Breathtaking Info About Depreciation In Financial Statements Balance Sheet What Is It

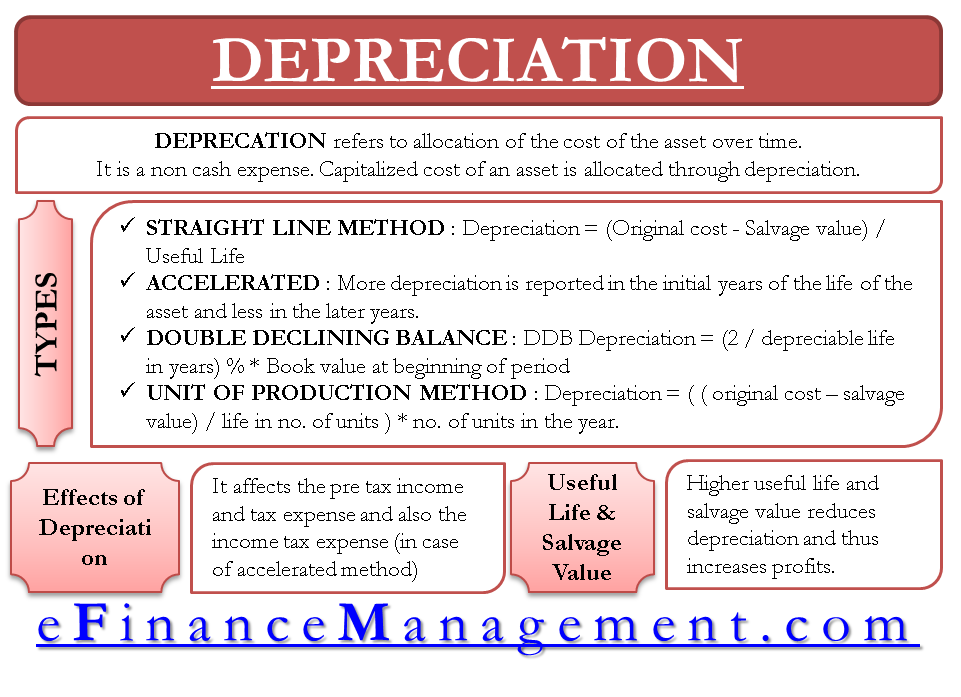

For purposes of financial reporting and tax liability, businesses need to demonstrate how their assets decrease in value, an accounting process known as depreciation.

Depreciation in financial statements. Regardless of the depreciation method used, the total amount of depreciation expense over the useful life of an asset cannot exceed the asset's depreciable cost (asset's cost. Depreciation is a financial accounting method used to allocate the cost of tangible assets over t. clearias on. Depreciation's impact on financial statements.

Depreciation significantly affects a company's financial statements and performance metrics. Depreciation is a financial concept that affects both your business accounting financial statements and taxes for your business. Fact checked by suzanne kvilhaug depreciation is a type of expense that is used to reduce the carrying value of an asset.

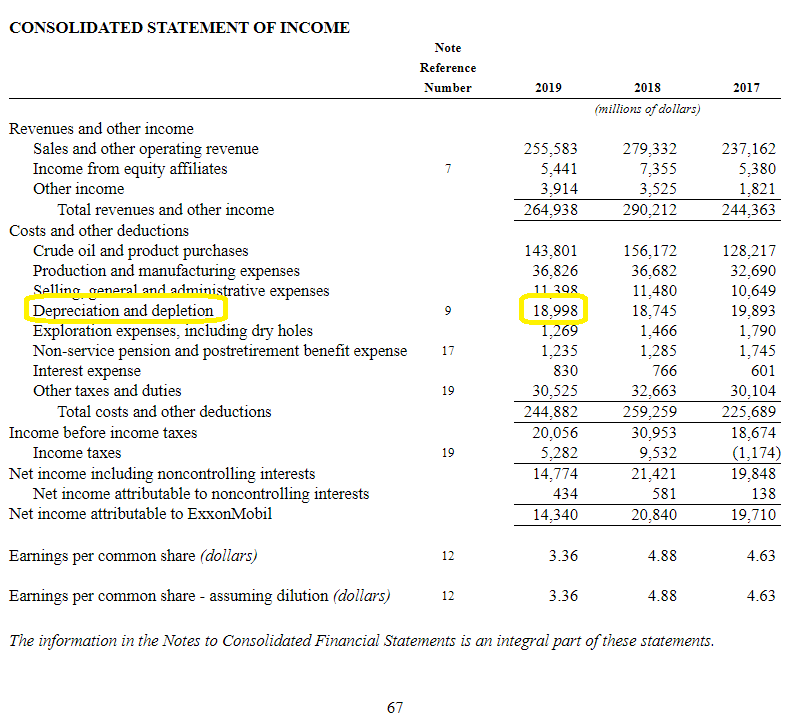

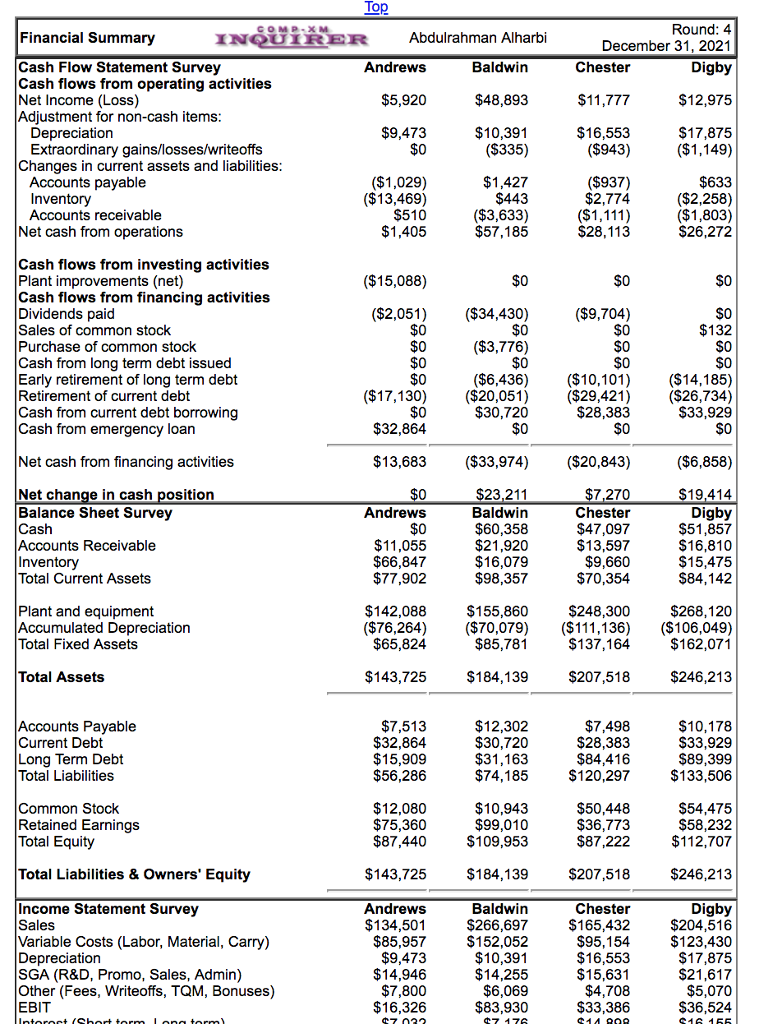

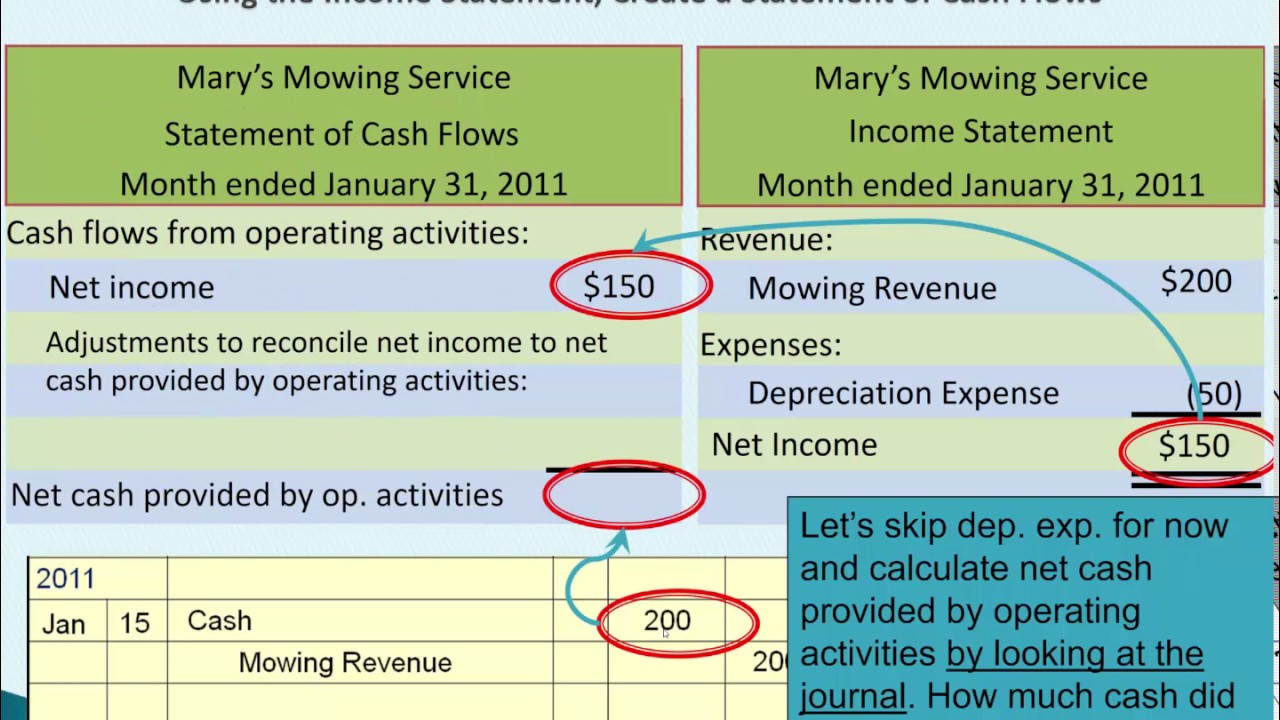

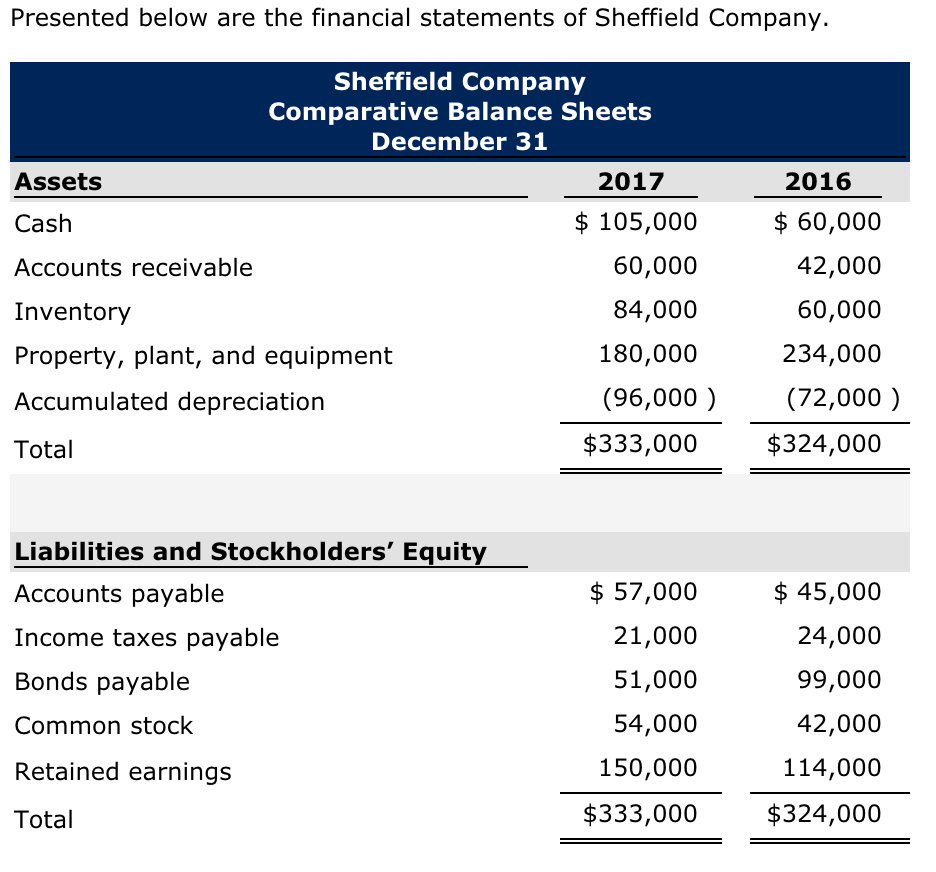

Companies depreciate assets for both tax and accounting purposes and have several different. When depreciation expenses appear on an income statement, rather than reducing cash on the balance sheet, they are added to the accumulated depreciation. James emejo in abuja.

If your business uses a different method of depreciation for your. Depreciation represents how much of the asset's value has been used up in any given time period. On the income statement, it is listed as depreciation expense, and refers.

Accumulated depreciation is the sum of all recorded depreciation on an asset to a specific date. The international monetary fund (imf) has warned that the country’s exchange rate may depreciate further by about 35 per cent this year. But you won't ever see it.

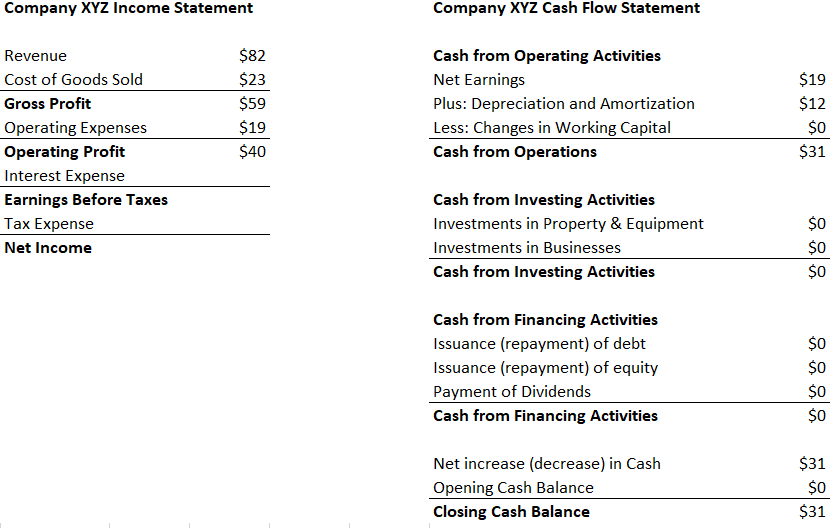

For tax depreciation, different assets are sorted into different classes, and each class has its own useful life. Depreciation expense is presented within the income statement. The most important point, which must be understood at the outset, is that all these adjustments have an.

Depreciation expense is the amount that a company's assets are depreciated for a single period (e.g, quarter or the year), while accumulated depreciation is the total. Depreciation expense is a fundamental concept in finance and accounting that represents the systematic allocation of the cost of a tangible asset over its estimated. It is an estimated expense that is.

Depreciation, and irrecoverable debts and allowances for receivables. Buying businesses and equipment for operations is a part of business, and using. Depreciation is an accounting practice used to spread the cost of a tangible or physical assetover its useful life.

If related to the production process, it may appear within the cost of goods sold.