Great Tips About Depreciation Reserve In Balance Sheet Financial Statement Analysis Excel Template

Depreciation expense has a direct impact on the balance sheet through the following components:

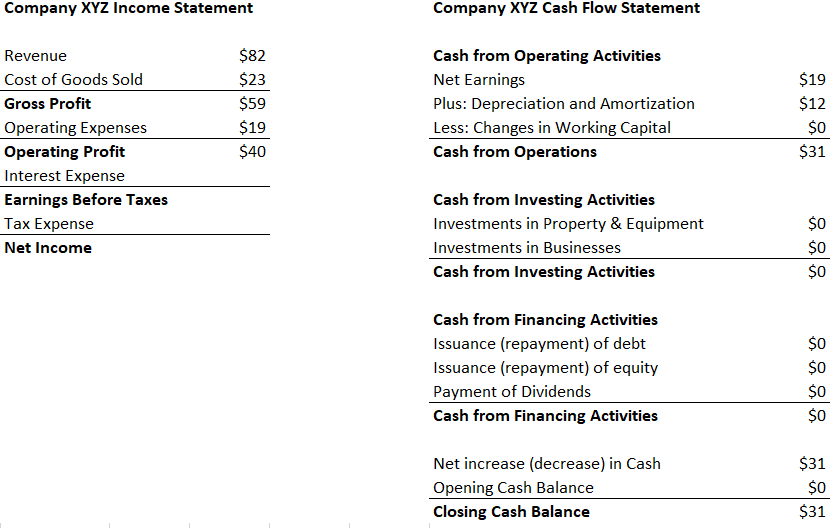

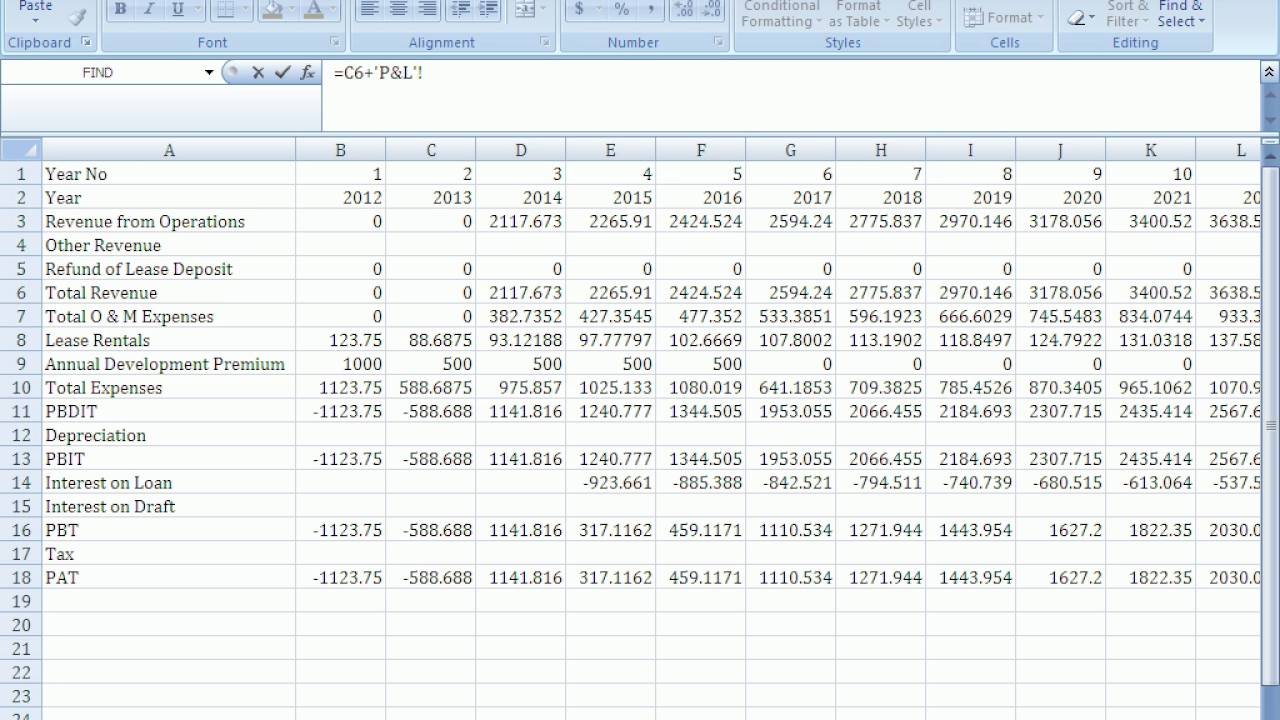

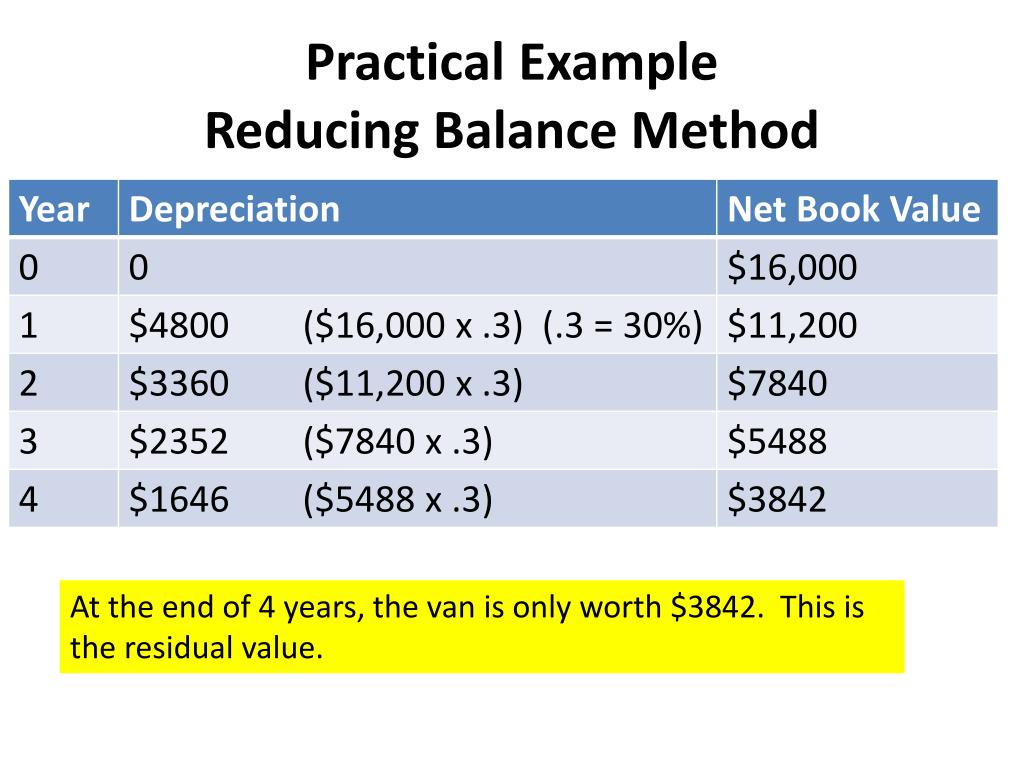

Depreciation reserve in balance sheet. The amount by which the asset is depreciated each year is deducted from. For income statements, depreciation is listed as an expense. Depreciation is included in the asset side of the balance sheet to show the decrease in value of capital assets at one point in time.

Component accounting frs 102 places more emphasis on component accounting. The journal entry for depreciation can be a simple entry designed to accommodate all types of fixed assets, or it may be subdivided into separate entries for. On an income statement or balance sheet.

When a company records accumulated depreciation on the balance sheet, it also creates a depreciation expense on the income statement. Component accounting would be appropriate when certain parts (i.e. Recording accumulated depreciation.

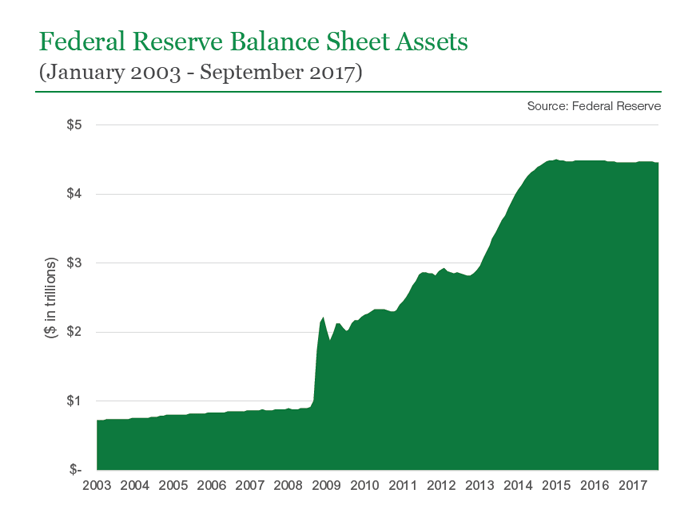

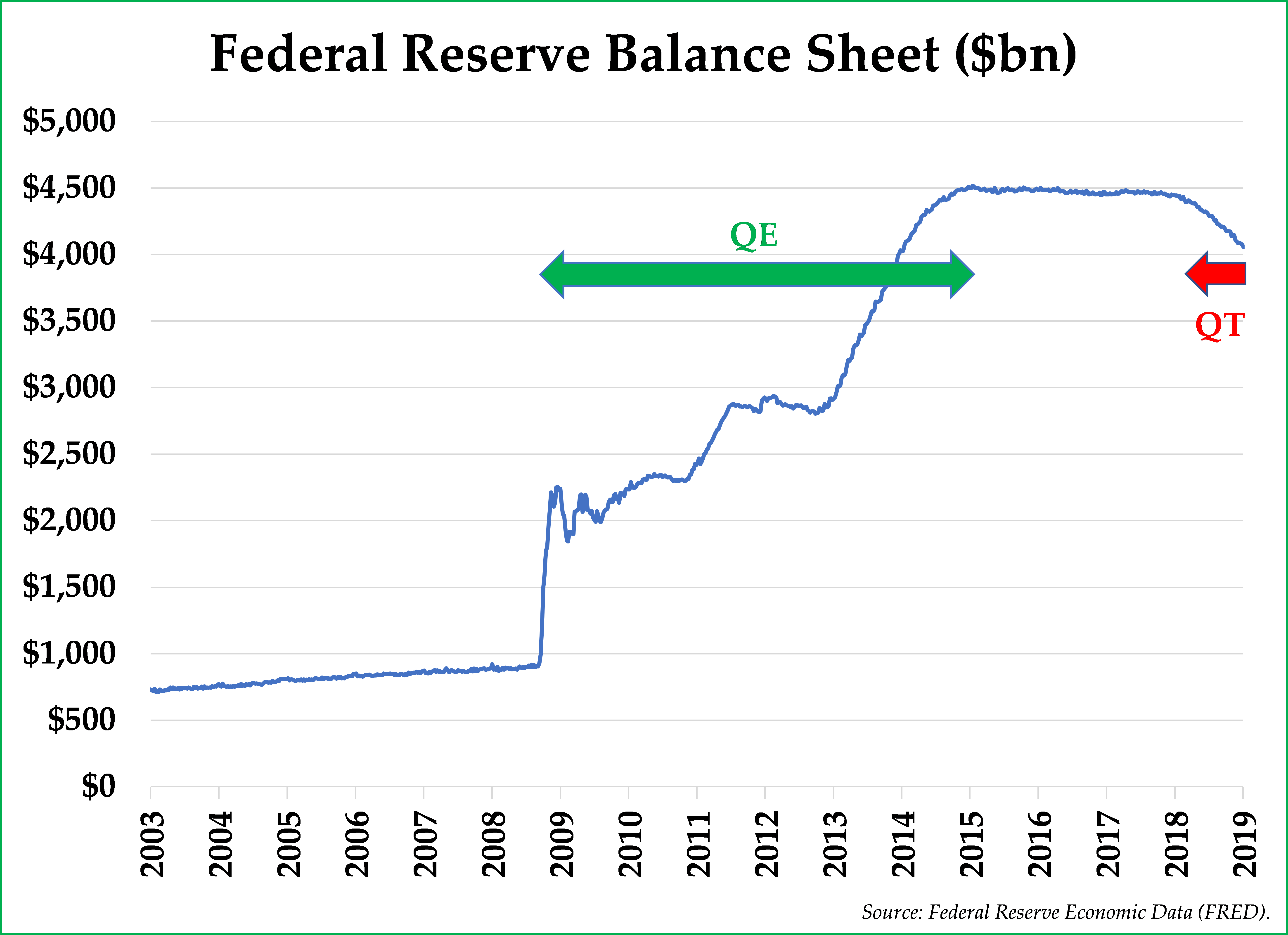

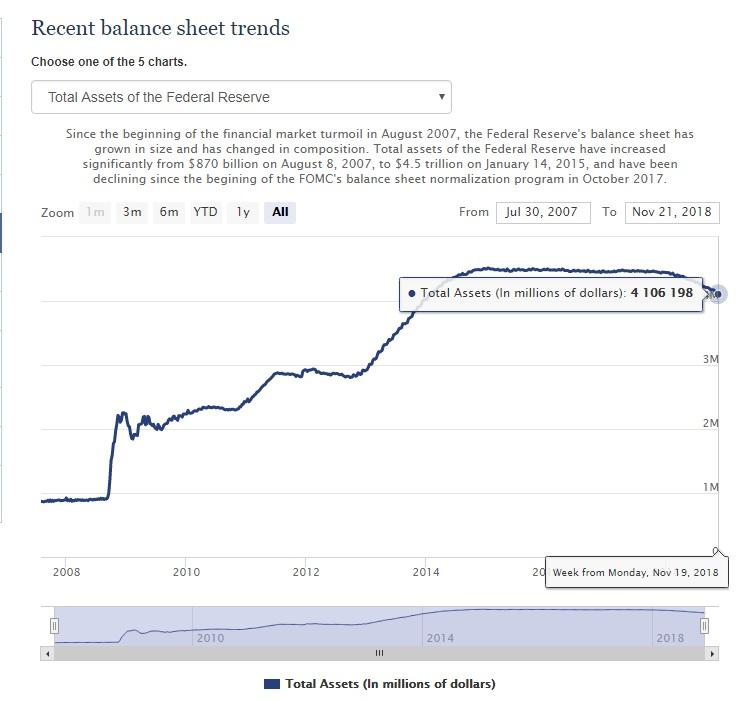

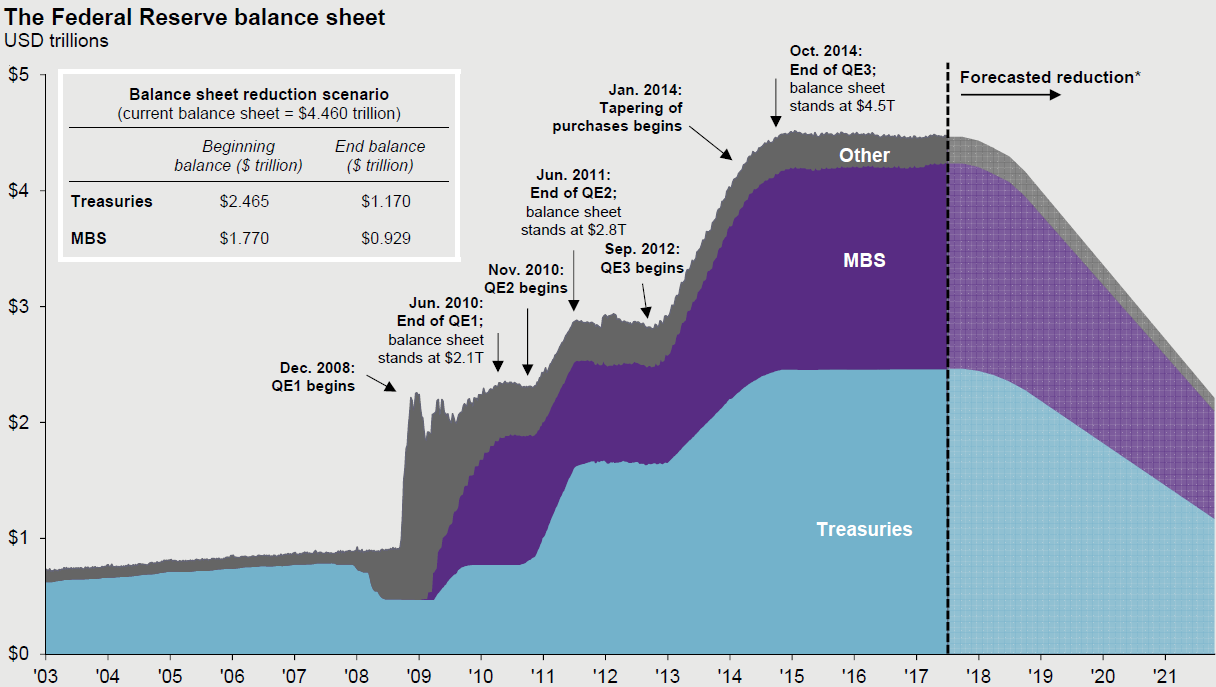

Therefore, the accumulated depreciation reduces the fixed asset (pp&e) balance recorded on the balance sheet. Assets have declined by about $1.3 trillion since june 2022. It is expressed as accumulated.

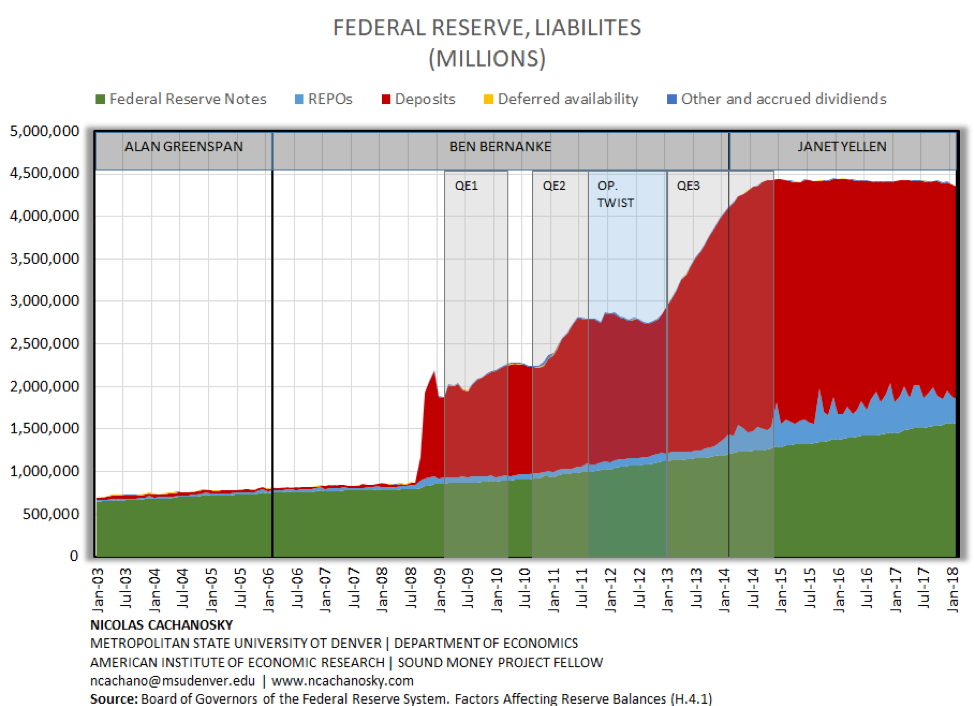

Officials at the federal reserve are generally uncertain on when they will begin cutting us interest rates, although most warned against starting too soon, minutes. The depreciation reserve account is also referred to as accumulated depreciation. A reserve is a portion of proprietorship which has been set aside for some specific purpose.

Once you own the van and show it as an asset on your balance sheet, you'll need to record the loss in value of the vehicle. At the same time, bank reserve balances — another large liability on the central bank’s balance sheet — are $3.54 trillion, according to the latest data. The federal reserve’s internal debate over the fate of its balance sheet reduction effort is set to quicken at its march policy meeting, with policymakers first.

Depreciation is an accounting practice used to spread the cost of a tangible or physical asset over its useful life. This view is perhaps a somewhat novel one in that the definition includes all classes of. Depreciation is typically tracked one of two places:

Depreciation represents how much of the asset's. Revaluation reserve is an accounting term used when a company creates a line item on its balance sheet for the purpose of maintaining a reserve account tied to. We need to define the cost,.

Under the diminishing balance method, the depreciation expense will be higher earlier on in the asset’s life and will reduce each year. The runoff of the bond portfolio has brought the total size of the fed’s balance sheet down by more than $1 trillion as of november, from a record peak of near. Fed minutes suggest officials are seeking smallest balance sheet possible.

Still, policy was also tightened by reductions in the size of the federal reserve’s balance sheet, beginning in june 2022.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

/GettyImages-1174783581-020e7504020947dc979f864f2ebee096.jpg)