Recommendation Tips About Cash Flow From Operating Activities Formula Balance Sheet Of

Use the net income figure from the income statement.

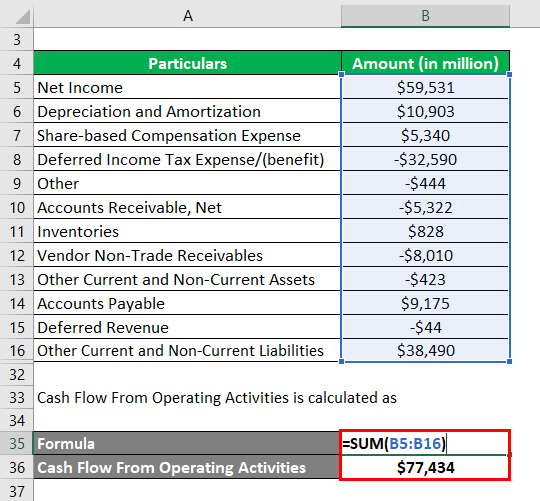

Cash flow from operating activities formula. Businesses can calculate the net cash flow from operating activities (cfo) using: That means, in a typical year, randi generates $66,000 in positive cash flow from her typical operating activities. Operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period.

Accounting march 29, 2023 when you run a business, it’s crucial to have an awareness of cash flow metrics. As such, you can calculate cash flow from operating activities using the following formula: The generic formula is:

This provides total cash generated. Randi’s operating cash flow formula is represented by: Cash flows from (for) operating activities:

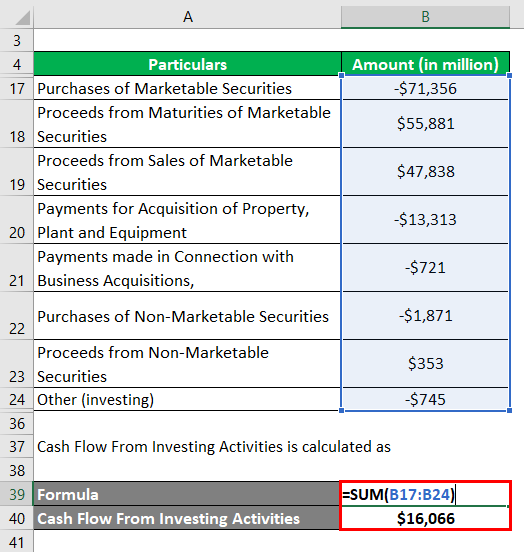

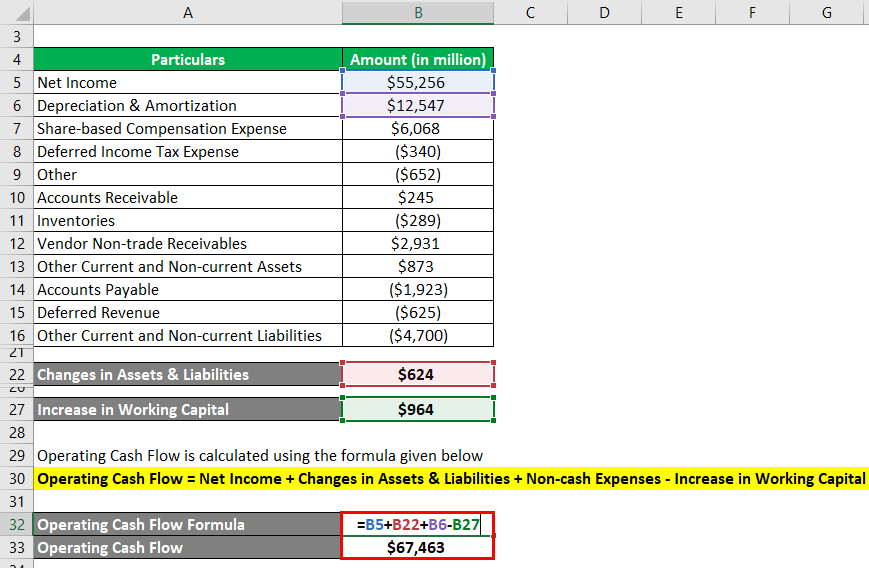

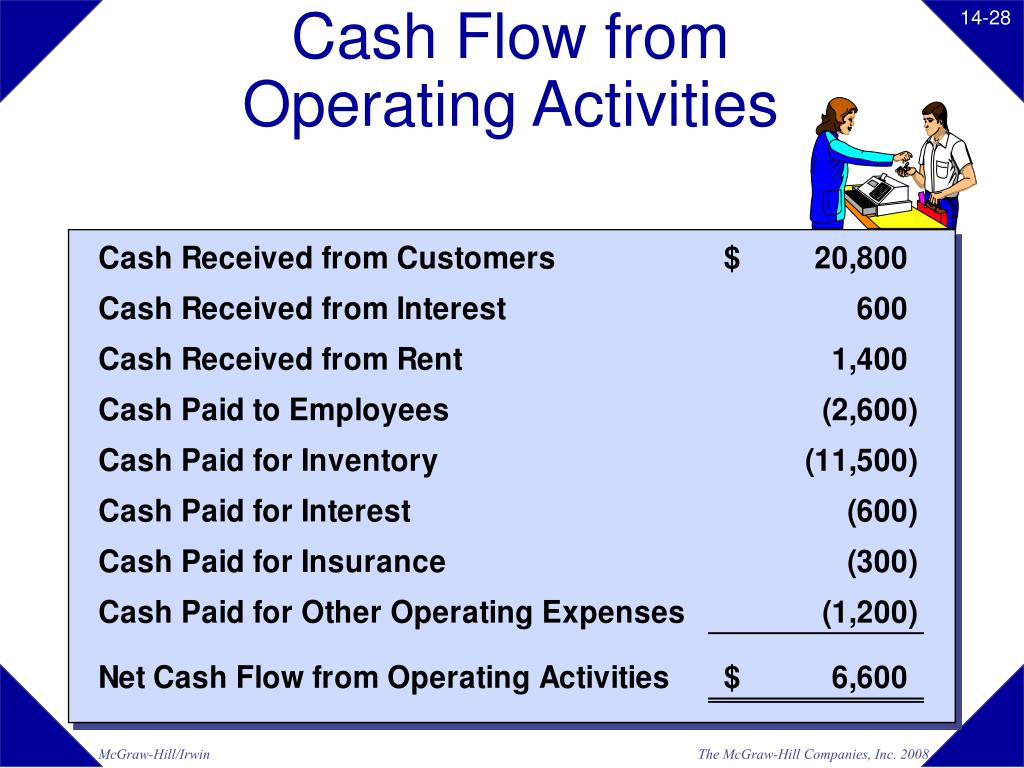

The format shown below can be used. Operating cash flow (ocf), often called cash flow from operations, is an efficiency calculation that measures the cash that a business produces from its principal operations and business activities by subtracting operating expenses from total revenues. Cash flow from operating activities = net income + depreciation, depletion, & amortization + adjustments to net income + changes in accounts receivables + changes in liabilities + changes in.

Operating cash flow is one of the amounts you should calculate and monitor regularly. This practice ensures good accounting, but it also gives you an accurate picture of your finances when speaking with investors and stakeholders. Cost of sales is how much money the organization pays to make revenue during the accounting period.

Q4 net cash from operating activities improved by $105.5 million; Operating cash flow: Direct method indirect method an overview of these methods is given below.

A positive ocf means the company can generate sufficient cash flow to support its operations. The operating cash flow ratio is calculated by dividing operating cash flow by current liabilities. Operating cash flow is the cash generated by a company's normal business operations.

The indirect method formula is: While the exact formula will be different for every company (depending on the items they have on their income statement and balance sheet), there is a generic cash flow from operations formula that can be used: Cash flow from operating activities is the first of the three parts of a company's cash flow statement.

Looking for more details on the operating cash flow formula? Cash flow from operations formula (indirect method) = $170,000 + $0 + 14,500 + $4000 = $188,500. Amortization of discount and issuance costs on convertible notes.

There are two methods to calculate cash flow (via a cash flow statement): Here is where you retrieve those figures: Direct method under the direct method, the information contained in the company's accounting records is used to calculate the net cfo.

-Formula.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)