Real Tips About Bank Overdraft Disclosure In Financial Statements P&l Management Definition

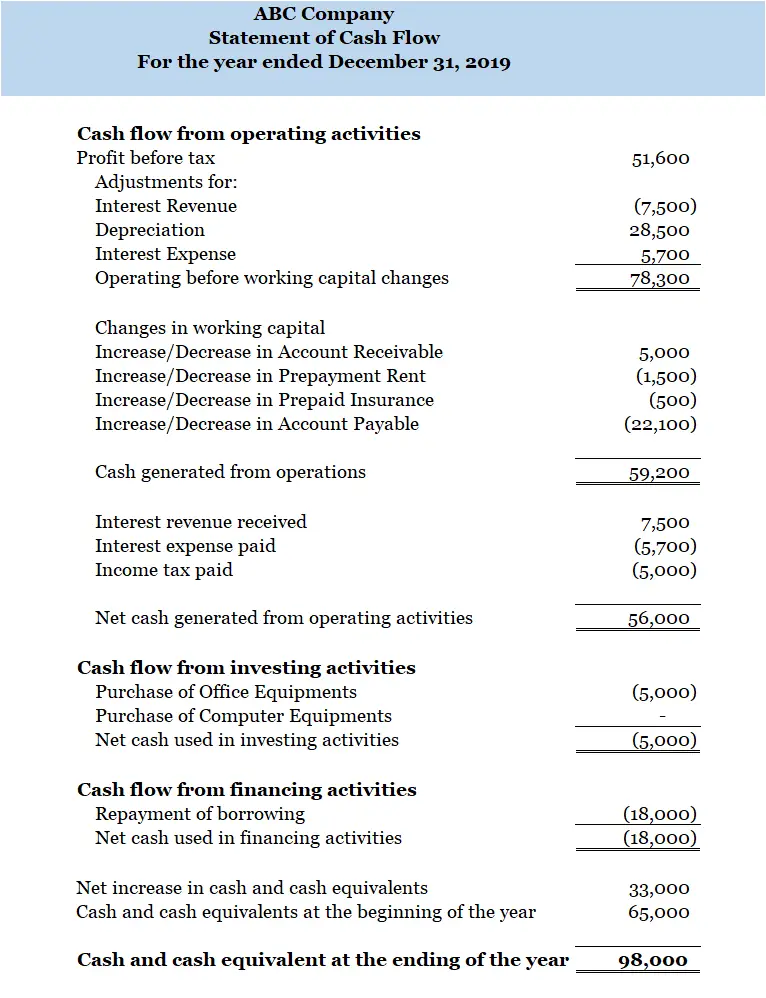

Statement of cash flows (ias 7) the statement of cash flows is a primary financial statement, mandated for presentation by all entities, irrespective of their business profile.

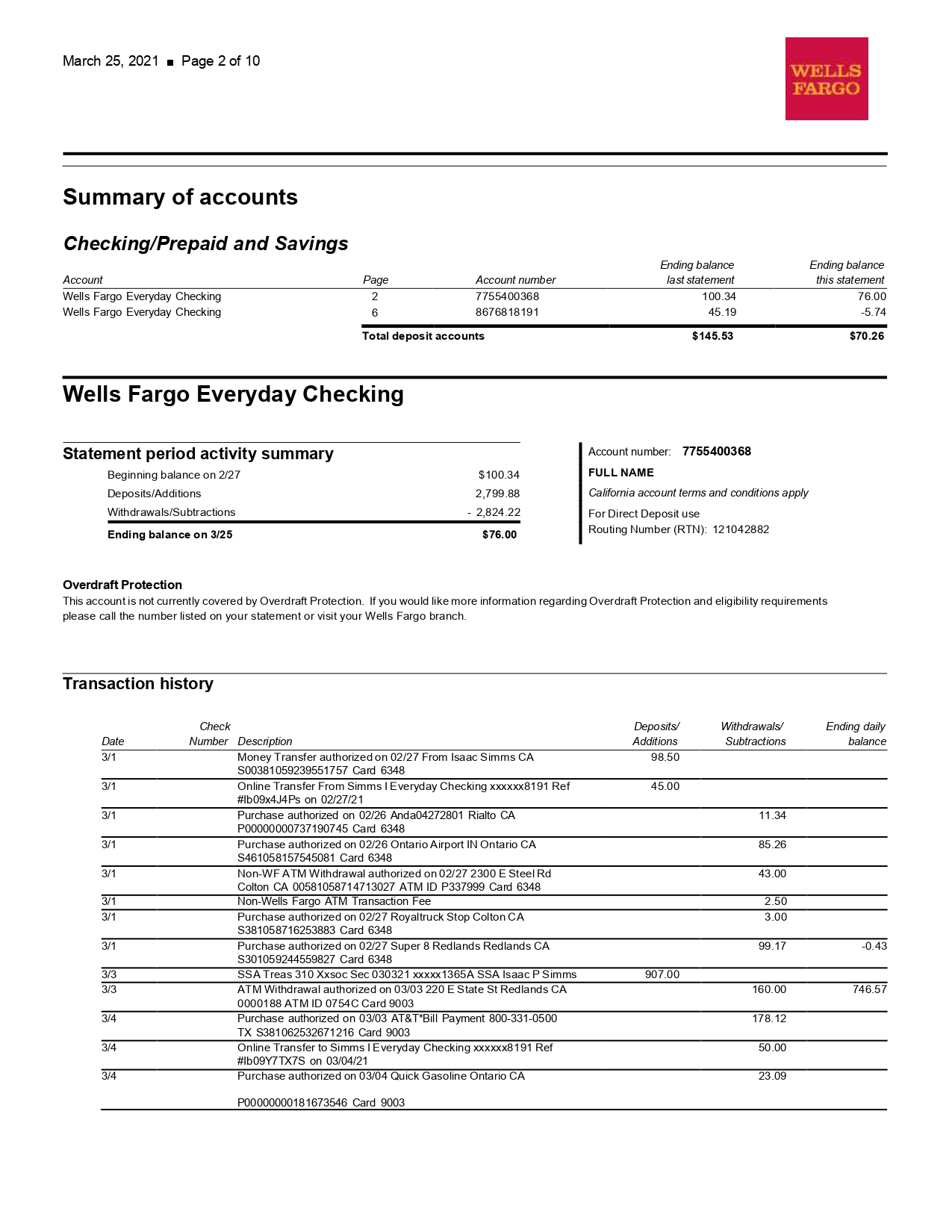

Bank overdraft disclosure in financial statements. Cash may be net of bank overdrafts under ifrs accounting standards; Retail mortgages, credit cards, commercial real estate etc. Financial highlights 7 consolidated statement of financial position 8 consolidated statement of profit or loss and.

Ias 30 — disclosures in the financial statements of banks and similar financial institutions; The bank overdraft and loan are secured by a floating lien over land and buildings owned by the group with a carrying amount of cu 266,000 at 31 december. However, there are detailed provisions in ias 32 relating to financial instruments, which.

Under us gaap, any changes in bank overdrafts are reported as a cash flow from financing activities. Statement of financial position cu. Fees for paying overdrafts.

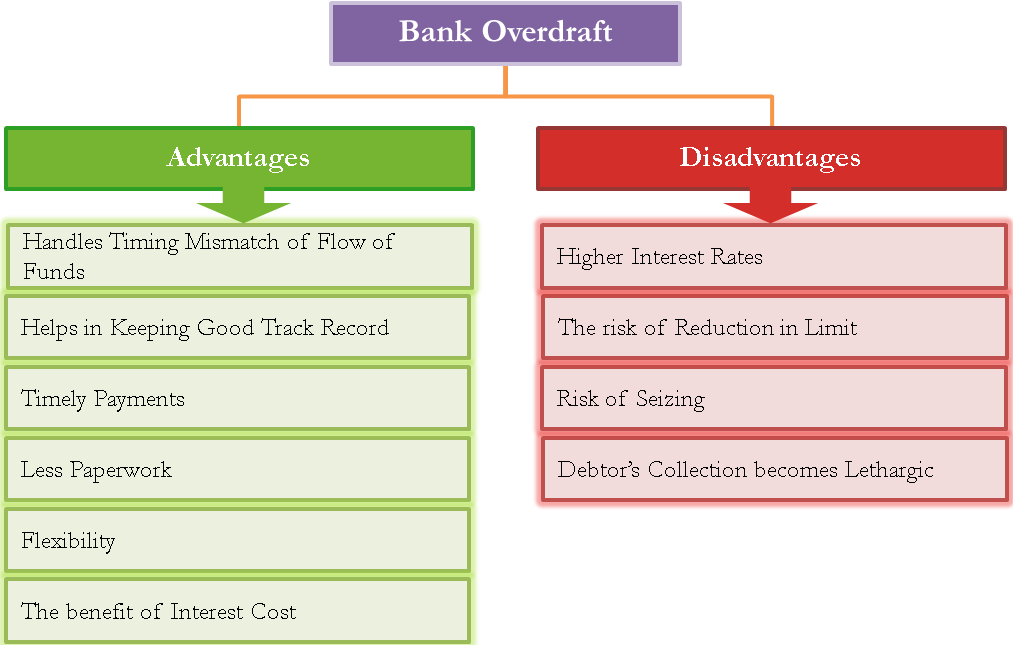

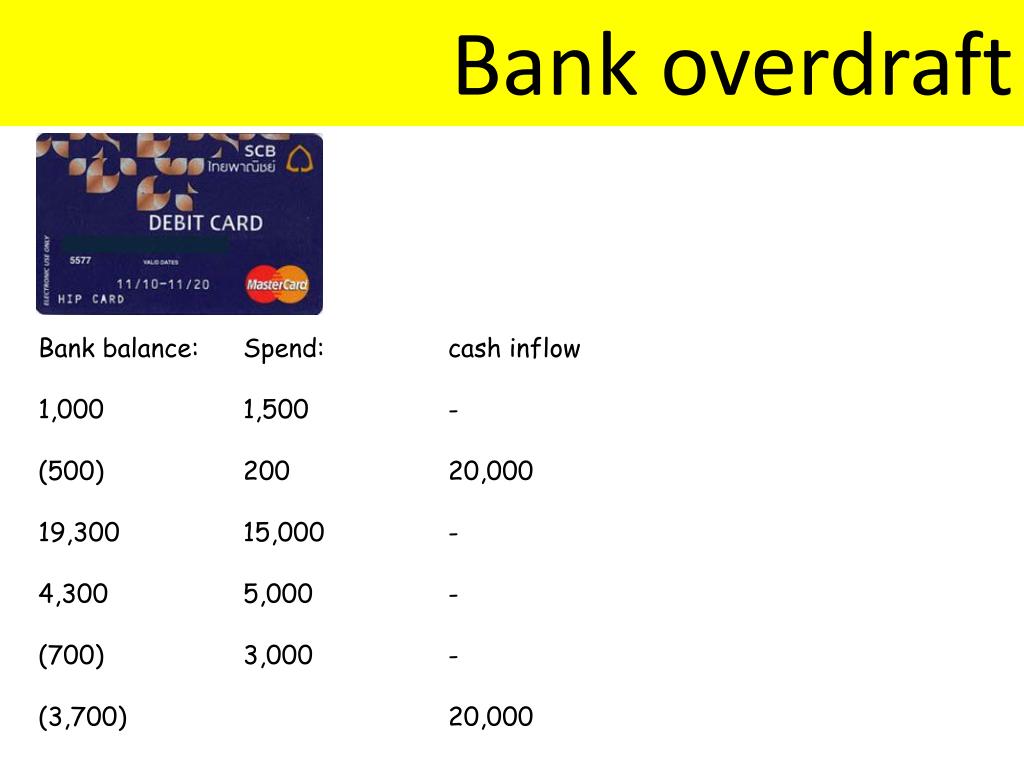

Intention of the paragraph is limited to bank overdrafts. Bank overdrafts are not included in cash and cash equivalents; Bank overdrafts occur when a bank honors disbursements in excess of funds on deposit in a reporting entity's account.

Bank overdraft and the statement of cash flows. Ias 31 — interests in joint ventures; Such a feature is commonly referred to as overdraft protection.

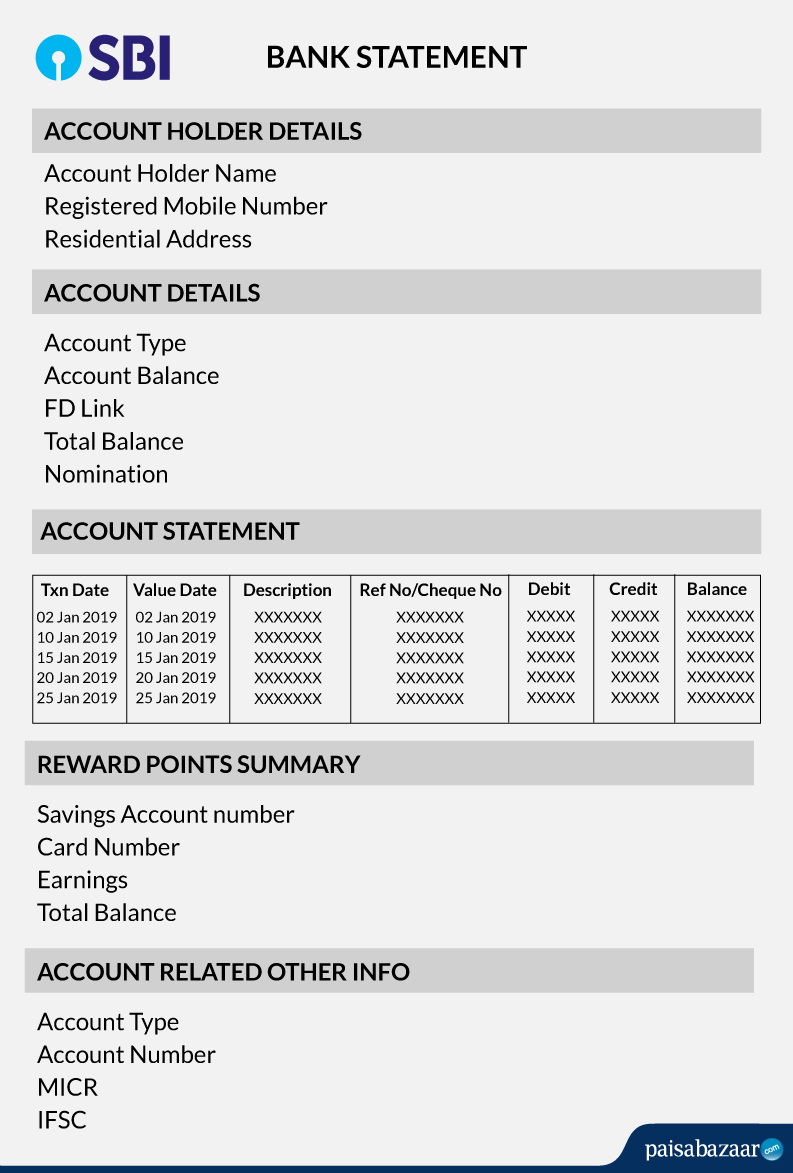

Consequently, entity a recognises amounts in its primary financial statements as follows: Consolidated financial statements 6. Our illustrative disclosures for banks illustrate one possible format for financial statements of a fictitious banking group that is involved in a range of general banking.

Changes in the balances of bank overdrafts are classified as financing cash flows. Cash and cash equivalents may. [ias 30.24] disclosures are also.

As a general principle, ifrss prohibit offsetting, as stipulated by ias 1.32. To discharge all or a portion of the debt owed to another party by applying against the debt an amount that the other party. Institutions must disclose on periodic statements a total dollar amount for all fees or charges imposed on the account for paying overdrafts.

Ifrs 7 requires disclosure of information about the significance of financial instruments to an entity, and the nature and extent of risks arising from those financial. The schedule iii to the companies act, 2013 (2013 act) became applicable to all companies for the preparation of financial statements for. A bank must disclose the fair values of each class of its financial assets and financial liabilities as required by ias 32 and ias 39.

A right of setoff is defined as “a debtor’s legal right. The overdraft fee forgiven period starts the first day your available balance becomes negative, and you were charged an overdraft paid fee(s).

.png/54e0c0ab-32ed-abb4-1db7-68c07a917b6c?t=1675021776880&download=true)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-overdraft-and-cash-credit-Final-8e1e4594a99342748fc565d7c5dd66d3.jpg)