Casual Info About Explain Income Statement Md&a Requirements

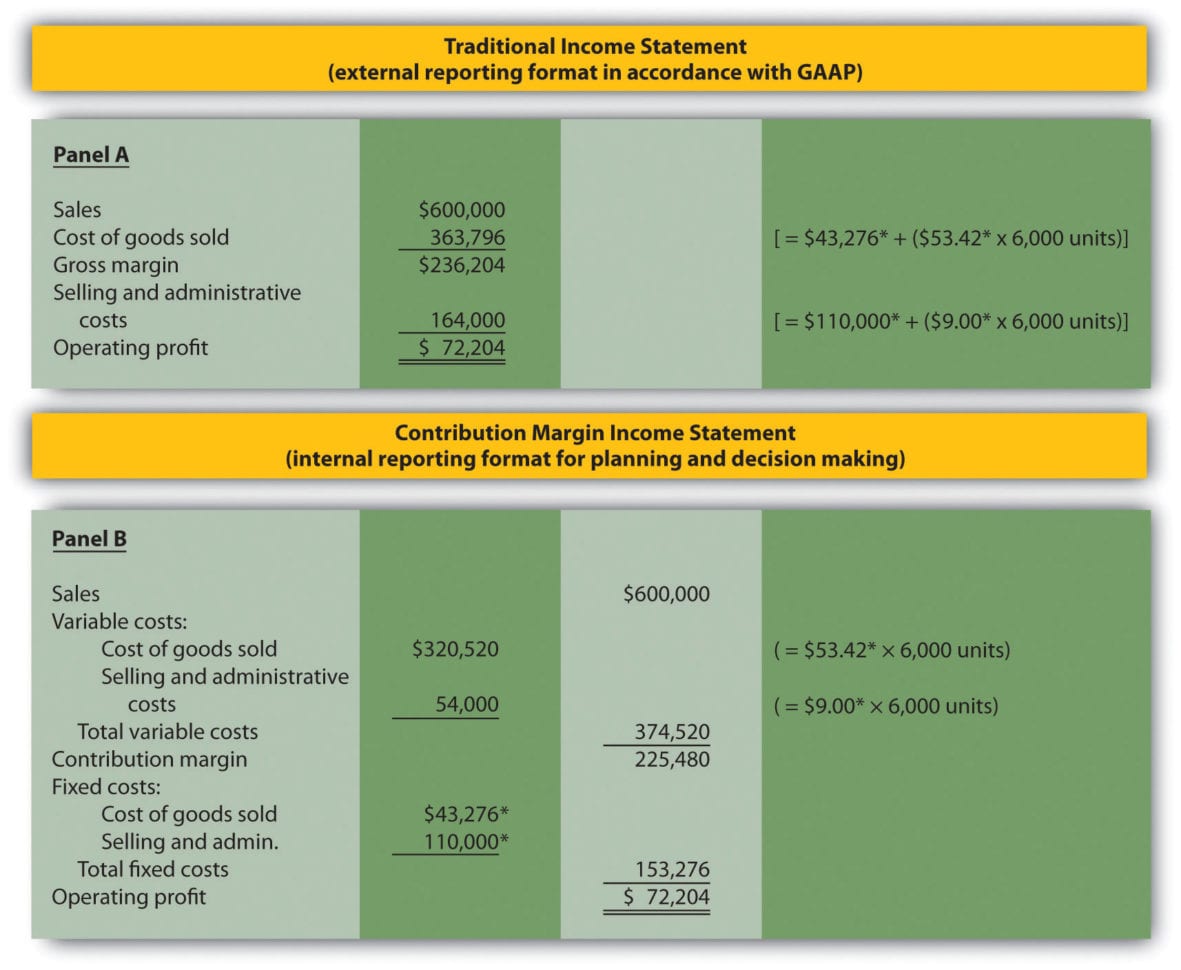

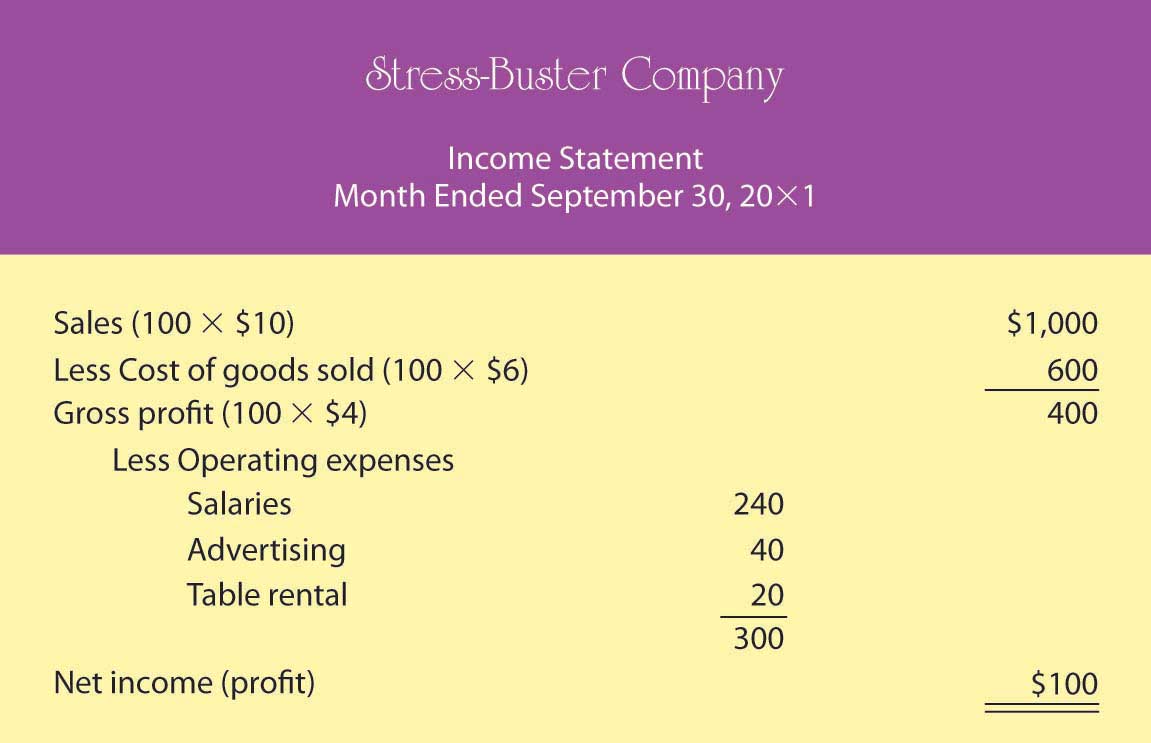

Businesses have two reporting options when preparing an income statement.

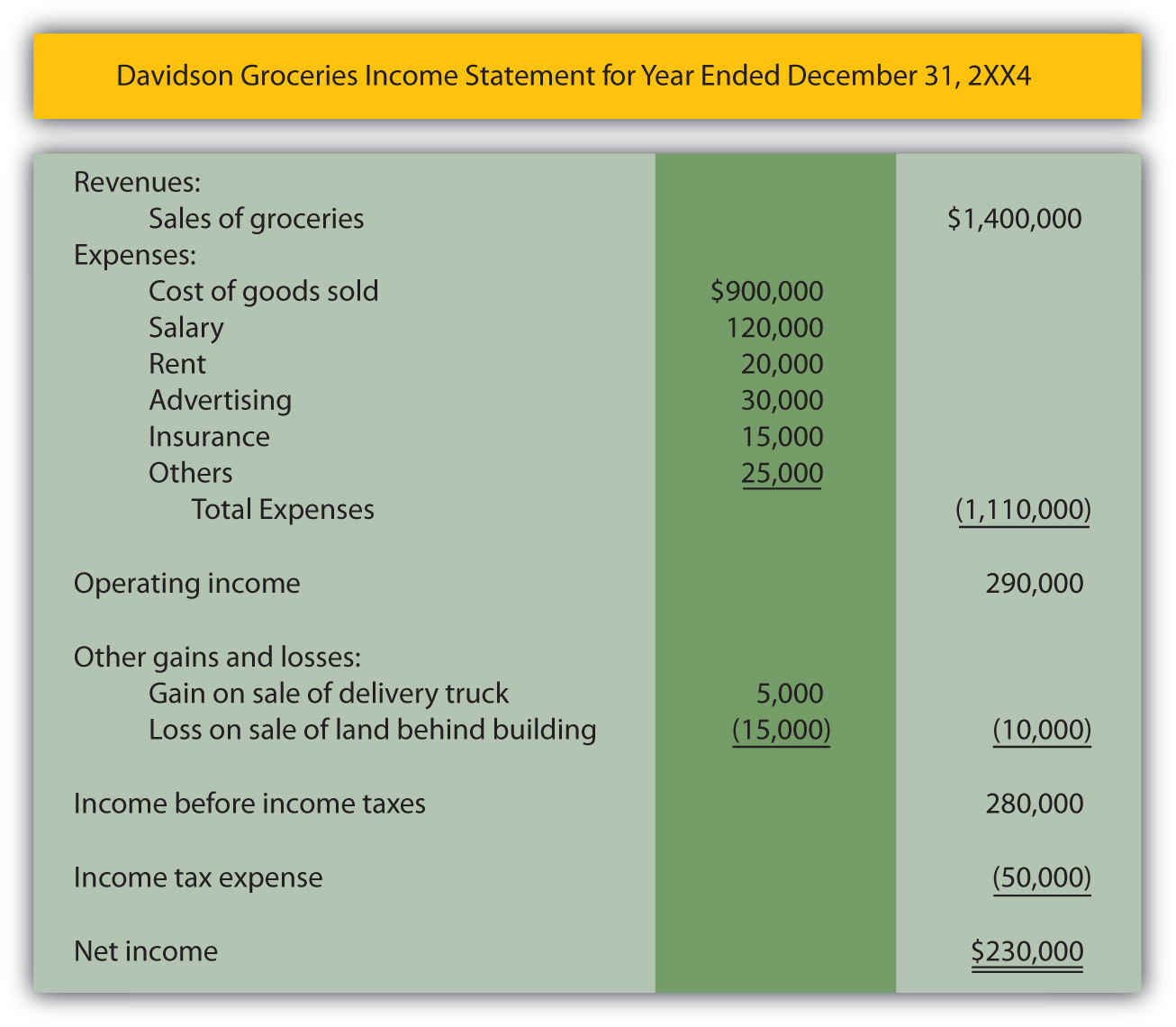

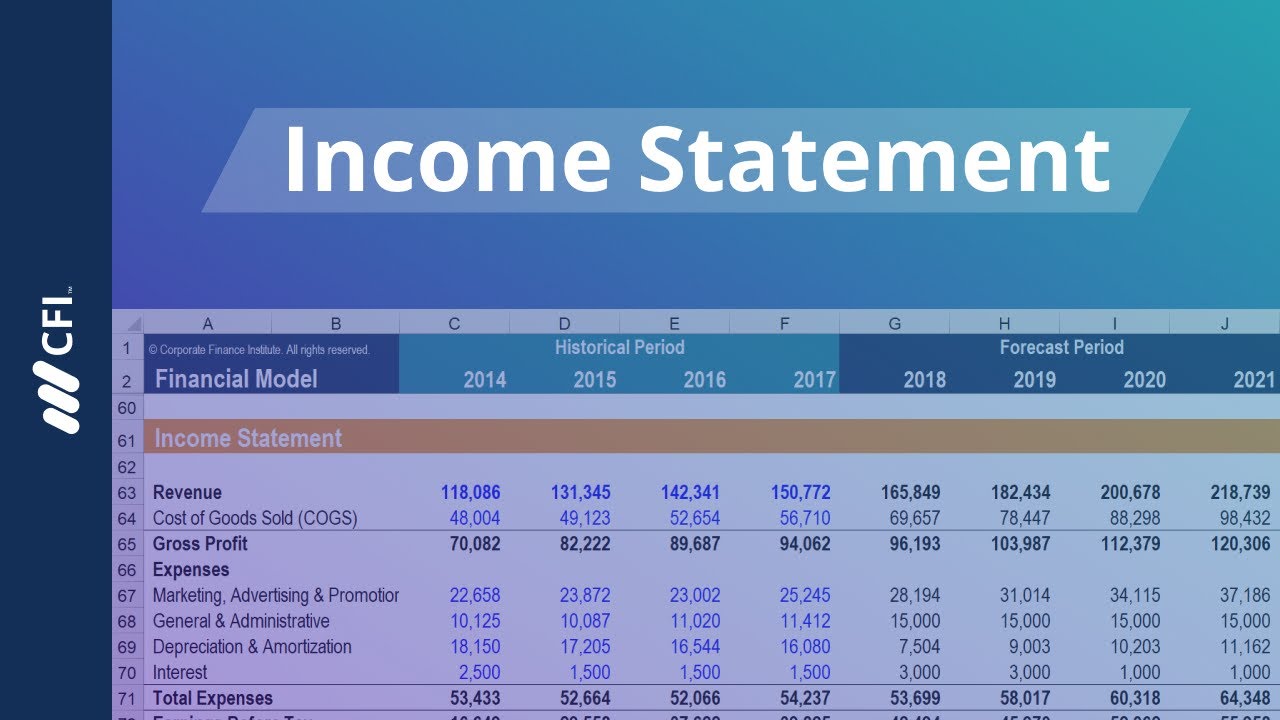

Explain income statement. * constant currency (c.c.) adjusts prior year for movements in currencies. A company's income statement provides details on the revenue a company earns and the expenses involved in its operating activities. The income statement, along with balance sheet and cash flow statement, helps you understand the financial health of your business.

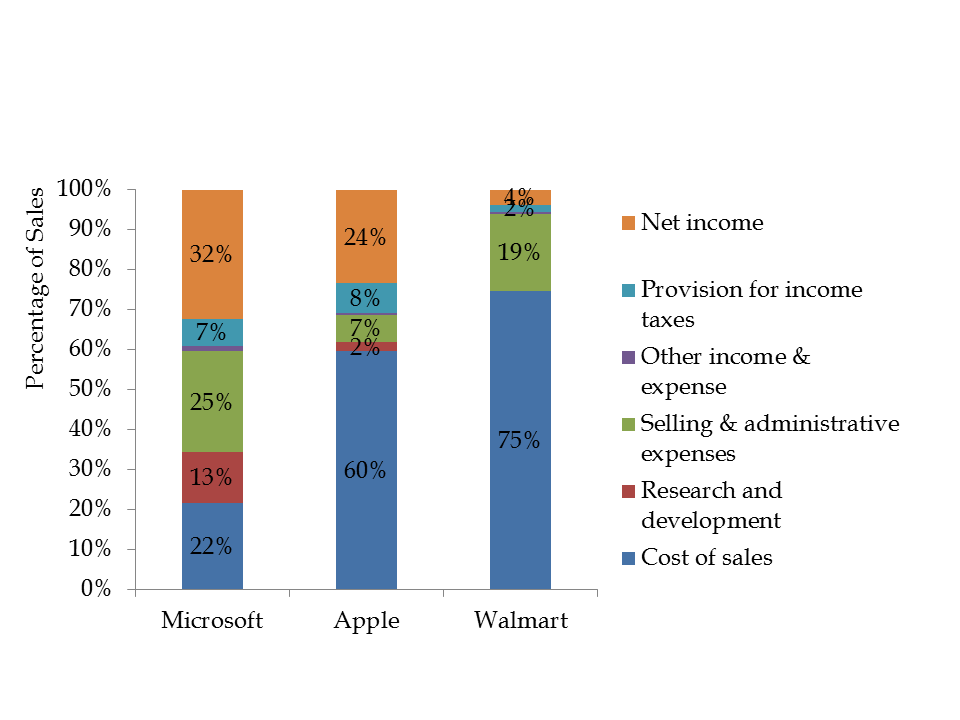

The income statement illustrates the profitability of a company under accrual accounting rules. It also helps business owners determine whether they can generate high profit by increasing prices, decreasing costs, or both. Income statements depict a company’s financial performance over a reporting period.

Income statements are used to evaluate the overall performance of a company during a period such as a fiscal year. It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually. Updated april 24, 2021 reviewed by margaret james fact checked by michael logan companies produce three major financial statements that reflect their business activities and profitability for.

The cash flow statement provides a view of a company’s. Filed a new brunswick tax return. With some exceptions, all income must be taken into account, including social security, pension, etc.

Had family net income of $70,000 or less for that taxation year. An income statement is a financial report that summarizes the revenues and expenses of a business. Revenue realized through primary activities is often referred to as operating revenue.

The income statement is also known. The basic equation underlying the income statement, ignoring gains and losses, is revenue minus expenses equals net income. It is standard practice for businesses to present.

The purpose of an income statement is to show the profits and losses a company made over a specified period of time. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. Income statement, profit and loss statement, or statement of financial performance, is one of the four financial statements which shows the company’s financial performance over a period of time.

Every income statement begins with your company’s revenues. You will need to file a return for the 2024 tax year: The income statement, also known as the profit and loss (p&l) statement, is the financial statement that depicts the revenues, expenses and net income generated by an organization over a.

Often shortened to “ cogs ,” this is how much it cost to produce all of the goods or services you. This calculation shows investors and creditors the overall profitability of the company as well as how efficiently the company is at generating profits from total revenues. During the period close process, all temporary accounts are closed to the income summary account, which is then closed to retained earnings.

For either 2022 or 2023: In one example, the attorney general's legal team showed that trump's triplex in his eponymously named. This year, the process of filing an income tax and benefit return may feel particularly daunting.

:max_bytes(150000):strip_icc()/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)