Out Of This World Info About Cash Flow Statement Starting With Ebitda Pwc Of Flows

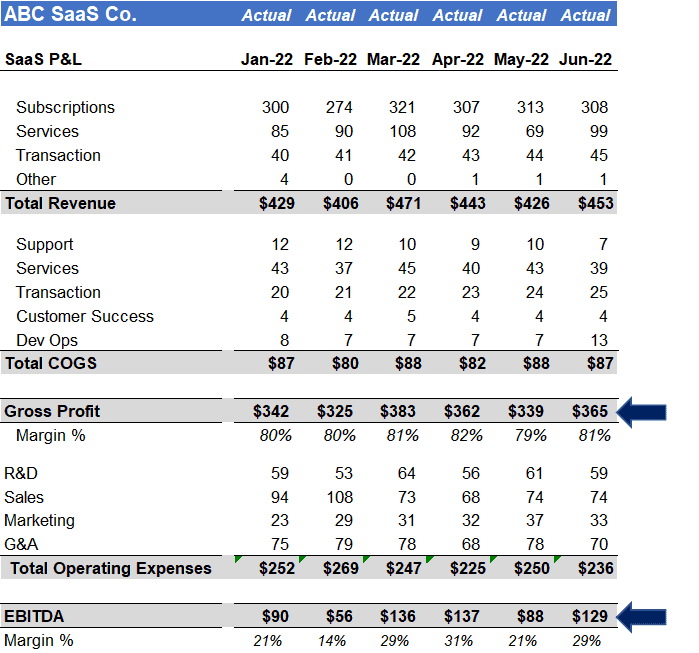

Ebitda stands for earnings before interest, taxes, depreciation and amortization.

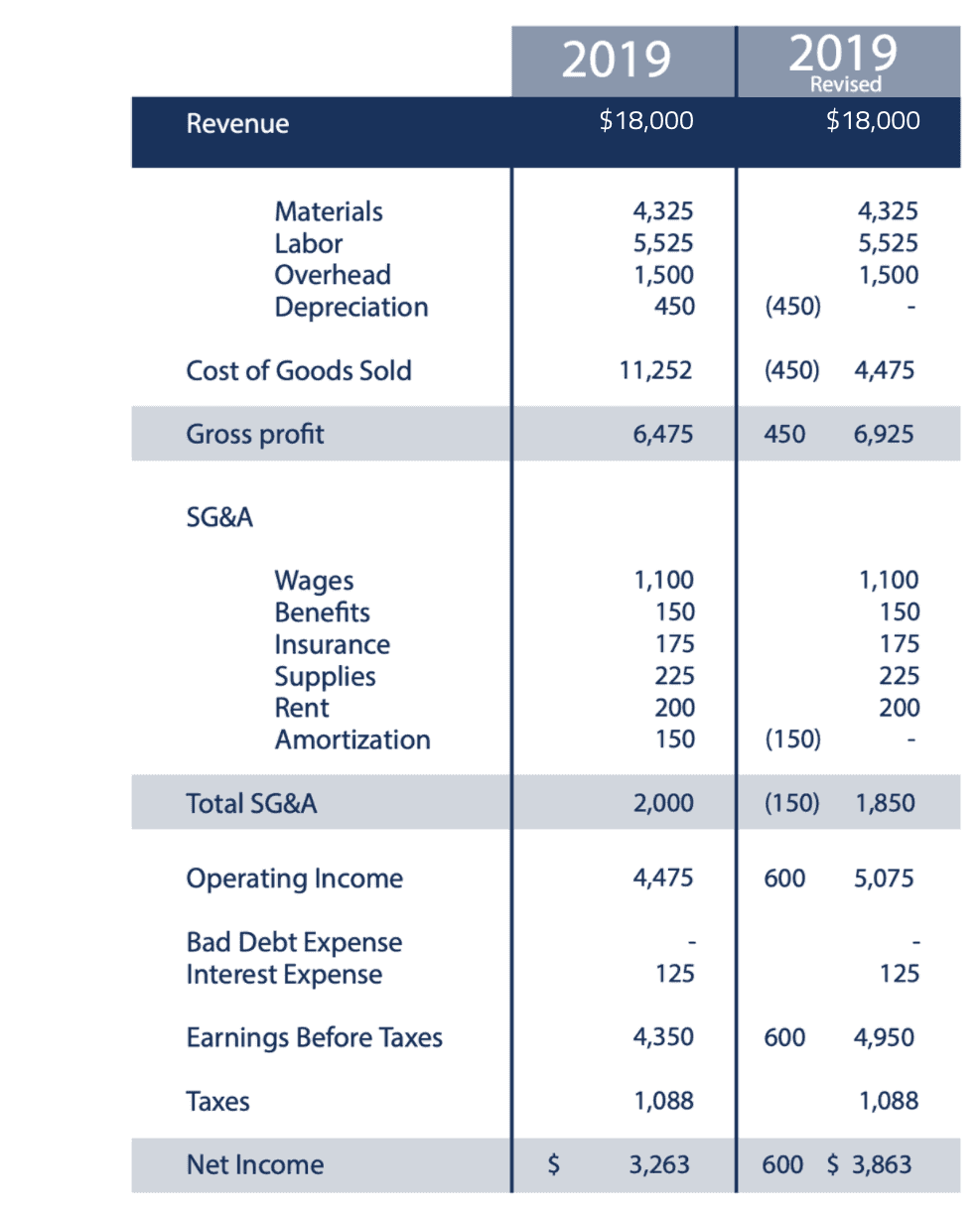

Cash flow statement starting with ebitda. The easiest way to ensure that you have the full depreciation and amortization numbers is by checking the cash flow statement,. The value of ebitda is equal to the sum of net income, interest, taxes, depreciation, and amortization. This calculation indicates the profitability of a company's core operations, and can be calculated using basic information from the.

An ebitda contribution chart can be used to visually represent the ebitda figure and its impact on the company's valuation. How to calculate ebitda from a cash flow statement. When calculating cash ebitda, the formula is only slightly more complicated.

Bankybanker1234 monkey 46 ib subscribe i got asked this in an interview and it tripped me up. To calculate ebitda, start with operating income or ebit on the income statement and then add the depreciation & amortization (d&a) from the cash flow statement. The income statement and cash flow statement cover a period of time, but a balance sheet generates on a specific date.

Ebitda can be easily calculated off the income statement (unless depreciation and amortization. But for year 1, the retained earnings balance is equal to the prior year’s balance plus net income. Ebitda, cf, fcf, fcff, and fcfe are key cash flow metrics used by finance professionals to assess a business's cash generation.

A firm’s earnings are received before paying interest, taxes, depreciation, and amortization expenses. An overview analysts use a number of metrics to determine the profitability or liquidity of a company. Ebitda and cash flow are similar, yes, but they are definitely not the same thing.

Fcfe = fcff − i × (1 − t) + b. All three reports address financial health and a company’s operating performance. Ebit, or earnings before interest and taxes, attempts to.

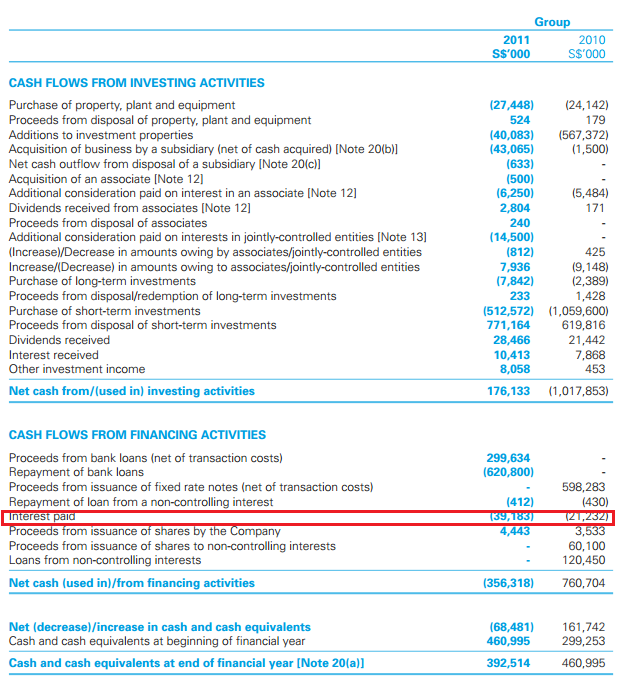

Interest interest expense is excluded from ebitda, as this expense depends on the financing structure of a company. By substituting fcff in the above equation, you can arrive at a direct formula for fcfe. It is a measure of a company’s operating performance and is often used to analyze a company’s cash flow.

To calculate free cash flow from ebitda, we must understand what ebitda is. Cfo is a reliable metric showing cash generated by ongoing activities, used in liquidity and profitability ratios. Entrepreneurs and business valuators often use ebitda to calculate a company’s valuation for a business sale or acquisition.

The extensive amount of capital spending required means that ebitda and cash flow will often. Updated august 22, 2023 reviewed by thomas j. Introduction ebitda, or earnings before interest, taxes, depreciation, and amortization, is a financial metric used to measure a company’s profitability.

Ebitda stands for earnings before interest, taxes, depreciation, and amortization. Free cash flow can be calculated from the cash flow statement starting with ebitda, using the following formula: I can get from revenue to fcf.