Stunning Info About Common Size Statement Balance Sheet Bad Debt Expense Cash Flow

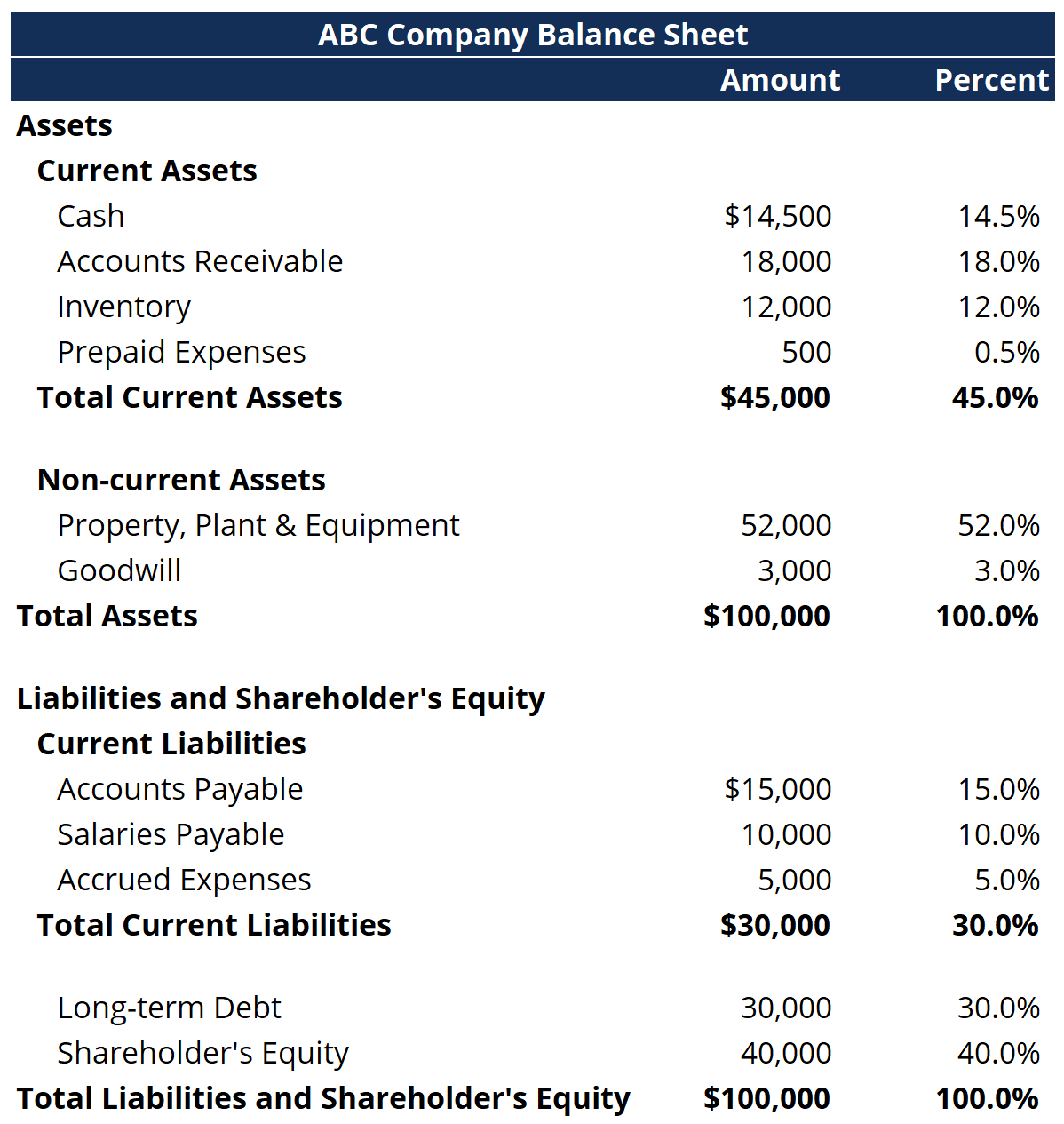

A common size financial statement lists any entries as a percentage of a base figure.

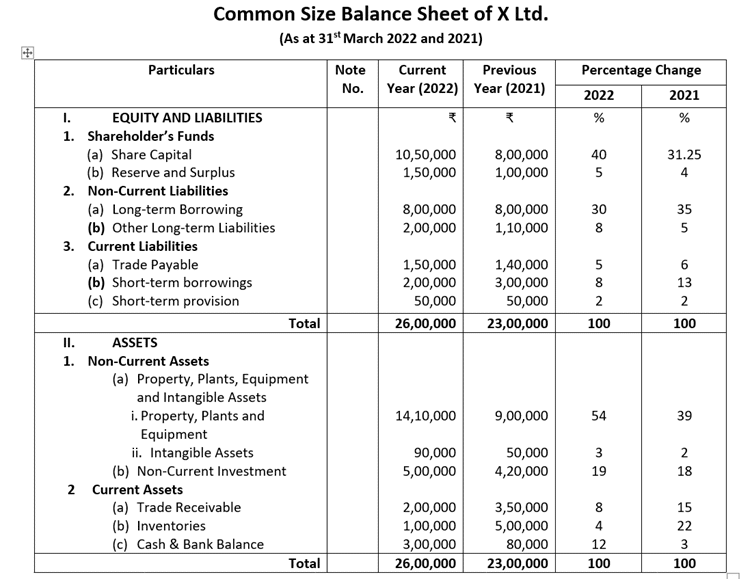

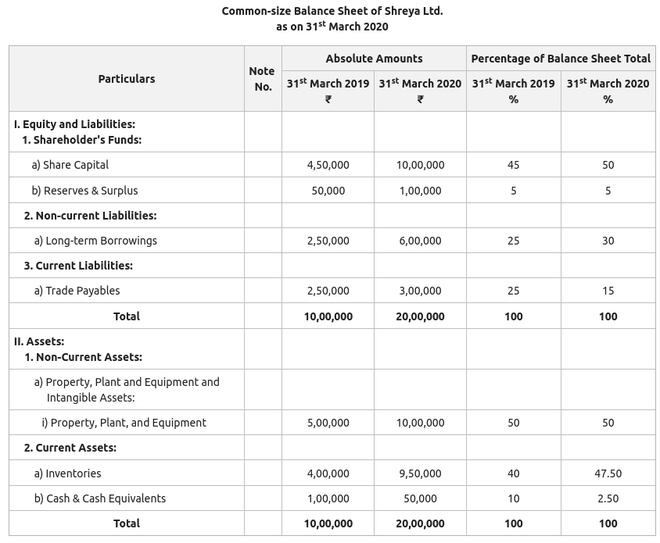

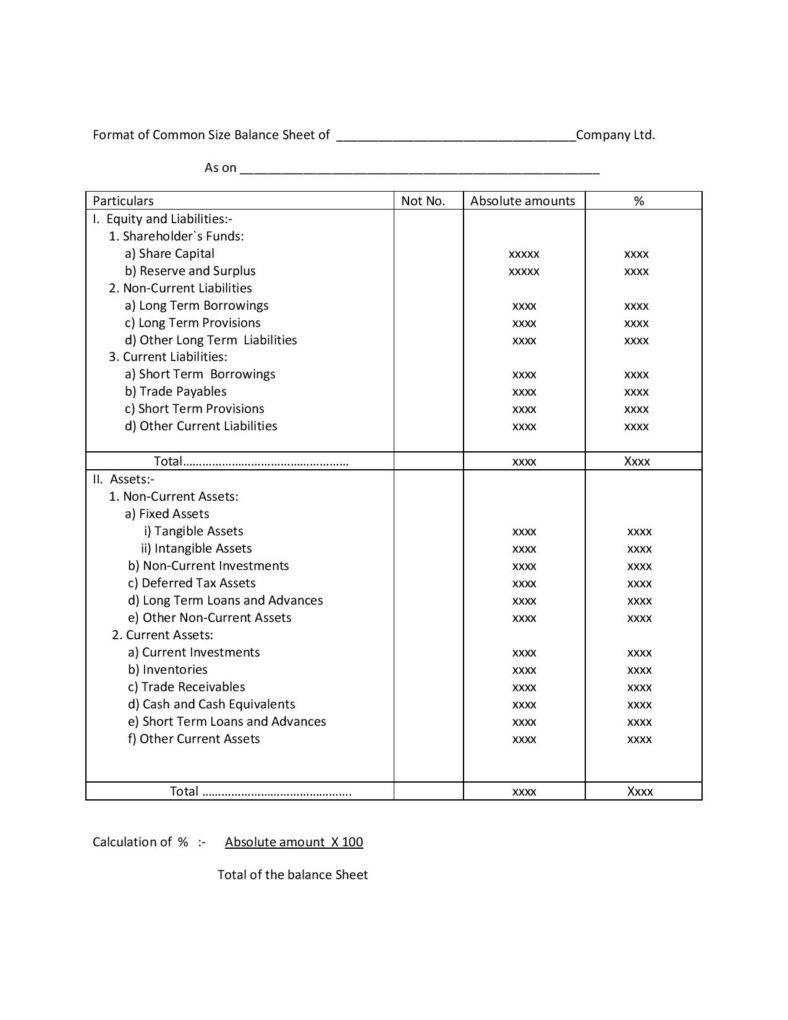

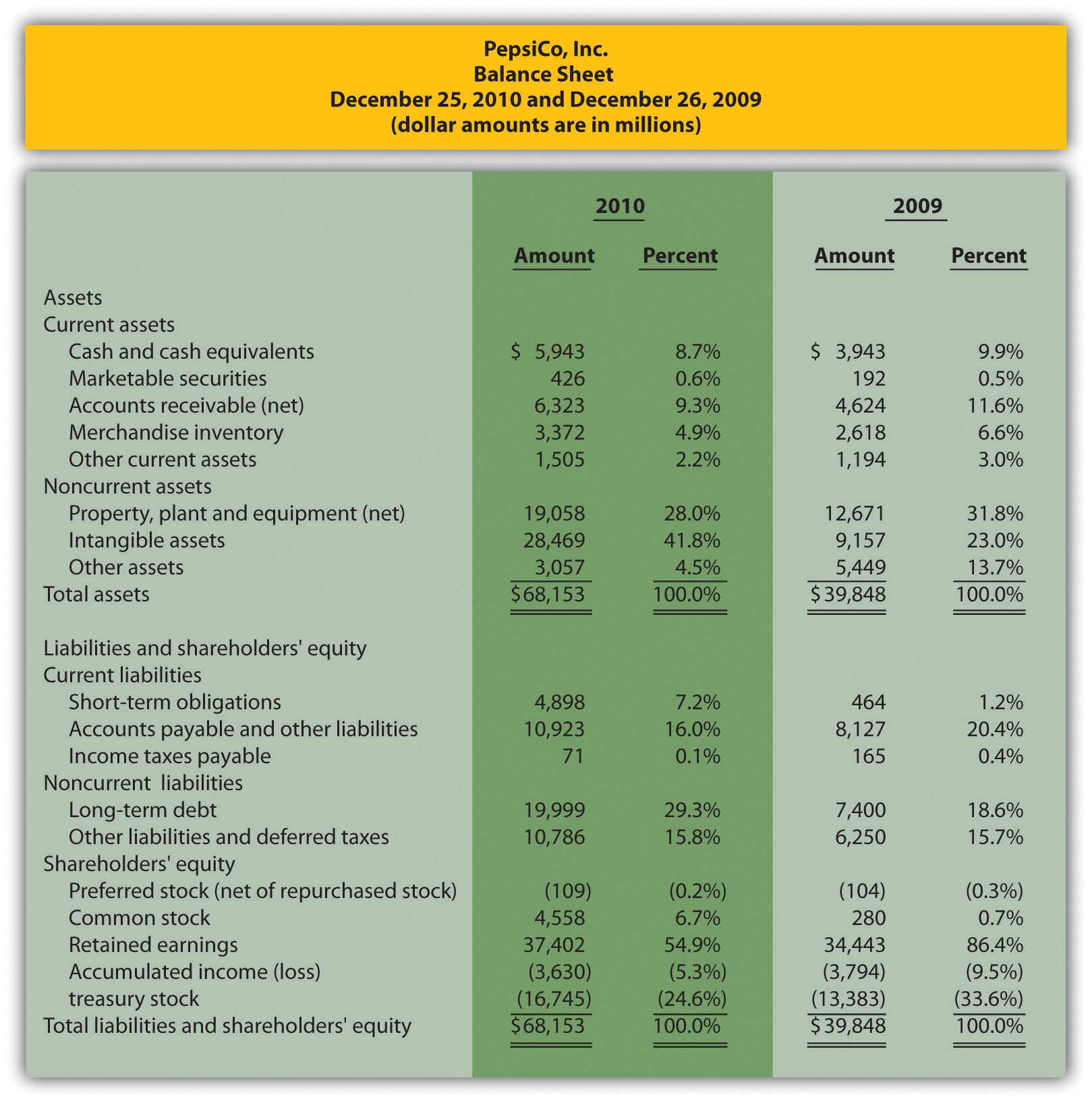

Common size statement balance sheet. Common size balance sheets are similar to common size income statements. As fixed assets age, they begin to lose their value. A common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts.

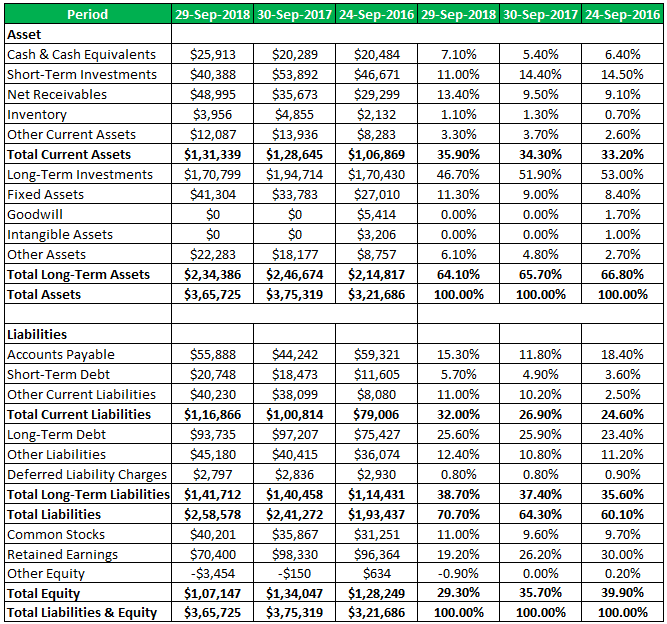

The only difference is that each line item on this accounting balance sheet is expressed as a percentage of total assets. Each line item on the balance sheet is restated as a percentage of total assets. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it.

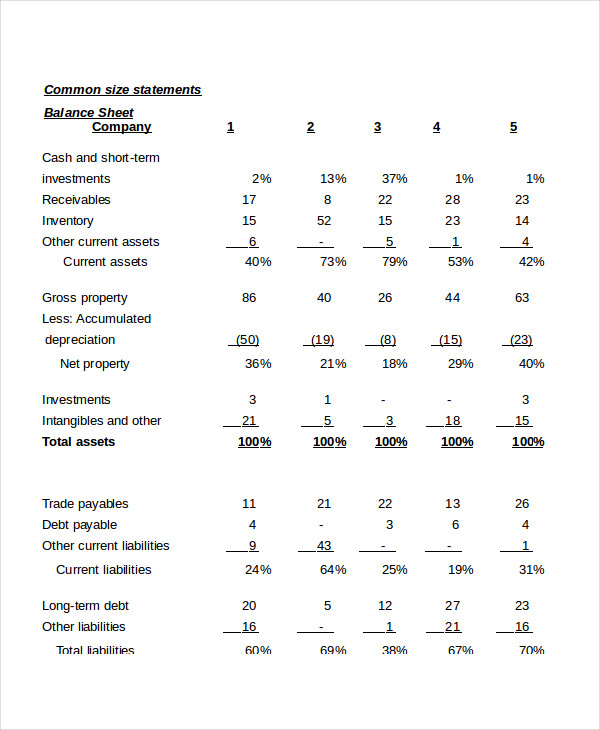

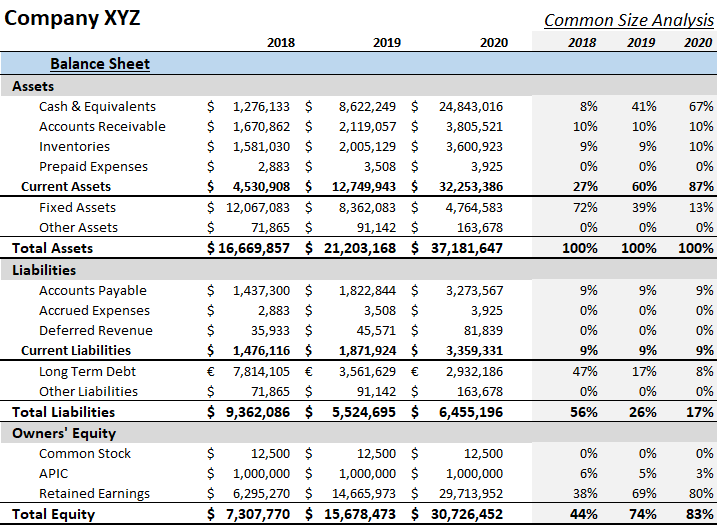

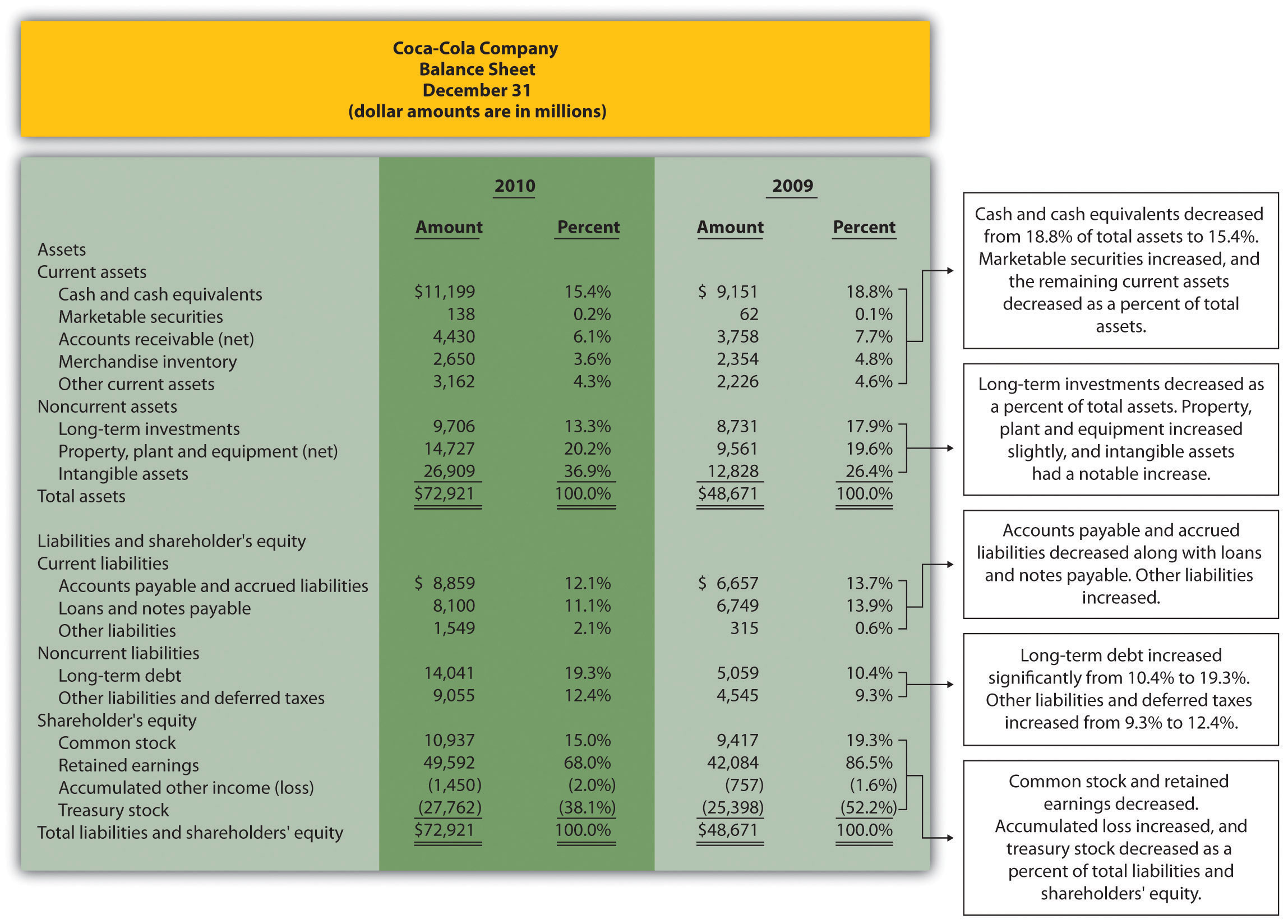

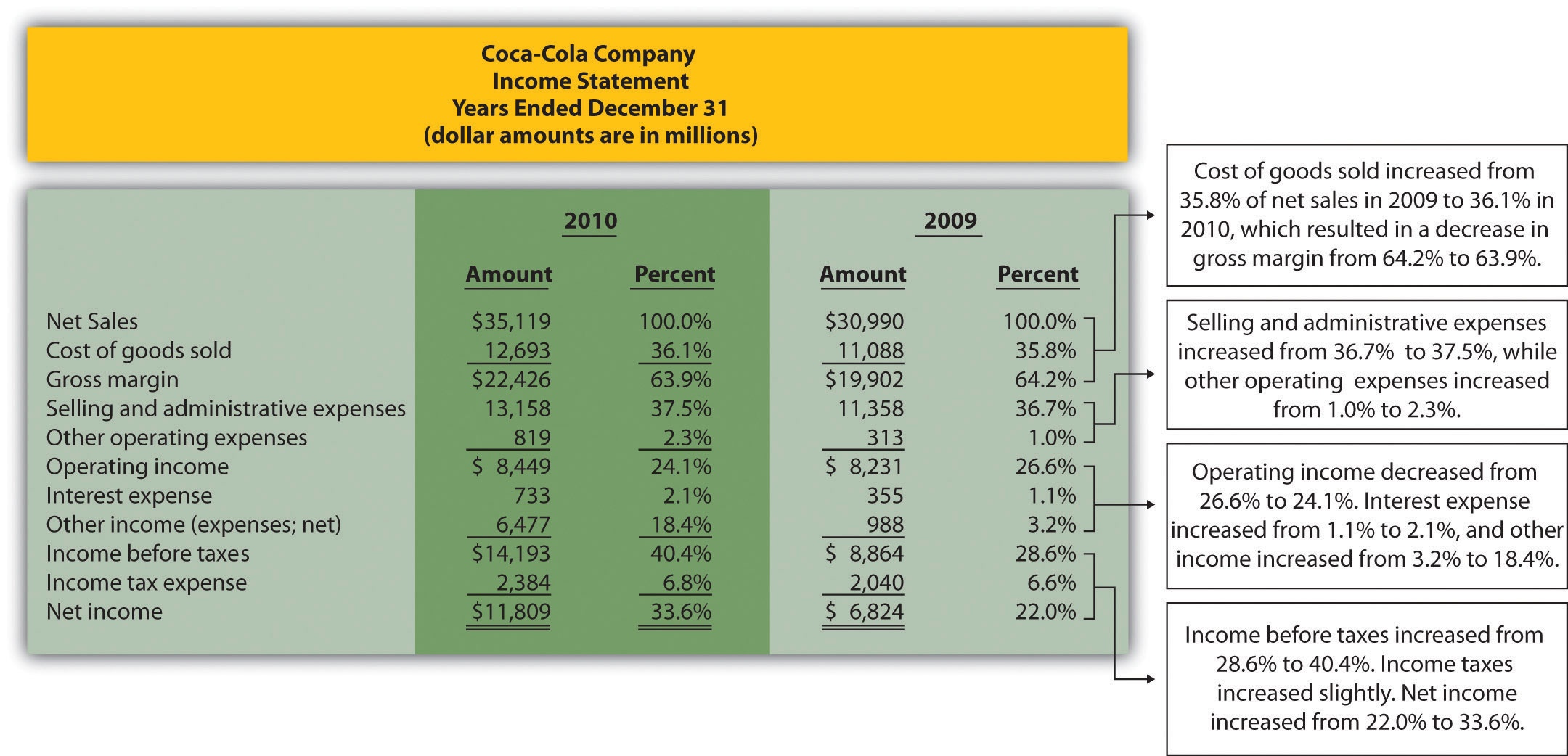

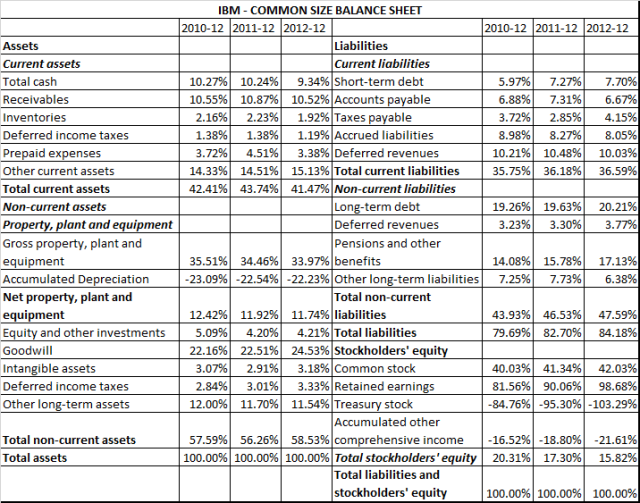

Expressing each item on the balance sheet as a percentage of total assets allows for easy comparison of different categories and helps identify trends over time. Briefly describe any significant changes from 2009 to 2010 identified in parts 1 and 2. To express the amounts as the percentage of the total, the total assets or total equity and liabilities are taken as 100.

Common size balance sheet. Based on the accounting equation, this also equals total liabilities and shareholders’ equity, making either term. What is common size balance sheet analysis?

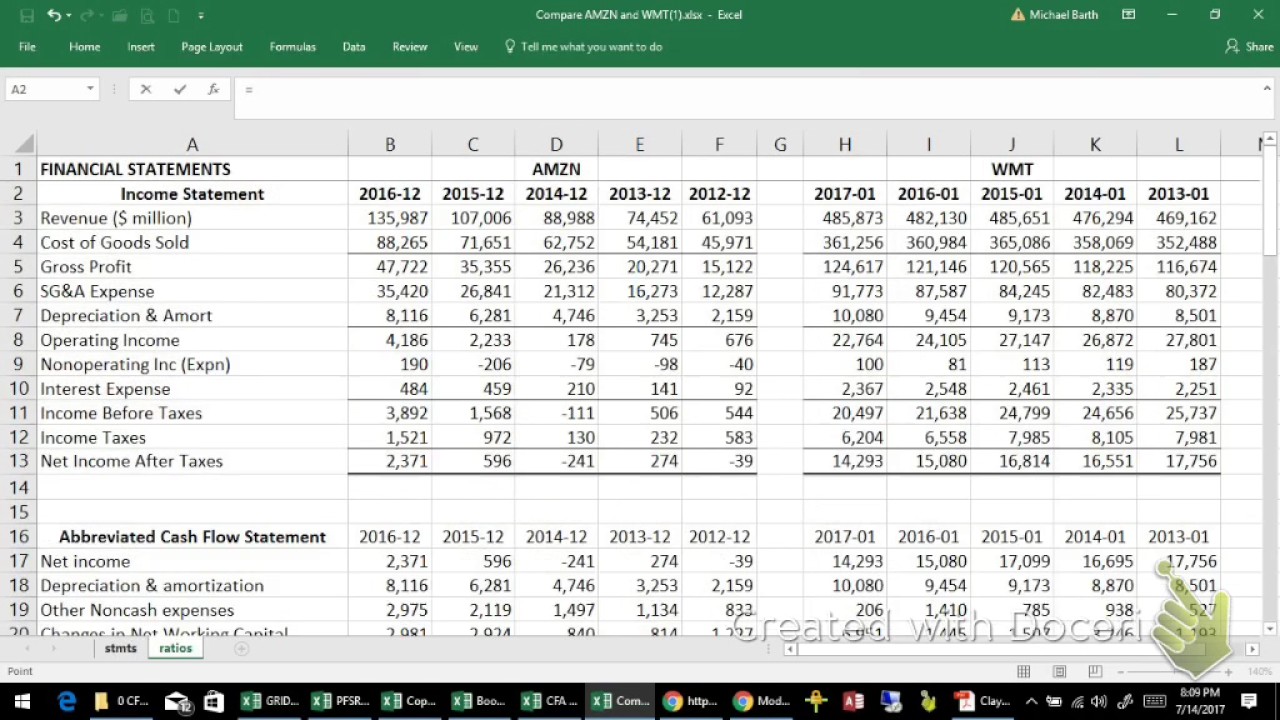

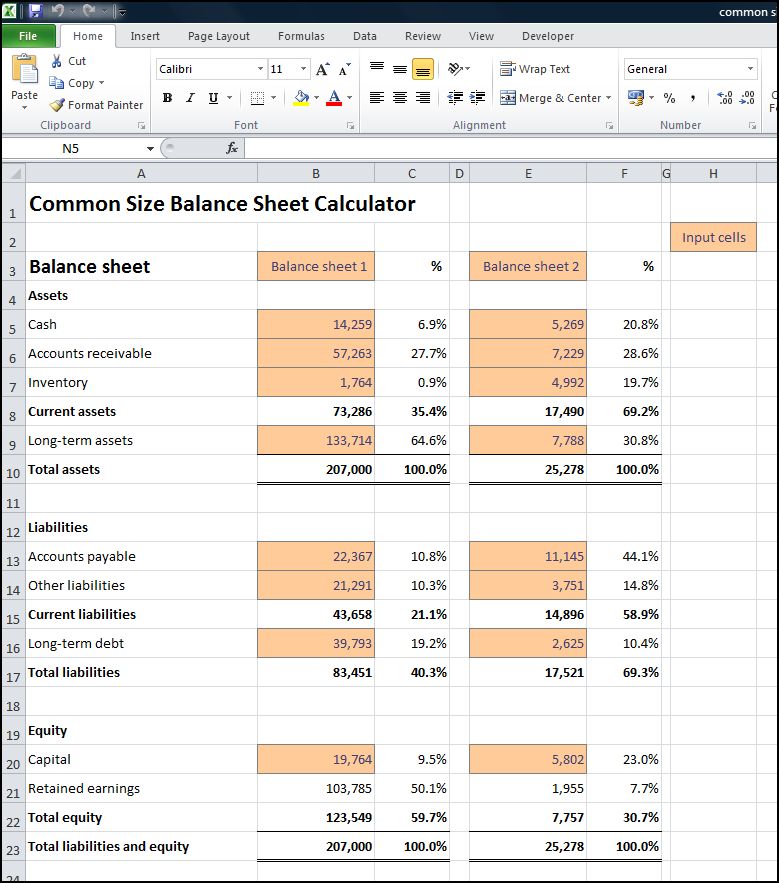

You can use it in financial analysis to compare the relative results of two or more companies. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. In the balance sheet, the common base item to which other line items are expressed is total assets, while in the income statement, it is total revenues.

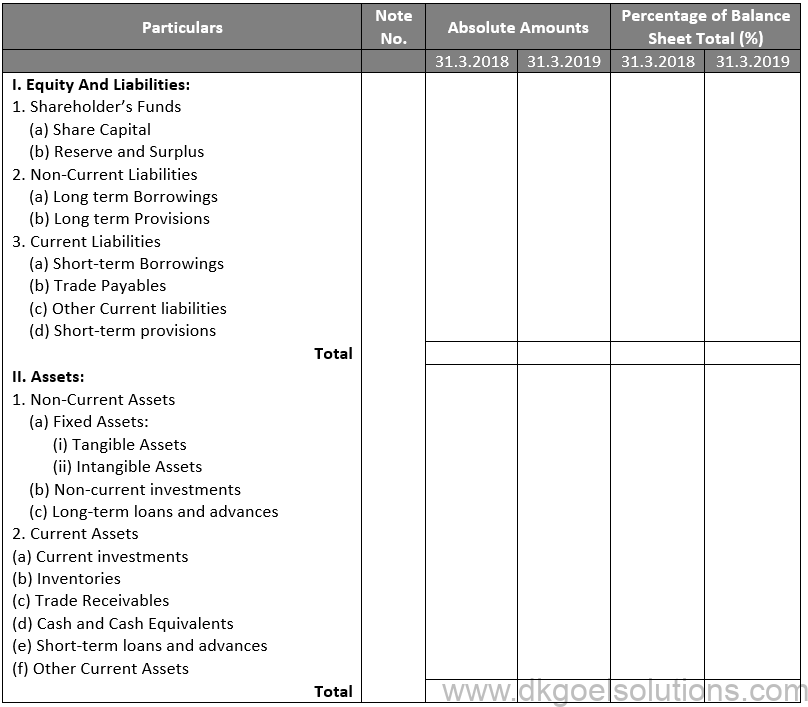

Explore the main common size financial statements. Common size financial statements include cash flow statements, balance sheets, and income statements. From the following balance sheet of vijay ltd.

Solution to review problem 13.2 Common size balance sheet chapters00:00 introduction01:00 what is common size balance sheet02:00 what is common size balance sheet03:52 common size balance s. However, in this article, we will cover most commonly used statements for common size analysis.

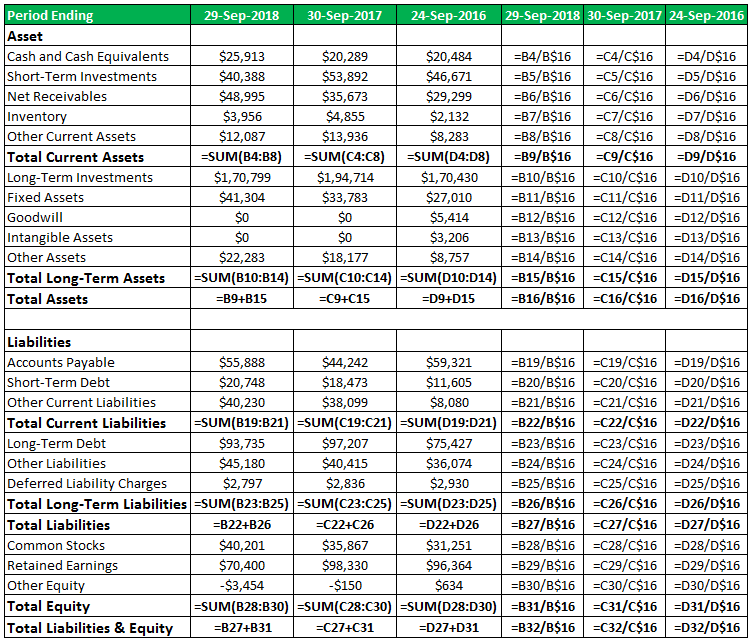

Common size balance sheet is the balance sheet that prepares by management to show both values of each item in assets, liabilities, and equity in currency (usd) and percentages (%) at the end of the accounting period. A common size balance sheet is set up with the same logic as the common size income statement. To common size a balance sheet, the analyst restates each line item contained in the balance.

In the balance sheet, the common base item to which other line items are expressed is total assets, while in the income statement, it is total revenues. The technique of common size statement analysis is used to interpret three financial statements including balance sheet, income statement and cash flow statement. The balance sheet equation is assets equals liabilities plus stockholders' equity.

As a result, it becomes easier to compare companies of various sizes and track changes within a company over time. A common size balance sheet is a financial statement that displays each balance sheet item as a percentage of total assets. The term “common size balance sheet” refers to the presentation of all the line items in a balance sheet in a separate column in the form.