Outstanding Info About Bookkeeping To Trial Balance Example Of Deferred Tax Liability Sec Financial Statement

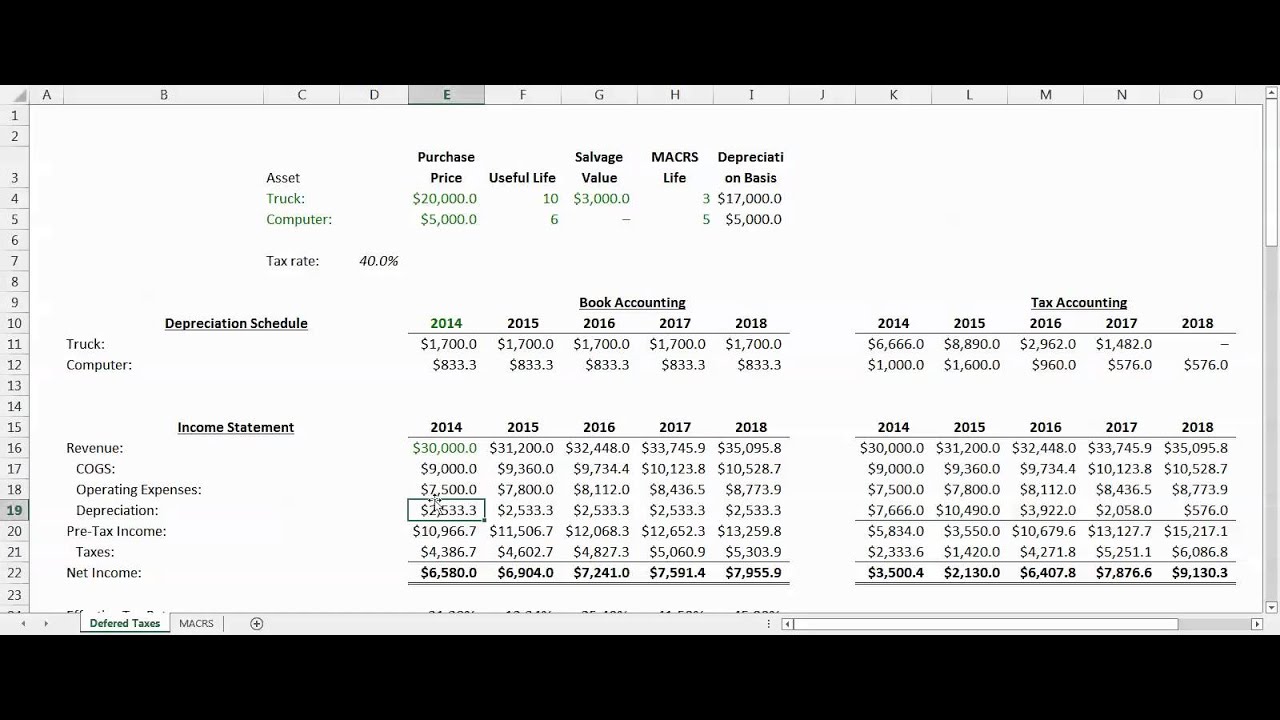

The balance on the deferred tax liability account is now 200, which is the beginning balance from year 1 (150) plus the movement for the year (50).

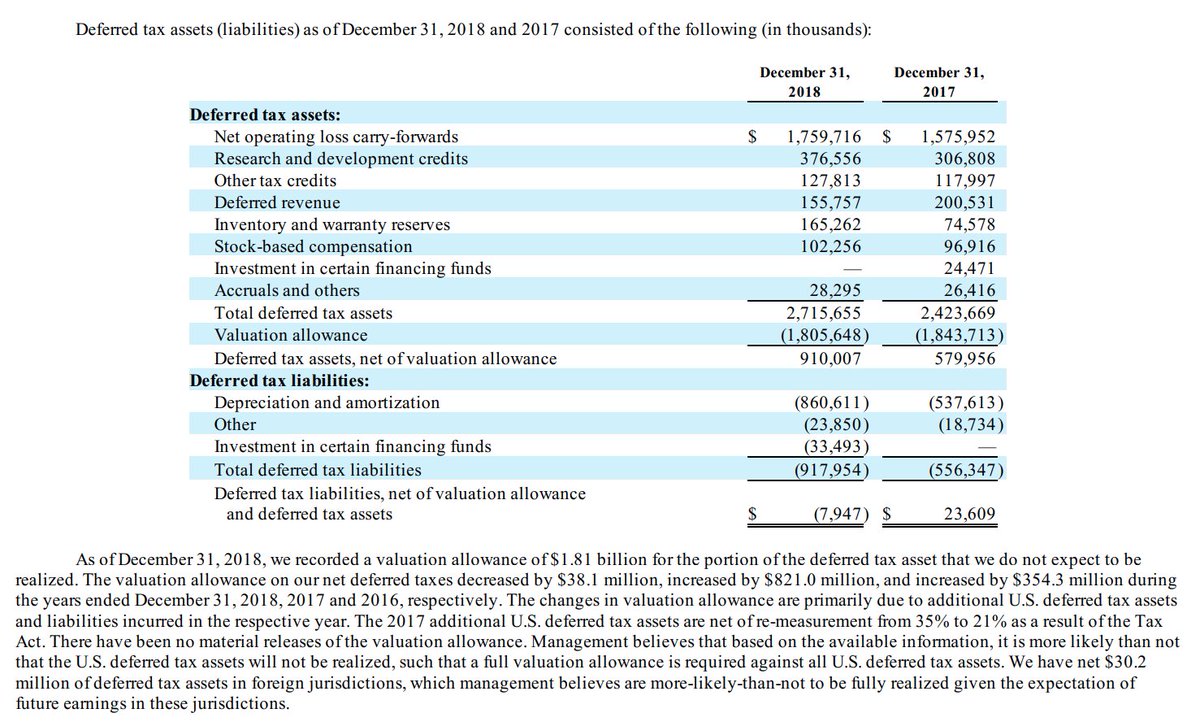

Bookkeeping to trial balance example of deferred tax liability. Why do you need a tb? A deferred tax liability is a. The deferred tax liability is currently $6,000.

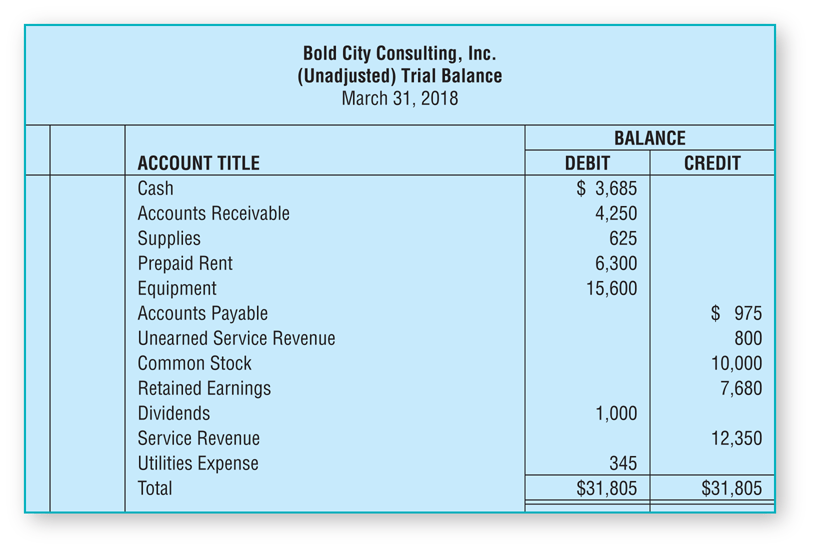

Accountant is preparing a financial statement for the company abc. Here’s a very simple example of a trial balance report. The notes to the question could contain one of the following sets of.

As you can see, debits are on the left while credits are on the right. Example 2 the trial balance shows a credit balance of $1,500 in respect of a deferred tax liability. Deferred tax liability.

The offsetting credit is to the deferred tax liability and the income tax payable. Such adjustments would make the financial statements. 9 strangest taxes in history.

In short, a deferred tax liability develops when a corporation and the tax department take opposite stances on accounting financial events. Based on the calculation the accounting profit (ebt) is. Deferred tax is accounted for in accordance with ias 12, income taxes.

Trial balance example. By obaidullah jan, aca, cfa and last modified on jul 9, 2020. In the subsequent year when the deferred income tax is paid, the deferred tax liability.

The tb is not part of the accounting records, it is extracted from the records as part of the accounting cycle to be used as the starting. In paper f7, deferred tax normally results in a liability being recognised within the statement of. For instance, in our vehicle sale example the bookkeeper could have accidentally debited accounts receivable instead of cash when the vehicle was sold.

This balance represents the cumulative difference between the tax depreciation and the book depreciation calculated as follows. This is then multiplied by the tax rate. Deferred tax liability journal entry example.

The resulting deferred tax liability or asset and adjust the carrying amount of the asset or liability by the same amount.

:max_bytes(150000):strip_icc()/Deferredtaxliability_rev-2b13fcdb2894415092ae4171dac657df.jpg)

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)