Awe-Inspiring Examples Of Tips About Statement Of Cost Good Sold Uses Comparative

How is cogs different from cost.

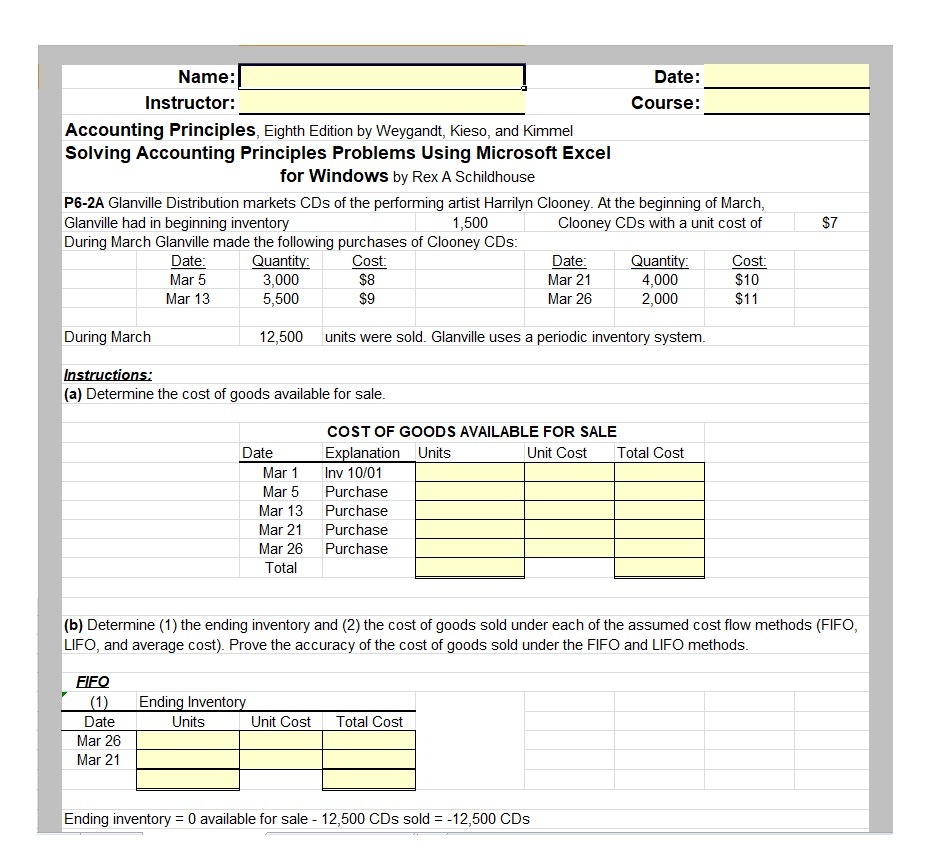

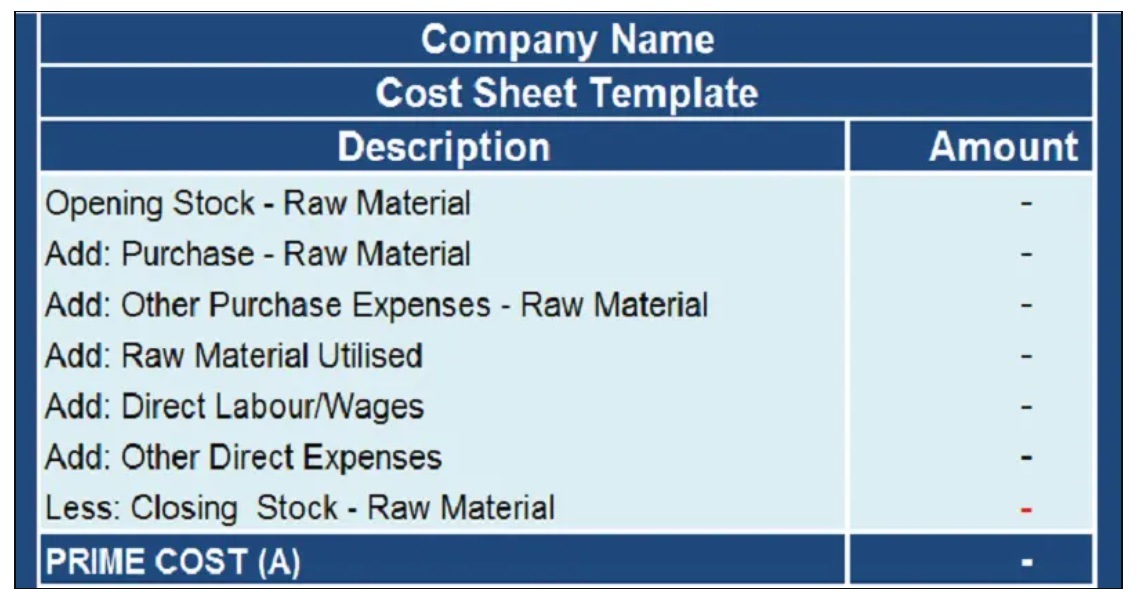

Statement of cost of good sold. The cost of goods sold (cogs) is the cumulative total of direct costs incurred for the goods or services sold, including direct expenses like raw material, direct labour cost. How to calculate cost of goods sold. This number is vital for the company.

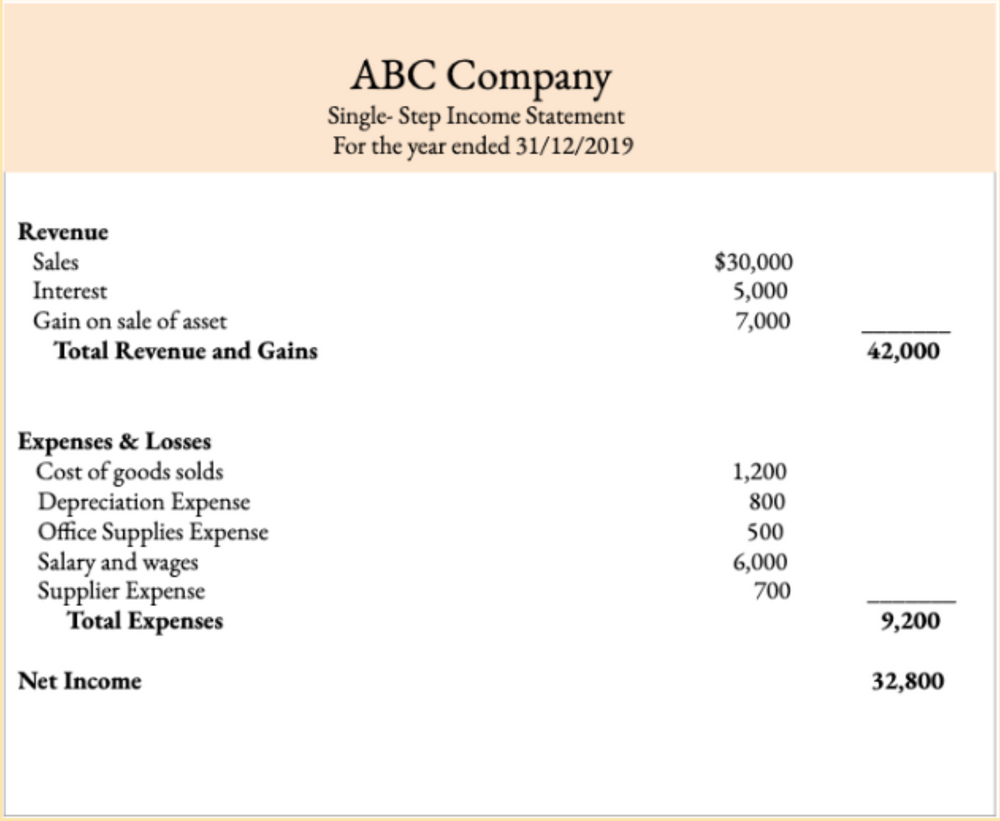

Choosing an accounting method for cogs; Analysis thus in the present case, the cost of goods sold by company abc ltd. Cost of goods sold, or cogs, is the total cost a business has paid out of pocket to sell a product or service.

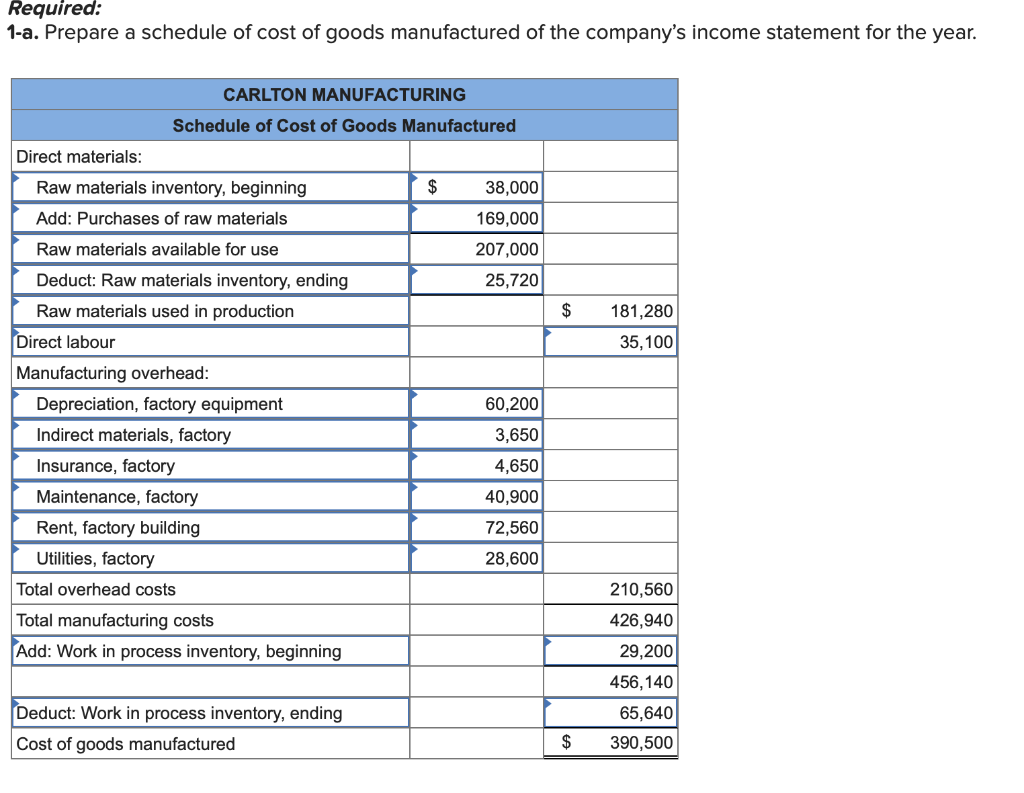

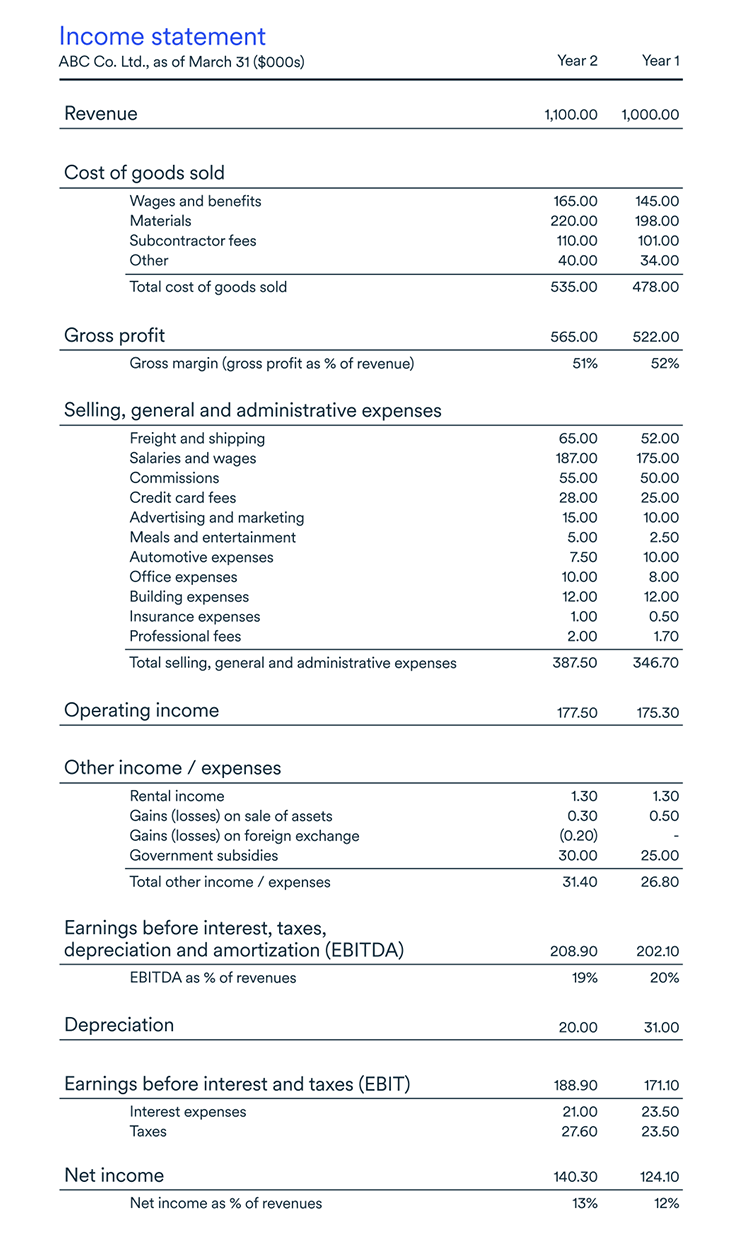

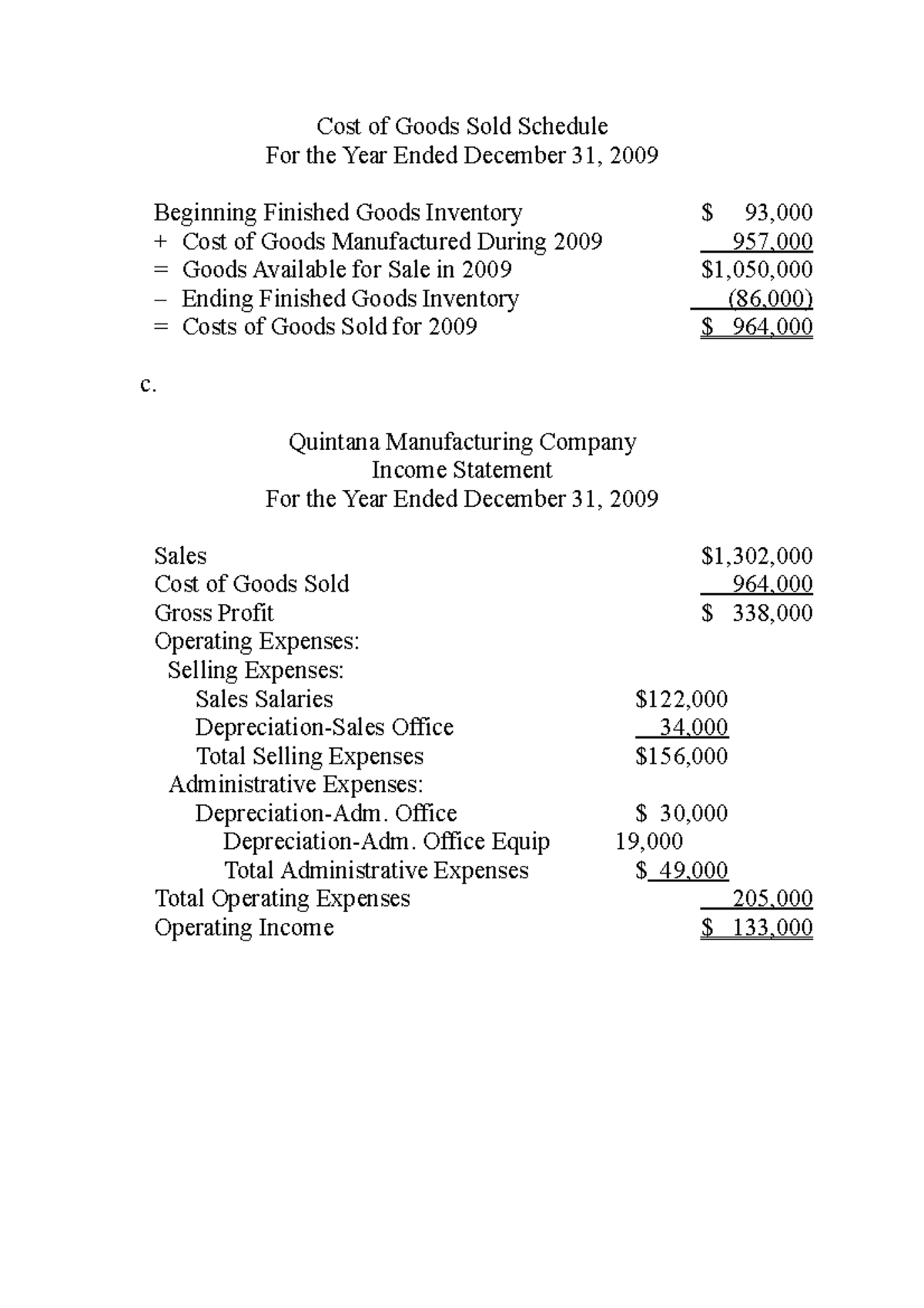

A cost of goods sold statement compiles the cost of goods sold for an accounting period in greater detail than is found on a typical income statement. The cost here refers to costs or expenses attributable. The cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company.

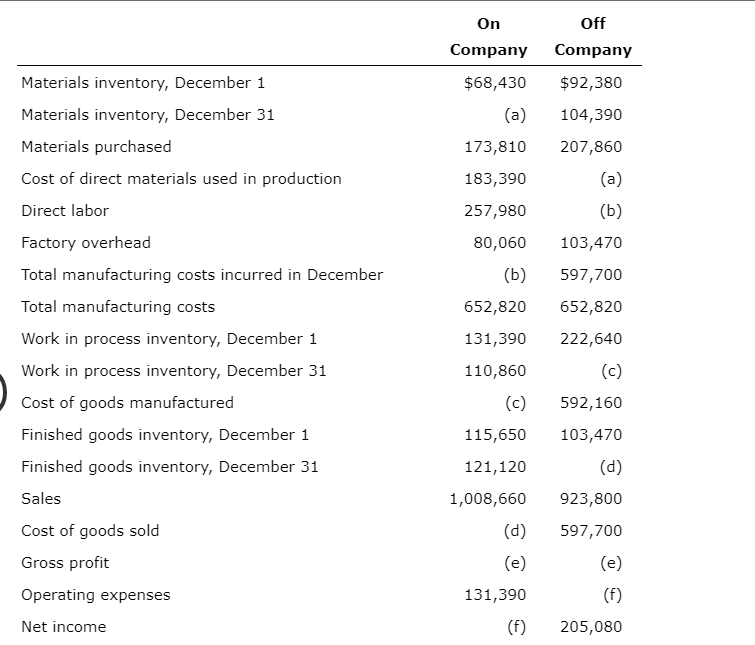

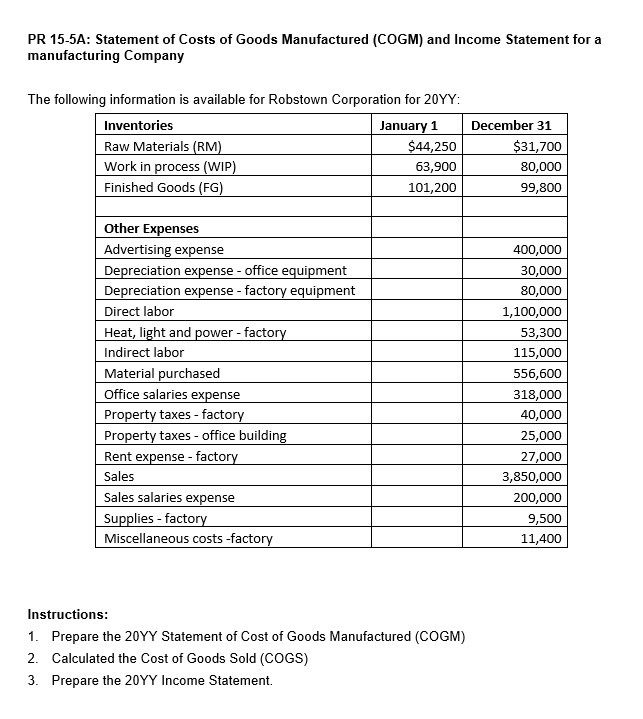

The cost of goods sold is presented immediately after the revenue line items in the income statement, after which operating expenses are presented. The cost of goods sold, also known as the cost of services or the cost of sales, includes both the cost of materials used to create the goods and the cost of. The statement of cost of goods manufactured supports the cost of goods sold figure on the income statement.

The two most important numbers on this statement are the total. To calculate cogs, take the cost of initial inventory and add additional direct costs during the period you are measuring. Cost of goods sold (cogs) on an income statement represents the expenses a company has paid to manufacture, source, and ship a product or service to.

It represents the amount that the business must. The cost of goods sold is the costs of goods or products sold during a specific period by the entity to its customers. For the year ending on december 31st, 2018, is $14,000.

The cost of goods sold amount on the income statement is determined by considering the changes in the three inventory account balances during the period. Example john manufacturing company, a manufacturer of soda. How to calculate the cost of goods sold (cogs) cogs and inventory;

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)