Neat Tips About Cash Flow Statement Is Useful For Budget Template Accounting

Cash received signifies inflows, and cash spent is outflows.

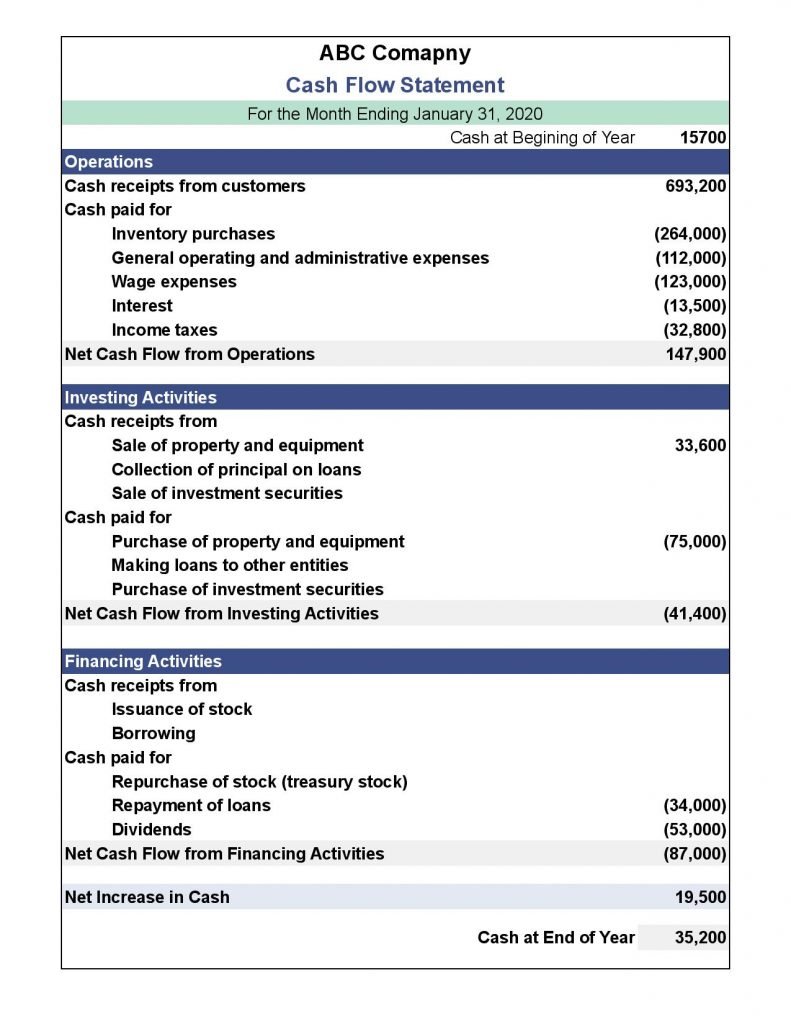

Cash flow statement is useful for. A good indicator of your liquidity. It simply tracks the movement of cash within a company. A cash flow statement is a crucial financial document that details all your sources of cash over a given period of time.

Cash flow statements provide details about all the cash coming into and exiting a. The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. If you run a business, it’s helpful to run cash flow statements regularly to track your progress and look for areas where you may need to adjust spending.

One of the importance of the cash flow statement is that there are certain payments that the company makes and that payment is not reflected in your company’s profit and loss statement. It provides information on how cash is generated and used by a business and helps in assessing the company’s liquidity, solvency, and overall financial health. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company.

The cash flow statement recognises three major. Key takeaways cash flow is the movement of money in and out of a company. It also shows you the net increase or decrease in cash, and explains the causes for the changes in the cash balance.

In financial accounting, a cash flow statement, also known as statement of cash flows, [1] is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing and financing activities. The cash flow statement includes cash. 1) the direct method and 2) the indirect method.

You can therefore see what you can and cannot afford in terms of your strategic choices. Innovation rate increased to 20%; Cash flow statement is considered a useful and important tool for short term planning as well as cash tracking for the management of your company.

8 reasons why a cash flow statement is important insight into spending activities. The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf. Thanks to the cash flow statement, you are perfectly aware of the state of your cash flow.

For example, the reasons why it plays a crucial role are: The cash flow statement is required for a complete set of financial statements. Cash flow statement analysis is a useful tool for investors and financial analysts because it helps assess a company’s liquidity, financial health, as well as ability to satisfy financial obligations.

Cash flow statements give a holistic picture of the different payments companies make. The direct method simply tallies all the cash inflows and outflows over a period of time. A cash flow statement is a financial statement that presents total data.

It also breaks down where you've spent that money so you can see if your business is making more money than it spends. The cash flow statement is a financial statement. A cash flow statement provides data regarding all cash inflows that a company receives from its ongoing operations and external investment sources.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)