Divine Tips About Ifrs 17 P&l Financial Statements Of Not For Profit Organisation Class 12

Tion with the use of fvoci in ifrs 17, for insurance companies.

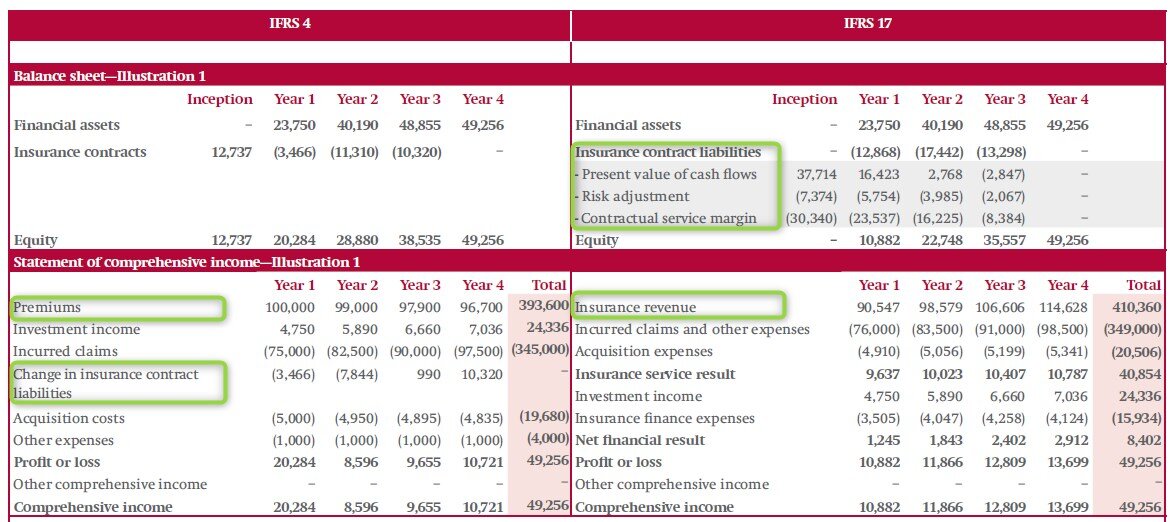

Ifrs 17 p&l. This document presents a selection of disclosures from the illustrative examples accompanying ifrs 17, to illustrate possible tagging using the ifrs taxonomy. What is oci in ifrs 17 23 september 2019 22 • option to recognise the effects of changing market conditions on liability valuations in two different ways :

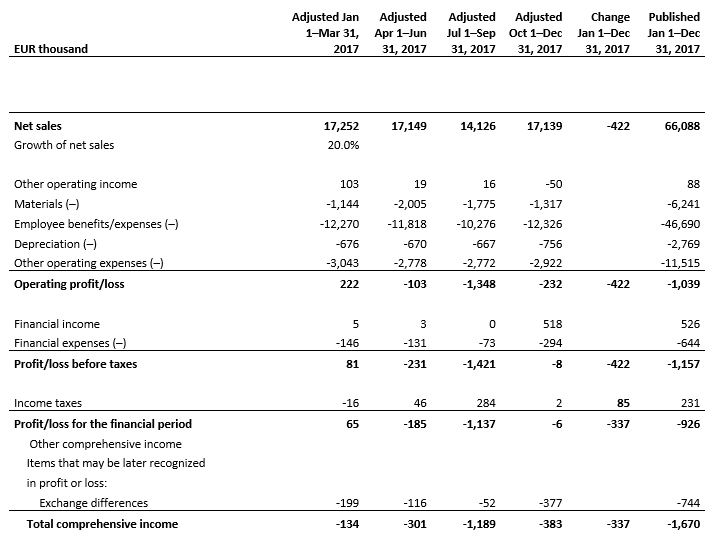

We believe, however, that there are meaningful limits to the effectiveness of further attempts to reach greater p&l stability without changing underlying beliefs. One example is the volatility caused by applying current rates for time value of money. This document is not intended to provide interpretative guidance.

It records the income from sales and the expenses incurred by. Ifrs 17 ifrs 17 is the newest ifrs standard for insurance contracts and replaces ifrs 4 on january 1st 2022. 19 feb 2024.

Insurance contracts combine features of both a financial instrument and a service contract. Under ifrs 17, the bonus and premium rebates will instead be included in “insurance service expense” (a new line item covering the sum of claims and costs) on the face of the p&l with additional disclosure in the notes. We discuss these further below.

A key feature of ifrs 17 is the concept of onerous contracts. With favourable market conditions and disciplined underwriting for swiss re, s&p global ratings anticipates even stronger earnings of $3.6b (ifrs 17 basis) in 2024. The focus remains on monitoring.

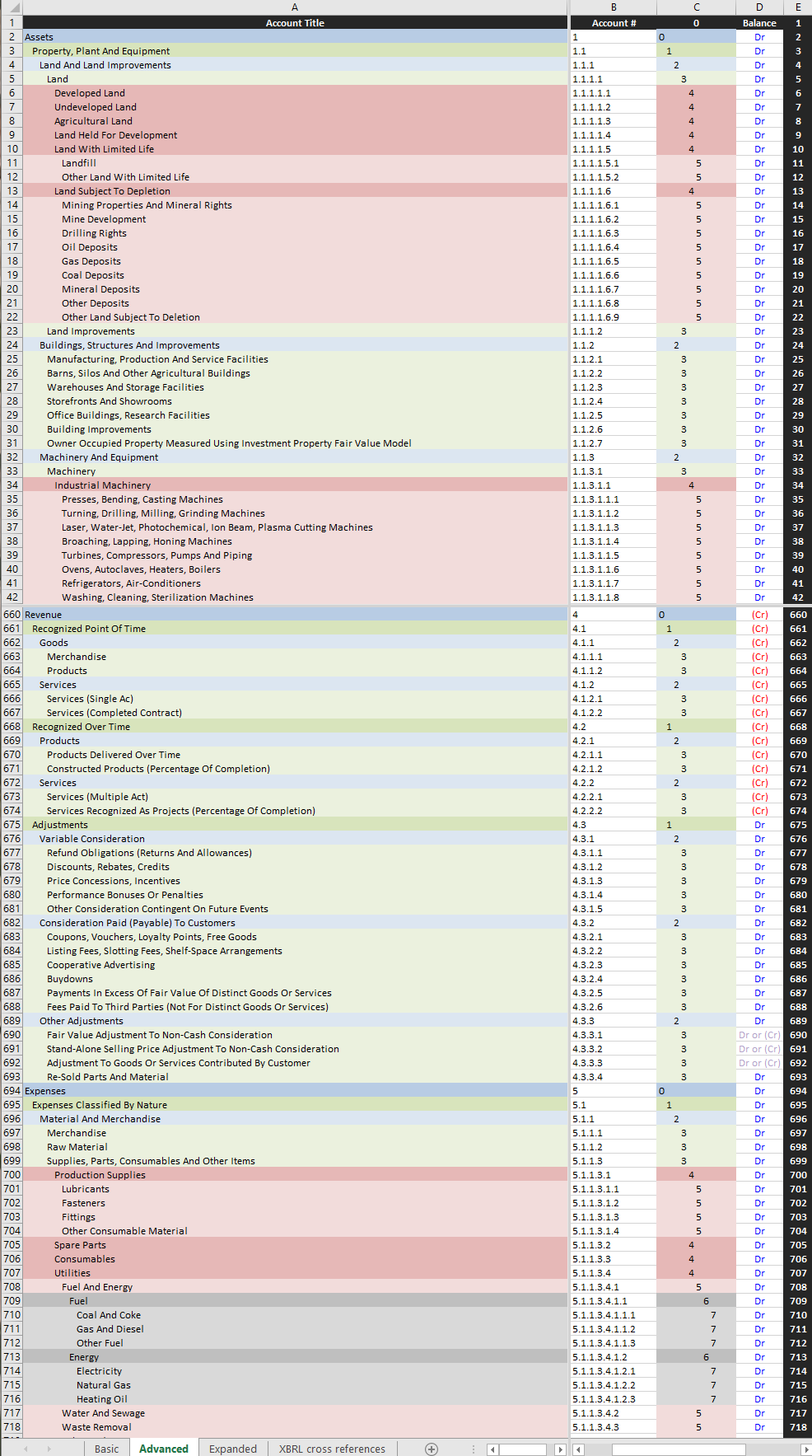

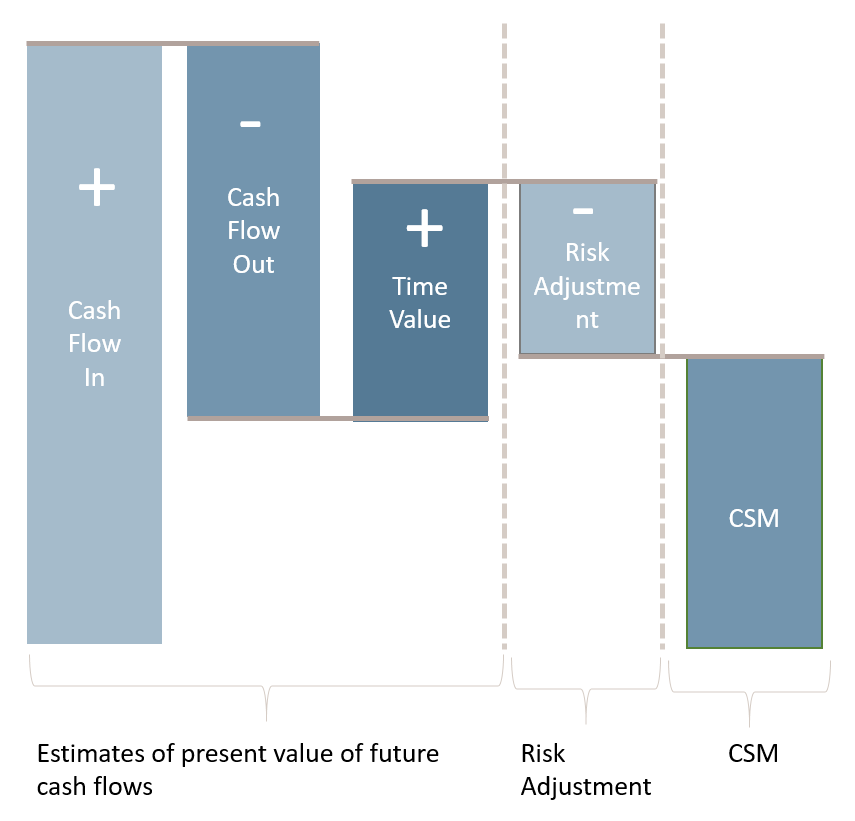

A possible format of the reconciliation of the insurance contract liability required by paragraph 101 of ifrs 17 is. Ifrs 17 insurance contracts 2 ifrs 17 issued on 18 may 2017 replaces an interim standard—ifrs 4 requires consistent accounting for all insurance contracts, based on a current measurement model will provide useful information about profitability of insurance contracts effective on 2021 early application permitted one year comparative information Ifrs 17 is effective for annual reporting periods beginning on or after 1 january 2023 with earlier application permitted as long as ifrs 9 is also applied.

What to do now implications for european insurers executive summary the international accounting standard board (iasb or board) issued the new insurance accounting standard, ifrs 17 insurance contracts (the standard) on 18 may 2017. Usual’ disclosures that are included in ifrs 17 and ifrs 7 (as amended by ifrs 17 and ifrs 9). With existing accounting for insurance contracts, investors and analysts find it difficult to:

Several features of ifrs 17 have been criticized by preparers. It states which insurance contracts items should by on the balance and the profit and loss account of an insurance company, how to measure these items and how to present and disclose this information. In preparation for the adoption of ind as 117, the equivalent to ifrs 17 'insurance contracts', the insurance regulatory and development authority of india (irdai) has announced the reconstitution of its expert committee dedicated to the implementation of indian accounting standards (ind as) and.

It is our impression that the ifrs 17 p&l remains more volatile than many stakeholders would like. Ifrs 4 was an interim standard which was meant to be in place until the board completed its project on insurance contracts. For insurance contracts, these include reconciliations of insurance contract balances, as well as new disclosures about insurance revenue, the contractual service margin, insurance finance income or expenses, transition

Ifrs 17 establishes the principles for the recognition, measurement, presentation and disclosure of insurance contracts within the scope of the standard. The standard will have to be applied for reporting periods starting on or after 1. Requirements of ifrs 17, insurance contracts (ifrs 17), as issued by the international accounting standards board (iasb) in may 2017, as well as the new disclosures introduced or modified by ifrs 9, financial instruments (ifrs 9), through