Outstanding Tips About Cost Of Goods Sold On A Balance Sheet Asian Financial Statement Analysis

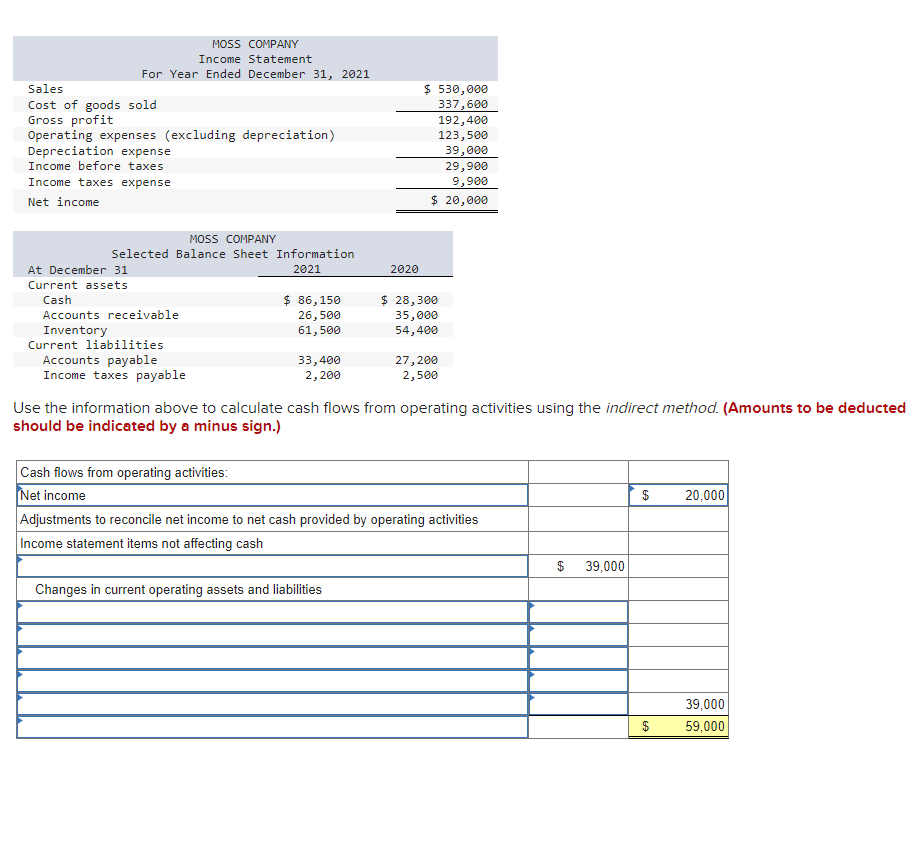

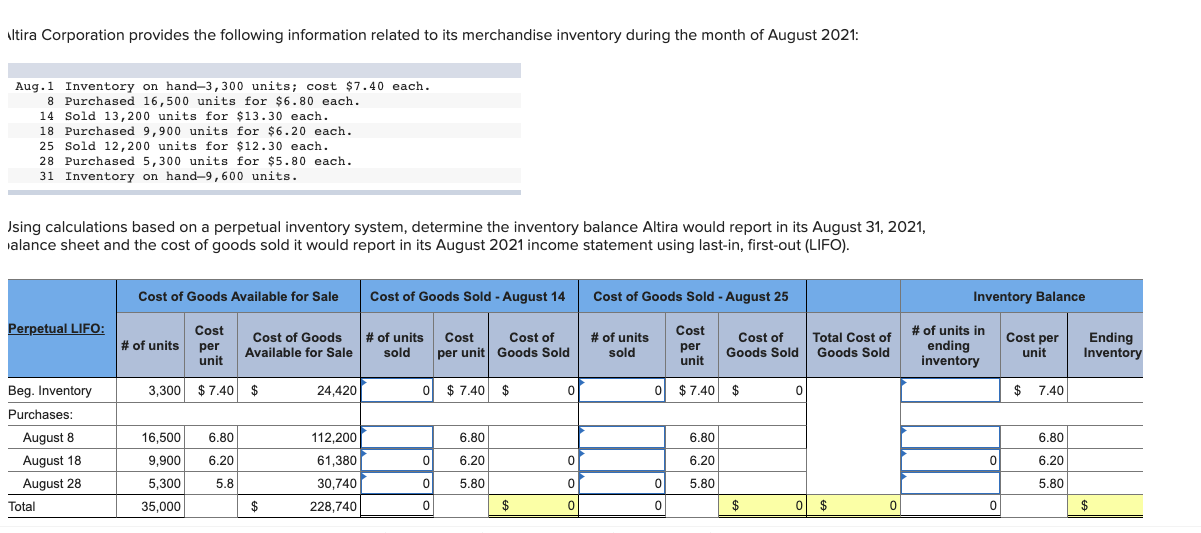

Determine the year 1 amount of cost of goods sold and the ending inventory balance that would appear on the financial.

Cost of goods sold on a balance sheet. In a general sense, the cost of goods sold is everything a company spends on during the production and sale of its products. In other words, it is the expense directly attributable. But before you prepare the financial statements, you need to first get the trial balance.

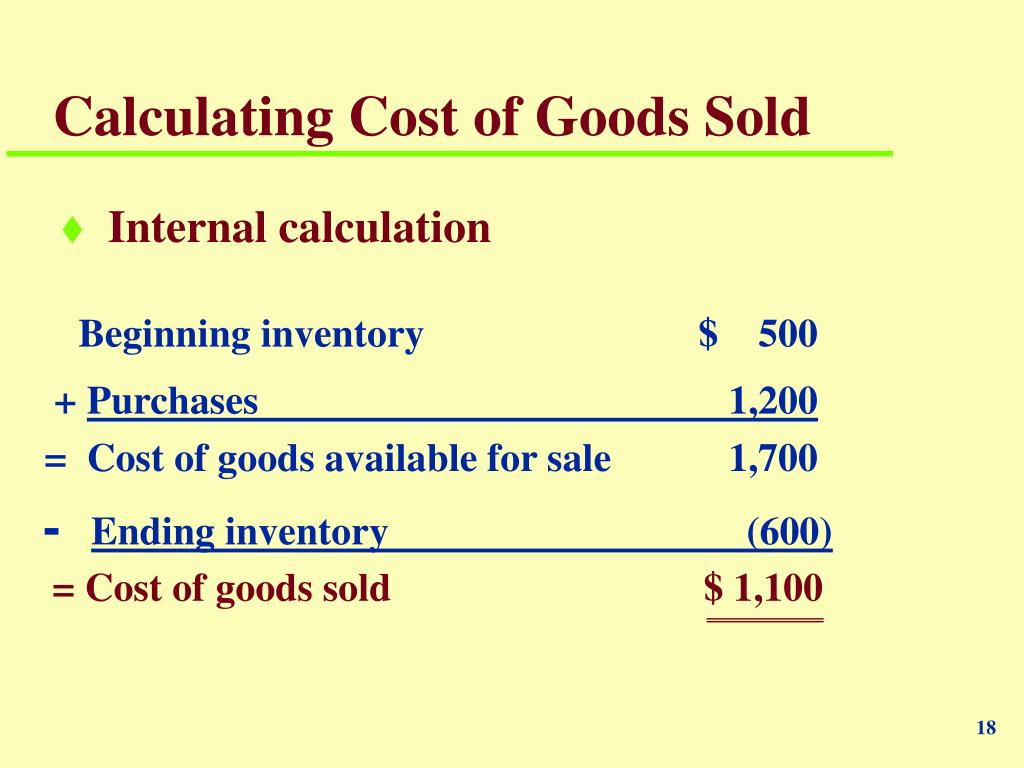

The cost of goods sold is a very important record in a company’s financial statements. Is cost of goods sold on the balance sheet? There are three methods that a company can use when recording the level of inventory sold during a period:

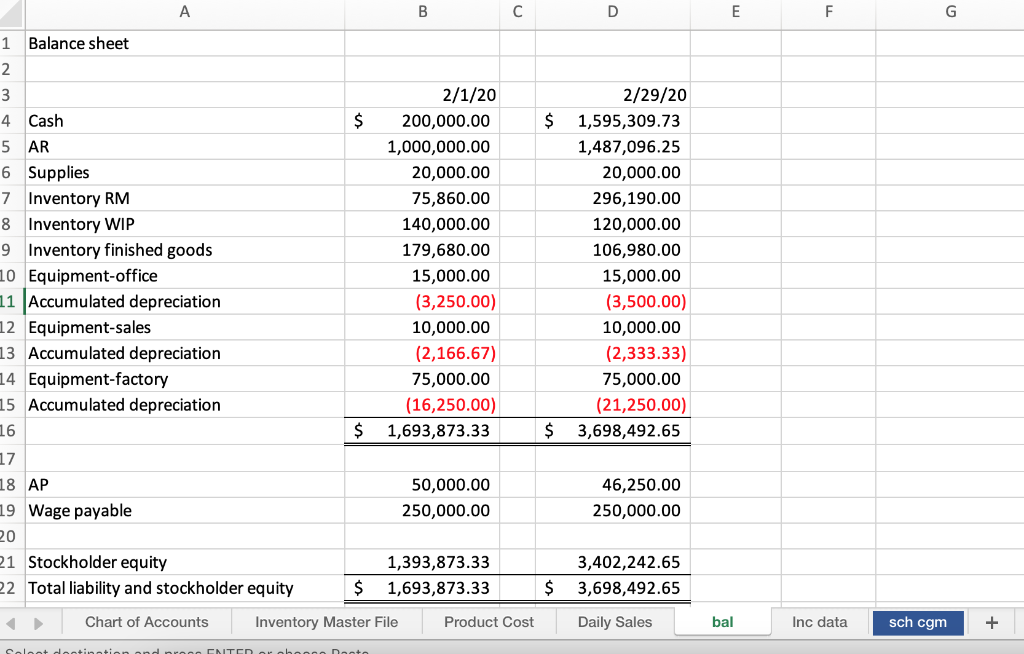

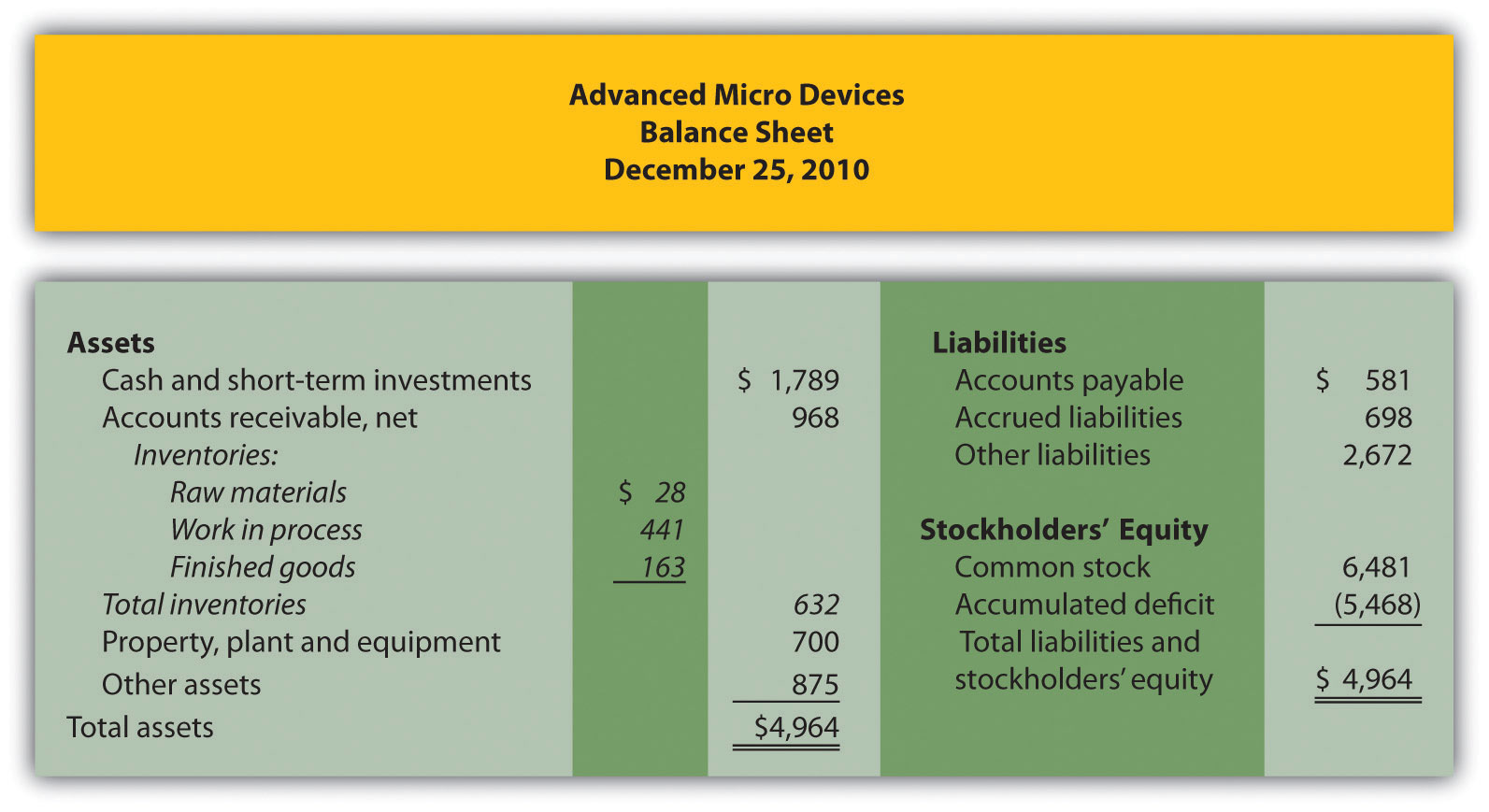

On february balance sheet, inventory balance decreases from $ 5,000 to $ 2,500 due to the sale of 500 units. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. First in, first out (fifo), last in, first out (lifo), and the average cost method.

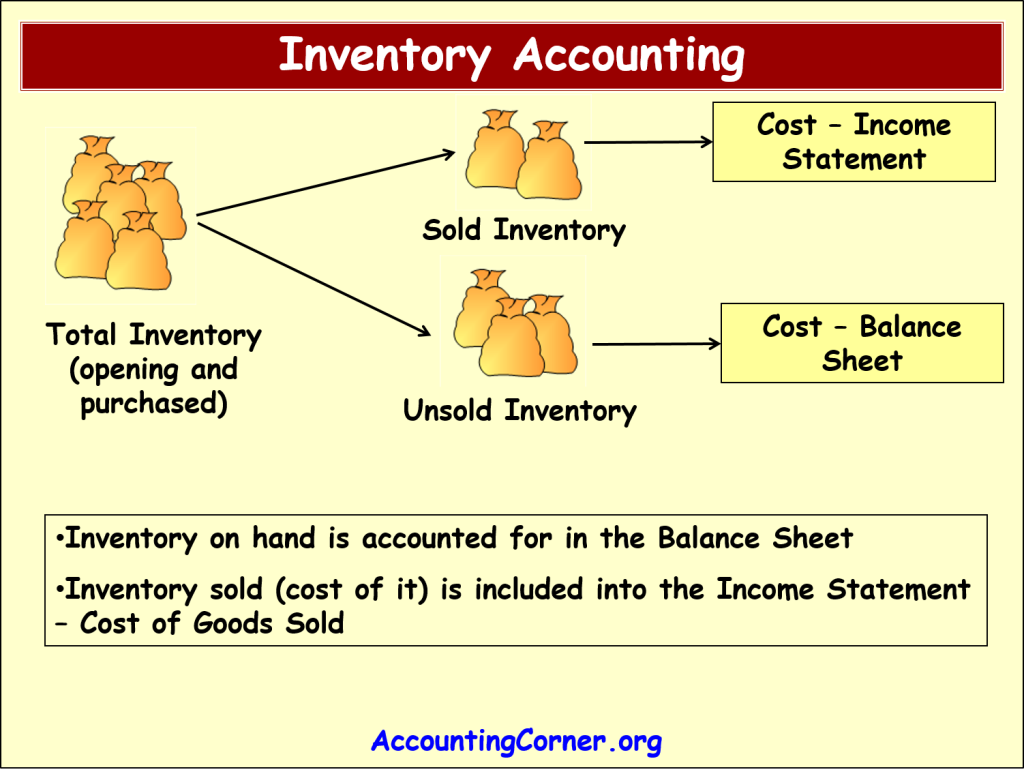

The value of the cost of goods sold depends on the inventory costing method adopted by a company. Cost of sales and cost of goods sold (cogs) both measure what a business spends to produce a good or service. Although the cost of goods sold (cogs) is not listed directly on the balance sheet, its impact is reflected in the inventory valuation, which is a component of.

It can also be referred to as a statement of net worth. For a retailer, the cost of goods sold. Cost of goods sold (cogs) refers to the direct costs of manufacturing a product that companies sell as a primary activity.

No, the cost of goods sold is the income statement’s item and is not present in the balance sheet. Is the cost of goods sold presently on the balance sheet? Welcome to our blog post where we will be discussing the important topic of cost of goods sold (cogs) and whether or not it.

For retailers, the cost of goods sold accounting formula is simple: The cost of goods sold is calculated by the following formula. On income statement, there will be revenue of $ 3,500 (500 units x.

Identify the upstream and downstream costs. Cost of goods sold (cogs) is an important financial metric that reflects the direct expenses incurred by a company in producing and selling its products. Cost of goods sold appear in the income statement, but inventories—which are goods yet to be delivered and are associated with the cost of sales—appear on the.

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

![[Solved] MOSS COMPANY Statement For Year Ended Dec](https://media.cheggcdn.com/media/c50/c50cca1f-cfa5-4c81-a37f-2810754a3a83/phpTzrprB)