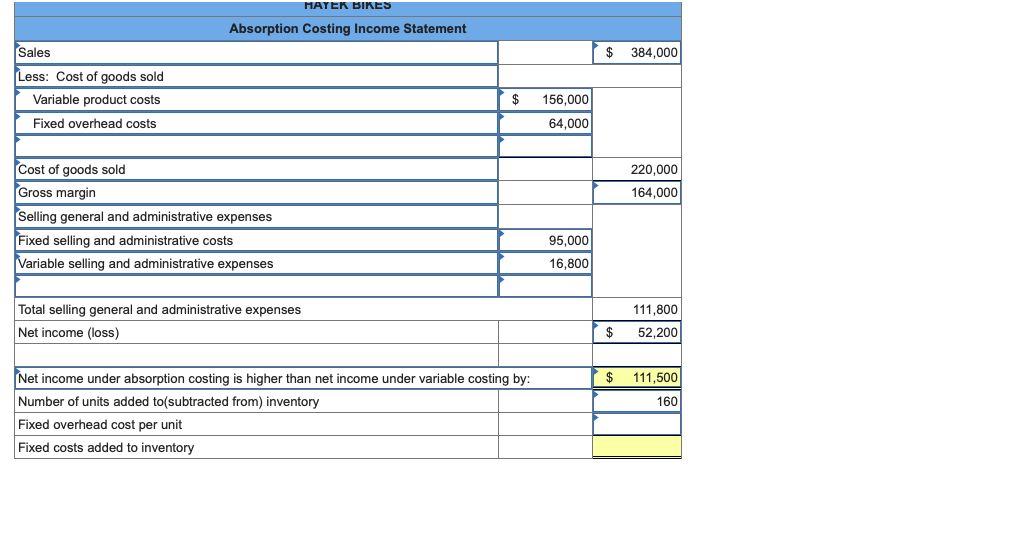

Income statements under absorption costing and variable costing. Total cost = total direct cost + total overhead cost total direct cost = direct material cost + direct labor total overhead cost = variable overheads + fixed overheads examples of absorption costing formula (with excel template) Things to bear in mind.

Absorption costing takes into account all costs associated with the manufacturing of products, regardless of whether the products were sold or not. If the company estimated 12,000 units, the fixed overhead cost per unit would decrease to $1 per unit. In contrast, fixed costs are apportioned over different products manufactured over time.

In comparing the two income statements for bradley, we notice that the cost of goods sold under absorption is $3.90 per unit and $3.30 per unit under variable costing. These traditional income statements use absorption costing to form an income statement. In the previous example, the fixed overhead cost per unit is $1.20 based on an activity of 10,000 units.

Fixed overhead so formula for the total cost in absorption costing is given by: We can see that the profit per lamp has increased from $100 when 1,200 lamps are sold to $120 when 1,500 lamps are sold. What is the income statement under absorption costing?

The traditional income statement, also called absorption costing income statement , uses absorption costing to create the income statement. Absorption costing is the costing method used for financial accounting and tax purposes because it reflects a more comprehensive net income on income statement and a more complete cost of inventories on balance sheet by shifting costs between different periods in accordance with the matching concept. In the previous example, the fixed overhead cost per unit is $1.20 based on an activity of 10,000 units.

This distribution establishes the relationship between these costs and production. The first thing to be clear is that an absorption cost income statement is generated from absorption costs. If the company estimated 12,000 units, the fixed overhead cost per unit would decrease to $1 per unit.