Beautiful Work Info About Distinguish Between Fund Flow And Cash Opening Trial Balance

Fund flow focuses on the movement of cash only and reflects the net flow after measuring inflows and outflows.

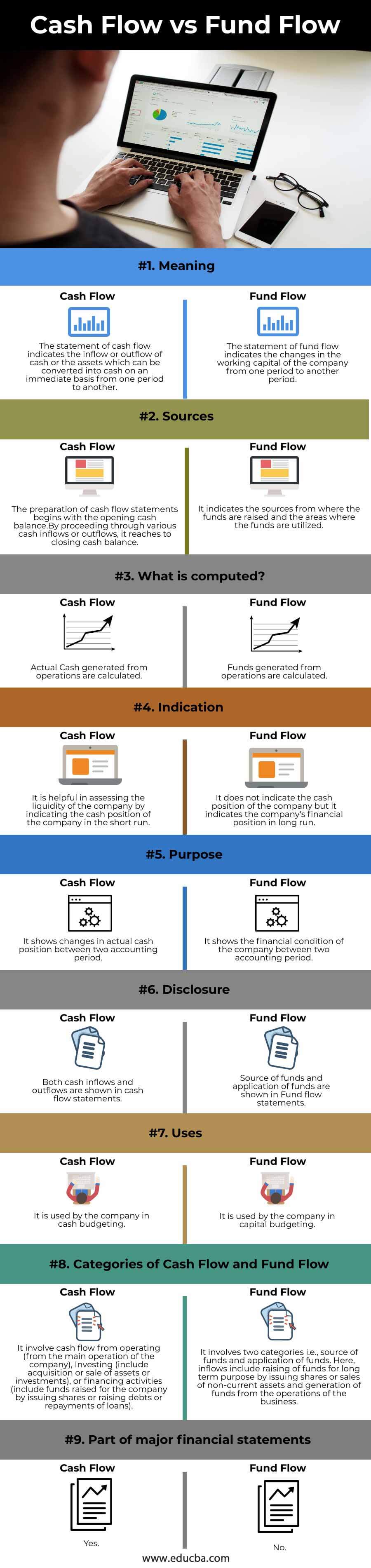

Distinguish between fund flow and cash flow. It also includes any cash outflows made within a specific period to cover investments and business expenses. To know about the liquidity of the company, one should refer cash flow statement instead of a fund flow statement. Fund flow on the other hand, is when there is a change in the financial position of a business between the previous year and the current one.

The concept of cash flow and fund flow is fundamental to the discipline of accounting. Difference between cash flow and fund flow. Cash flow is based on a narrow concept called.

The term ‘cash flow’ is a combination of two words ‘cash’ and ‘flow’ wherein the words cash. In the most simple terms, cash flow happens when cash moves (or flows) in and out of a business. Cash and funds are critically required for the smooth functioning of any business and are often perceived as similar to each other.

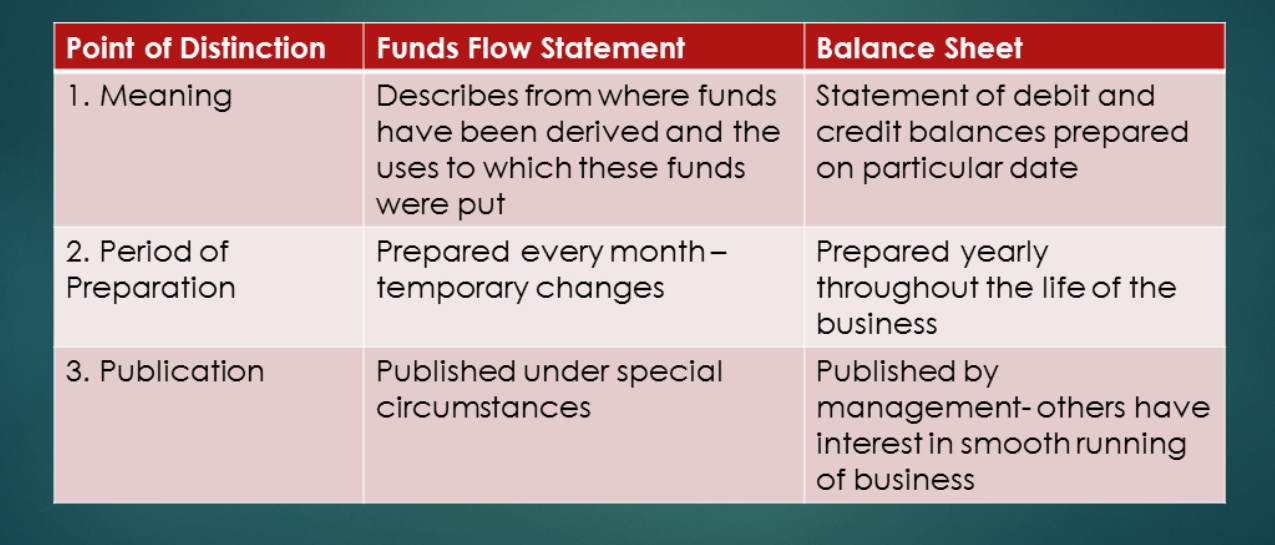

The cash flow will record a company's inflow and outflow of actual cash (cash and cash equivalents). The major cash flows are presented in one of three classifications: A balance sheet shows the financial position of an organization at a specific point in time.

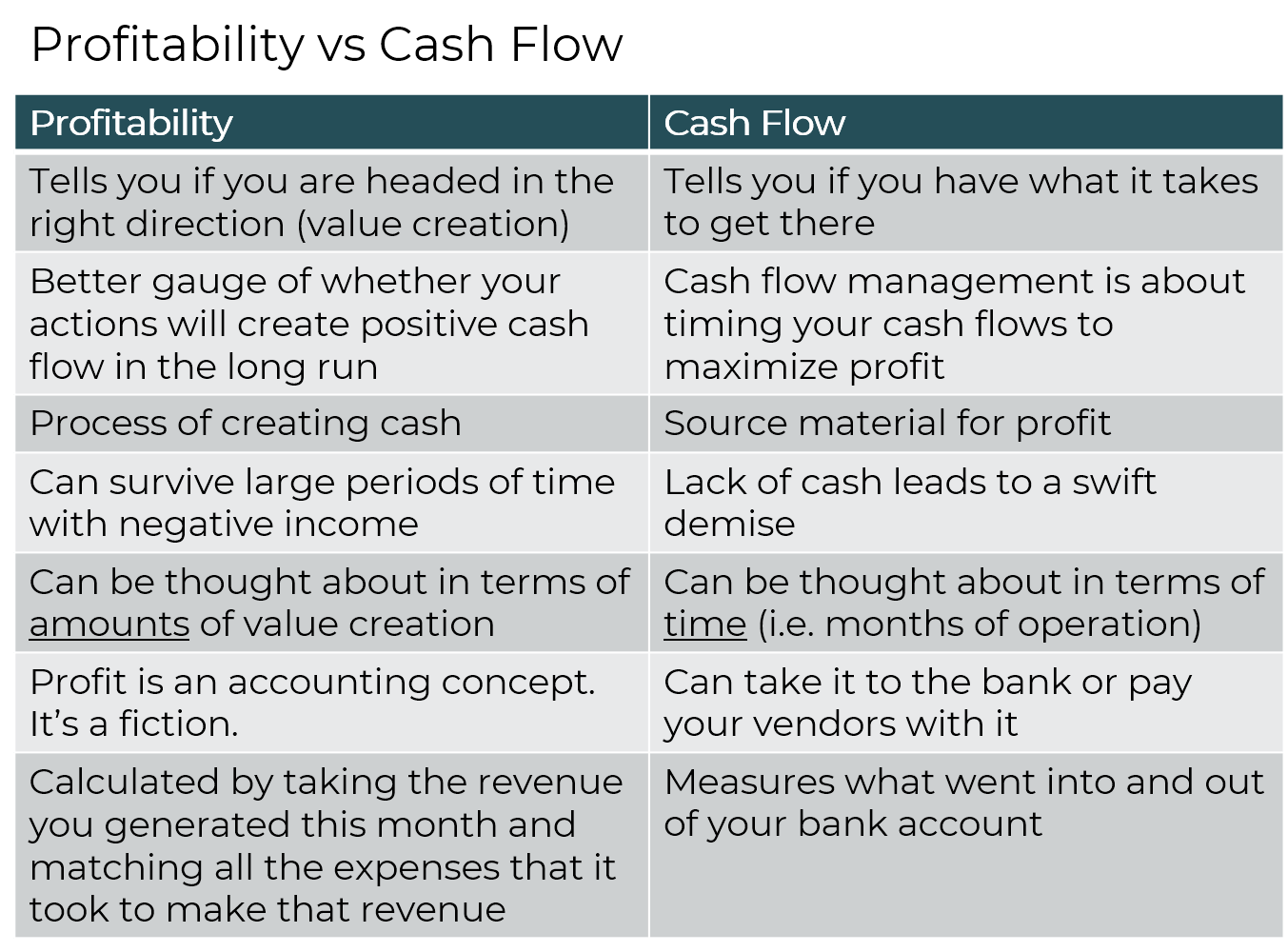

Difference between cash flow and fund flow. The primary difference between cash flow and fund flow is that cash is referred to as the physical currency available to any business. Cash flow and fund flow are essential statements to measure the financial health of a company.

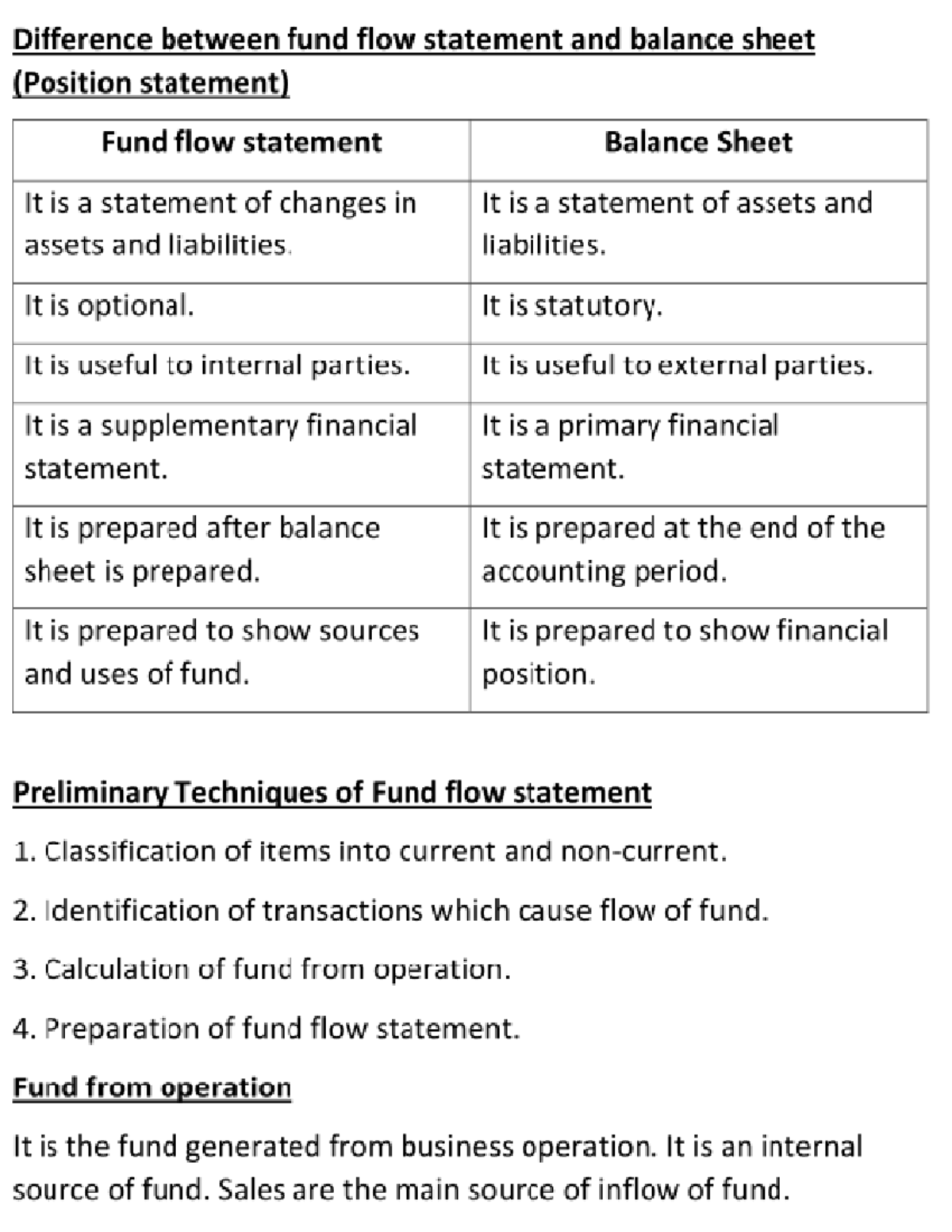

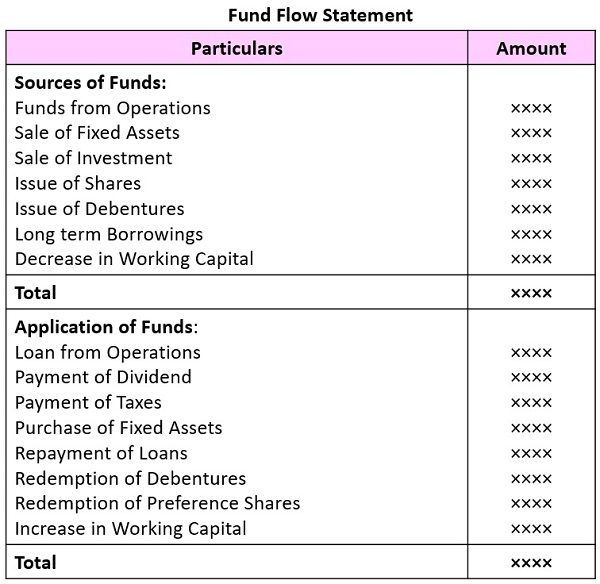

Furthermore, irregularities in company funds can be identified through fund flow statements. While the cash flow statement primarily tracks the movement of cash in and out of a business,. Thus, a fund flow statement tracks and records the net movement of funds in and out of the enterprise.

The cash flow statement indicates the actual cash position of the business which is not shown by the fund flow statement. Inflows can include the money retail investors put into mutual funds. Both help provide investors and the market with a periodic picture of the company’s performance.

On the other hand, a statement that. Difference between cash flow and fund flow statements meaning cash flow is a financial statement that details the cash inflows and outflows that happened during that particular accounting period. A cash flow statement is a type of financial statement that gives total information about all of the cash inflows a business makes from continuing activities and external investment sources.

Fund flow signifies the working capital of an enterprise. Cash flow and fund flow are two completely different statements that are required for running a business and analyzing its shortcomings. These ratios are important in assessing the liquidity position of a company.

Whereas, the total financial resources available with a business are its funds. A fund flow statement shows how cash has flowed in and out of an organization over a specific period of time. Definition of cash flow and funds flow statements the cash flow statement, known formally as the statement of cash flows, reports a company's change in cash and cash equivalents from one balance sheet date to another.