Matchless Info About Increase In Receivables Cash Flow Comparative Balance

This entails selling your outstanding ar to a.

Increase in receivables cash flow. Factor or finance ar invoices. How does increase in accounts receivable affect cash flow introduction. The average daily sales volume is computed by dividing your annual sales amount by 360:

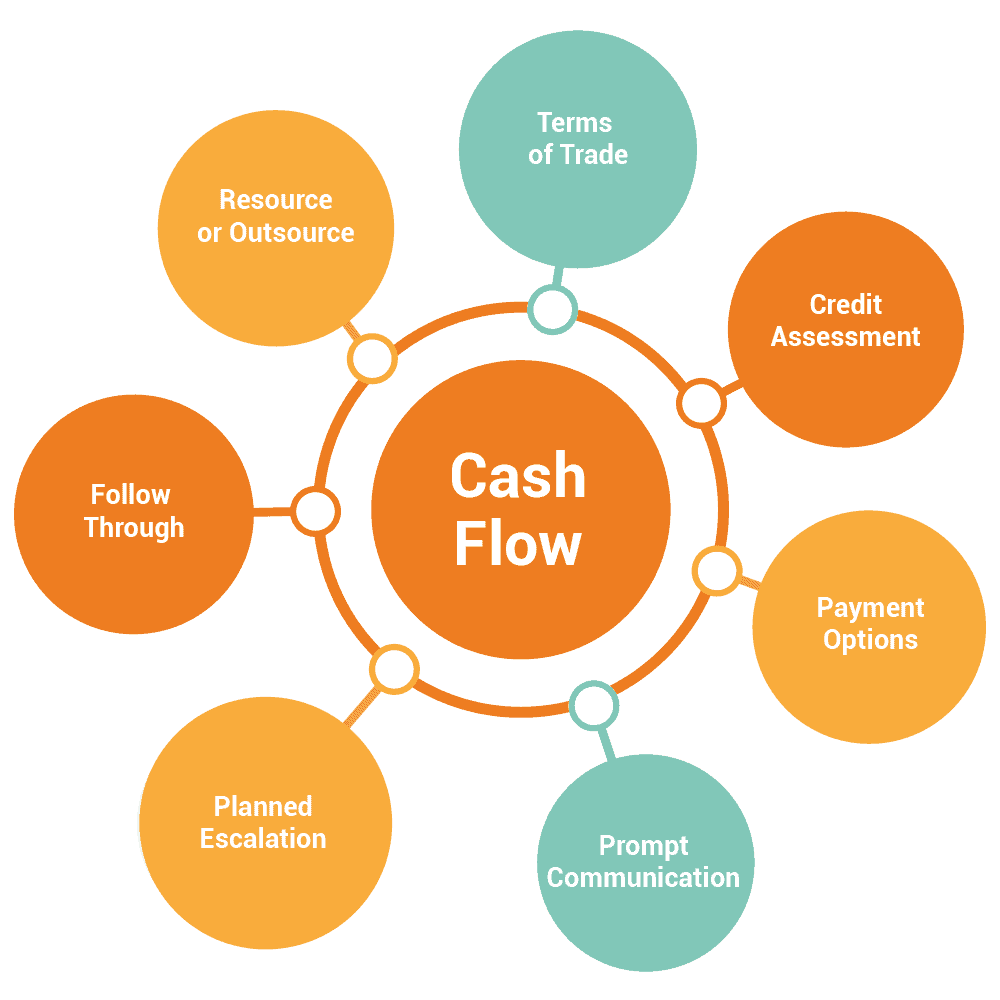

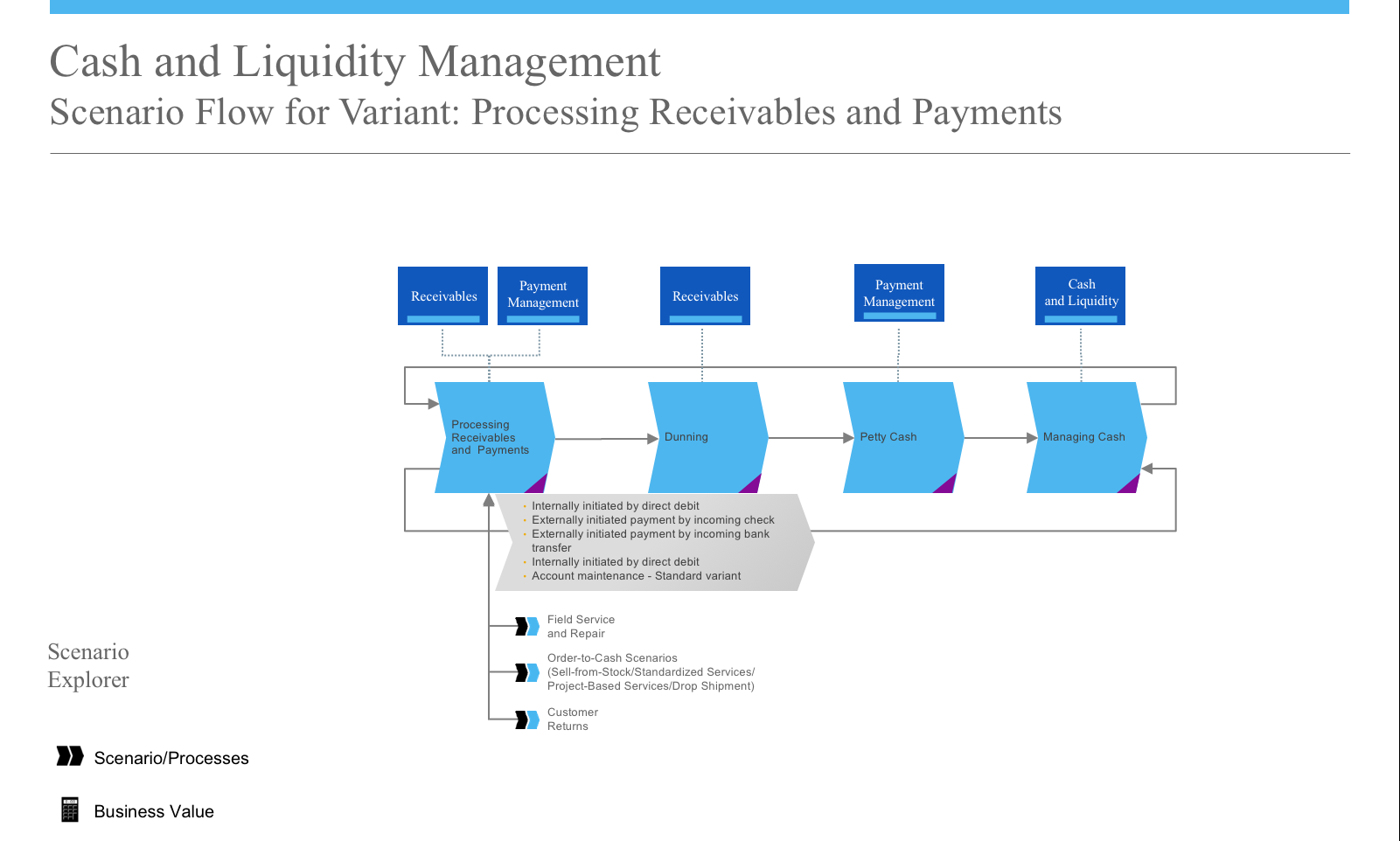

Receivables offer confidence of future cash flow, but they are not a guarantee. Optimize your cash flow and maintain liquidity with our suite of account and reporting solutions. The cash flow statement is typically broken into three sections:

Solution here we can take the opening balance of ppe and reconcile it to the closing balance by adjusting it for the changes that have arisen in period that are not cash. There may be an increased amount of receivables. This article delves into the relationship between accounts receivable and cash flow statements.

We’ll begin by defining ar, cash flow, and the cash flow statement. An increase in the notes receivable does not necessarily do anything on the cash flow statement unless it is accompanied with a cash outflow due to a credit. It is popularly called trade receivables and it is a current asset.

The liabilities of the business may have decreased, i.e. The cash flow must be presented using standard. Analyze accounts receivable information on a company's balance sheet carefully.

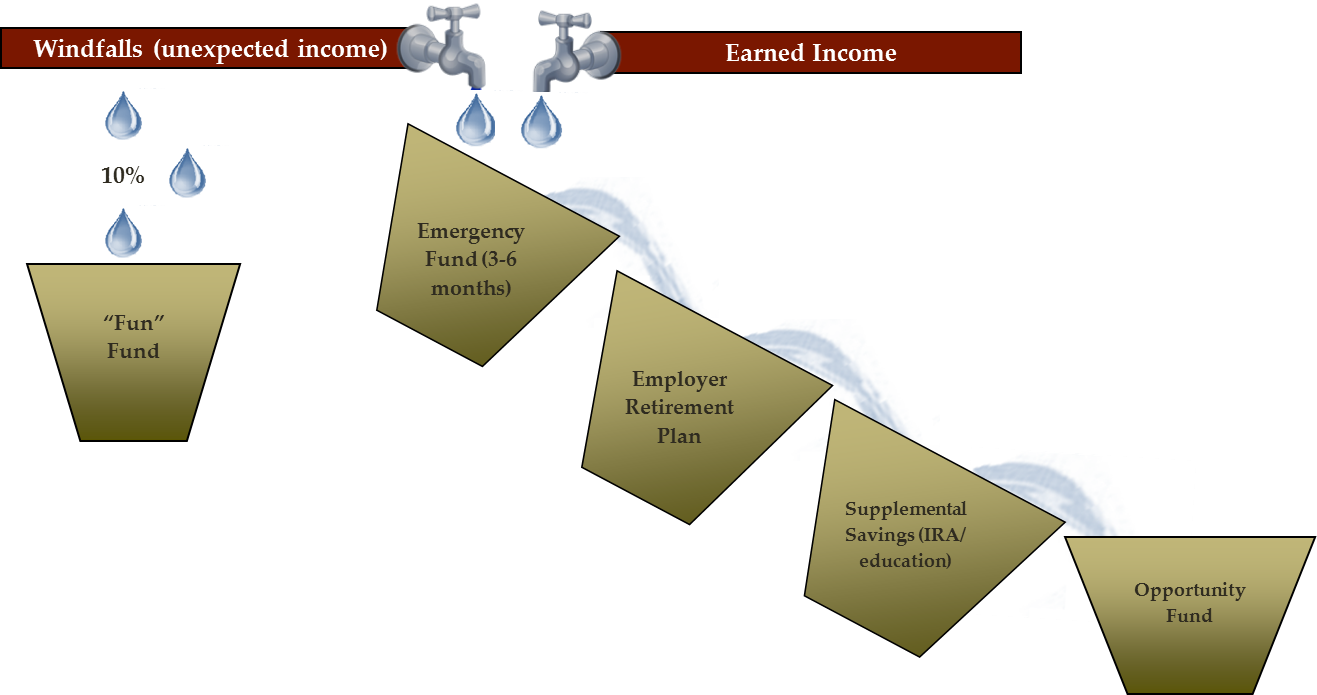

If you're carrying balances that charge you monthly interest, paying them off is an opportunity for better to reduce your expenses long term. The amount due from the customer is called accounts receivables. Another fast source of cash to consider is ar factoring, also called invoice factoring.

Overall shorter collection periods increase liquidity and generate better cash flow efficiency. Companies use the average collection period as a key aspect of. Accounts receivable management allows you to take control of your cash flow by streamlining payments and invoicing and improving customer relations.

When it comes to managing finances, one crucial aspect that businesses must pay close. Accounts receivable and the cash flow implications company abc has an accounts receivable balance of $200m in 2005. There may be increased investment in inventory.

Robert jacobs, richard b chase. For example, we have a $57,800 net income on the income statement for the period. To reiterate, an increase in receivables represents a reduction in cash on the cash flow statement, and a decrease in it reflects an increase in cash.

To reiterate, an increase in receivables represents a reduction in cash on the cash flow statement, and a decrease in it reflects an increase in cash. 10 ways to improve cash flow by dan moskowitz updated september 10, 2022 reviewed by charlene rhinehart fact checked by kirsten rohrs schmitt if you. Ias 7 statement of cash flows requires companies to prepare a statement of cash flows within their financial statements.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)