Outrageous Info About Allergan Financial Statements Trial Balance To Sheet And Profit Loss Example Cash Flow Statement Is Based On Which Basis Of Accounting

Pass the journal entries (which should have at least 30 transactions (without gst), post them into the ledger, closing the books of accounts prepare a.

Allergan financial statements trial balance to balance sheet and profit and loss example. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit columns. (5,265) (5,086) (3,716) (935) (2,868) (1,630) income (loss) before gain (loss) on sale of properties: The cash flow statement provides information about allergan inc.

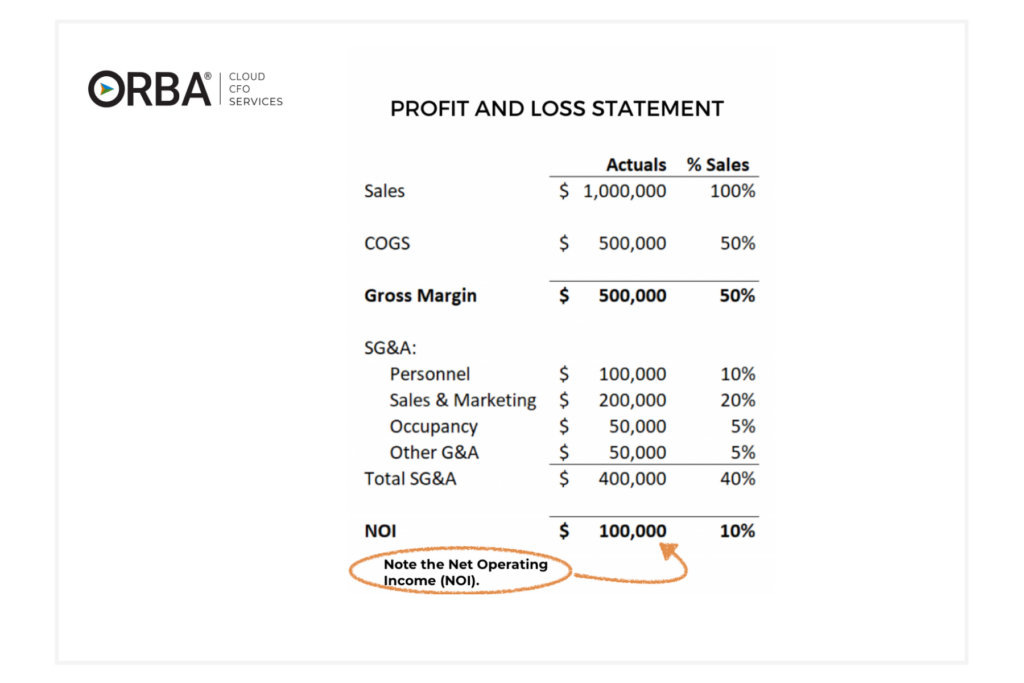

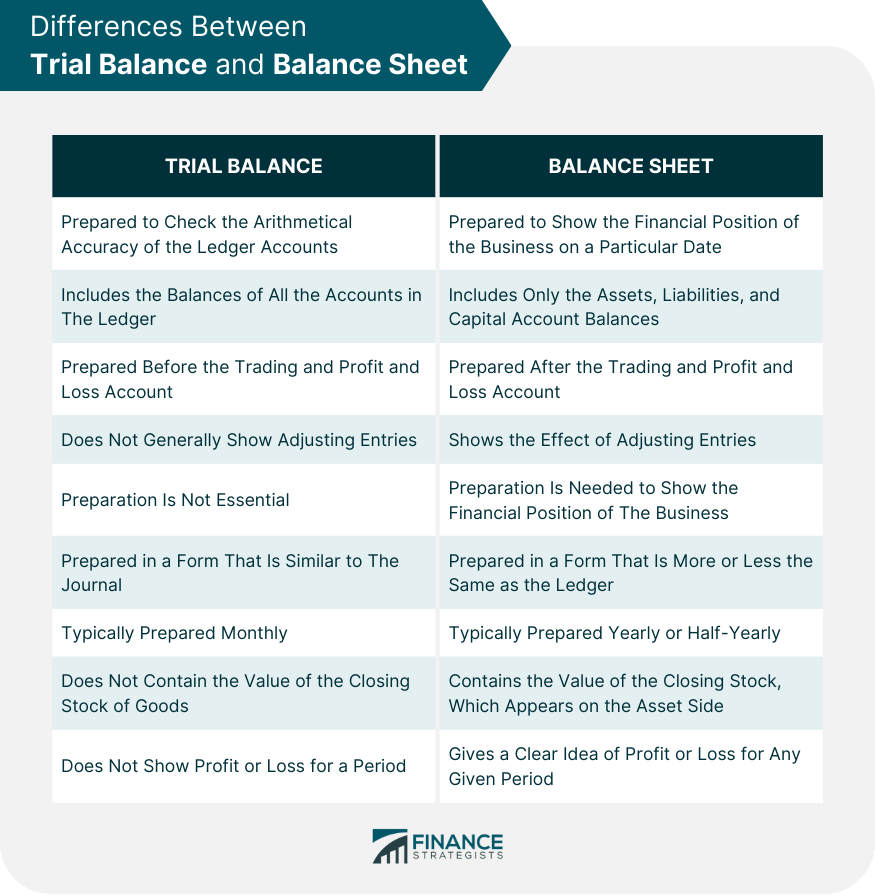

It provides a summary of the ledger accounts. How to read a profit and loss statement. The key difference between trial balance vs.

Cash receipts and cash payments during an accounting period, showing how these cash flows link the ending. Profit and loss statement template example; Thus, it serves as a link between the books of accounts.

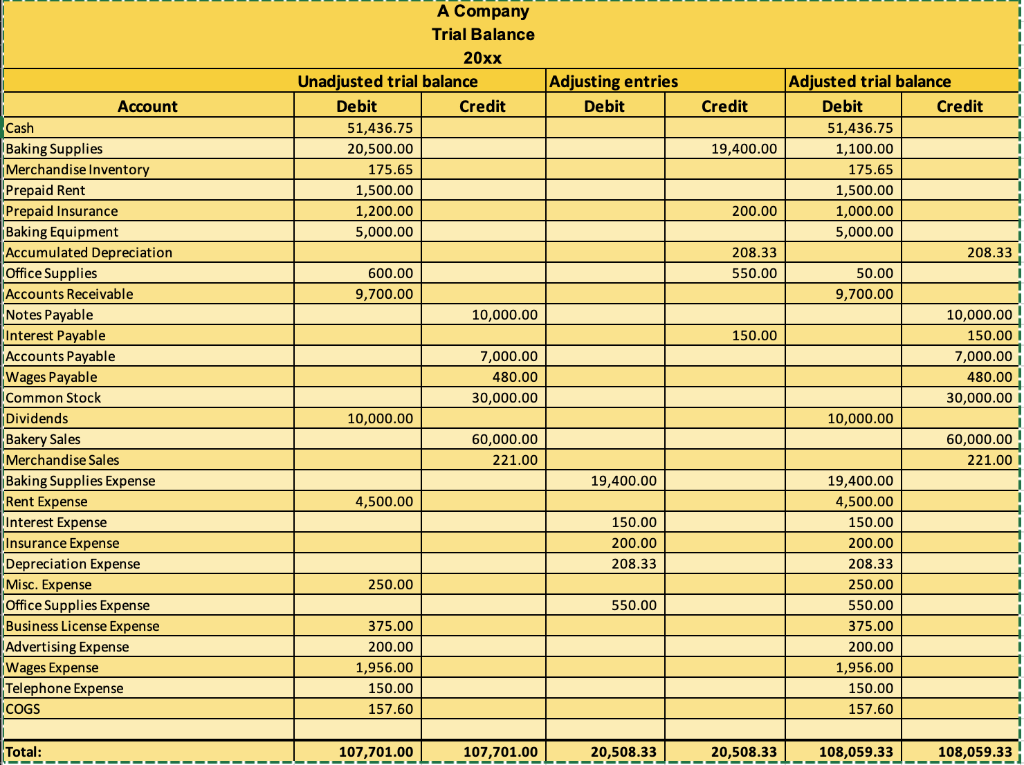

Preparing an unadjusted trial balance is the fourth step in the accounting cycle. Loss from continuing operations: In order to prepare the profit and loss account and the balance sheet, a business.

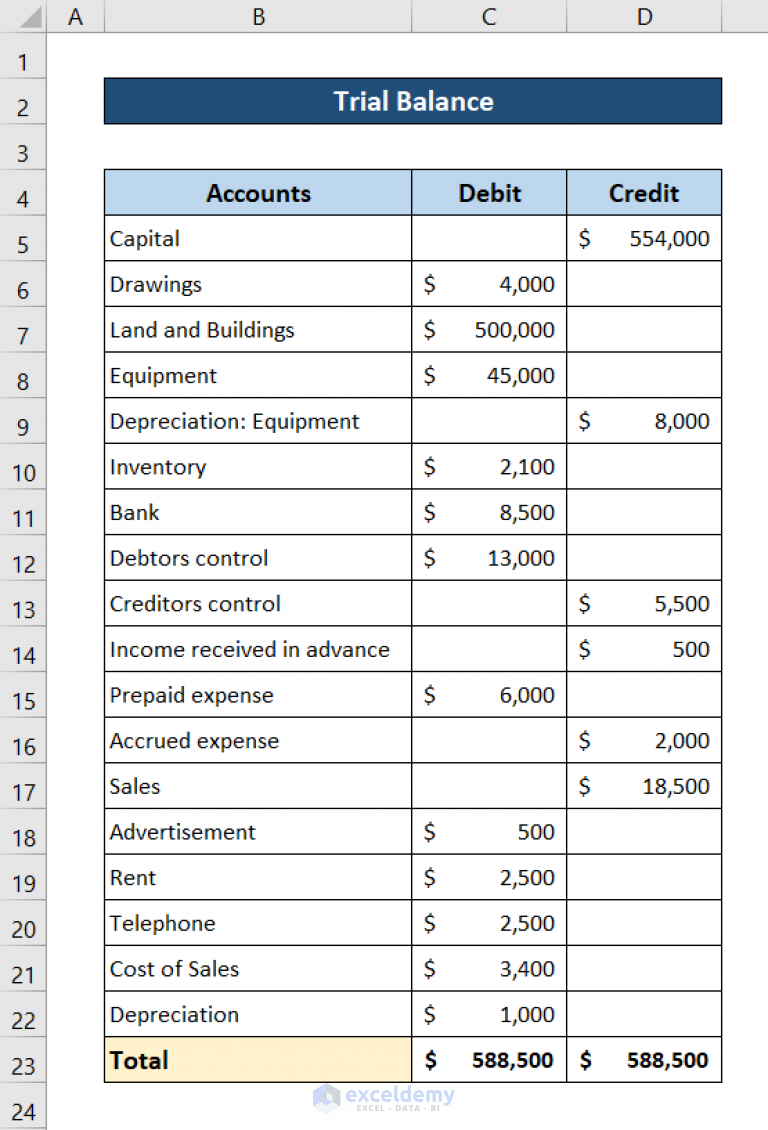

In this chapter we will bring together the material from theprevious chapters and produce a set of financial statements from a trialbalance. How to prepare financial statements from trial balance in excel: Allergan financials data including stock price, creditsafe score, income statement, balance sheet, cash flow, and acquistions and subsidiaries.

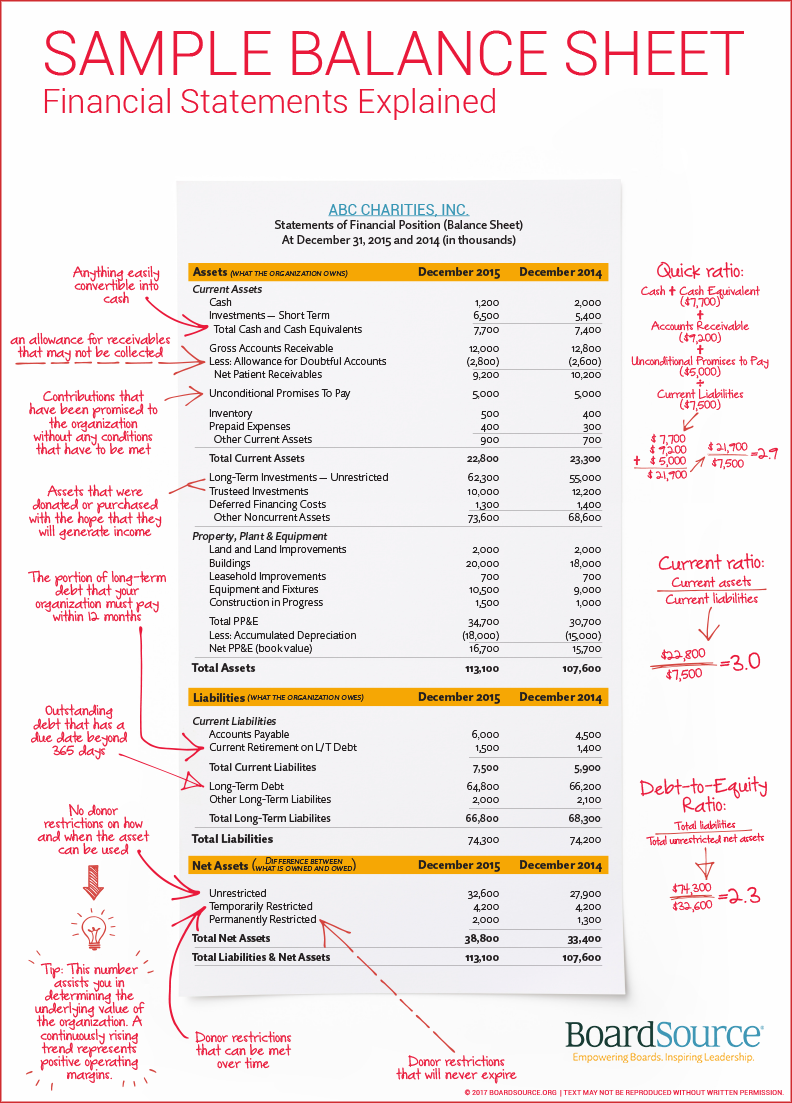

The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. A balance sheet is that trial balance is the report of accounting in which ending balances of different general ledger general. Both the profit and loss account and the balance sheet are drawn from the trial balance.

Categorizing assets and liabilities on a balance sheet helps a company evaluate its business. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. Trial balance does not form a part of the final accounts.

Using classified balance sheets to evaluate liquidity. As fixed assets age, they begin to lose their value. Here are steps to make a balance sheet from trial balance.

How often do you prepare a profit and loss statement? Agn), headquartered in dublin, ireland, is a bold,. Step 4) balance day adjustments;

A trial balance is a list of all accounts in the general ledger that have nonzero balances. Trial balance, p&l, and balance sheet reports are interconnected, with the data from the trial balance report serving as the foundation for generating the other two financial. We will prepare three financial statements from the trial balance.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)