Who Else Wants Info About Economic Dependence Note Disclosure Example Indirect Method Cash Flow From Operating Activities

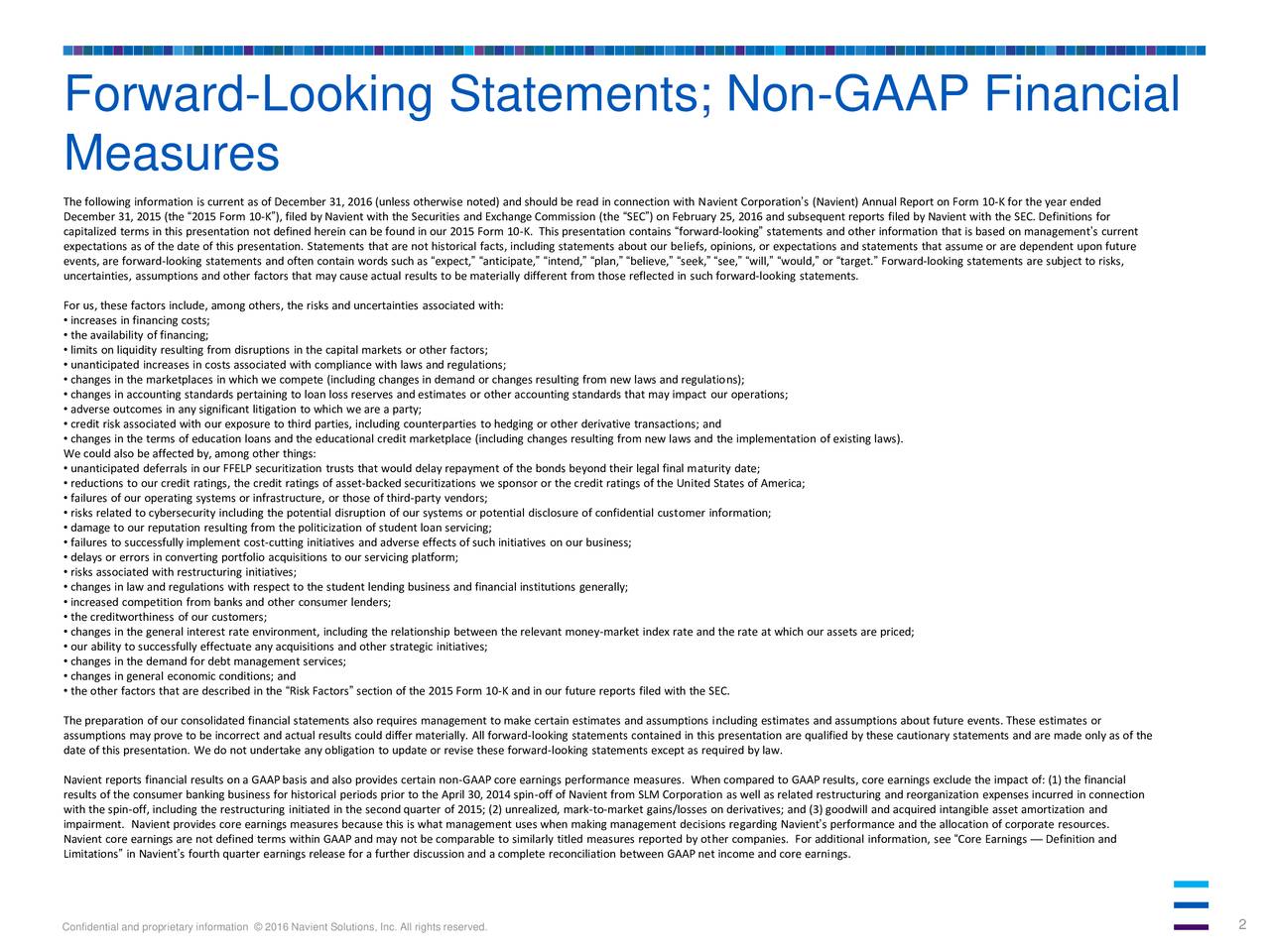

This heads up discusses the fasb’s recently issued accounting standards update (asu) no.

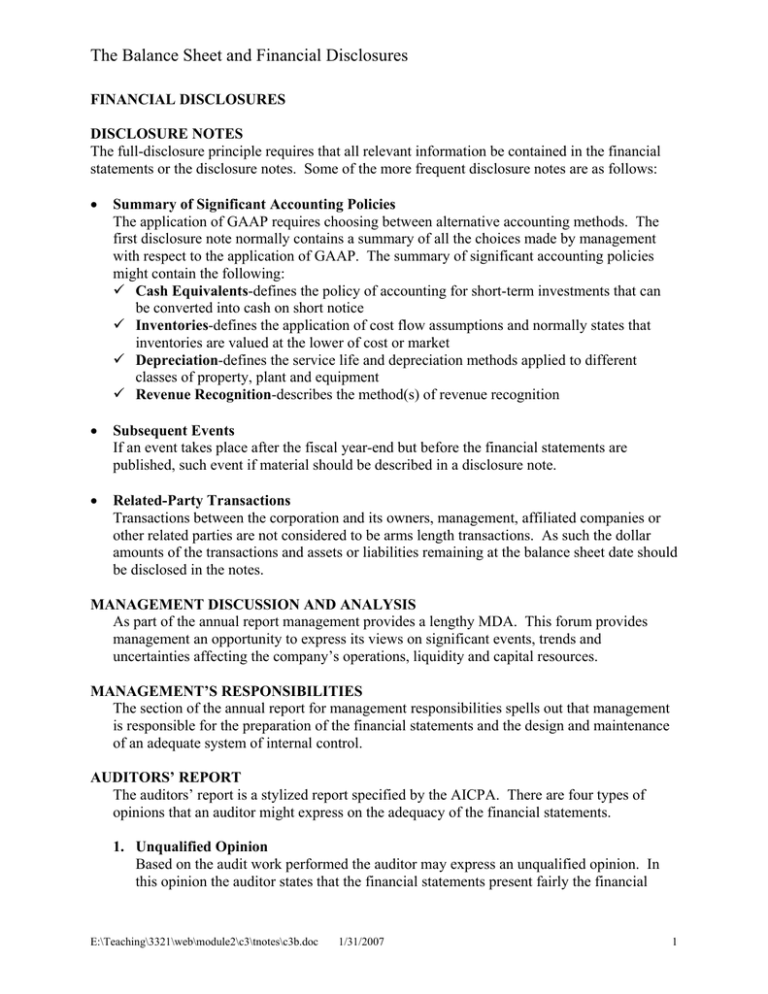

Economic dependence note disclosure example. 1980 disclosure of related party transactions and economic dependency; The standard defines various classes of entities and people as. Ias 24 requires disclosures about transactions and outstanding balances with an entity's related parties.

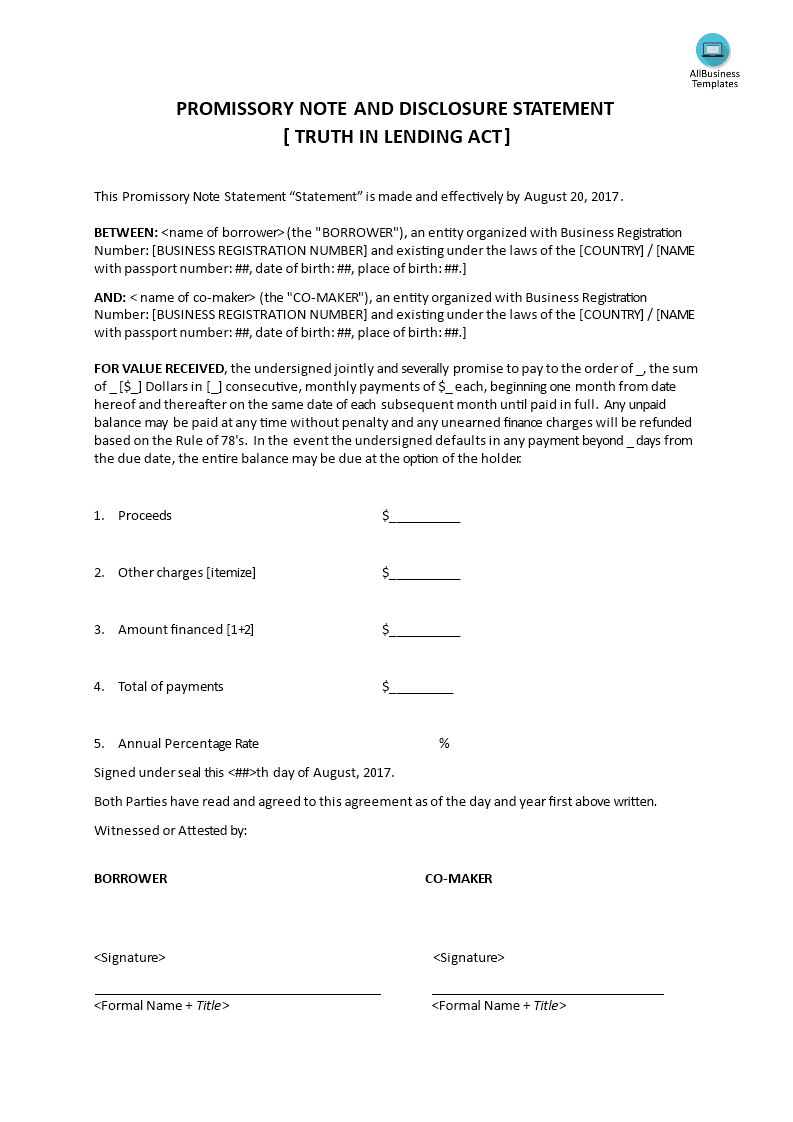

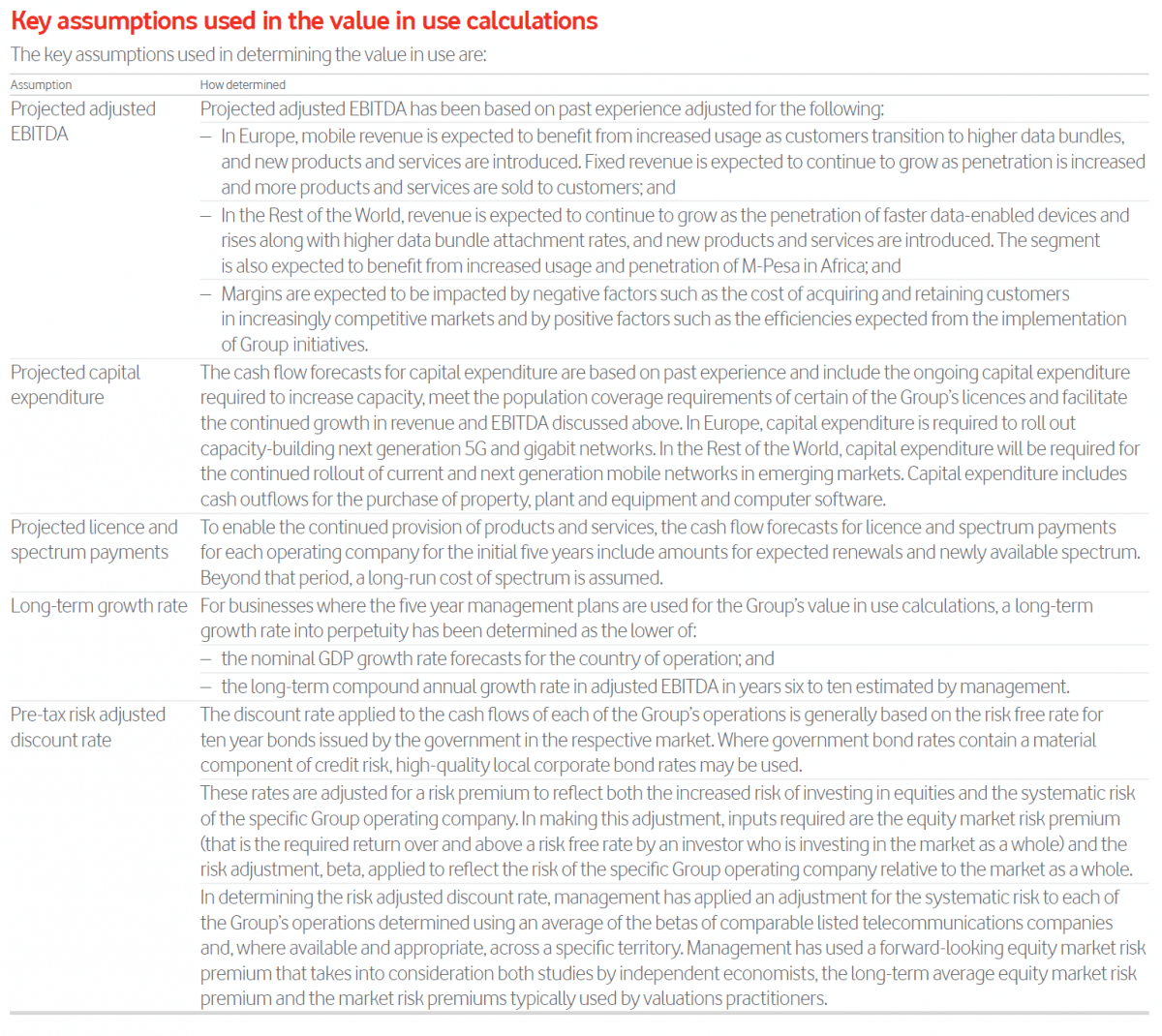

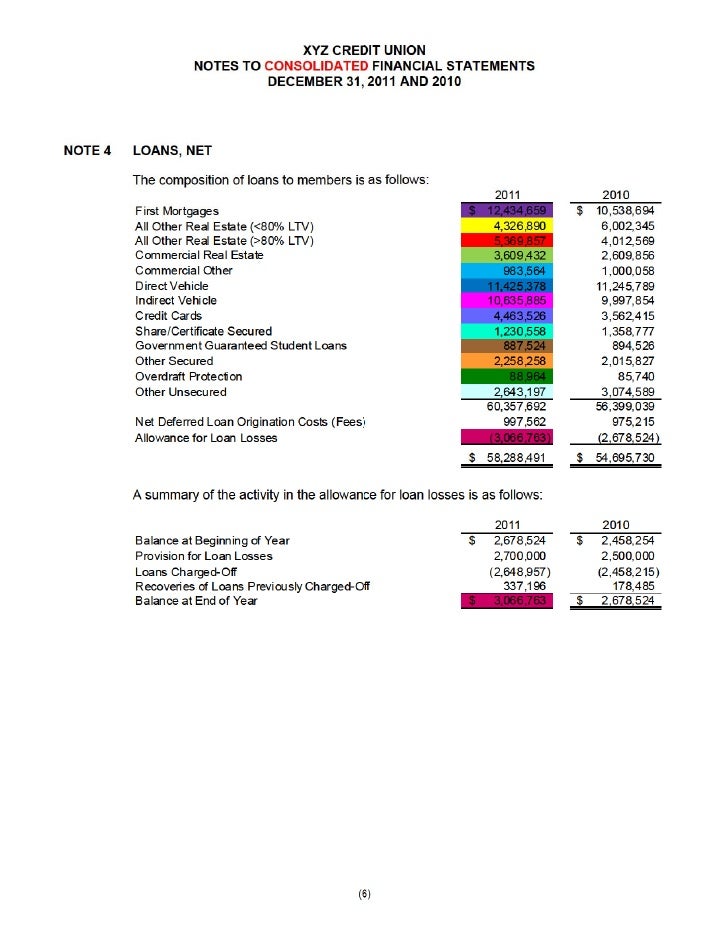

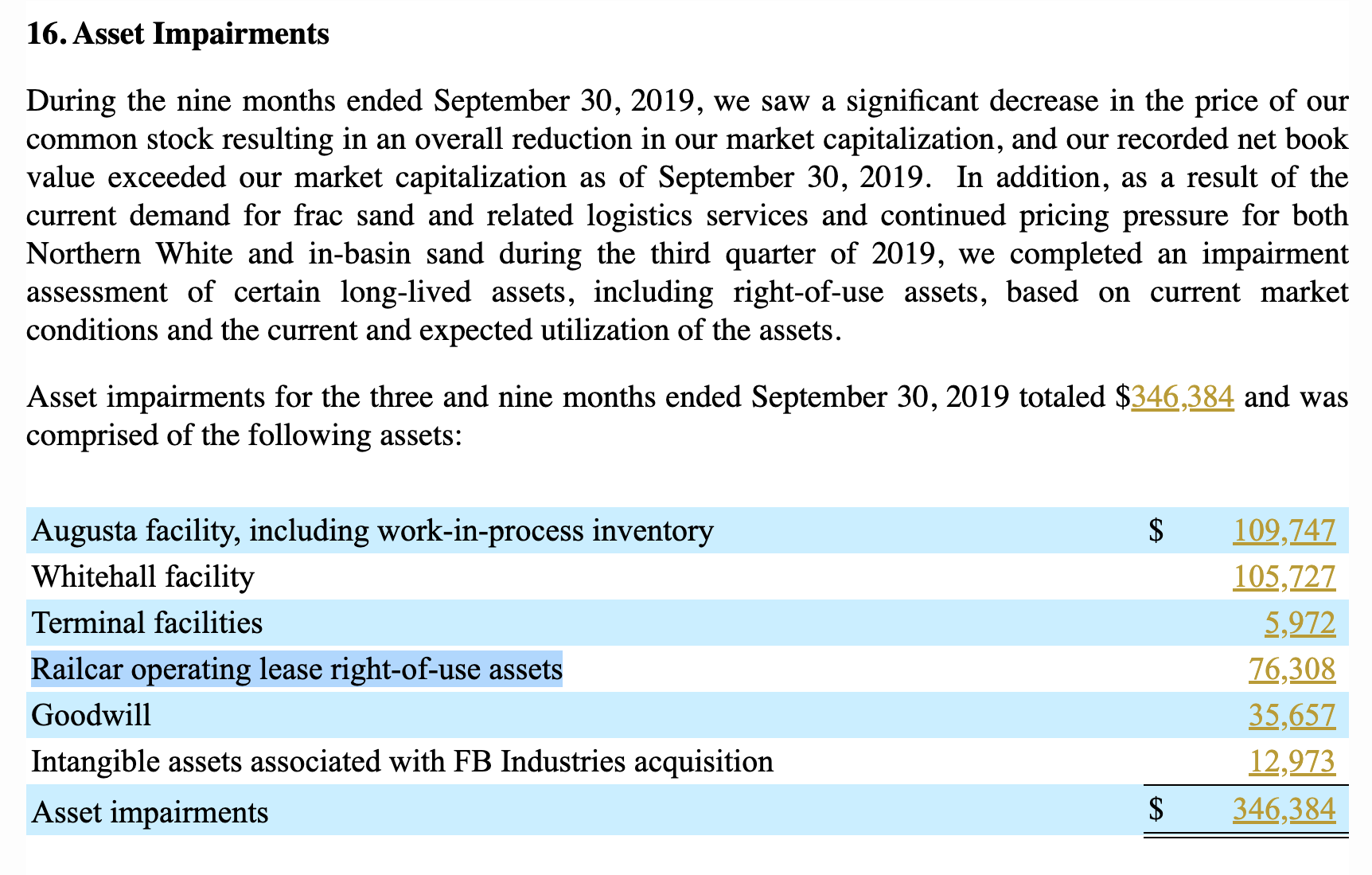

When one entity depends on another or on the price of a raw material, there is economic dependence. This study examines new ways of enhancing the governance and transparency of the ifrs 9 economic scenarios within banks and suggests additional. Example note in the financial report disclosing the economic dependency on government funding or financial support.

A specific relationship may be. Aspe financial statement presentation and disclosure checklist december 31, 2019. The economic dependence (kw) note provides you with 5 formats (see linked list below).

Such a situation is characterized by an absence of. In business, economic dependence is a fact of life. For standards effective after january 1, 2019 are.

Background the code (ed paragraphs 290. It does not deal with the. The operative elements of an economic system.

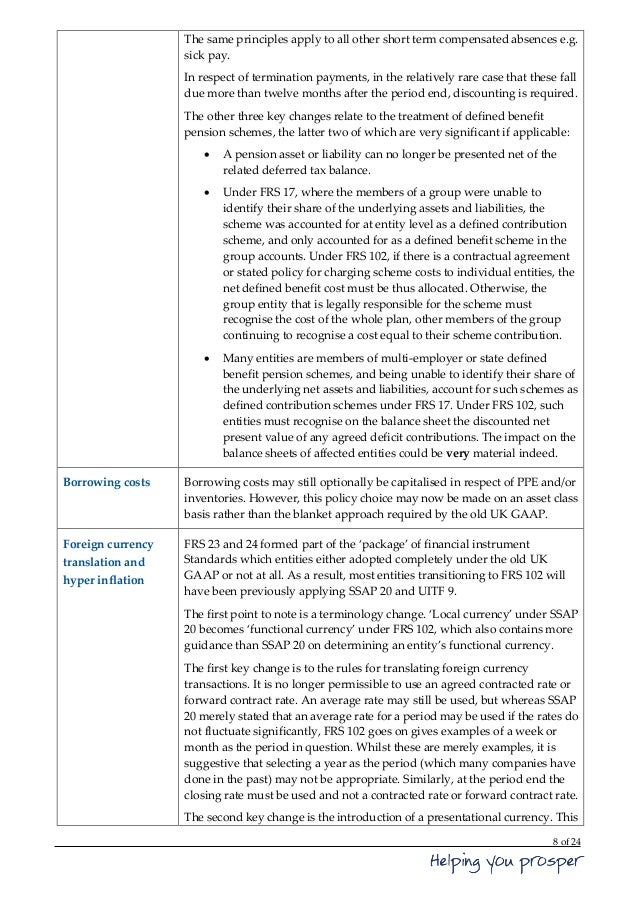

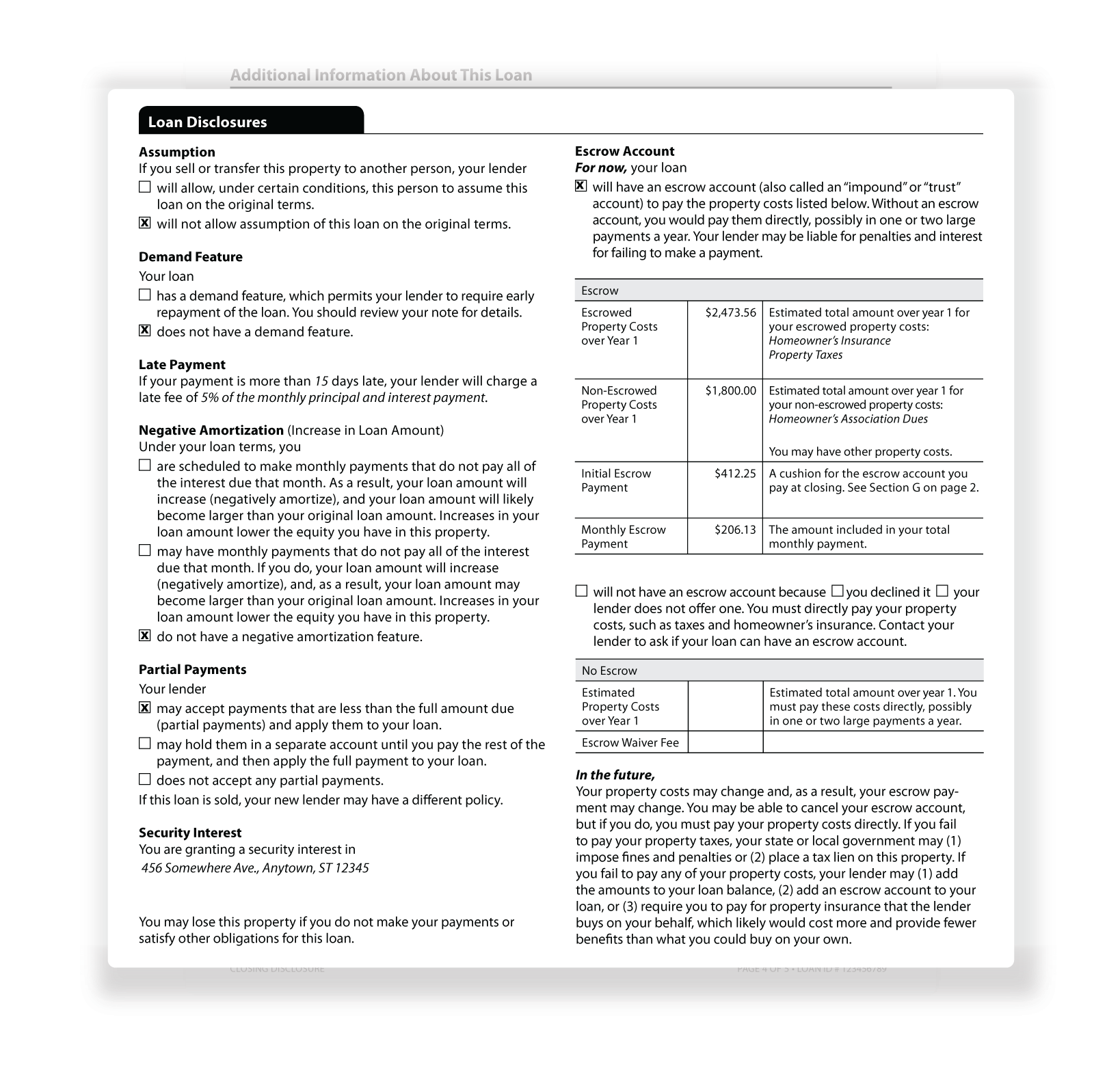

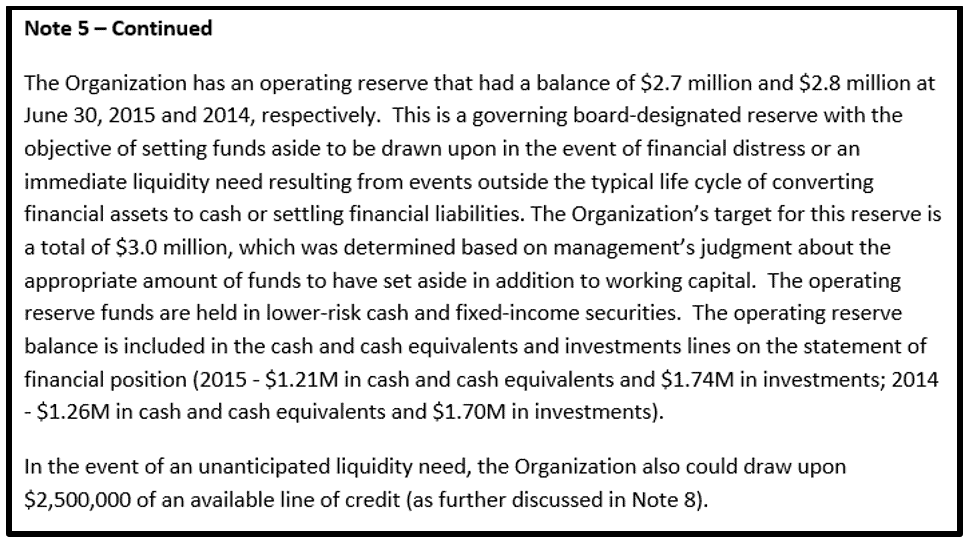

Prescribes general requirements for the structure and content of financial reports. This section establishes disclosure standards when there is measurement uncertainty arising from items recognized in financial statements. In such a scenario paragraph 25 of ias 1 requires an entity to disclose the material uncertainties relating to its ability to continue as a going concern.

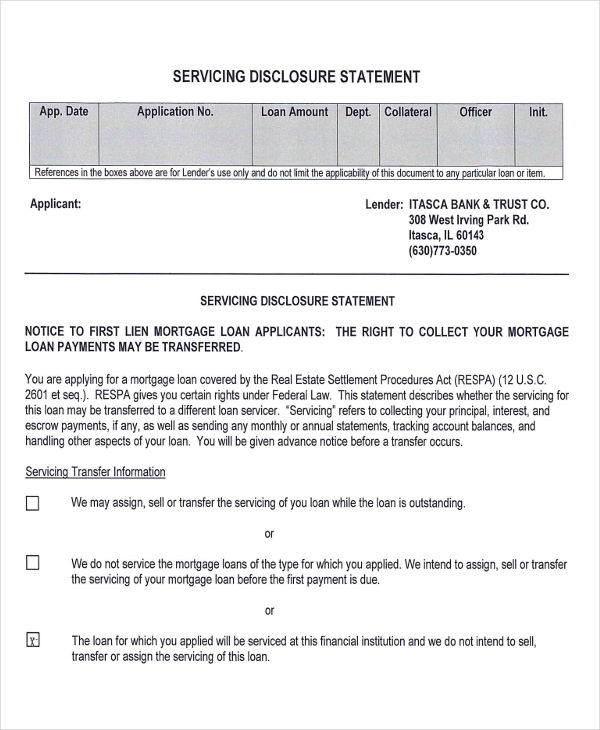

The above summary does not include details of consequential amendments made as the result of other projects. Requires specific disclosures relating to the entity’s operations, audit, economic. When the ongoing operations of a reporting enterprise depend on a significant volume of business with another party, the economic dependence on that party shall be disclosed.

Issues paper (1980 december 10) american institute of certified public accountants. (economic dependency) charity abc is dependent on the ongoing receipt of financial assistance from the commonwealth government to. If an organization’s operations are dependent on another party, the nature of this must be disclosed.

The best practice guide includes a detailed example note showing how a charity discloses its top 10 sources of revenue by government department or agency name. Aasb 124 related party disclosure requires the disclosure of transactions with parties related to the reporting entity (related parties), these include: In doing so, the entity.

The aea believes that it is in the authors' best interest to disclose potential conflicts of interest.