Spectacular Info About Owners Equity Account Monthly Cash Flow Template Excel

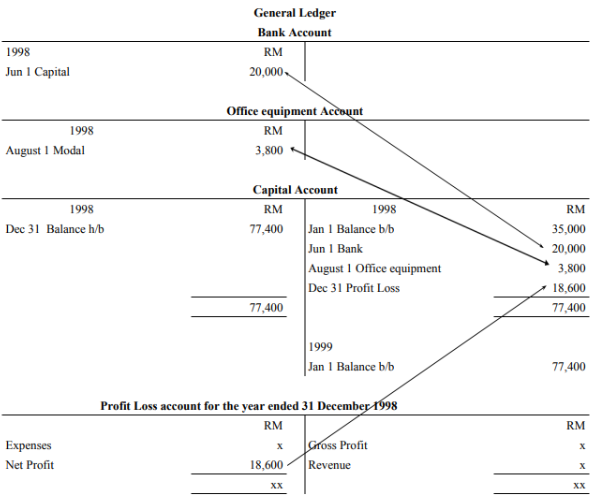

The owner’s equity (capital) also increases.

Owners equity account. Owner’s equity is recorded in the balance sheet at the end of an accounting period. Assets (money) increase from $0 to $15,000. Carrie sun was the personal assistant to a billionaire founder of a top wall street hedge fund.

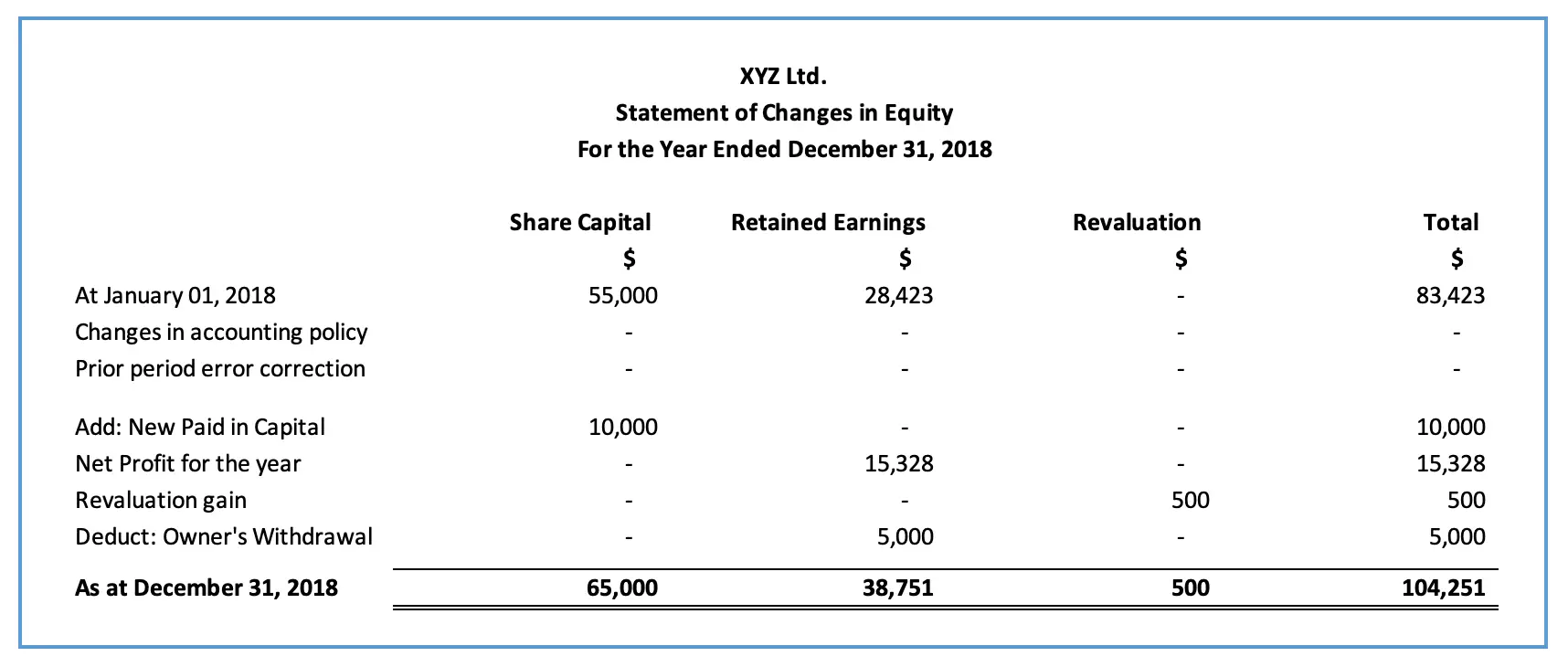

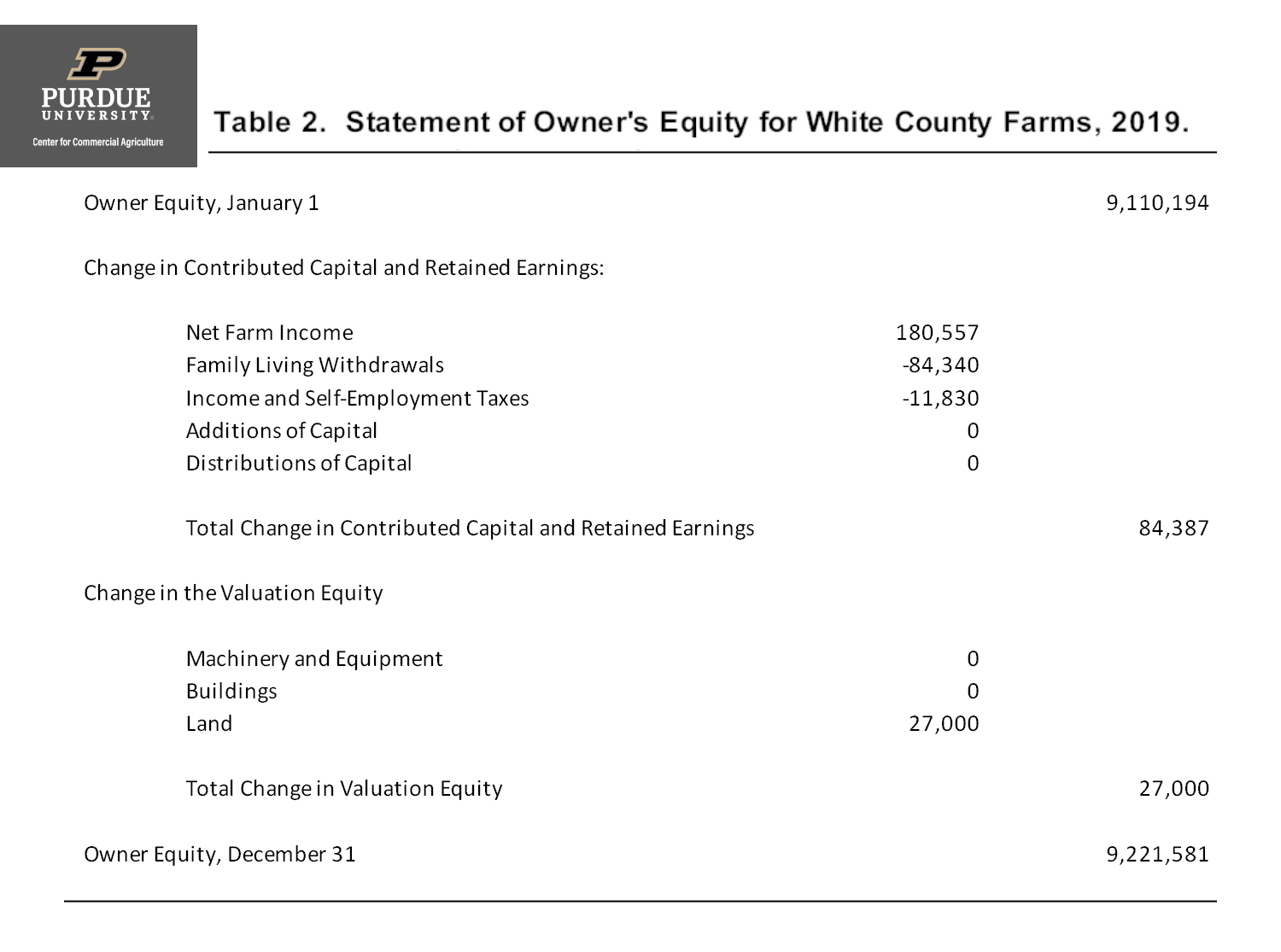

The statement of owner’s equity is a financial statement reporting changes in the equity section of the balance sheet. Openai has completed a deal allowing employees to sell stakes in the company, according to a person familiar with the matter. The statement of owner’s equity tracks the changes in the value of all equity accounts attributable to a company’s shareholders and impacts the ending shareholder’s equity carrying value on the balance sheet.

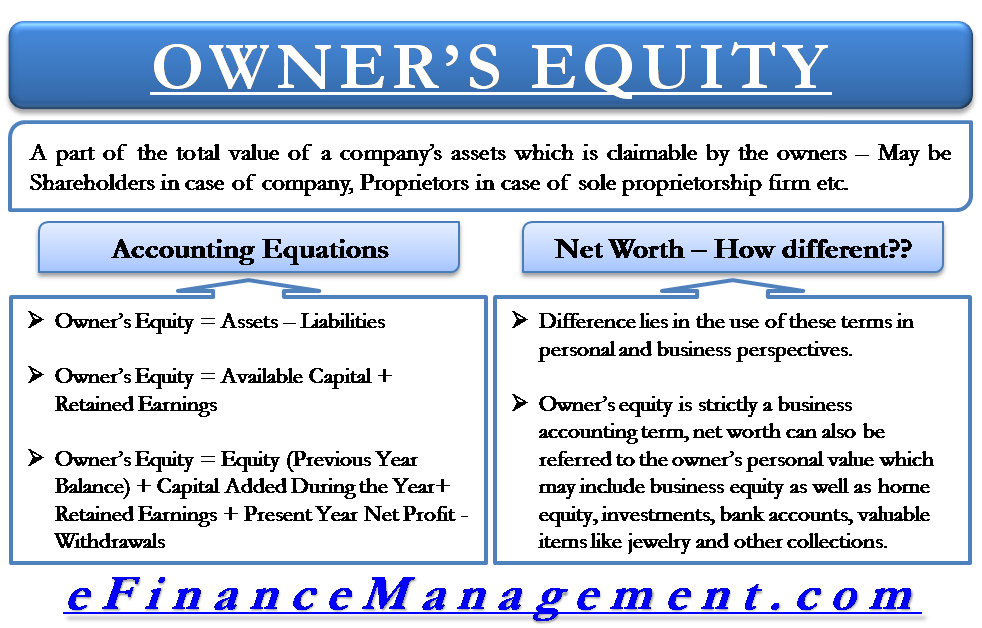

Owner’s equity is the amount that belongs to the business owners as shown on the capital side of the balance sheet, and the examples include common stock, preferred stock, and retained earnings. Learn what owner’s equity is, how it affects you and your business, how to calculate it, as well as helpful examples. The formula for owner’s equity is:

How to calculate owner’s equity. Owner’s equity represents the investment of the owners plus retained earnings. Owners’ equity is the capital theoretically available for distribution to the owner of a sole proprietorship.

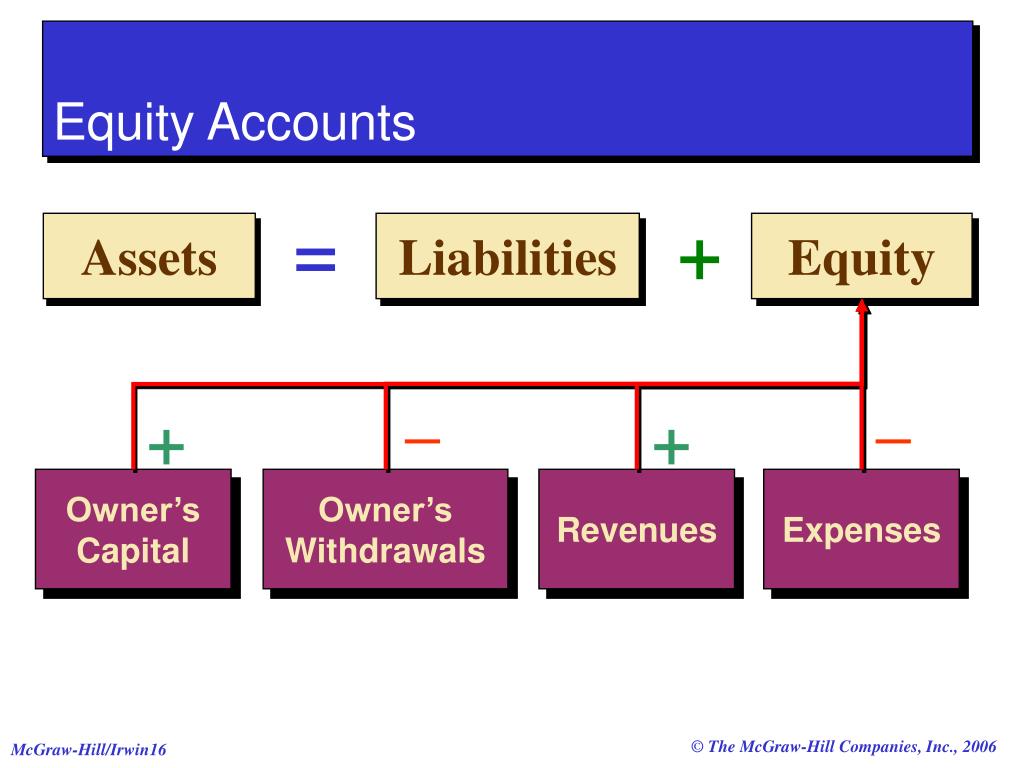

Owner’s equity is listed on a business’s balance sheet. On what side does the owner’s equity increase? Equity may come from the company's earnings or payments by owners, and because there are different types and sources of equity, there are different accounts and types.

How to calculate owner’s equity. This calculation indicates that the owners of the company have a residual claim of $500,000 on the company's assets after all liabilities have been settled. Owner’s equity can be calculated by summing all the business assets (property, plant and equipment, inventory, retained earnings, and capital goods) and deducting all the liabilities (debts, wages, and salaries, loans, creditors).

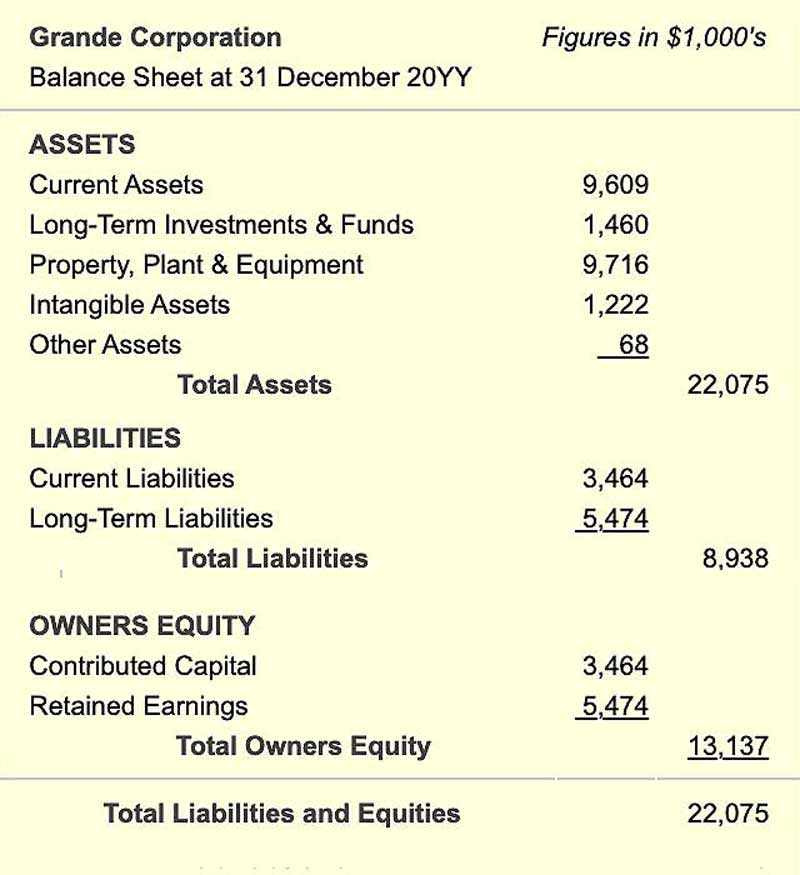

The higher the owner's equity, the stronger the financial position of the company. Owner’s equity is an umbrella term for the residual interest of business owners. Assets, liabilities and subsequently the owner’s equity can be derived from a balance sheet.

Share issued will increase owners equity by 1,00,000 (1,000 x 100) and issued capital over par by $20,000 (1,000 x 20) 3. It's the difference between the number of assets and the value of liabilities that allows the owner to know what they own after paying off debts. Money invested by the owner of the business plus profits of the business since its inception

It can be negative if the business’s liabilities are greater than its assets. An equity account is a financial portrayal of a business, company or organization. Equity accounts often vary based on the entity.

This is one of the four main accounting. Owner's equity represents the owner's investment in the business minus the owner's draws or withdrawals from the business plus the. Owner’s equity is a key variable in the classic accounting equation, assets = liabilities + owner’s equity, by which a company’s balance sheet literally “balances.” (if it doesn’t, there may be accounting errors or financial statement fraud.)

/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)