Painstaking Lessons Of Info About Financing Activities Examples Cash Flow What Goes On A Balance Sheet Accounting

Financing activities will differ depending on your type of business, but here are a few of the most common financing activities found on cash flow statements:

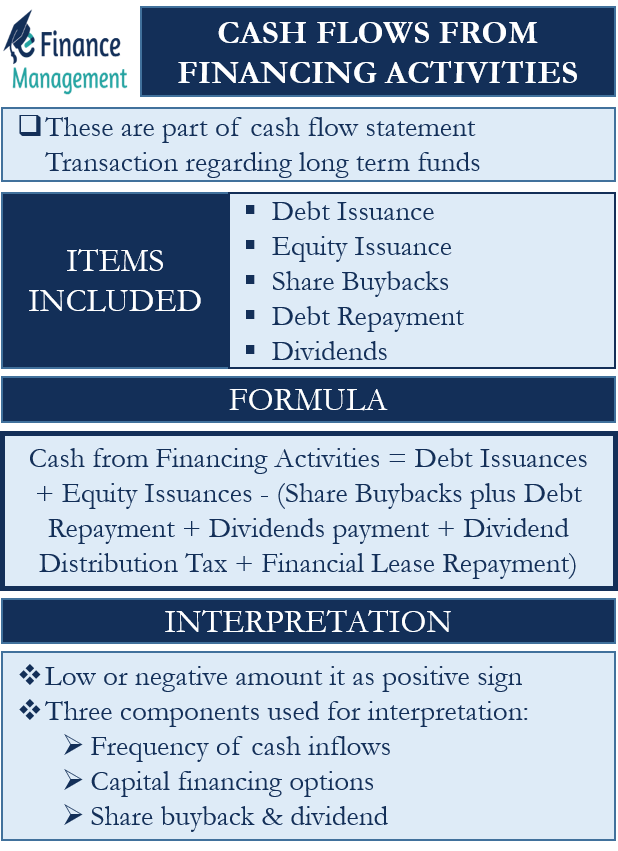

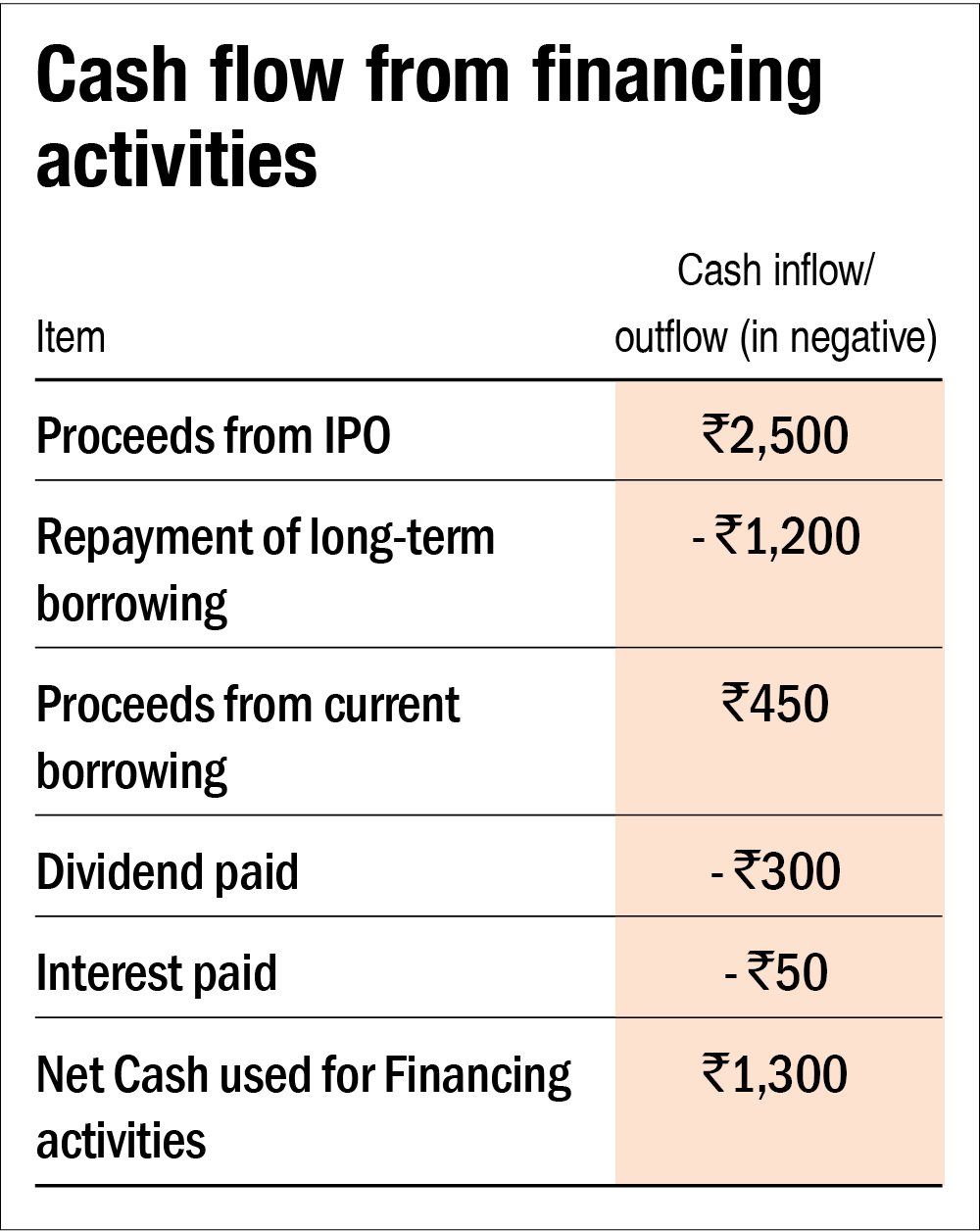

Financing activities examples cash flow. ($700) net cash flow from financing activities. The net cash impact of raising capital from equity/debt issuances, net of cash used for share buybacks, and debt repayments — with the outflow from the payout of dividends to shareholders also taken into account. Cash flow from financing activities is the net increase or decrease in cash and cash equivalents resulting from sources of finance, such as issuing debt or equity, borrowing, repaying loans, etc.

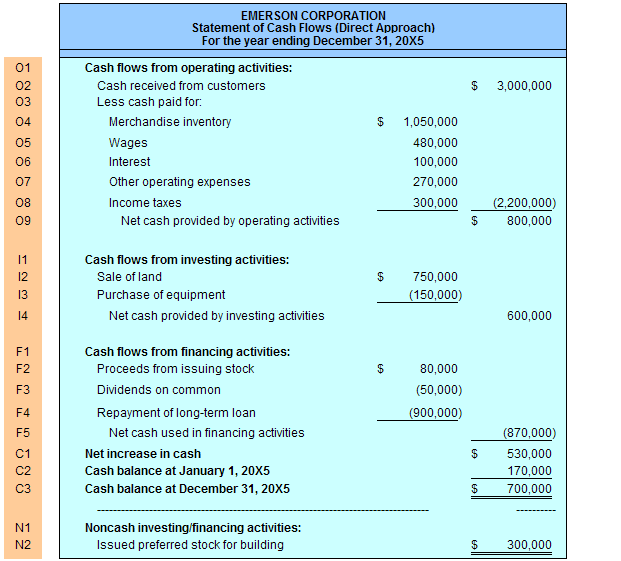

Some of the most common examples of financing activities for cff (cash flow from financing activities) include treasury stock, business loans, new stocks or dividends. This statement is one of the documents comprising a company's financial statements. In the bottom area of the statement, you will see the cash inflow and outflow related to financing.

Operating investing financing this article discusses the “ins” and “outs” of the types of cash flow and how they might impact your business. Financing activities and cash flow. What are some examples of financing activities on the cash flow statement?

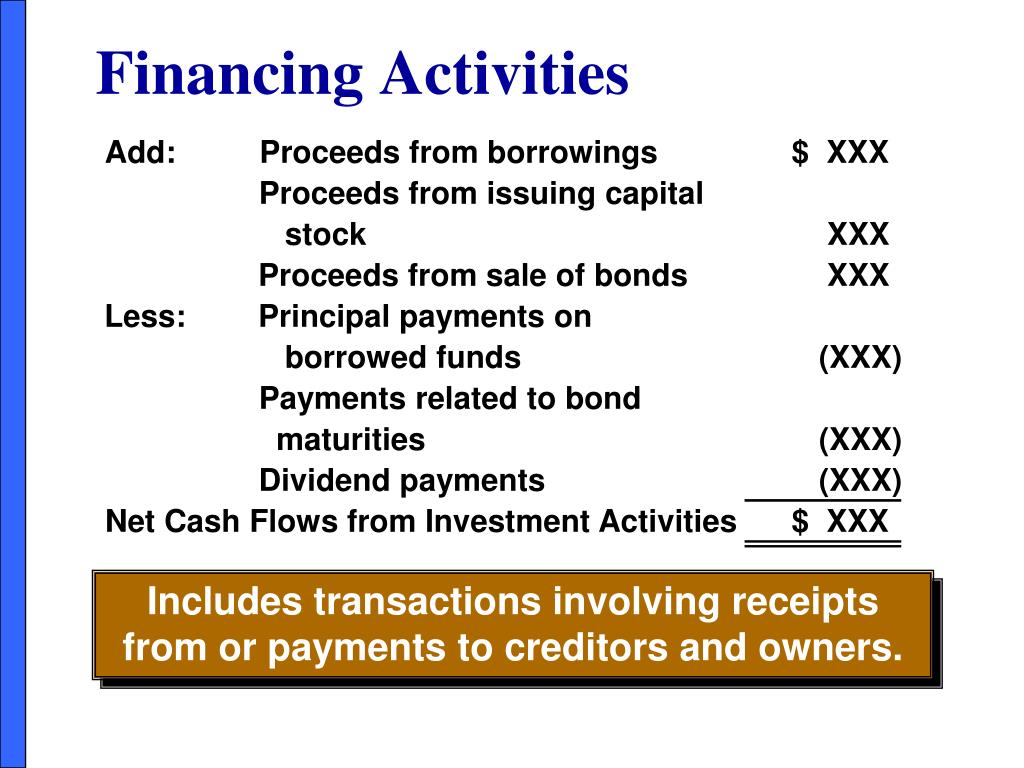

Debt is a form of external borrowings repayable as per the agreed terms. Cash flow from financing activities (cff): Receiving cash from issuing stock or spending cash to repurchase shares receiving cash from.

Repurchase of existing stock. Cash flow types what is cash flow? Your cash flow comes from three activities:

The activities affecting the cash flows of an organization can be classified into operating activities, investing activities and financing activities. Following are the common items that come under cash flows from financing activities: Financing activities examples include the issuance of shares and bonds, borrowing a loan, servicing debt, buying back shares, etc.

In other words, it enumerates the flow of cash to and from an organisation’s capital and the means through which a company raises funds for its operations. The cash flow from financing activities section of the cash flow statement includes cash inflows and cash outflows for business activities related to the financing of the business. And cash outflows that are incurred while r.

It is the last of the three parts of the cash flow statement that shows the cash inflows and outflows from finance in an accounting year; Examples of common cash flow items stemming from a firm’s financing activities are: The main cash flow types are:

Operating, investing, and financing activities. To calculate cash flow from financing activities, all of the cash inflows and outflows associated with obtaining or repaying capital are summed. Financing activities cash flow refers to the act of raising money or returning this raised money by promoters or owners of the firm to grow and invest in assets like purchasing new machinery, opening new offices, hiring more workforce, etc.

Anything to do with the movement of money is a financial activity. Issuing bonds (positive cash flow) sale of treasury stock (positive cash flow) loan from a financial institution. Examples of cash inflows included in the cash flow from financing activities section are:

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)