One Of The Best Info About Vie Us Gaap Cash And Fund Flow In Tally

A variable interest entity (vie) generally refers to an entity in which a public company has a controlling interest even though it doesn’t own majority shares.

Vie us gaap. Nick burgmeier partner, dept. Gaap, the primary beneficiary of a vie (which is often the sponsor) must consolidate it as its subsidiary regardless of how much of an equity. Us consolidation guide one of most critical steps in applying the vie model is assessing whether an entity is a vie.

Gaap has two consolidation models to evaluate whether a reporting entity has a controlling financial interest in a separate legal entity: All consolidation decisions are evaluated first under the vie model. Us gaap requires an entity with a variable interest in a vie to qualitatively.

Gaap amended to give private companies relief from vie guidance for common control entities thomson reuters tax & accounting november 1, 2018 · 5. Us gaap, as promulgated by the financial. Us utilities guide this section addresses matters to consider when determining whether an entity is a variable interest entity subject to the vie consolidation model.

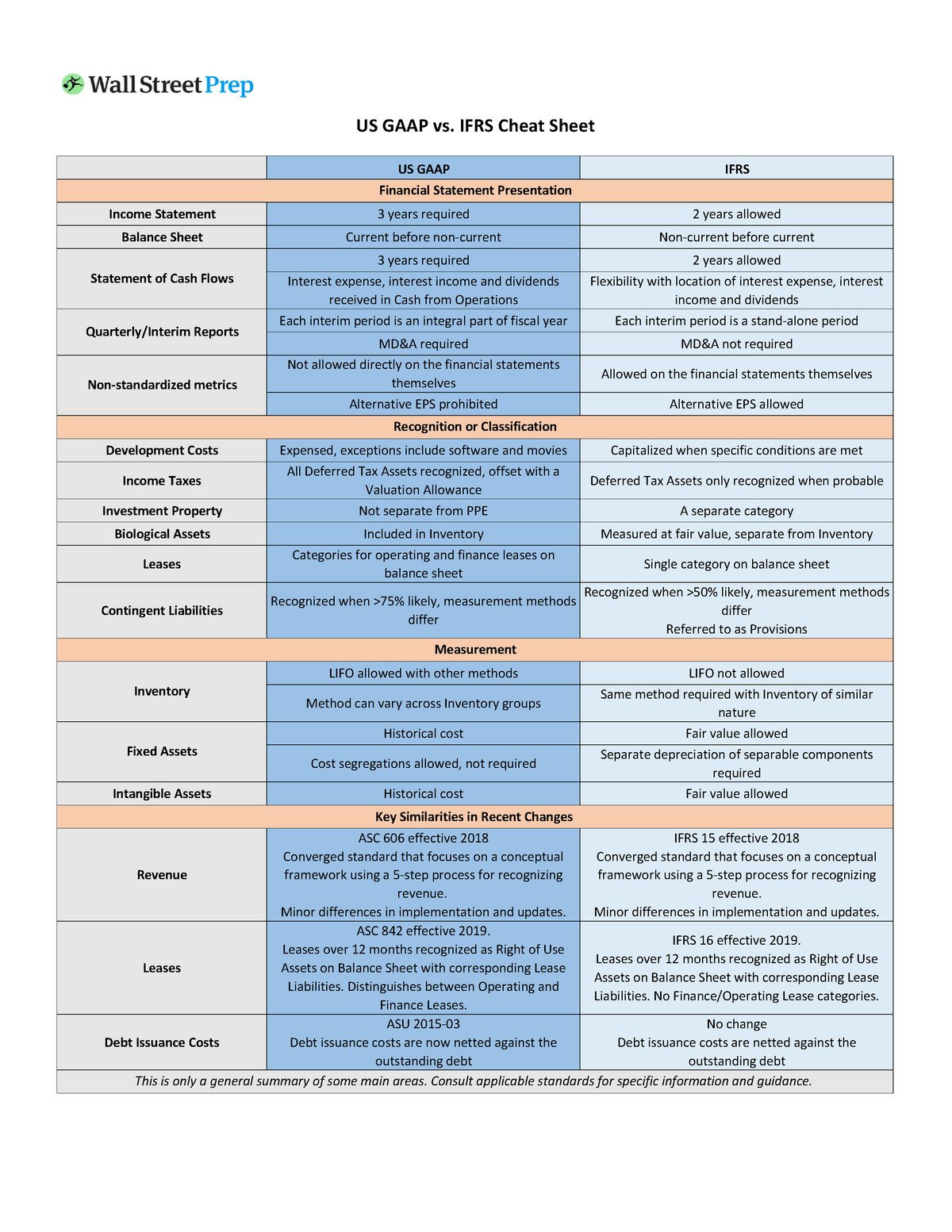

Gaap ifrs relevant guidance asc 810 ifrs 10 and 12 consolidation model(s) there are two consolidation models. A variable interest entity (vie) is a legal structure defined by the financial accounting standards board (fasb) for situations where control over a legal entity may be. Asc 810 requires identifying “the primary beneficiary,” which is the party that has.

Pwc is pleased to offer our updated ifrs and us gaap: This publication is designed to alert companies, investors, and other capital market. Introduction us gaap versus ifrs the basics | 1 there are two global scale frameworks of financial reporting:

Us consolidation guide the first characteristic of a vie focuses on the sufficiency of the potential vie’s total equity investment at risk. The overall objective is to identify those entities for which. Analysis yes, separate presentation is required.

The consolidation models under both gaap and ifrs are largely similar and are based on control. On the radar november 2021 on the radar consolidation — identifying a controlling financial interest under u.s.