Perfect Info About Example Of Cash Flow Operating Activities Mcdonalds Income Statement 2018

Cash flow statement:

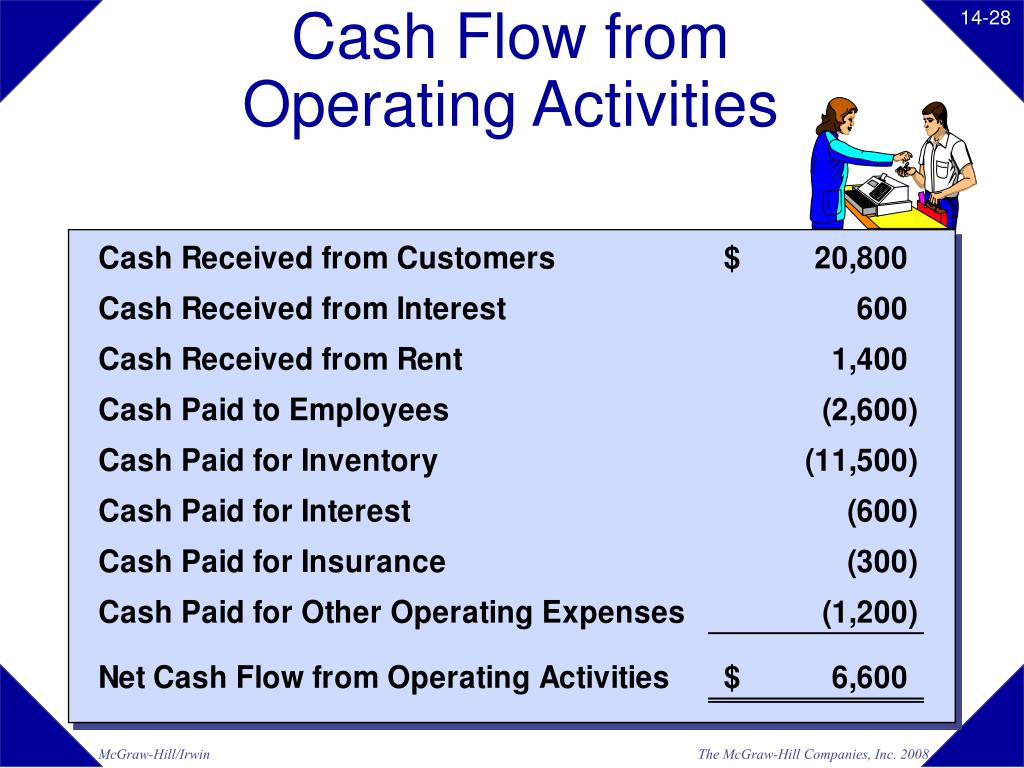

Example of cash flow operating activities. The cfs starts with the “cash flow from operating activities” section, which calculates a company’s operating cash flow (ocf) in a specified period. Mark herman, cfp verified by a financial expert updated september 13, 2020 what is cash flow from operating activities? Example of cash flow using the direct method here's an example of a cash flow statement using the direct method:

Cash receipts from the sale of goods and rendering of services cash receipts from royalties, fees, commissions, and other revenue cash payments to suppliers for goods and services cash payments to and on behalf of. Cash receipts from the sale of goods and rendering services. Operating cash flow is an essential part of a cash flow statement as it gives a transparent financial view of the current business operations.

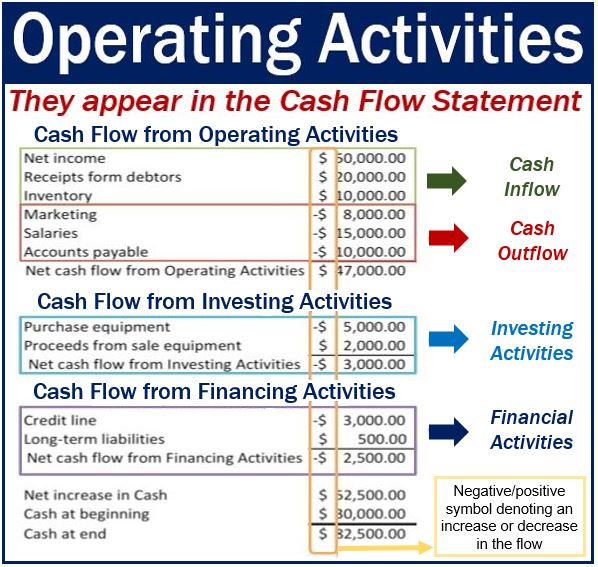

Your cash flow comes from three activities: Receipts from sales of goods and services interest payments income tax payments payments made to suppliers of goods and services used in production Examples include disposal income or loss.

Additions to plant, property, and equipment (pp&e) capitalized software expense cash paid in mergers and acquisitions (m&a) purchase of marketable securities proceeds from. For instance, the following are examples of entries that should be included in the cash flow from investing activities section: Operating investing financing this article discusses the “ins” and “outs” of the types of cash flow and how they might impact your business.

There is typically an operating activities section of a company's statement of cash flows that shows inflows and outflows of cash resulting from a company's key operating activities. Importance of operating cash flow. Cash receipts from fees, royalties, commissions, and other revenue.

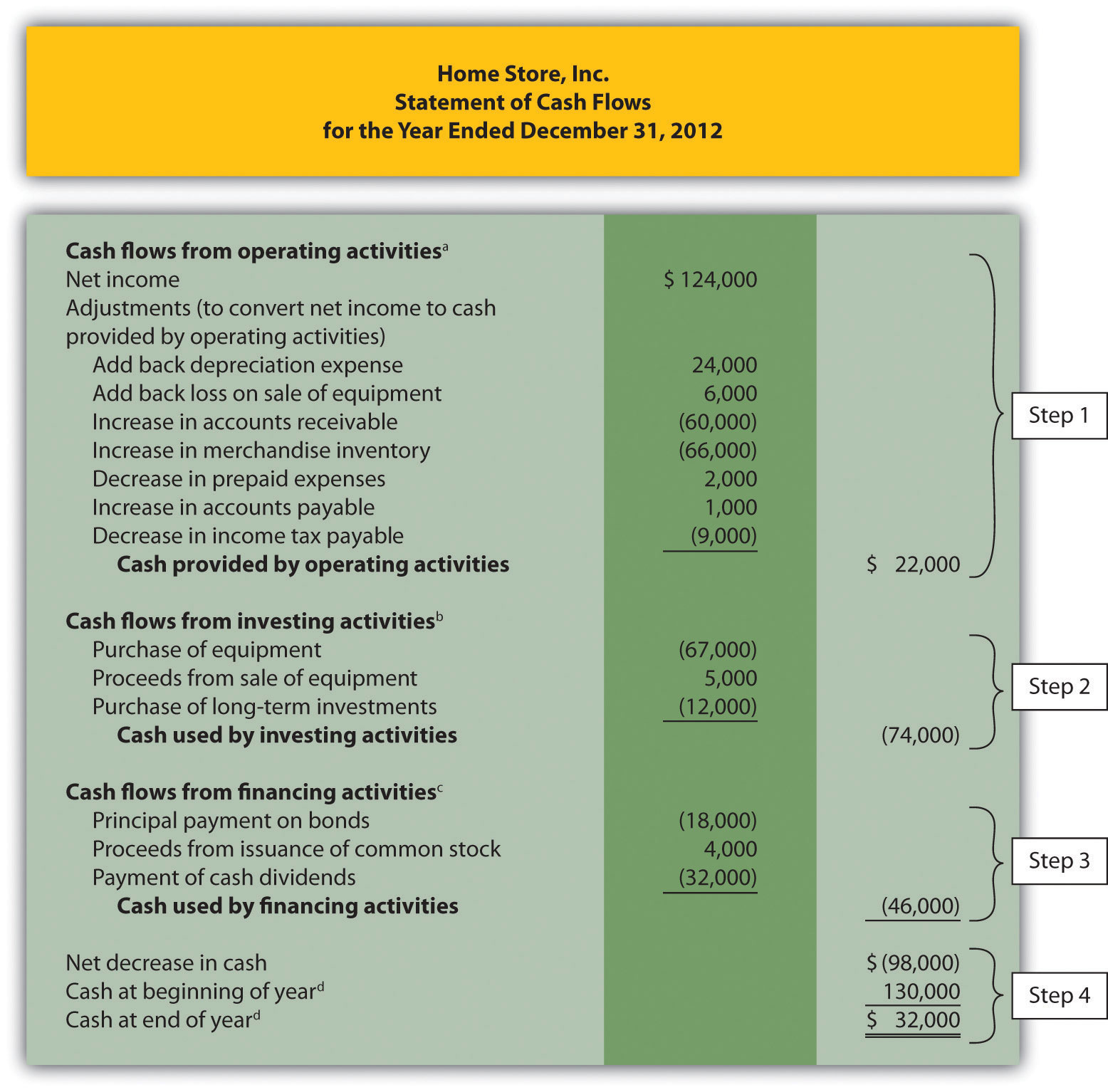

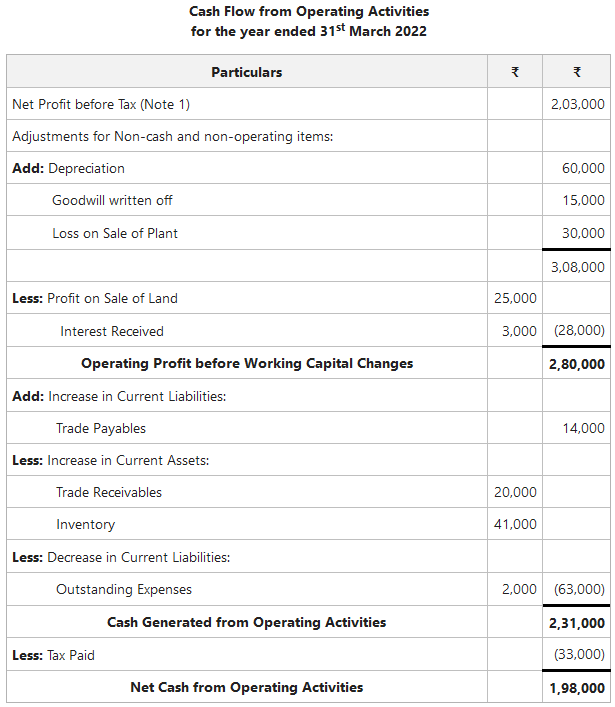

Such items are excluded from operating activities and shown under investing or financing activities accordingly. Cash flow from operations example. The company’s chief financial officer (cfo) chooses between the direct and indirect presentation of operating cash flow:

Operating cash flow represents the cash impact of a company's net income (ni) from its primary business activities. Learn more with detailed examples in cfi’s financial analysis course. Operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period.

That’s why gaap requires companies. Cash flow types what is cash flow? These operating activities might include:

Some of the cash flows arising from operating activities are as follows: Examples of the direct method of cash flows from operating activities include: Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows:

Net cash flow from operating activities is a financial metric that indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a service. Begin with net income from the income statement. Cash payments to and on behalf of employees.

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)