Heartwarming Tips About Accounting For Realized And Unrealized Gains Losses Proper Heading On A Balance Sheet Efficiency Ratio Analysis

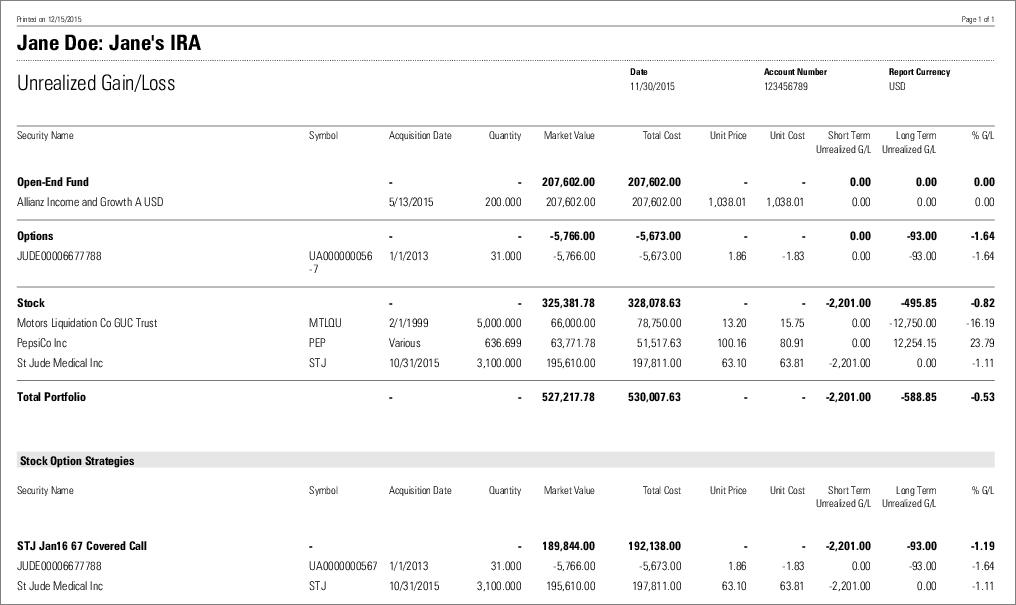

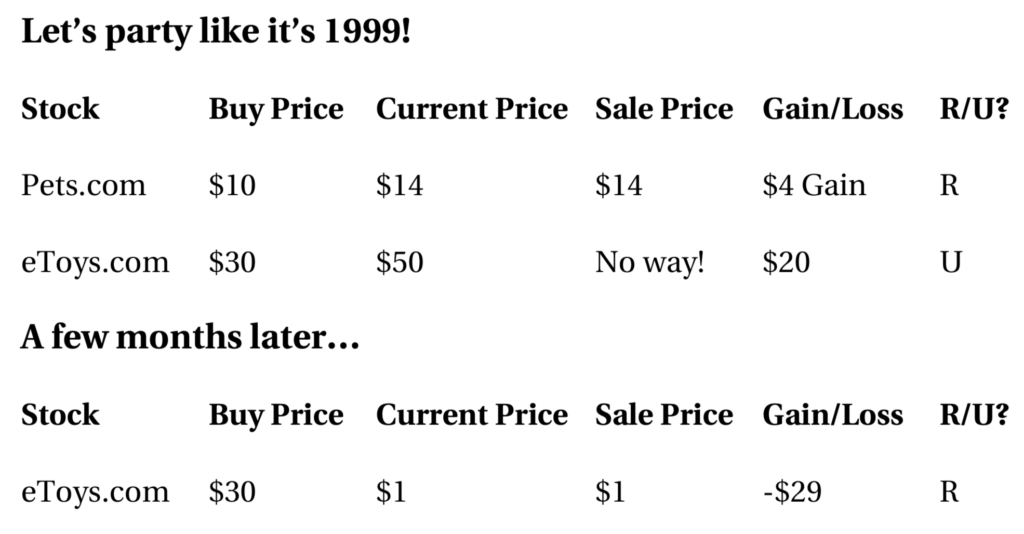

The gains and losses you see in your portfolio are considered “unrealized” until you sell the investment.

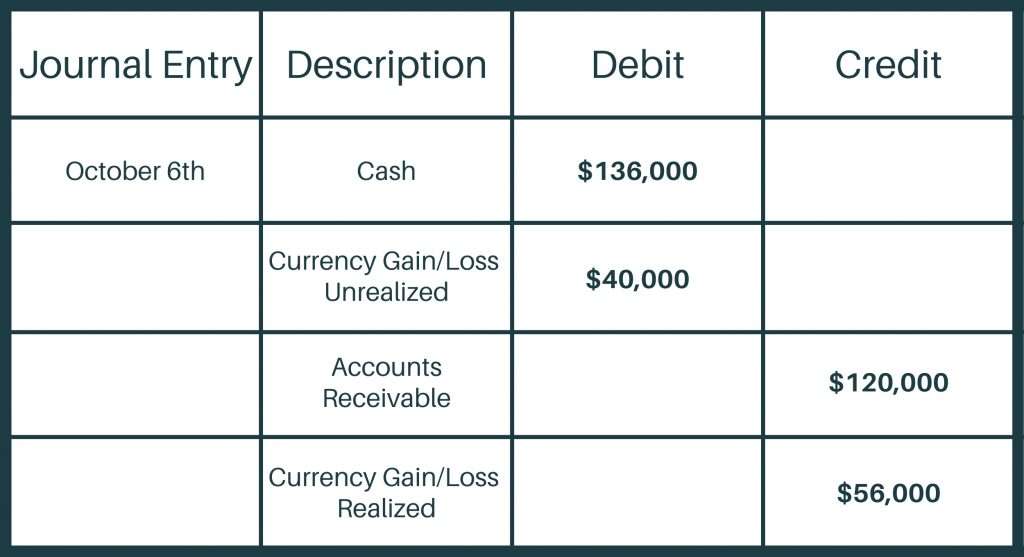

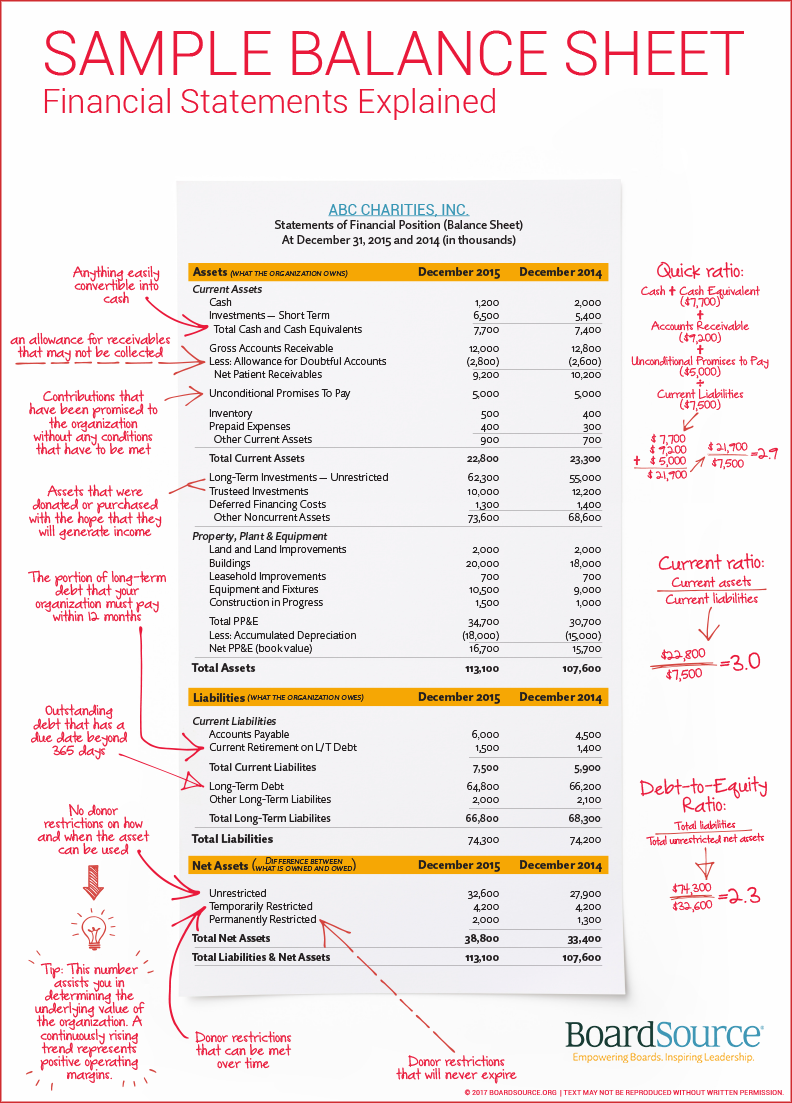

Accounting for realized and unrealized gains and losses proper heading on a balance sheet. Keep in mind that not all investments will have unrealized. Realized gains and losses are defined as the gains or losses on transactions that have been completed. This implies that the customer had already settled the amount before.

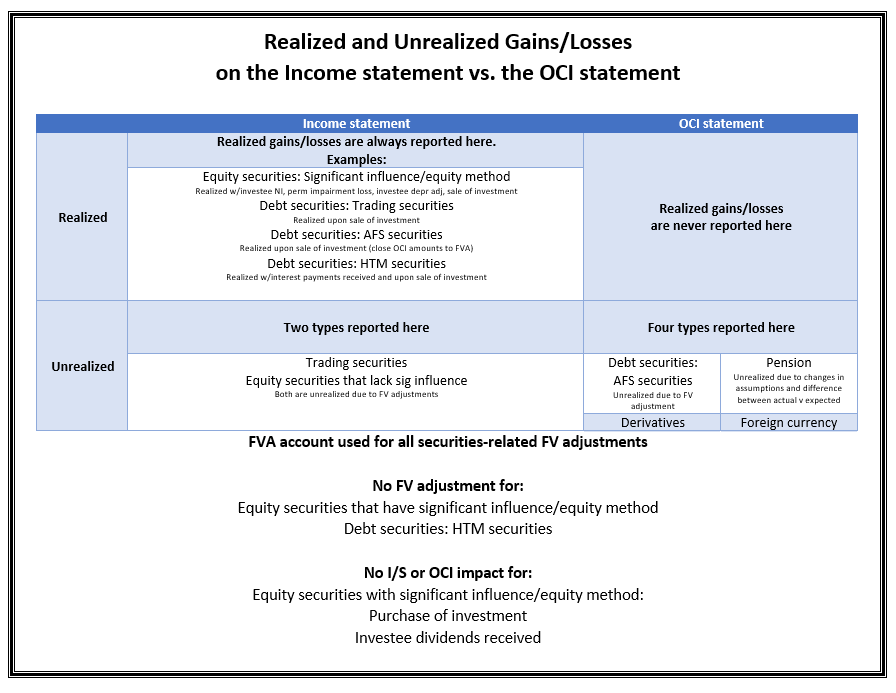

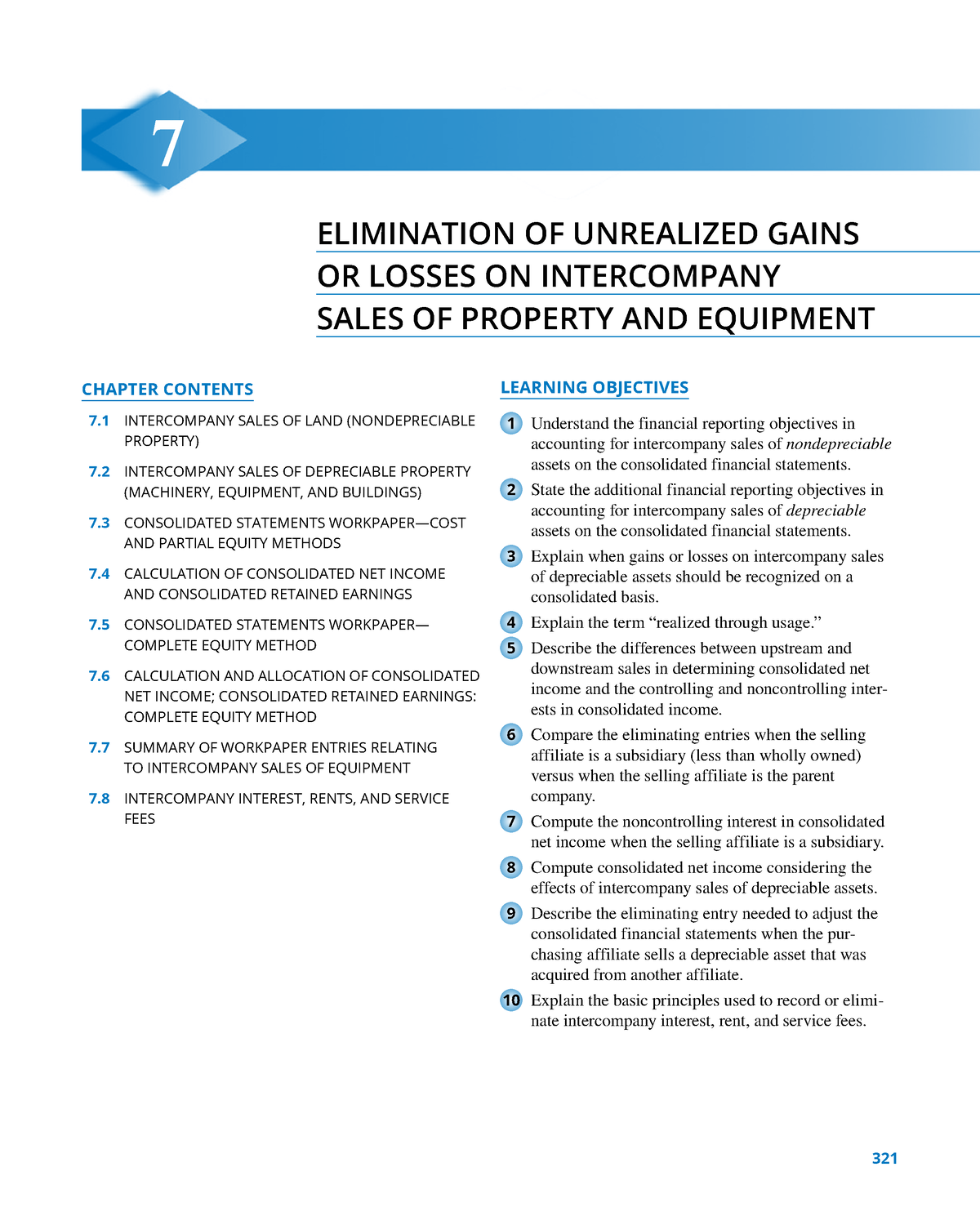

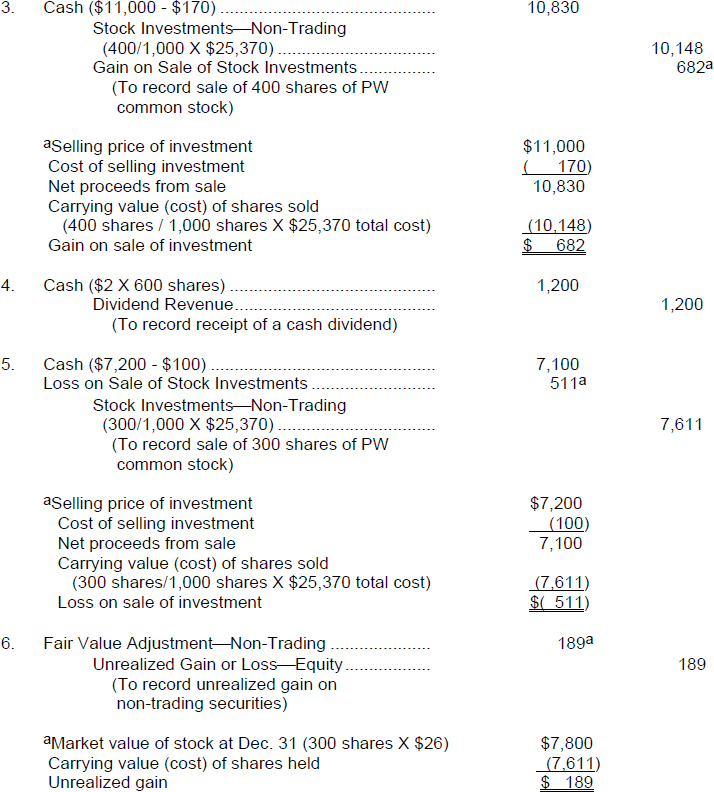

= realized gain or loss the full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income statement. So at that time, the entry is either a debit or credit to realized gains/losses and offset by. You are free to use this image o your website,.

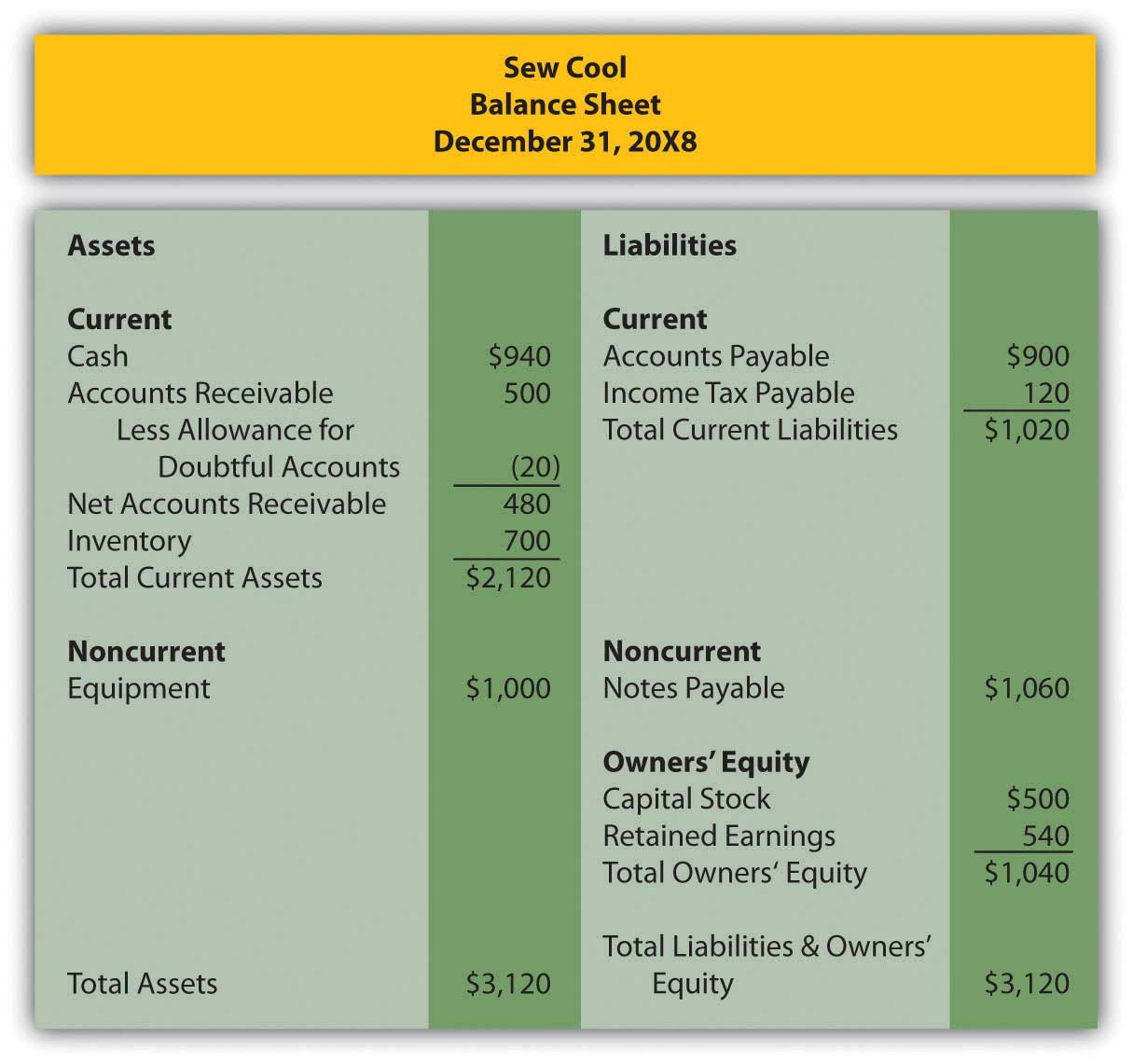

Generally accepted accounting principles provide differing treatments of unrealized capital gains and losses on the balance sheet, depending on the nature of. The full amount of the gain or loss during the holding period is reported as “realized gain or loss” on the income statement. Fidelity & guaranty life.

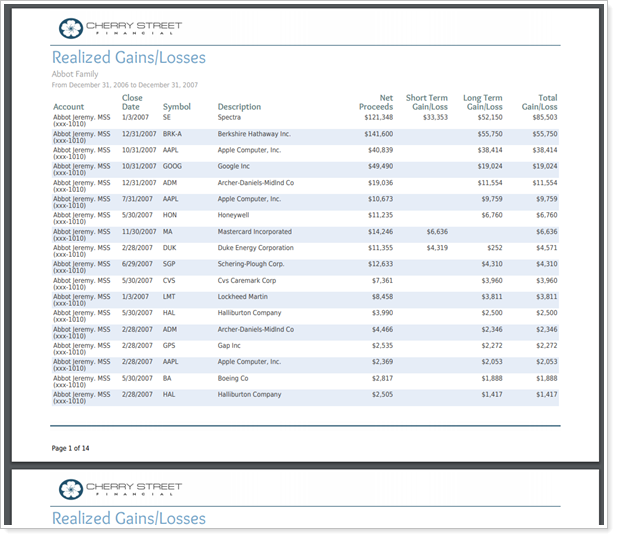

Other income of $183 million increased by $184 million compared to the same quarter of 2022, was primarily due to the accounting gains recorded as a result of. A realized gain results from selling an asset at a price. Realized gains/losses are recognized when the funds are sold.

Updated april 26, 2022 reviewed by charlene rhinehart fact checked by kirsten rohrs schmitt what is a realized gain? In recording the gains and losses on trading securities, a valuation account is used to hold the adjustment for the gains and losses so when each investment is. It is not necessary to.

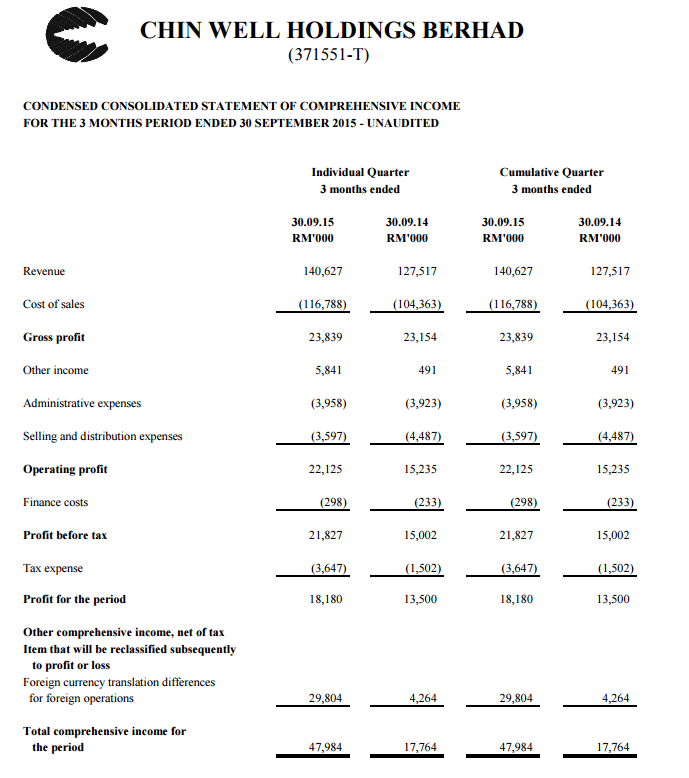

Other comprehensive income vs. Once they are sold the gain or. N business context realized gains and losses are profits or losses arising from completed transactions.

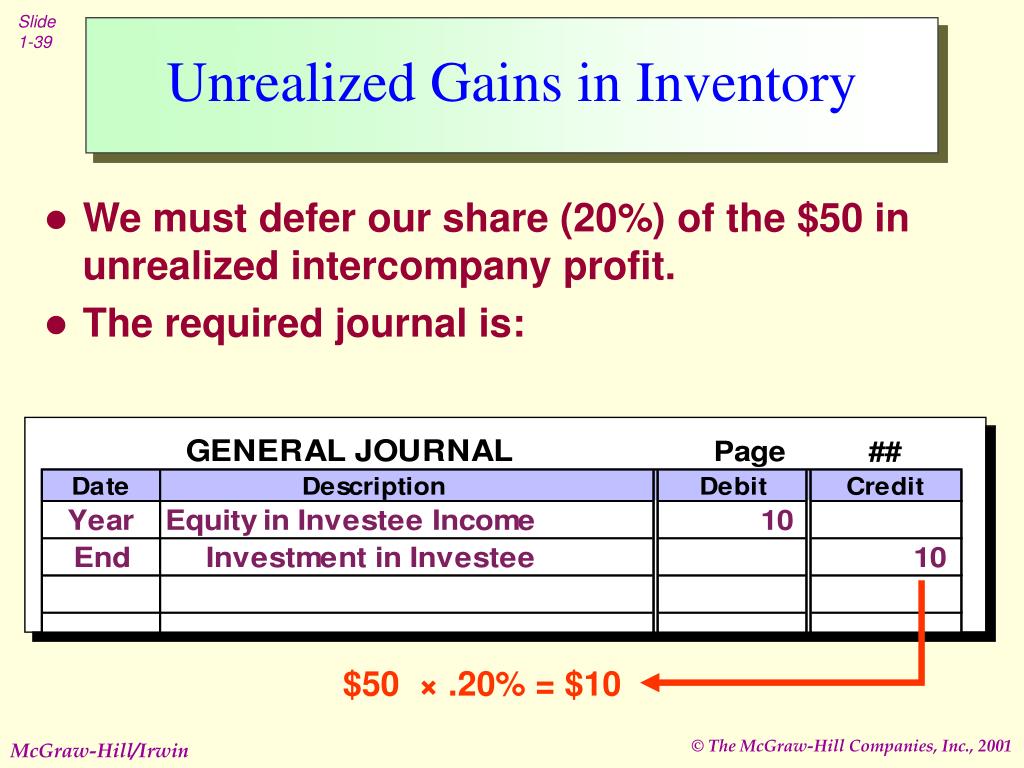

Unrealized revaluation gains and losses refer to profits or losses that. It is not necessary to reverse. The accounting treatment depends on whether the securities are classified into three types, which are given below.

Operating earnings remove the impact of realized and unrealized gains and losses that run through income statements, thus focusing on underwriting results and. Example 1 if a company owns an asset, and that asset increases in value, then it may intuitively seem like the company earned a profit on that asset. Unrealized losses on derivatives:

An unrealized gain is an increase in the value of an asset or investment that an investor has not sold, such as an open stock position. Realized income unrealized gain and losses on securities held to maturity are not recognized in the financial statements. January 30, 2021 what we’ll cover:

Unrealized gains are increases in the value of an asset that have yet to be realized by selling or converting it to cash. A gain or a loss becomes. The us gaap accounting treatment of unrealized gains depends on the type of investment a company holds.