One Of The Best Info About Lease Receivable Balance Sheet Statement Of Financial Position Template Excel

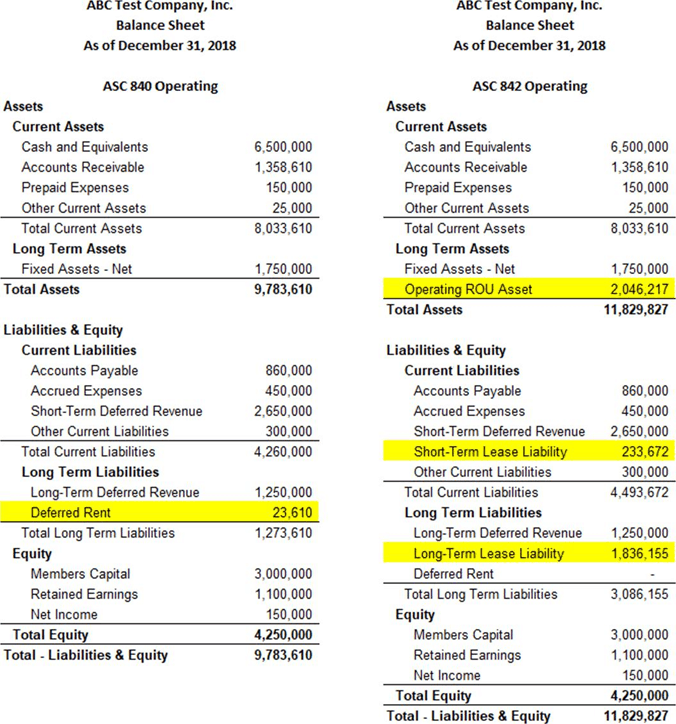

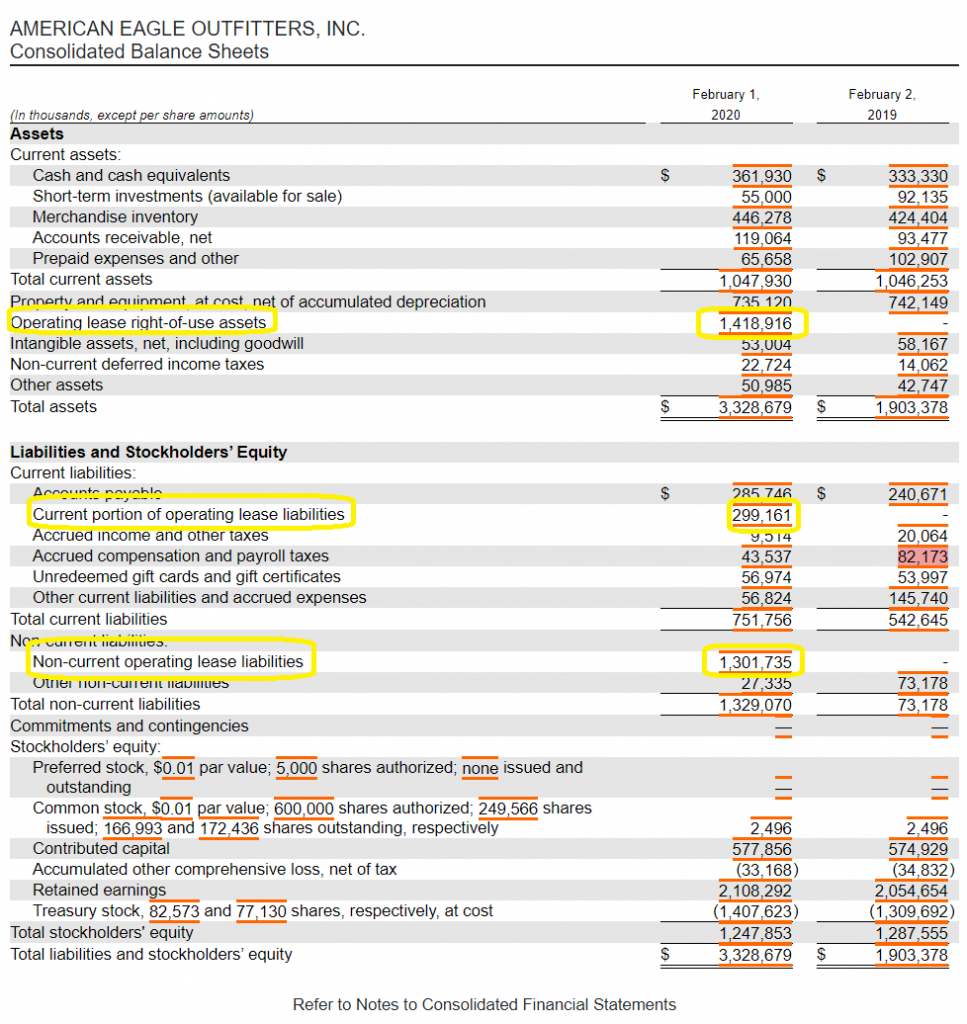

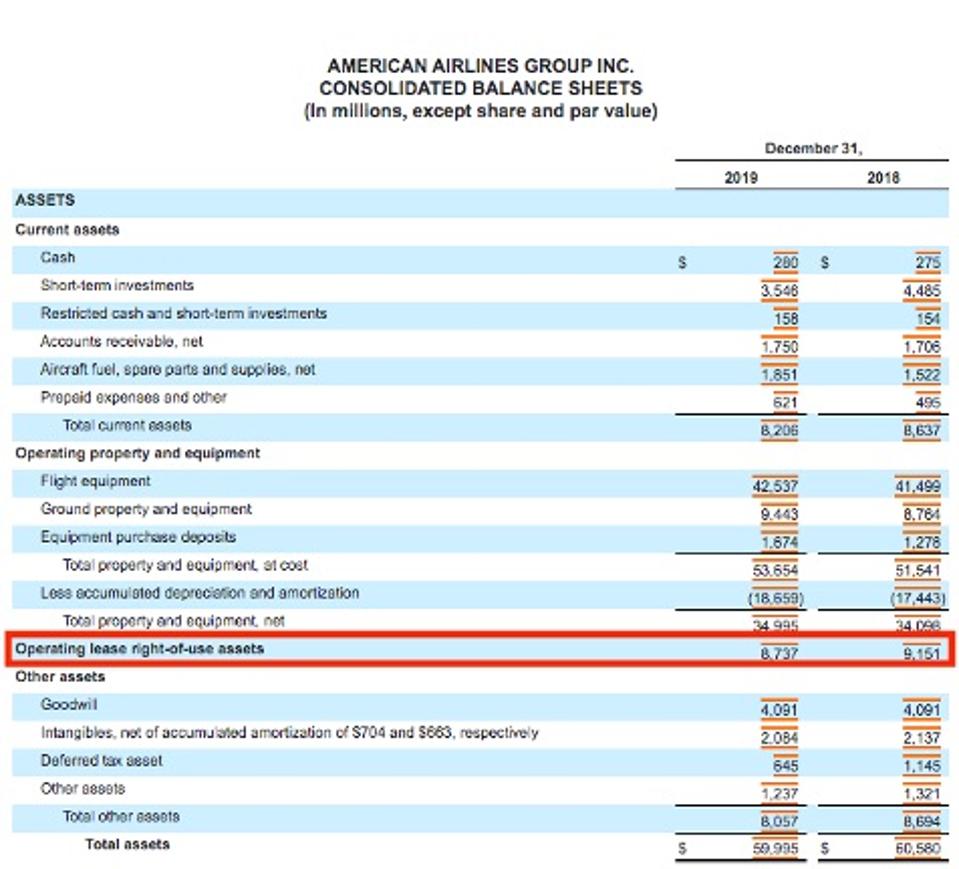

Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet.

Lease receivable balance sheet. On may 14, 2019, the company signed a land lease. These actions will create a cleaner balance sheet for future financings. Ifrs 16 leases has now been successfully adopted by companies reporting under ifrs® standards.

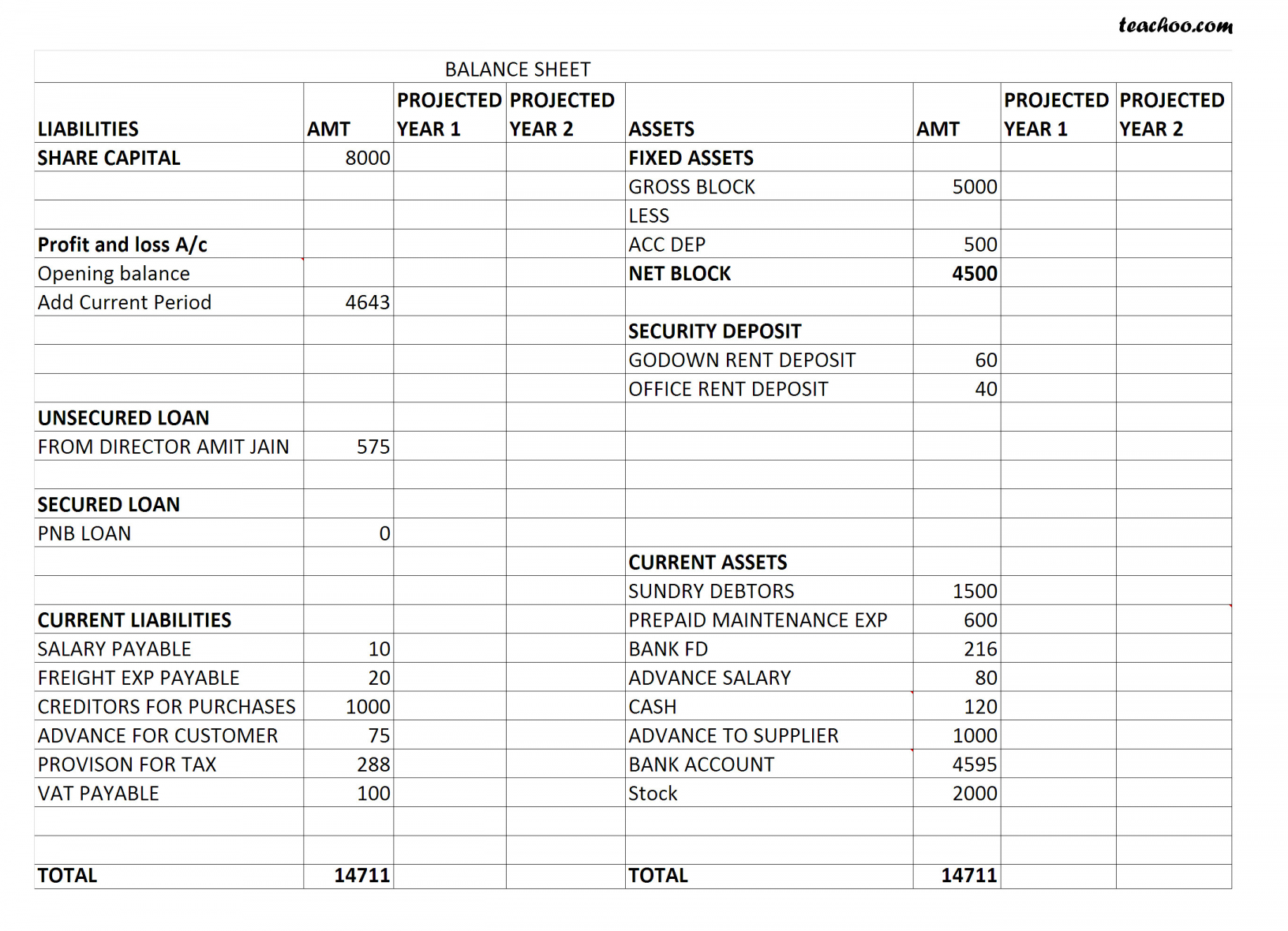

Rent receivable is an asset account in the general ledger of a landlord which reports the amount of rent that has been earned but not received as. It is the new normal for lease accounting around the world. General description of significant leasing arrangements;.

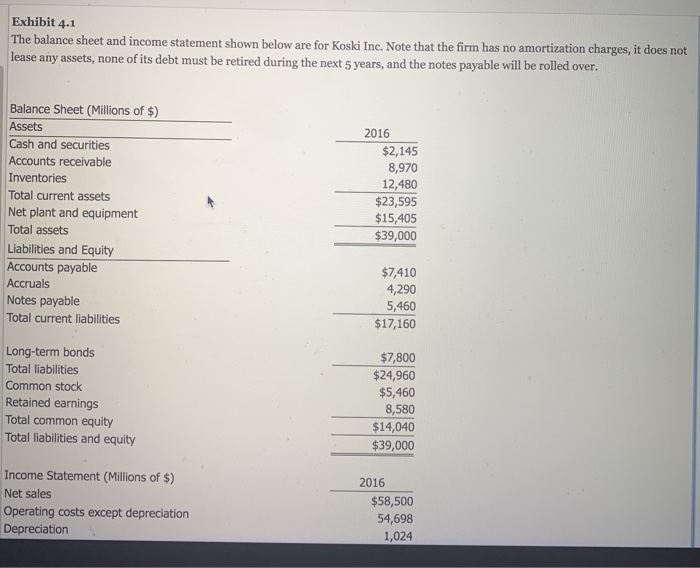

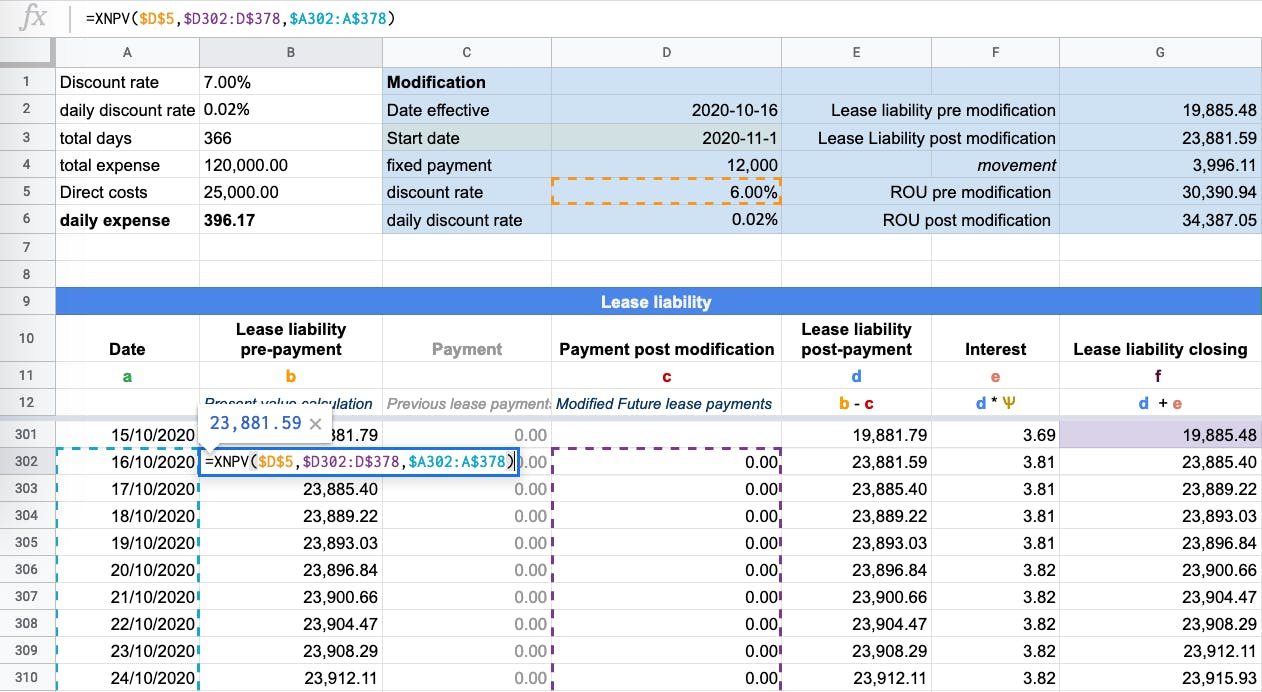

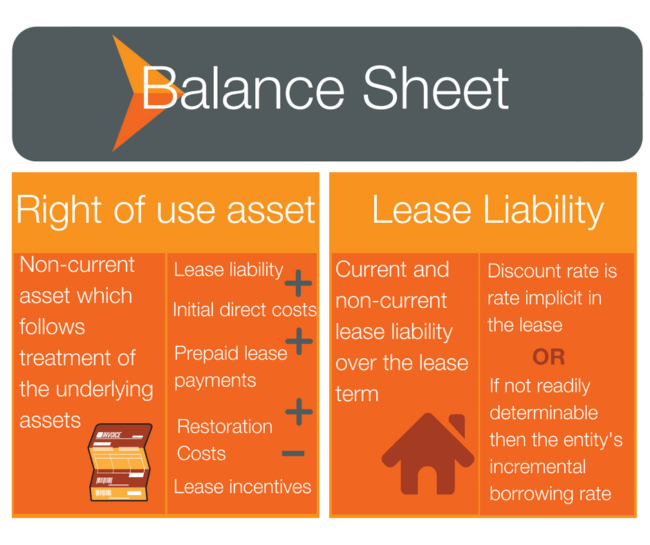

A lease is a legal agreement by which the owner of a specific asset (lessor) allows a second party (lessee) to use the asset for a specific period in exchange for periodic payments to the lessor. For finance leases the net investment is presented on the balance sheet as a receivable, and; Interest expense is calculated as the opening lease liability balance multiplied by the interest rate of 10.5%, and the lease liability opening balance can be calculated in one.

Assets subject to operating leases continue to be presented according. Accumulated allowance for uncollectible lease payments receivable; Definition of rent receivable.

Unwinding the land lease agreement. Only finance leases are required to be. A lessor is required to first determine whether a lessee is an operating lease or a finance lease.

They reported operating lease assets and liabilities recorded in the. Lessors should present a rent receivable, deferred rent, or prepaid initial direct costs with items of similar maturities on a classified balance sheet; They also state that companies must record a.

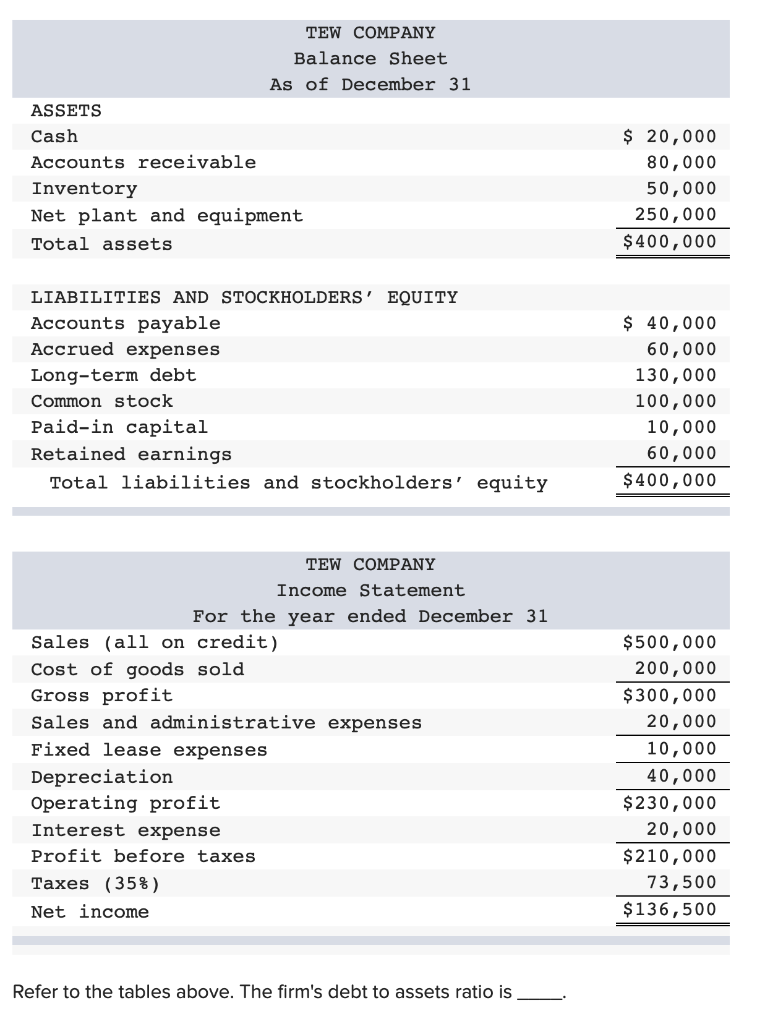

Lease accounting is the process organizations use to record the financial impact of their leases. Balance sheet as a receivable, and • assets subject to operating leases continue to be presented according to the nature of the underlying asset. Amounts of minimum lease payments at balance sheet date under noncancellable operating leases for:

Initial direct costs are included in. Accounting by lessors. Liability for most leases on the balance sheet.

Lease payments receivable by a lessor under a finance lease, and any unguaranteed residual value accruing to the lessor. Under the new model, lessees will classify a lease as finance or operating; In order to record the lease liability on the balance sheet, we need to know these 3 factors:

Determining the lease term sometimes. For example, with other prepaid. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the.