Have A Info About Taxable Income On Statement Applied Materials Balance Sheet

Your taxable income is used to work out how much tax you need to pay.

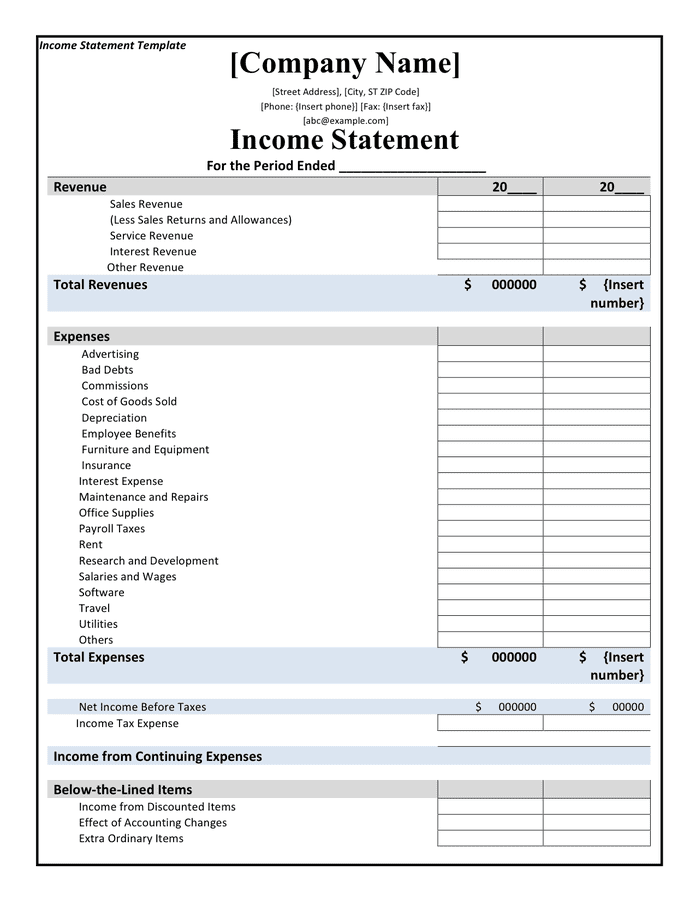

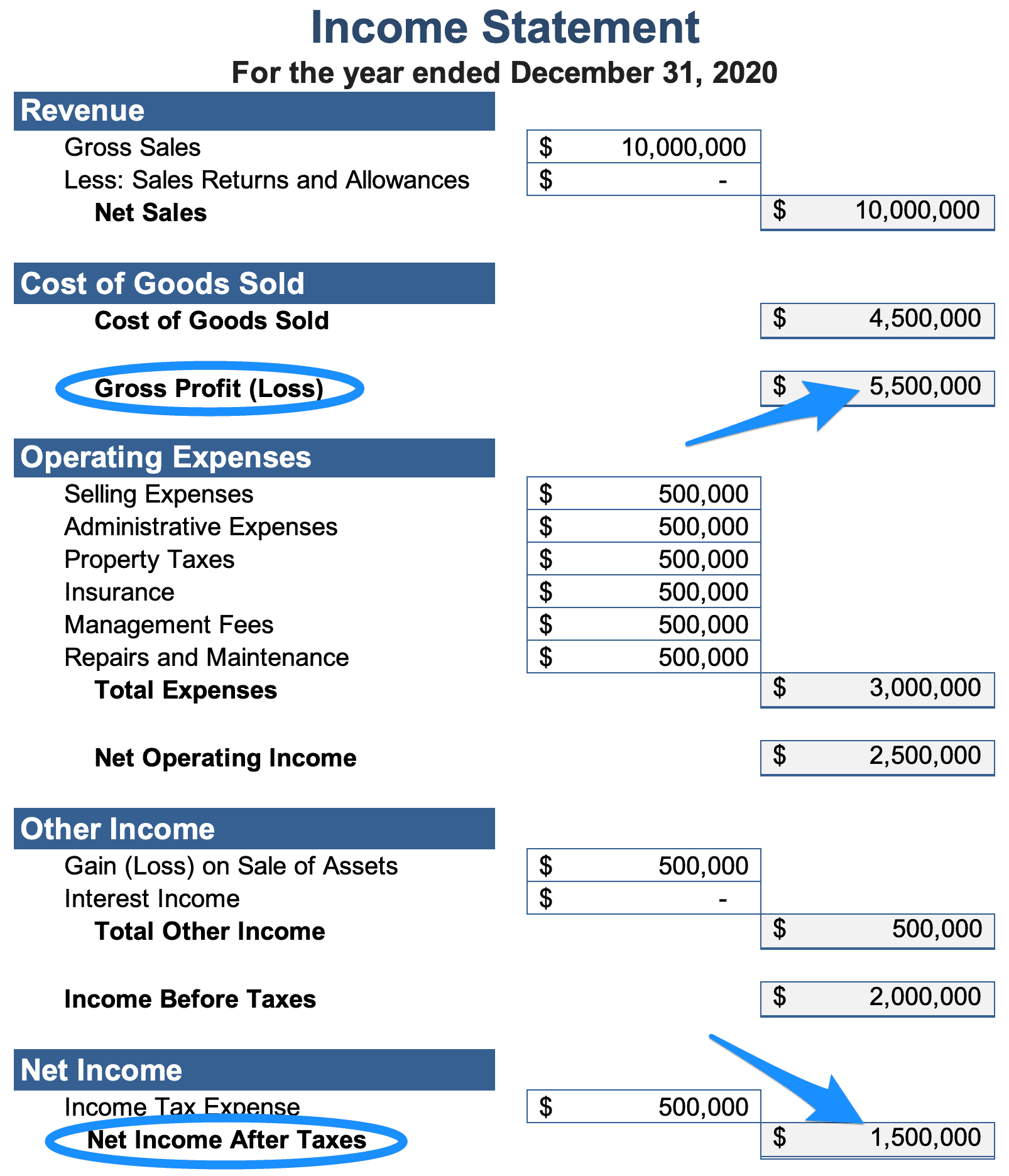

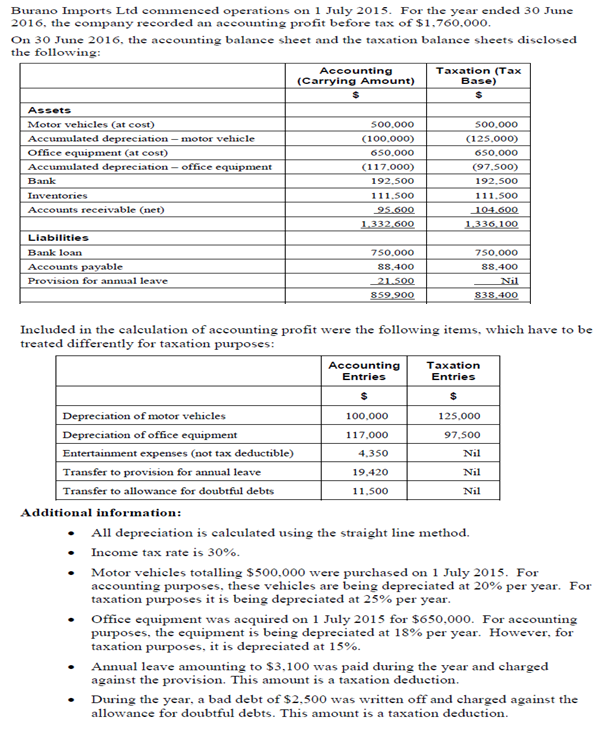

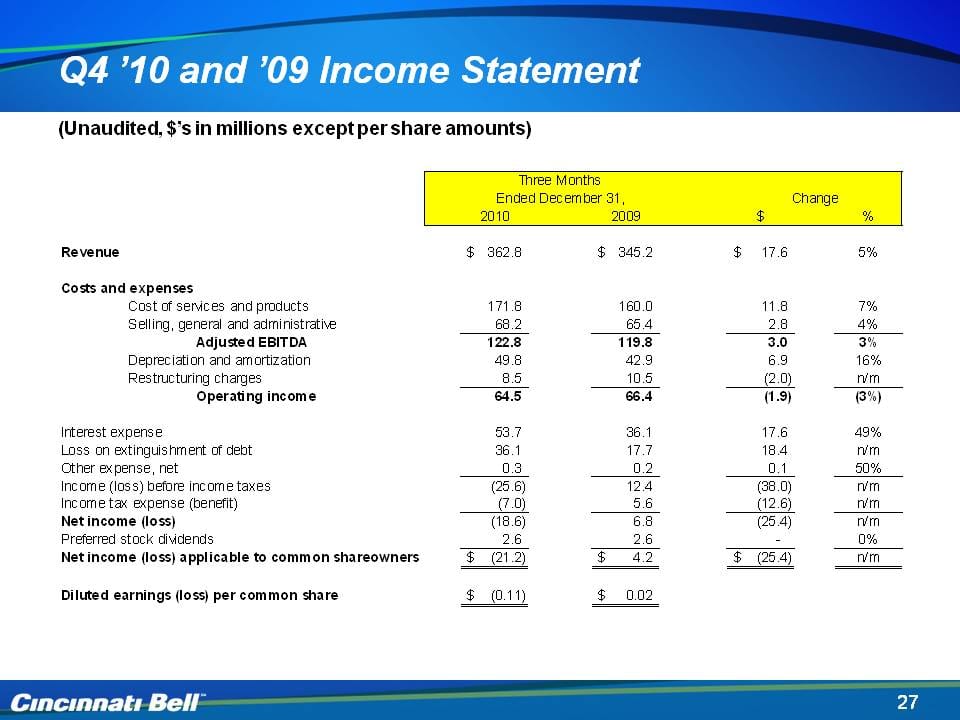

Taxable income on income statement. After deducting interest payments, and depending on the business and other expenses, you're left with the profit a company made before paying its income tax bill. Then, subtract any eligible deductions from your adjusted gross income. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time.

Taxable income refers to the portion of an individual's or a business's income that is subject to taxation by the government. You will need to file a return for the 2024 tax year: Tax expense (or tax benefit) is reported on the income statement and is an aggregate of a company’s income tax payable (or recoverable) and any changes in.

[1] in other words, the income over which the government imposed tax. It is calculated based on a company’s tax rate and appears on the balance sheet. Your taxable income is your assessable income minus any allowable deductions.

You’ll need to know your filing status, add up all of your sources of income and then subtract. Taxes appear in some form in all three of the major financial statements: An income statement is a financial statement that reports a company's financial performance over a specific accounting period.

On the screen you will see your income from your employer or employers for the income year, and the tax that has been withheld. Financial performance is assessed by giving a. The income is still taxable.

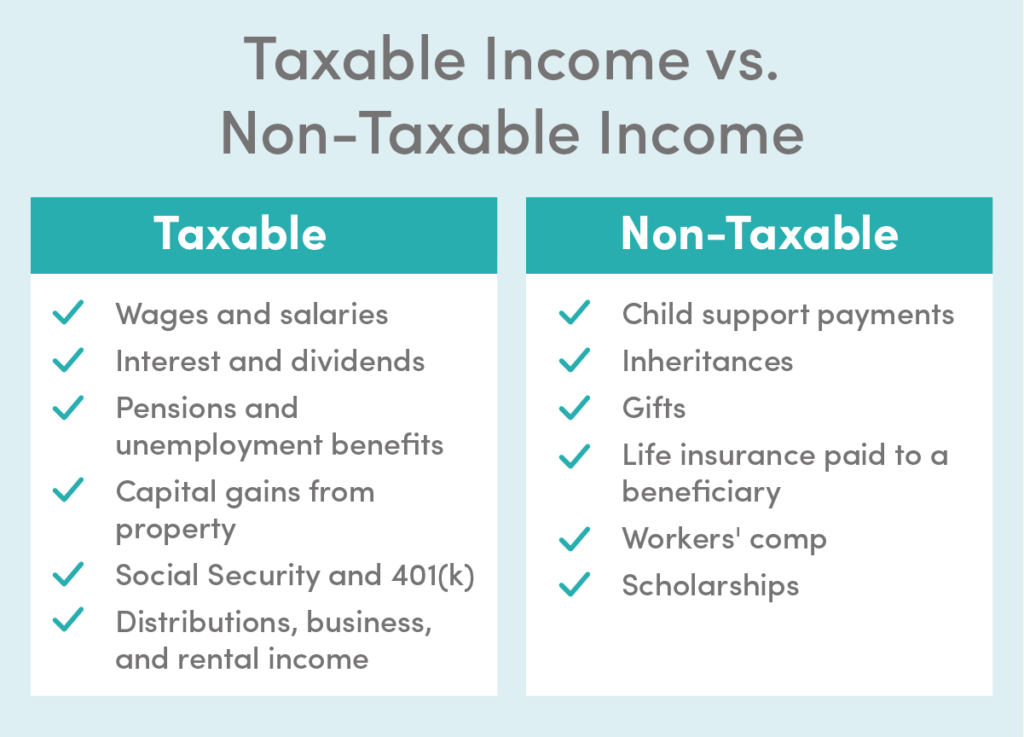

This section discusses many kinds of income that are taxable or nontaxable. Enter the total, and attach a statement to your tax return that itemizes where. Next, find your adjusted gross income.

Learning how to calculate your taxable income involves knowing what items to include and what to exclude. Your gross revenue includes all income received from sales, after you subtract things like returns and discounts. To calculate income tax, you add all forms of taxable income earned in a tax year.

By filing your tax return on time, you’ll avoid delays to any refund, benefit. Gather documents for all sources of income when you know your filing status, you will need to gather documents. Generally, it includes some or all items of income and.

For those with a provisional income between $25,001 and $34,000 filing single, or $32,001 and $44,000 filing as married jointly, just 50% of. Select income statement. Taxable income is the basis for a company’s income tax payable or recoverable.

Learn more about why investors should look at a company's income before taxes, also known as pretax earnings. Assessable income − allowable deductions = taxable income How to calculate taxable income step 1: