Neat Info About Statement Of Profit And Loss A Company Business Income

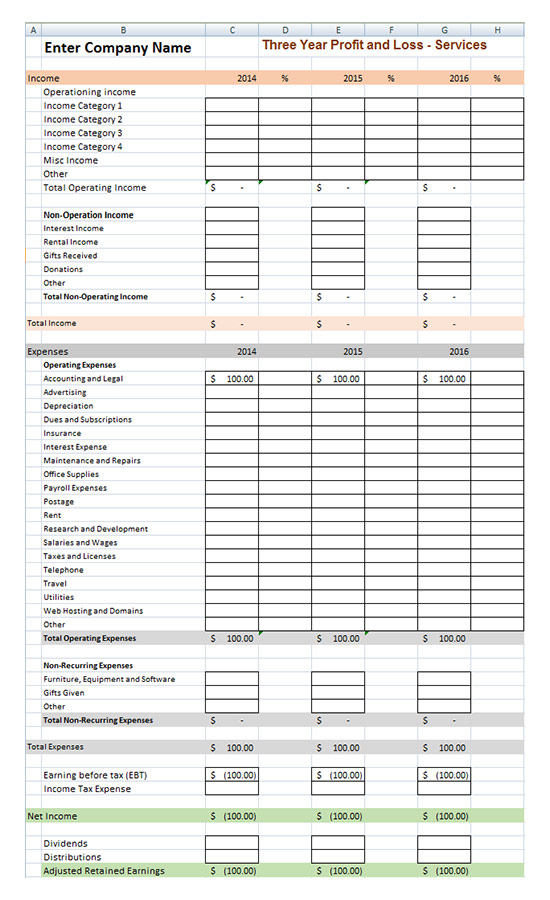

A p&l statement is a financial statement summarising the costs, expenses, and revenues a company incurs during a specific period.

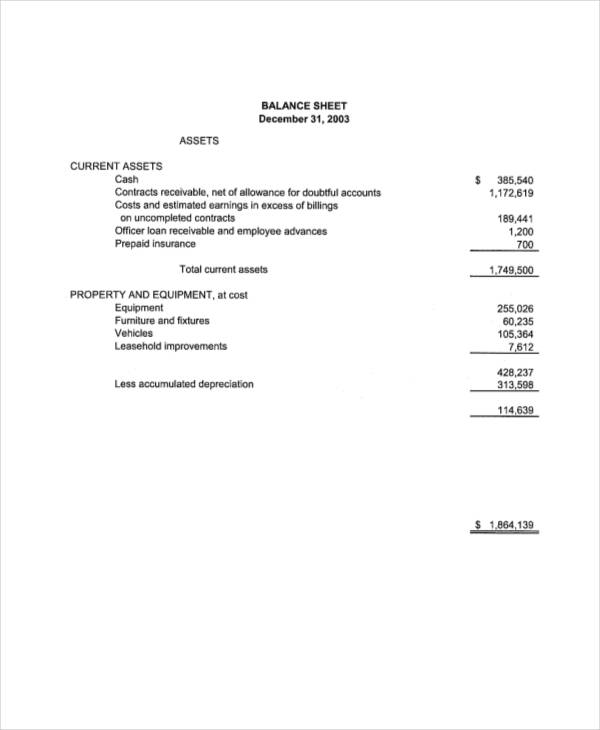

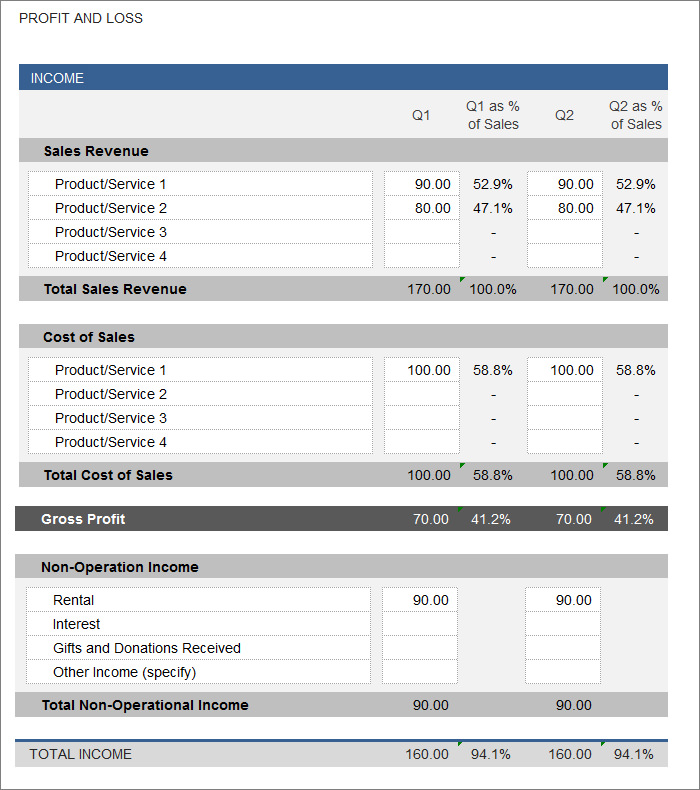

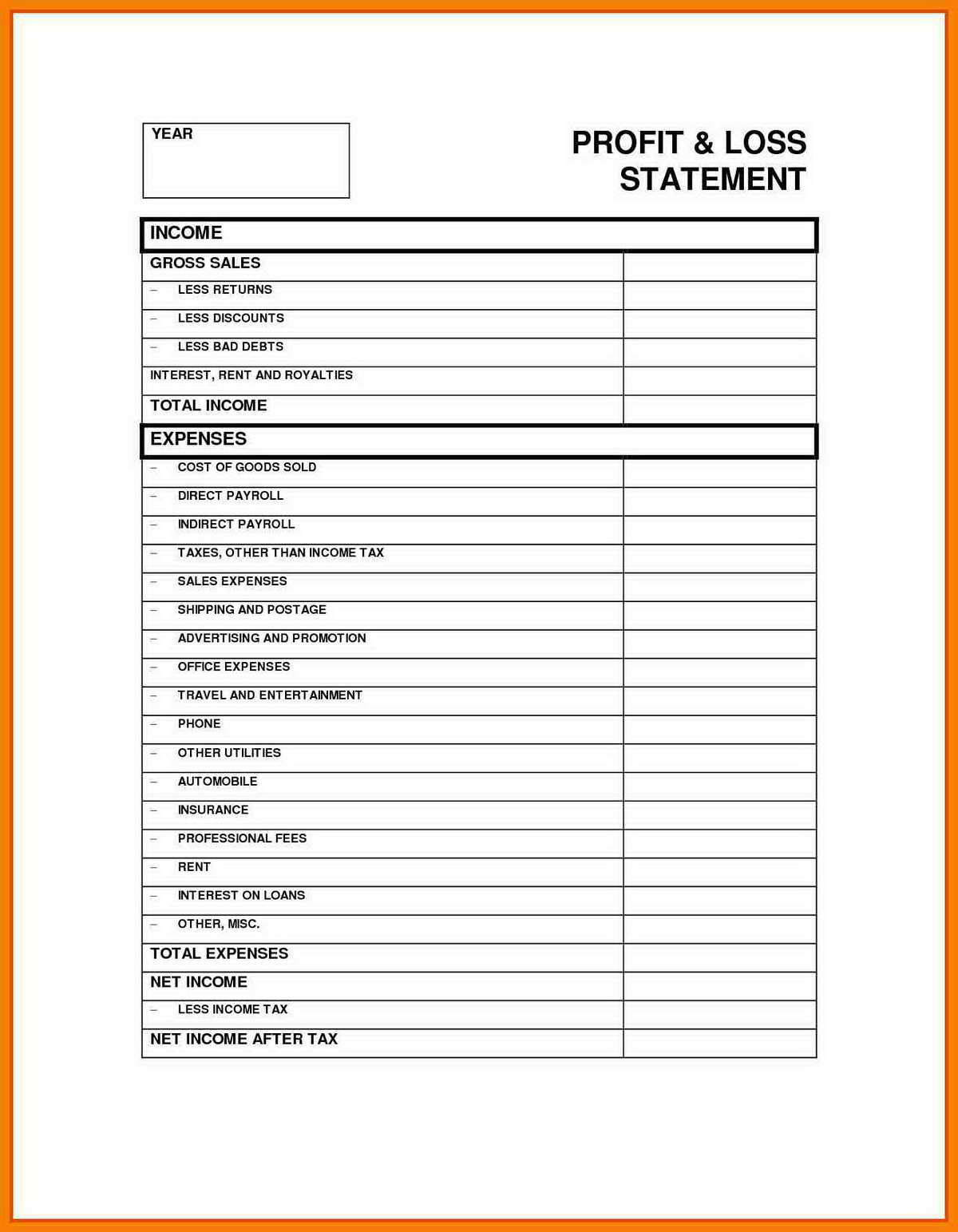

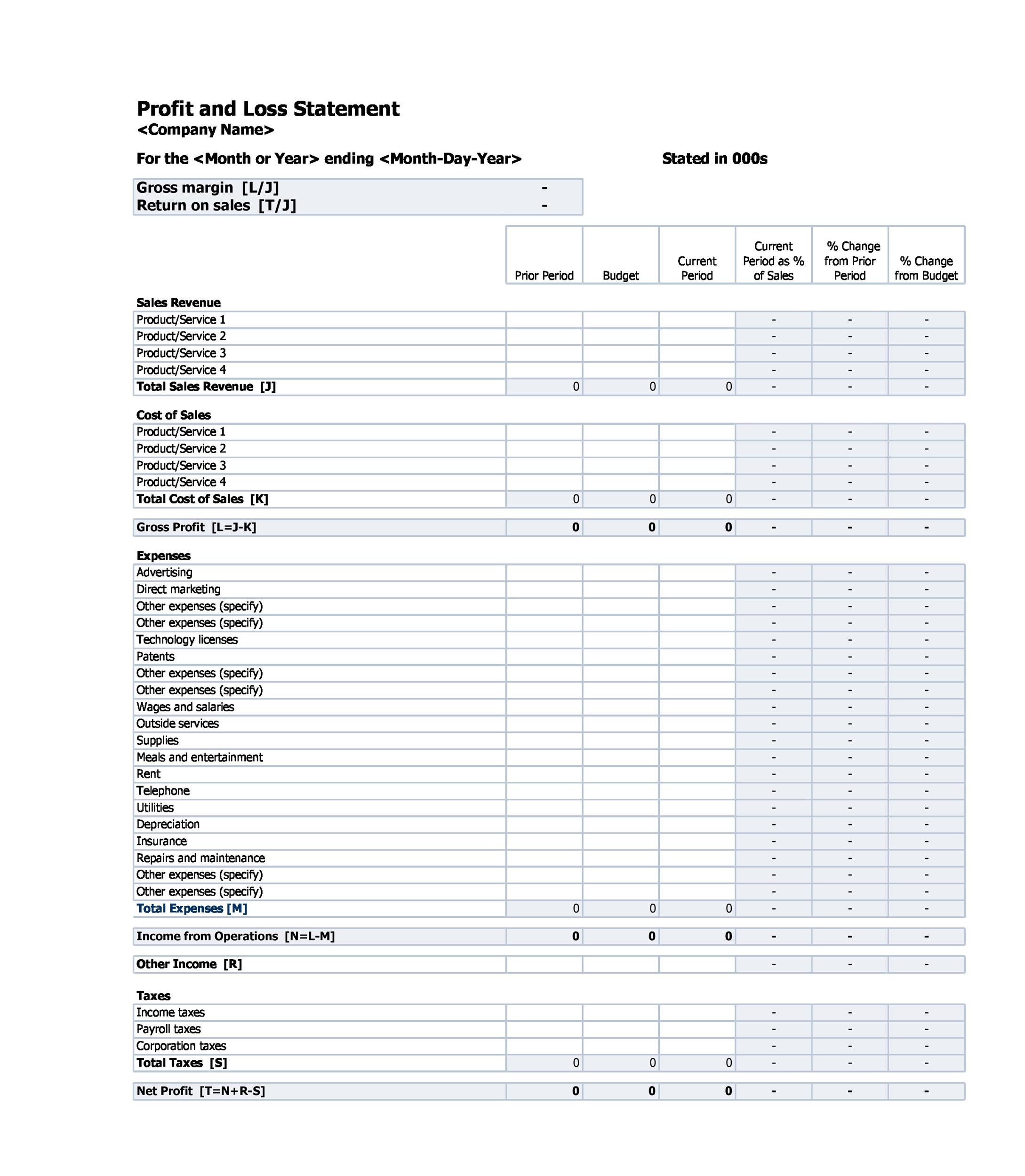

Statement of profit and loss of a company. Cash basis or accrual method. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. This is one of three financial reports businesses are required to prepare annually and quarterly, along with a cash flow statement and balance sheet.

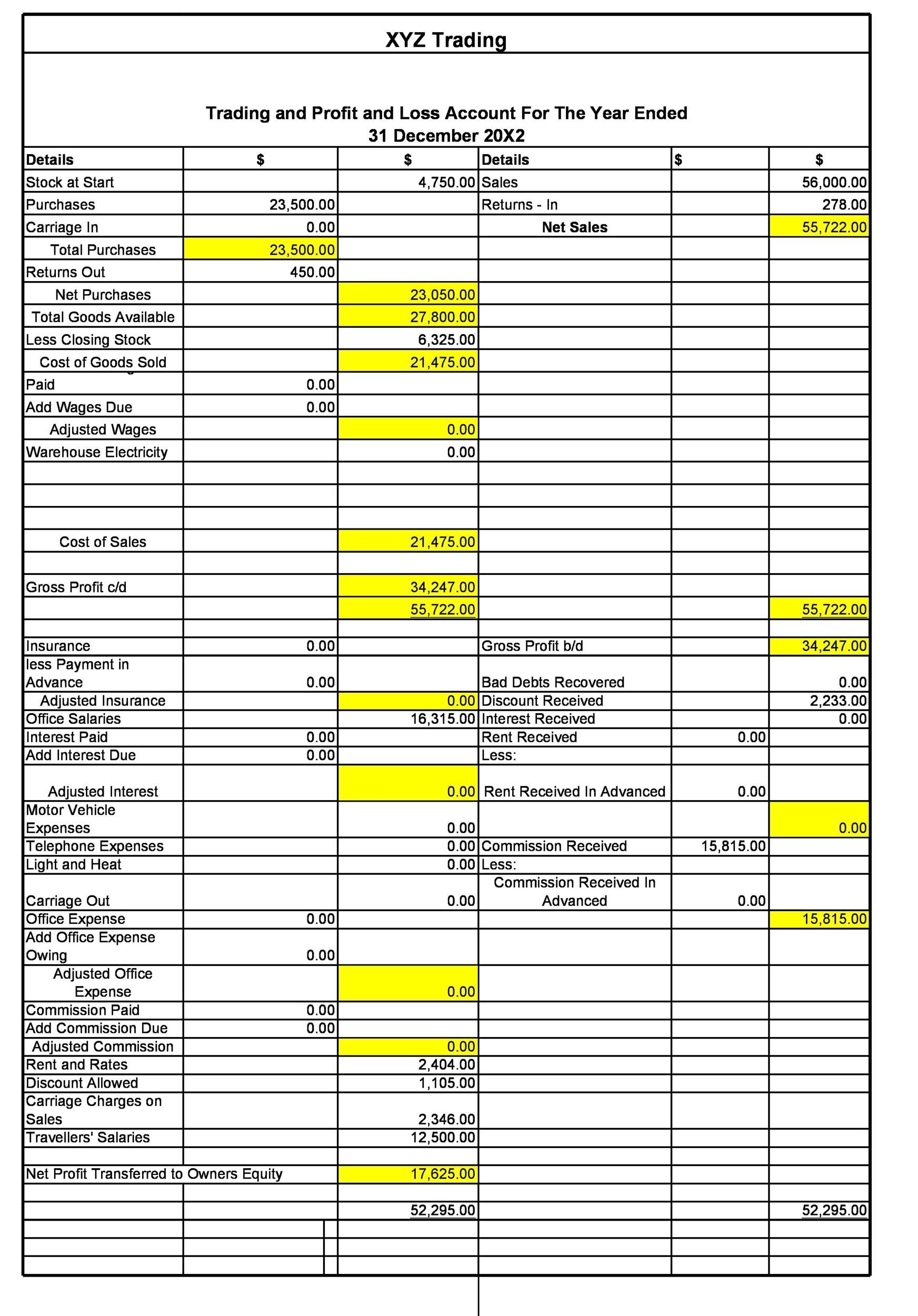

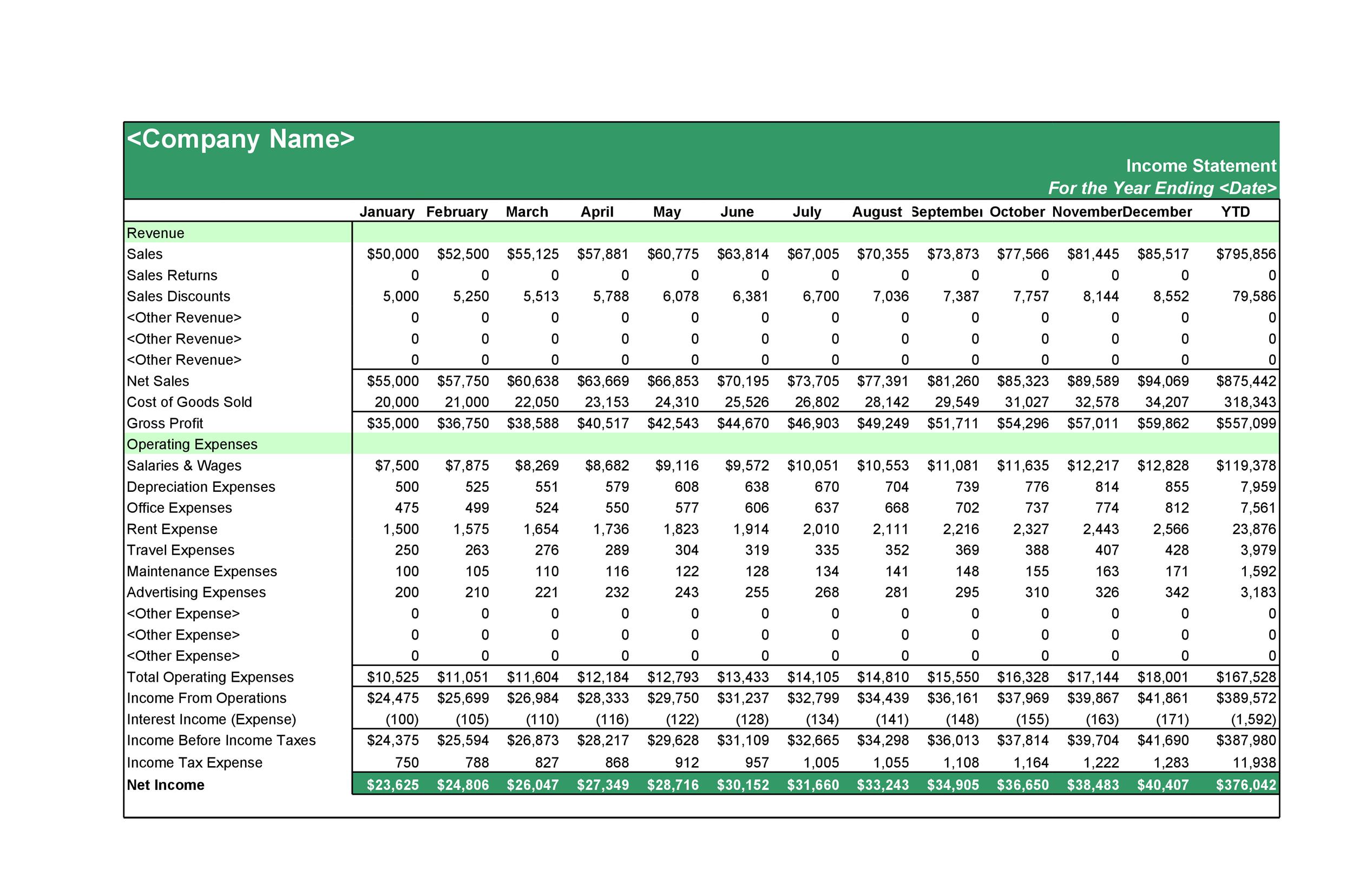

The period typically refers to a quarter or a fiscal year. In basic accounting, the p&l statement is always one of the first financial statements to be prepared. Moreover, a profit and loss statement usually consists of company revenues, costs, and expenses within a specific period, like a month, a quarter, a fiscal year — or even a week.

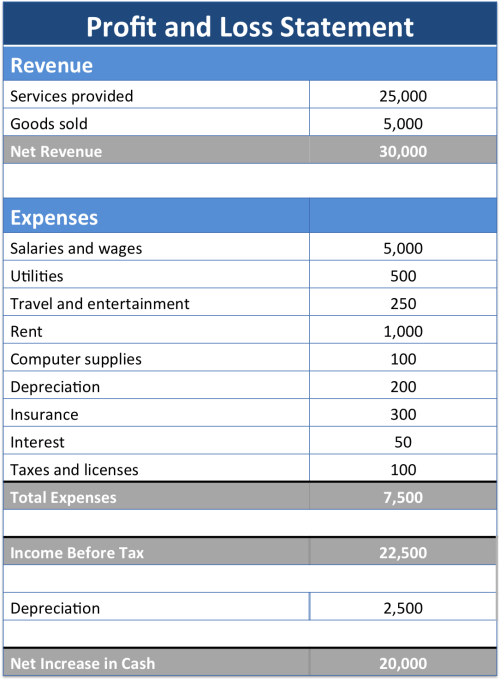

The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. A profit and loss statement is also called an “income statement,” as it presents the revenue and expenses that ultimately created profitability — or loss — for the period. The final figure will show the financial performance and show if the business has made a profit or loss.

Profit and loss are two financial terms that are probably the most common in the world of finance and business. The judge's ruling orders former president donald trump and his company to pay $354 million in fines, plus almost $100 million in interest, and restricts trump's business activities in the state. It contains information pertaining to a company’s revenue and expenses over a given period.

What is a profit and loss statement? The result is either your final profit (if. The profit and loss (p&l) statement (also known as an income statement) is one of the four basic financial statements that presents the revenues, expenses, and net income of a business.

A profit and loss statement is a financial statement that typically covers the following items: It shows all the company’s income and expenses incurred over a given period. The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

A profit and loss (p&l) statement, also known as an income statement or statement of earnings, is a vital financial document that provides insights into a company’s financial performance during a specific period. How to read a profit and loss statement It captures how money flows in and out of your business.

The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. Profit and loss statement is the financial report of the company, which provides a summary of the revenues and expenses of the company over a period of time to arrive at profit or loss for the period. A profit and loss statement is a snapshot of a company's sales and expenses over a period of time, such as one year.

A profit and loss statement is part of a trifecta of financial statements that every public—but not private—company is required to issue on a quarterly and annual basis. The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of a company, in a specified period. A company’s profit and loss (p&l) statement shows the companies revenues, costs, expenses, and net profit for a certain period.

The outcome is either your final profit or loss. Creating one is a standard way to compile historical data for your business to tell its financial story over time. It meant, the preparation of :