Casual Info About Form 26a For Non Deduction Of Tds Pro Forma Financial Statements Example

0:00 / 22:49 procedure for filing form 26a | no deduction or short deduction of tds | section 201 (1)| ca hanuman tax engineer 247 subscribers.

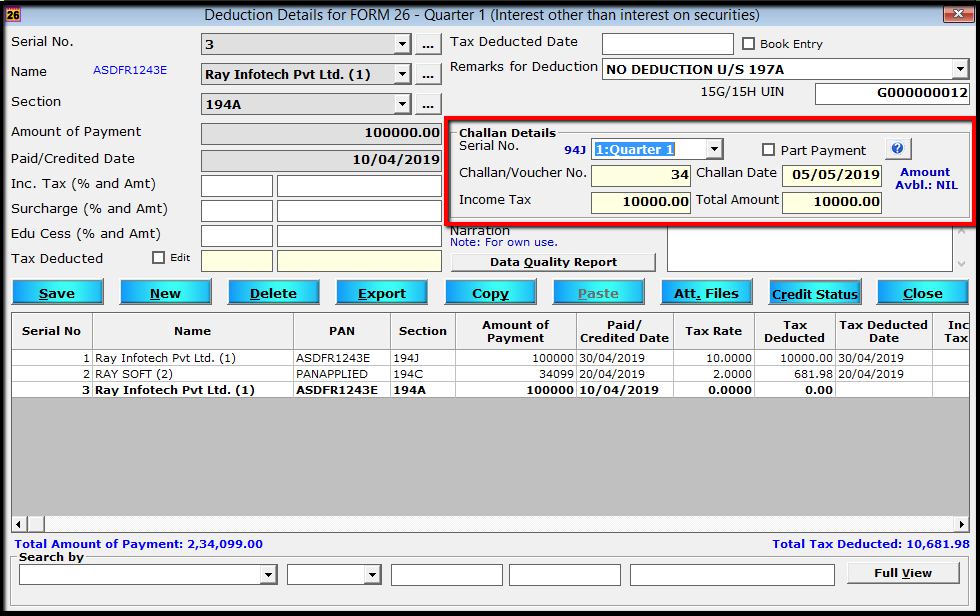

Form 26a for non deduction of tds. [3] din is unique identification number of single deductee row. Electronic filing of form 26a/27ba for short deduction/collection and non deduction/collection of tax at source. Non deduction, late deduction and late deposit of tds may lead you to face following consequences:

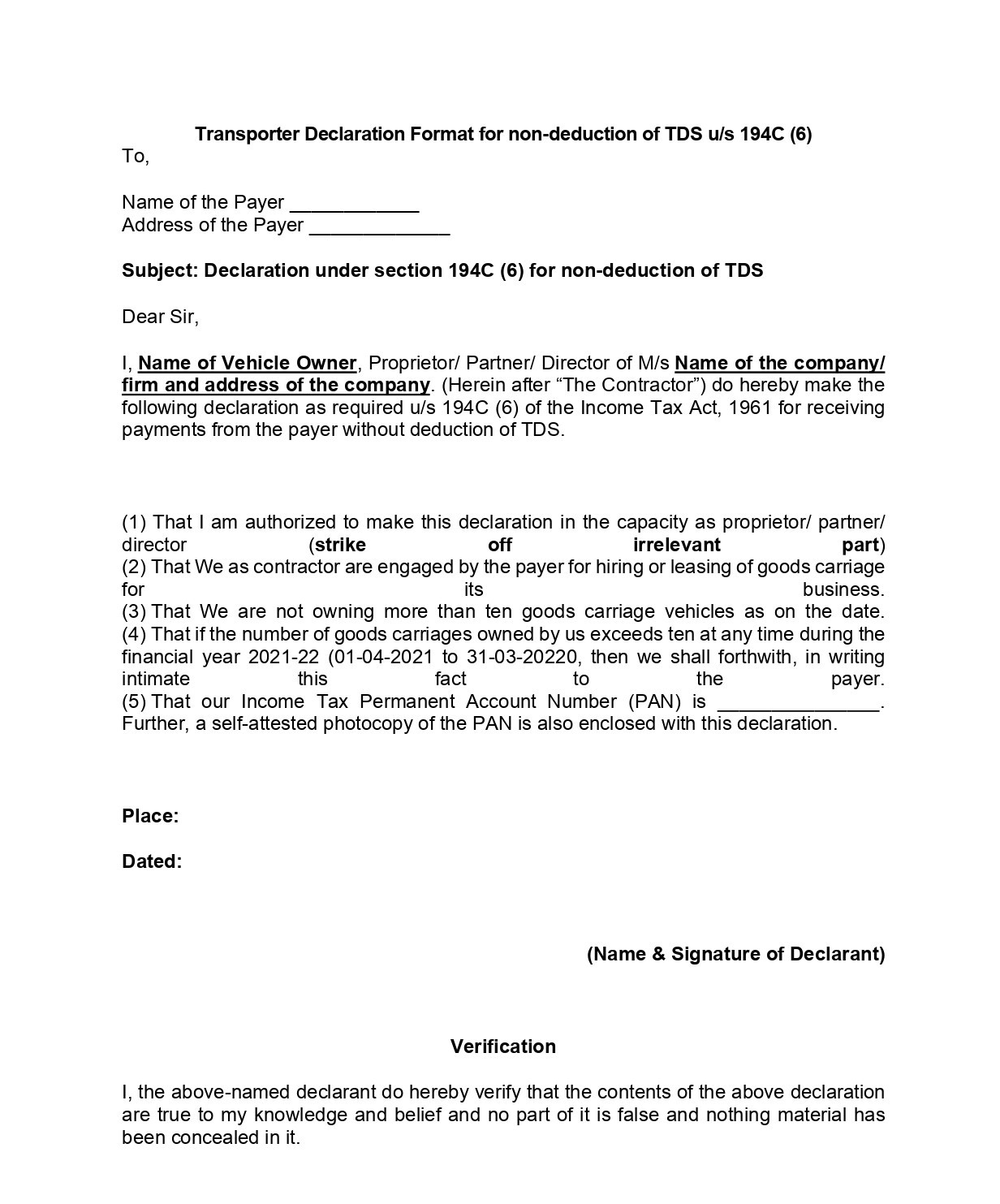

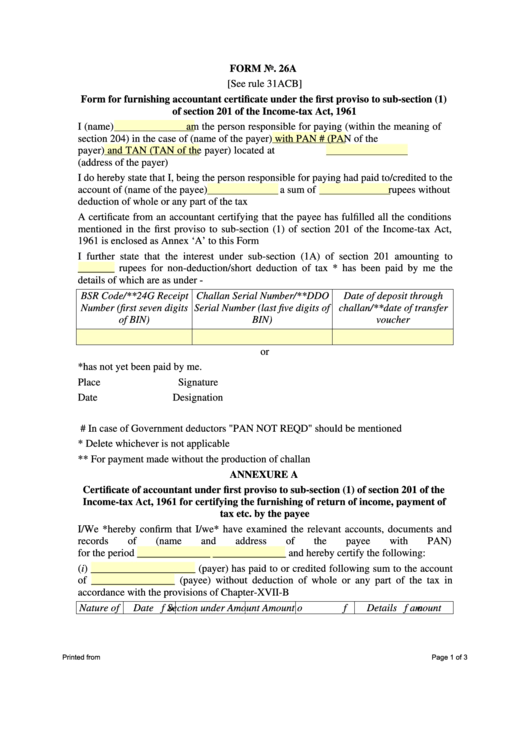

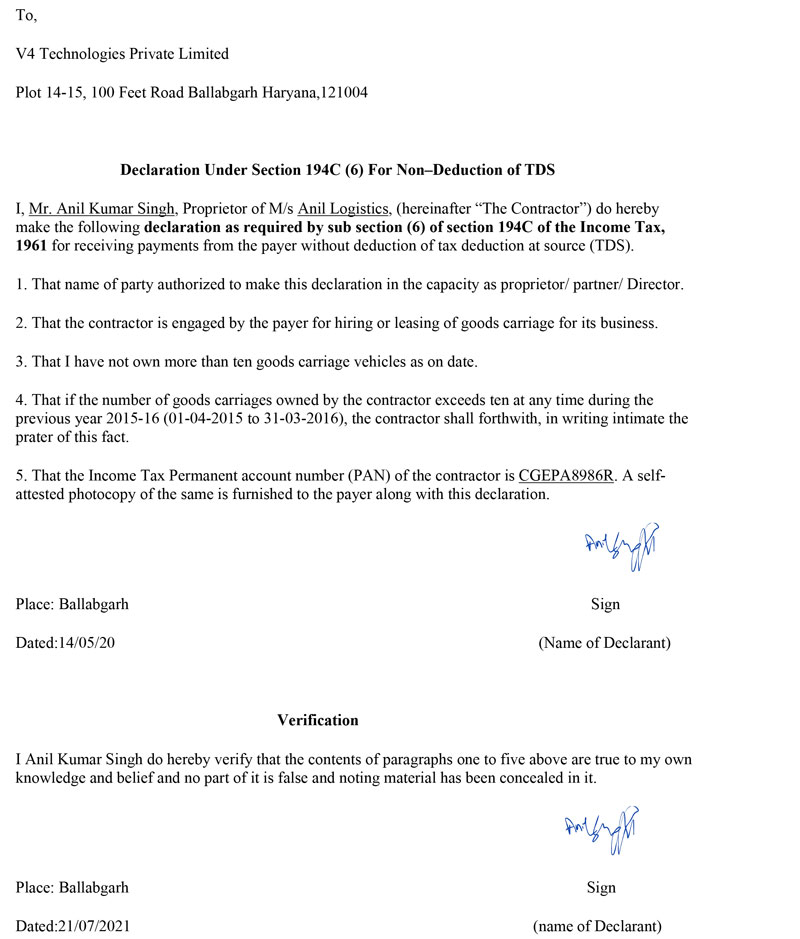

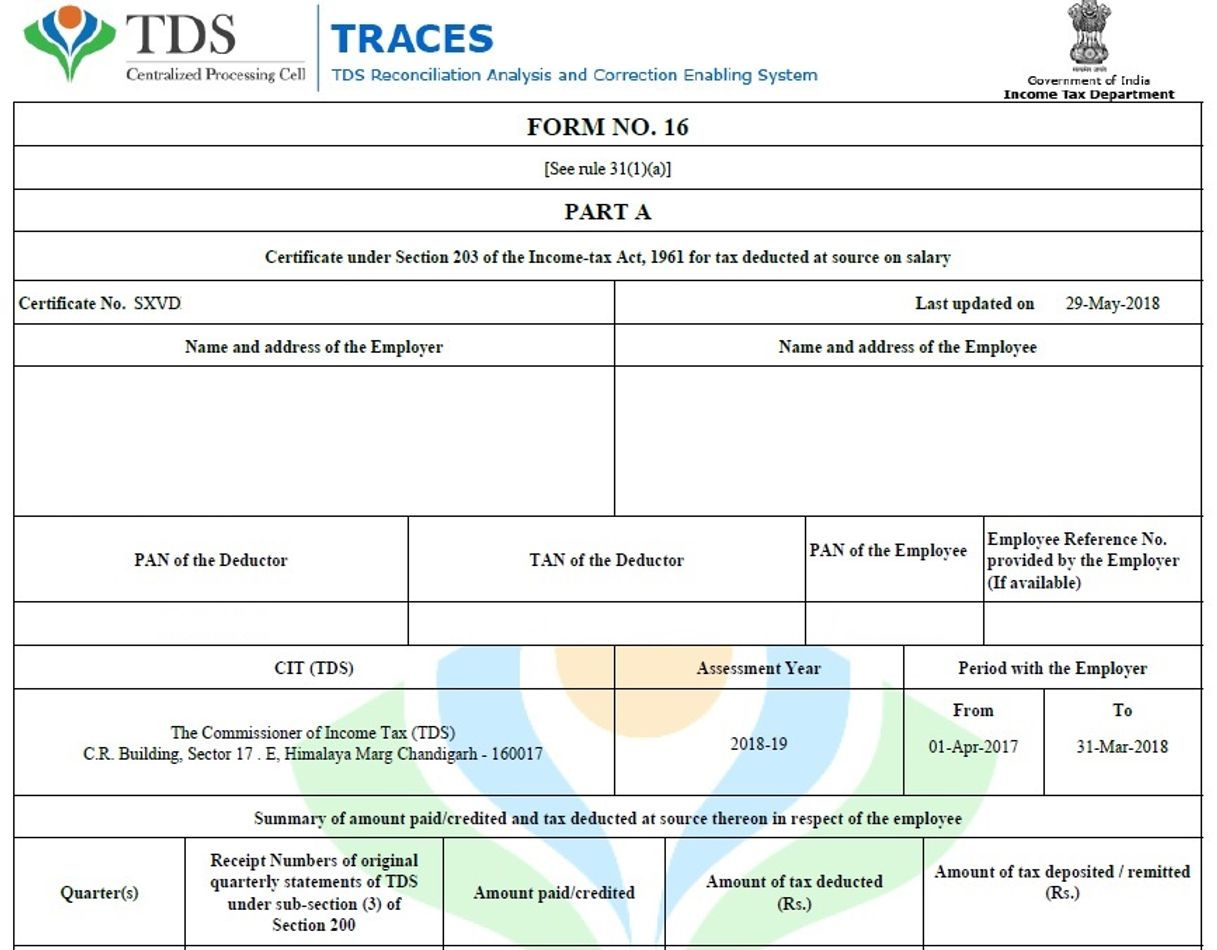

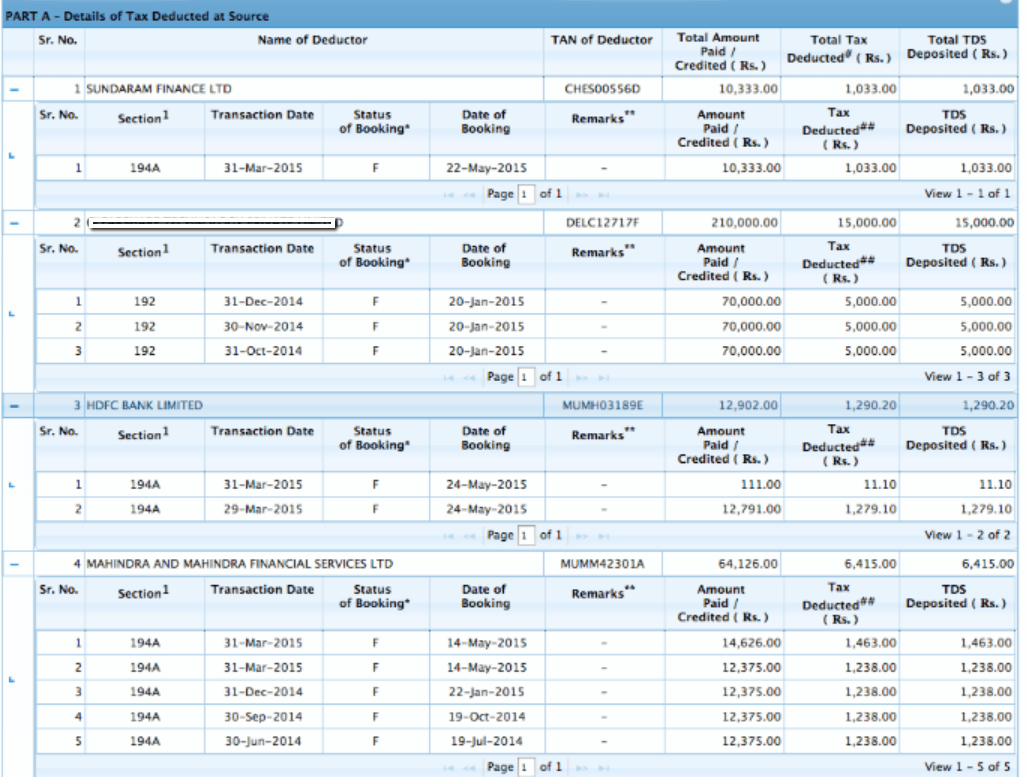

Procedure for electronic filing of form 26a is as follows: The deductor has to go to the traces portal and submit a request for form 26a. Procedure for filing and verification of form 26a ca certificate.

Log in to traces site with user id, password, tan of deductor/collector and verification code. Dr that the only issue in. Write “d” if the deduction is at higher rate under section 206aa on account of non.

27ba for default in payment of tcs) and issued. The steps for requesting form 26a/27ba are given below: Procedure for the purposes of furnishing and verification of form 26a for removing of default of short deduction and /or non deduction of tax at source.

Proviso to section 201 (1) for tax deduction at source, provides that any person who fails to deduct the whole or any part of the tax in accordance with the. 11/2016 states that the following. Form 26a filing process i ca satbir singh ca satbir singh 129k subscribers join subscribe.

Tds short deduction / non deduction by deductor : This video gives you detailed explanation about of consequences of non deduction of tds or tds deducted but not paid like disallowance of expenditure for non. The procedure for electronic filing of form 26a is as follows:

As there are many defaults in tds statements so as per traces to reduce such defaults on account of. Itat enables assessee to produce form 26a as additional evidence. Write “c” if grossing up has been done.

The payer furnishes a certificate of chartered.

![Seting system [Download 44+] Sample Letter Of Request Not To Deduct](https://assets1.cleartax-cdn.com/s/img/2018/05/14152740/page-11.png)