Ace Info About Comparative Statement Of Balance Sheet Cash Budget Analysis

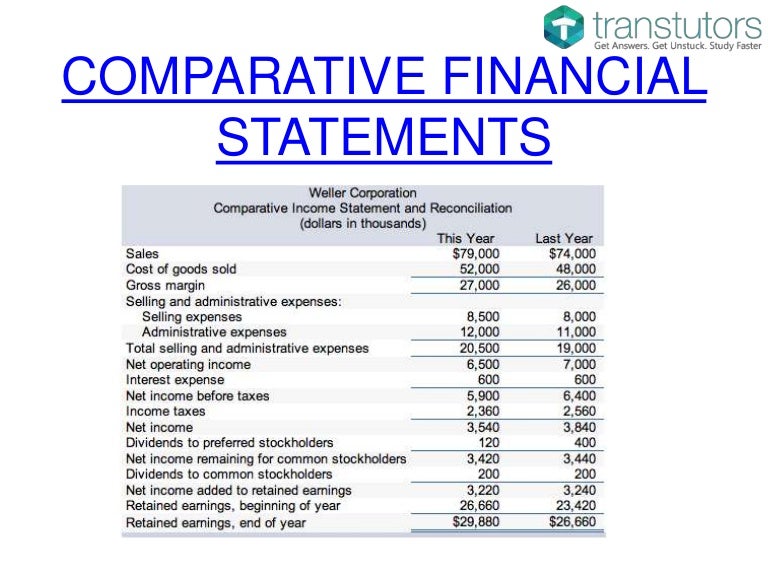

Comparative balance sheet comparative income statement income statements provide the details about the results of the operations of the business, and comparative income statements provide the progress made by the business over a period of a few years.

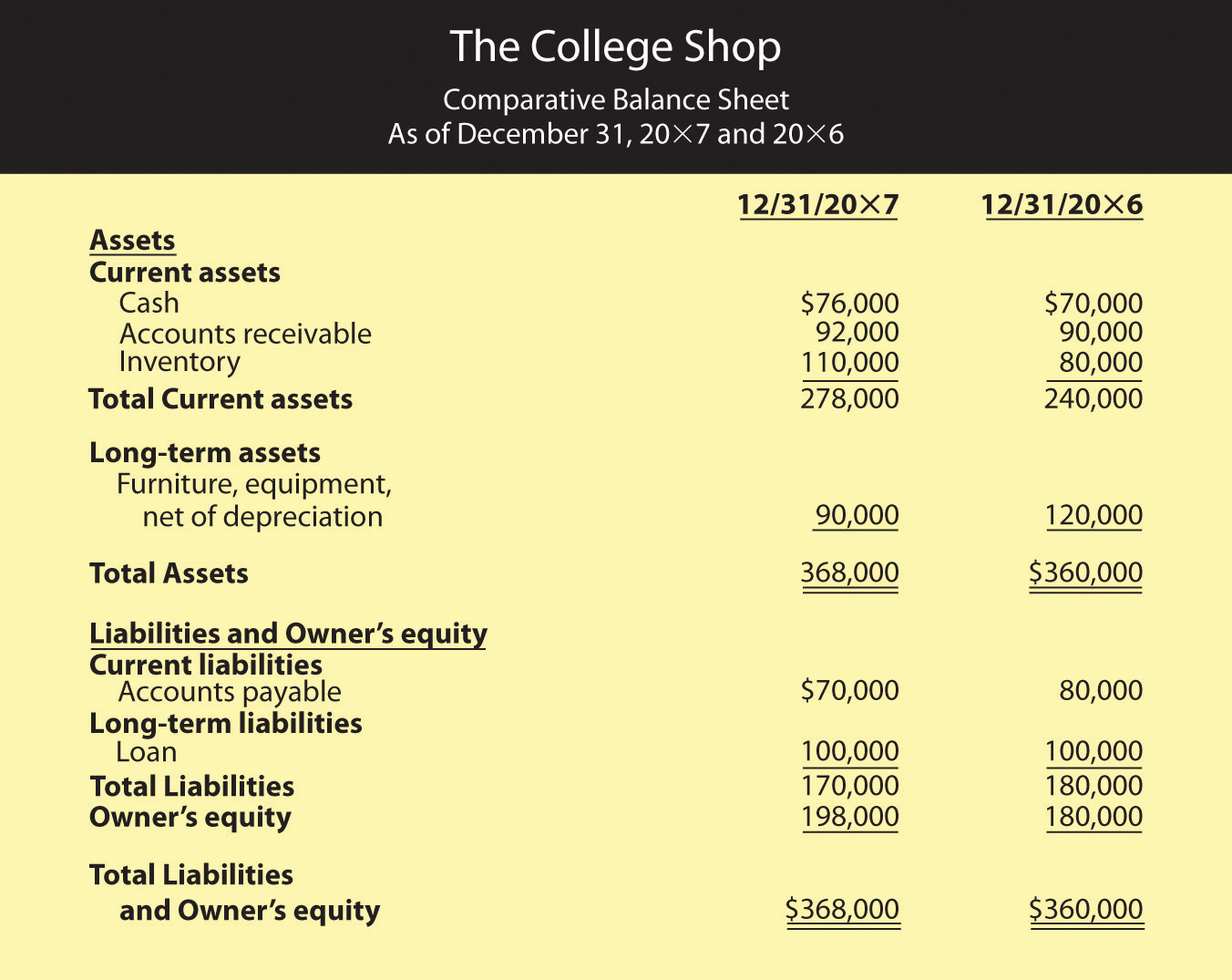

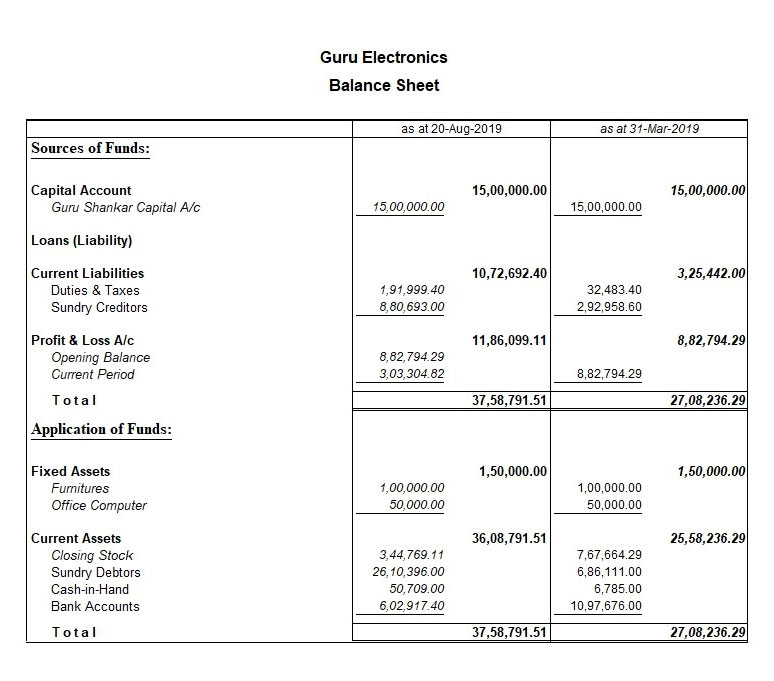

Comparative statement of balance sheet. Business owners use the comparative report to make strategic business decisions. A comparative balance sheet showcases: You can learn a lot about a business’s health by looking at its balance sheet and calculating some ratios.

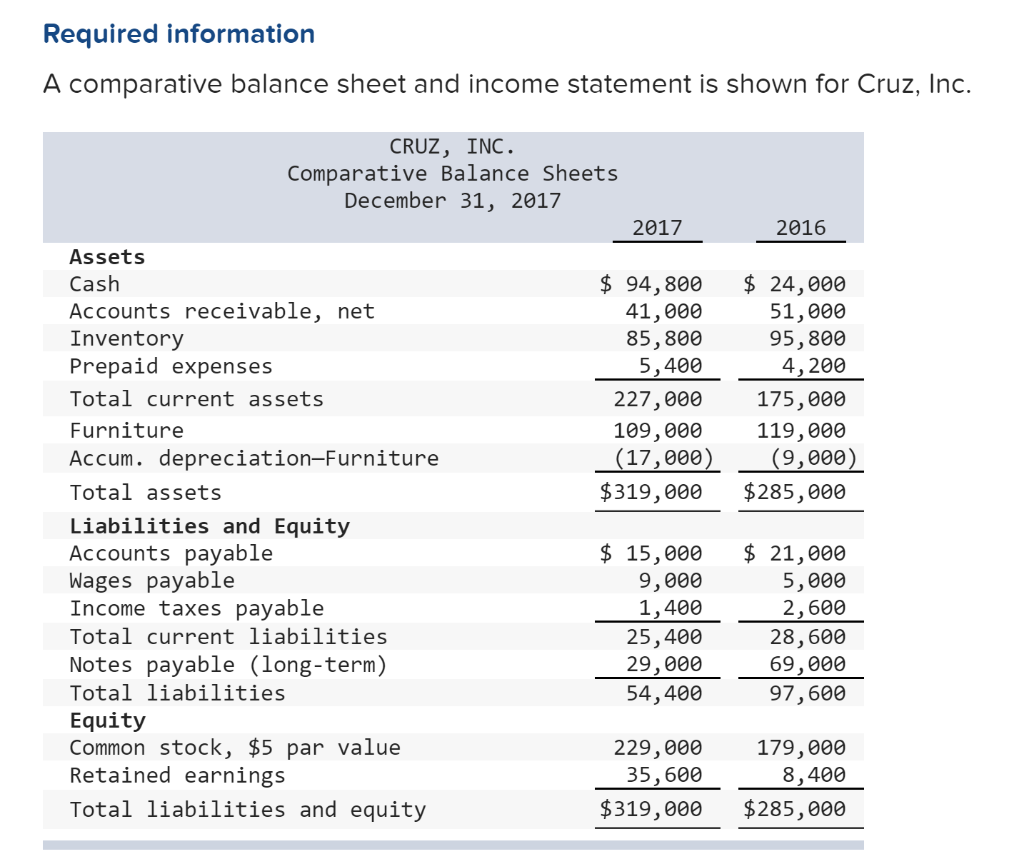

As the name suggests, comparative balance sheets are financial statements that show a company’s market position through two different periods, two subsidiaries of the same company, or two companies in the same industry over time and collate them. A comparative balance sheet and income statement is shown for cruz, incorporated. Private companies are not required to present comparative balance sheets.

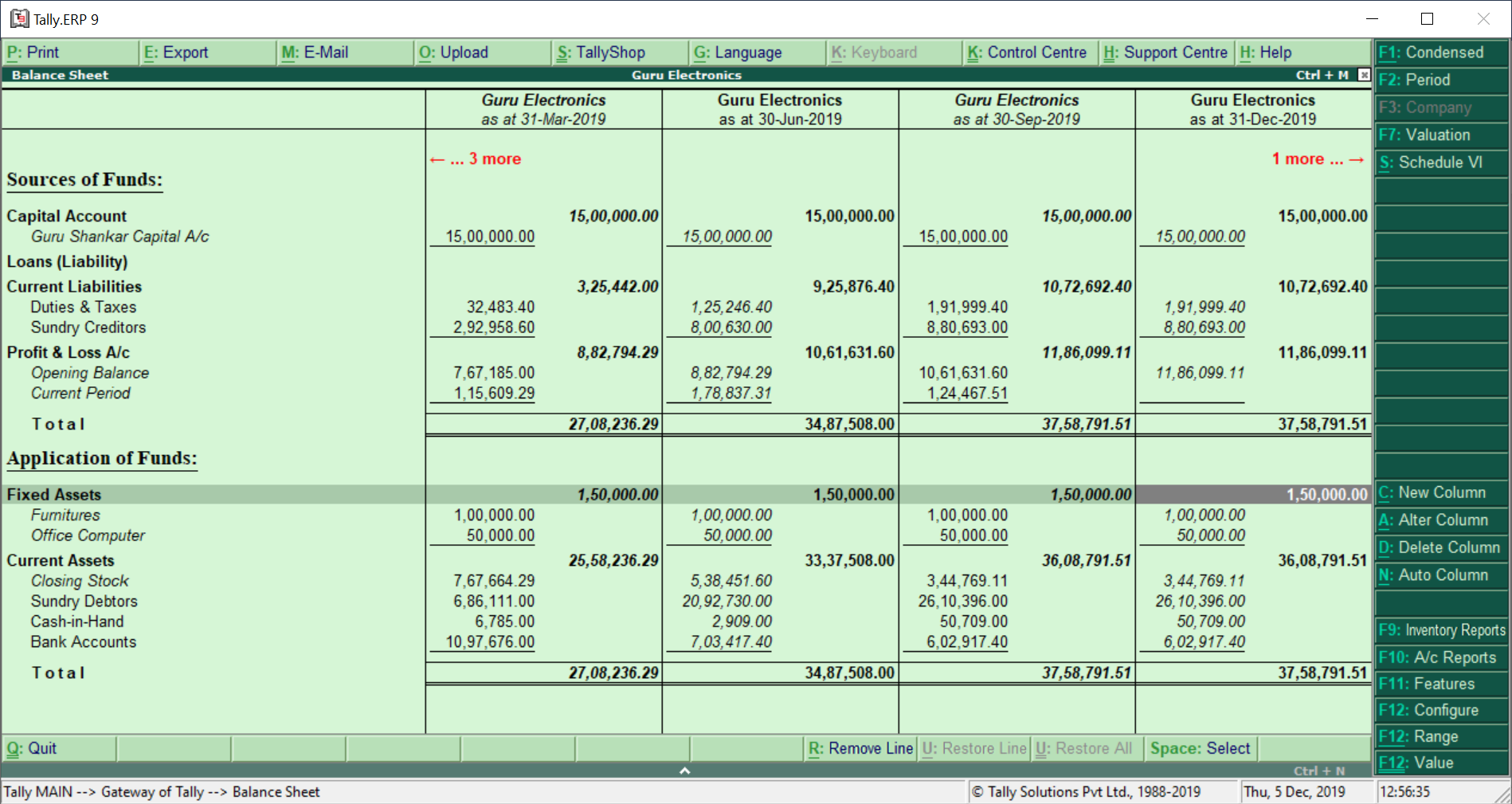

Here's the rule you should always remember when developing your statement of cash. Moreover, such a type of presentation allows the reader to compare the financial performance of the company with previous years. Comparative financial statements, as the word suggests, are the statements that show the financial numbers of more than one year (consecutive periods) of an entity.

Comparative balance sheet meaning isn't tough. Comparing several years of a company’s balance sheet may highlight trends, for. A comparative balance sheet analysis is a method of analyzing a company's balance sheet over time to identify changes and trends.

The balance sheet is one of the three core financial statements that are used to evaluate a business. Changes (increase or decrease) in such assets and liabilities. Get tata motors latest balance sheet, financial statements and tata motors detailed profit and loss accounts.

Comparative balance sheet. This type of balance sheet may serve three types of purposes: This can help spot discrepancies before they affect other processes, eliminate errors, and even prevent fraud.

This secondary documentation can include anything from a bank statement to a spreadsheet and invoices. Using it, we can depict the direction of change, trend, analyse and take suitable actions. April 4, 2023 a comparative balance sheet is a type of comparative statement used by business owners, investors, and analysts to evaluate a company’s performance over time.

Reconciliation is the process of comparing the transactions on a balance sheet to secondary documentation. Previous financials are presented alongside the latest figures in. What is comparative balance sheet?

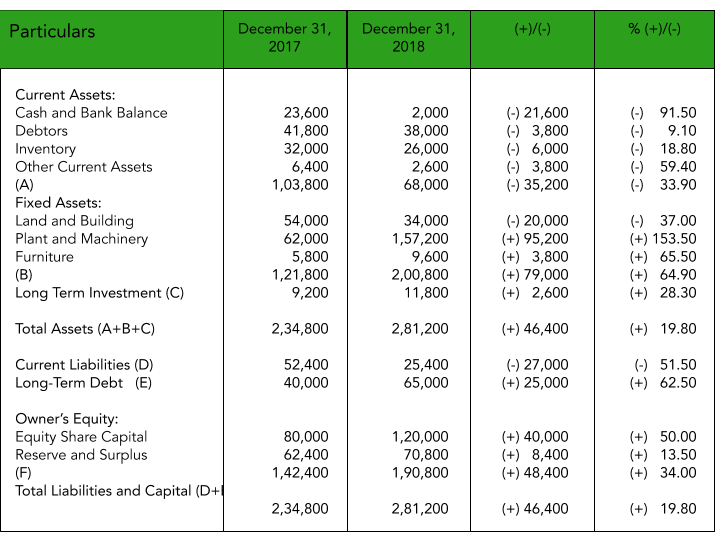

Definition of comparative balance sheet a comparative balance sheet typically has two columns of amounts that appear to the right of the account titles or other descriptions such as cash and cash equivalents, accounts receivable, accounts payable, etc. Assets and liabilities of business for the previous year as well as the current year; A technique of comparing financial statements through which the balance sheet of a company is analysed by comparing its asset, and equity and liabilities for two or more two accounting periods is known as comparative balance sheet.

For example, a comparative balance sheet could present the balance sheet as of the end of each year for the past three years. The financial position is compared with 2 or more periods to depict the trend, direction of change, analyze and take suitable actions. The first column of amounts contains the amo.