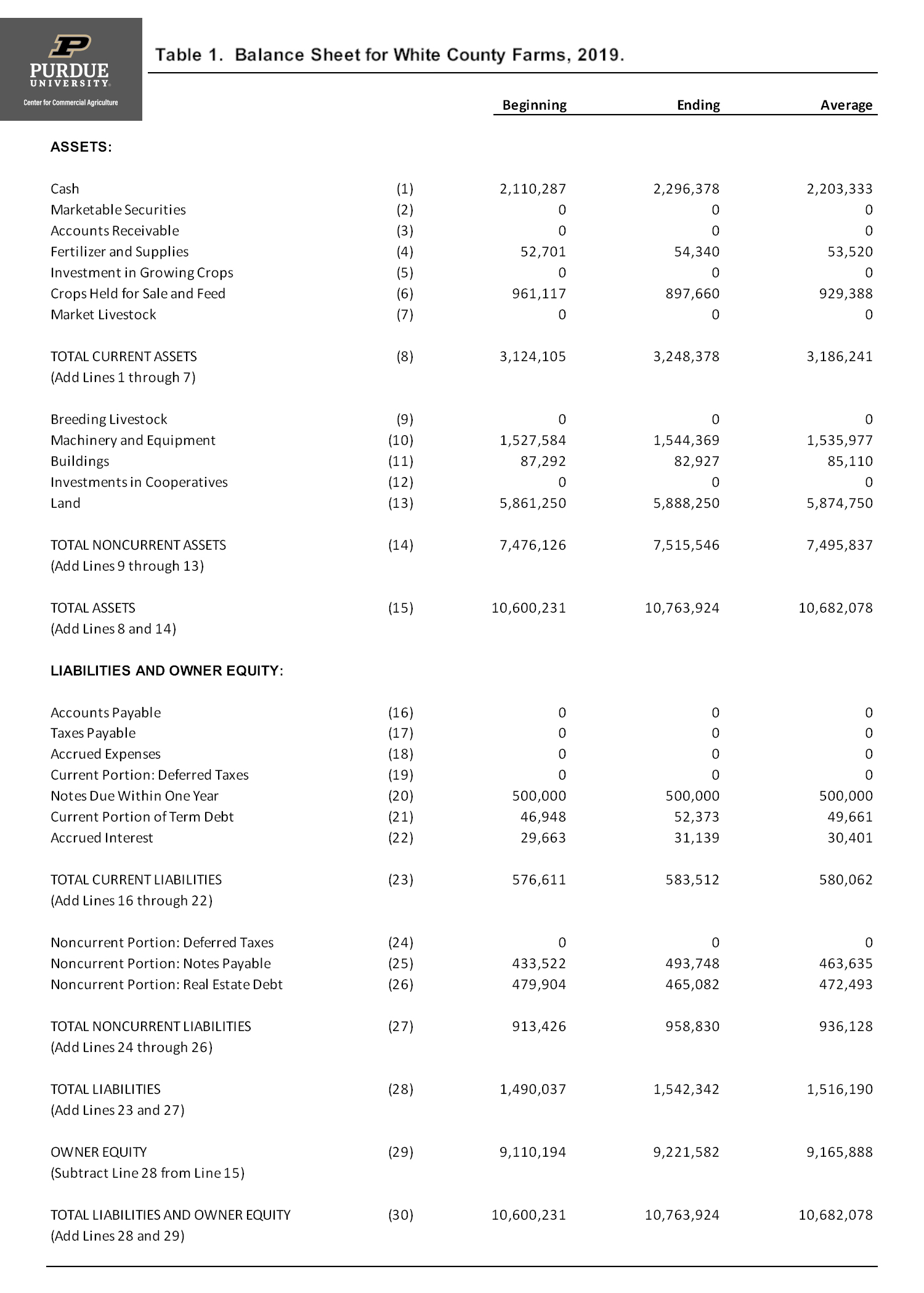

Peerless Info About Market Value Of Equity From Balance Sheet Gross Margin Statement

As we mentioned earlier, the market value tends to remain higher than the book value of the equity.

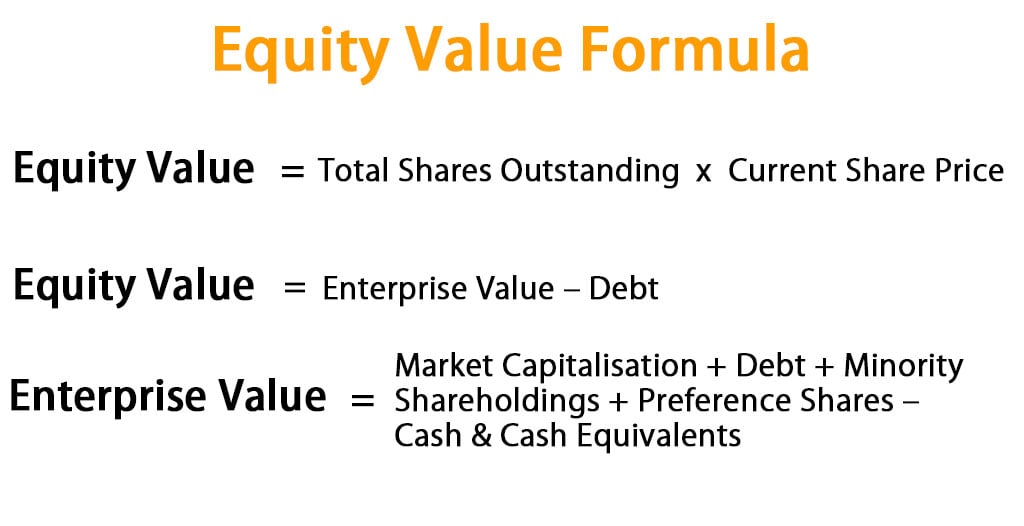

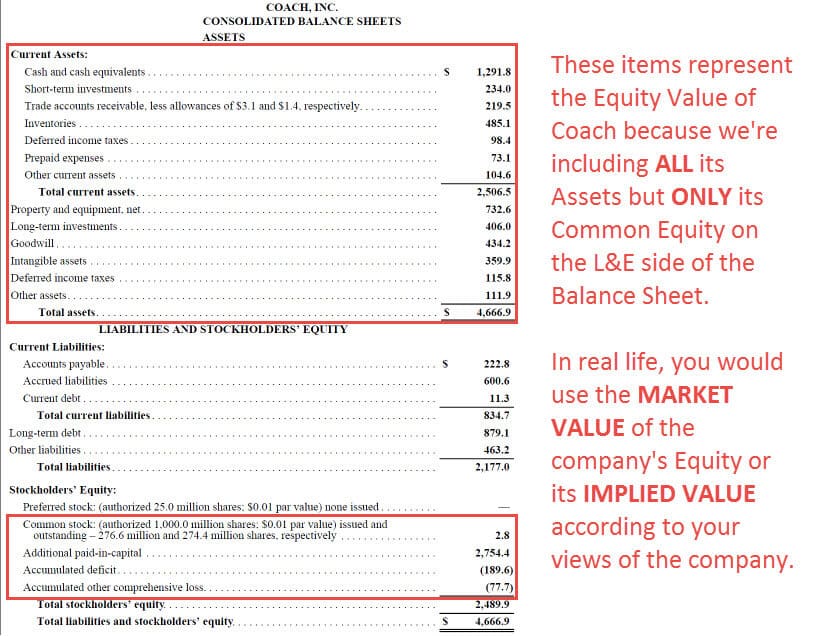

Market value of equity from balance sheet. Equity value, commonly referred to as the market value of equity or market capitalization, can be defined as the total value of the company that is attributable to equity investors. To calculate this market value,. Market value is the price currently paid or offered for an asset in the marketplace.

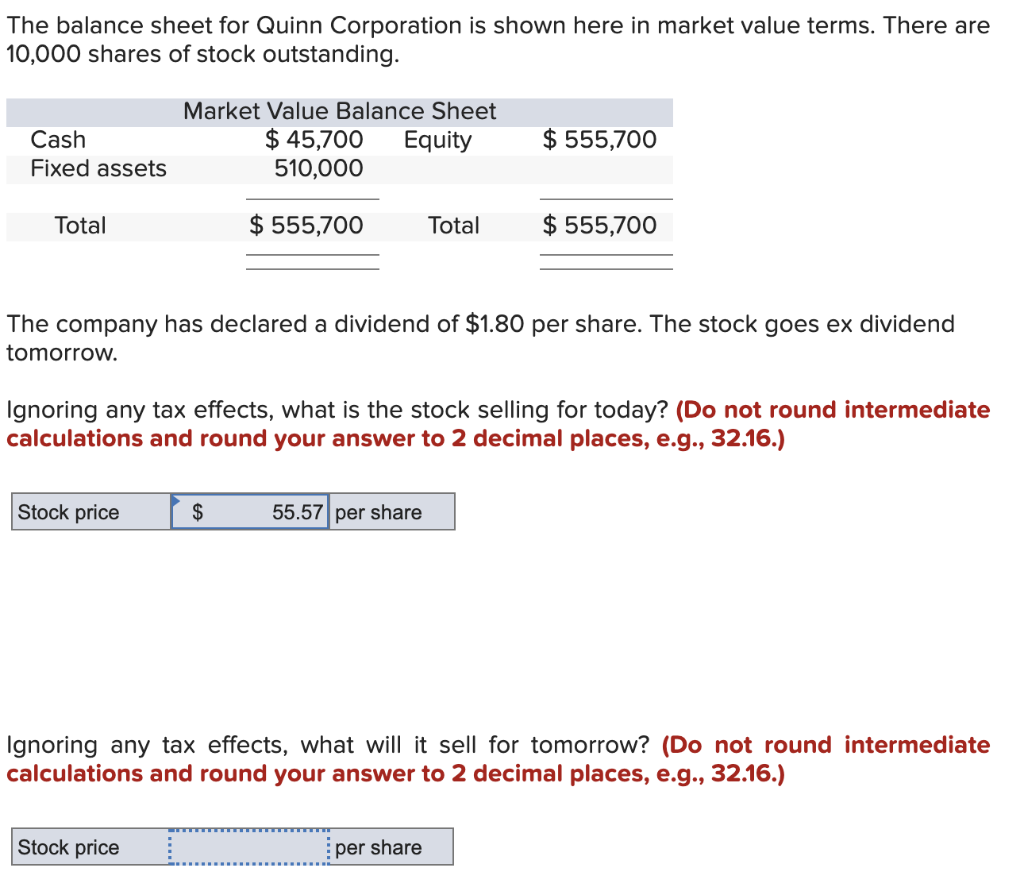

For example, on march 28, 2019, apple stock was trading at $188.72 per share. September 09, 2023/steven bragg. As of this date, the company's stock buy back programhas lowered the shares outstanding from over 6 billion to.

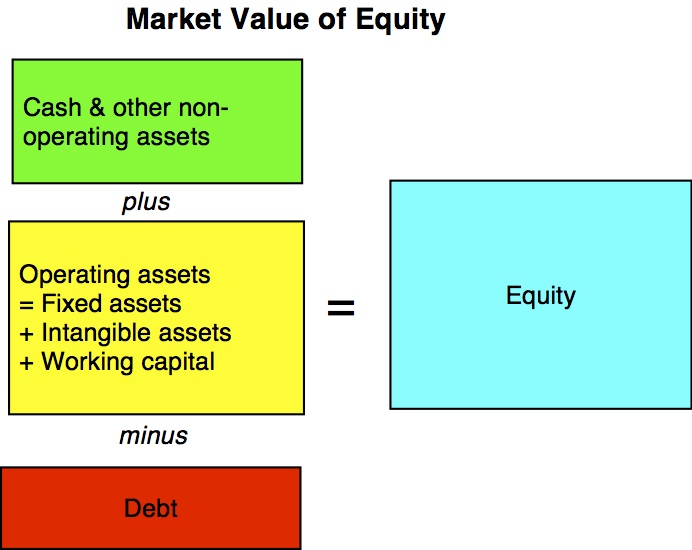

The market valueof a company's equityis the total value given by the investment community to a business. The market value is a function of the daily actions in the. Book value means the net worth of the company.

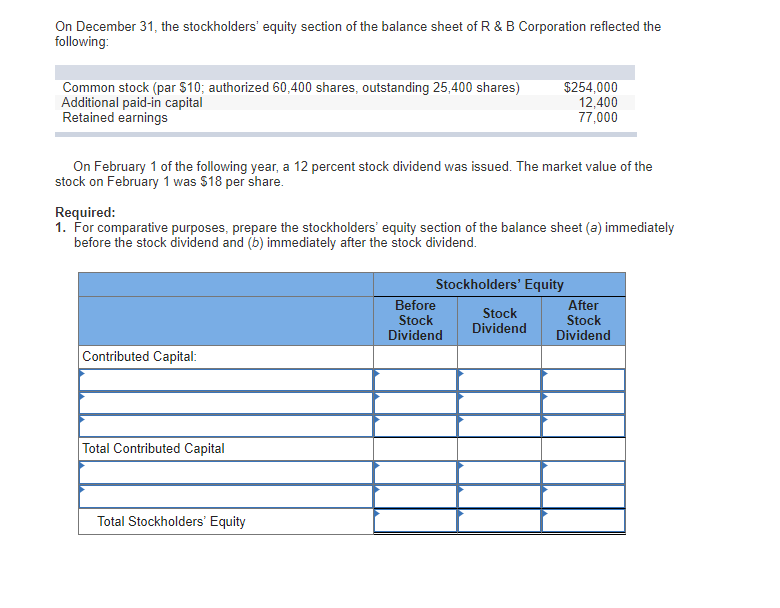

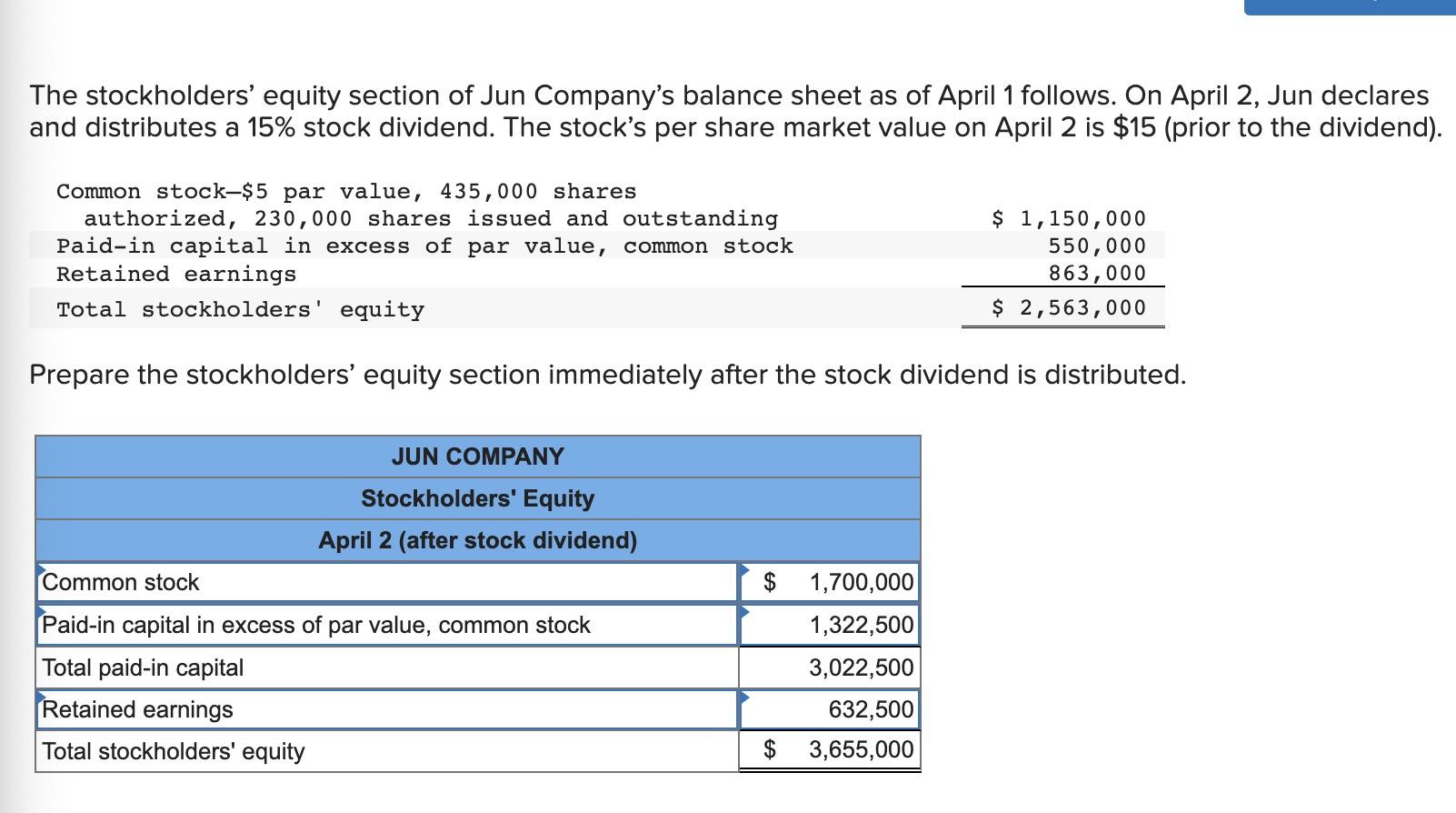

There can be many reasons why the market value of a corporation's stock is much greater than the amount of stockholders' equity reported on the balance sheet. Market value of equity = market price per share * total number of outstanding equity shares example let us take an example to understand the. Market value of equity = total outstanding number of shares x share price in the market.

Equity value vs market cap. On a company’s balance sheet, owners’ equity shows what the owners of the business (or shareholders) would have if the company paid off all its debt with its. Market value #1 book value of equity.

The value of market capitalisation is almost always greater than the value of equity because investors weigh in factors such as the projected future. Market value of equity is calculated by multiplying the number of shares outstanding by the current share price. There are generally two types of equity value:

Essentially, the market value of an asset is a quantified reflection of the perception of. In this method, book value as per the balance sheet is considered the value of equity. Net worth is calculated as.

In accounting, equity is always listed at its book value. Market value of equity = 500,000 shares x $50 per share. An investor can calculate the book value of an.

This is the value that. Book value is equal to the value of the firm’s equity, while market value indicates the current market value of any firm or asset.

:max_bytes(150000):strip_icc()/ScreenShot2022-03-08at4.53.06PM-eda6eb2099b245129240ed8ef9d984ed.png)

![Book Value of Equity (BVE) Formula + Calculator [Excel Template]](https://media.wallstreetprep.com/uploads/2021/10/26024701/Book-Value-of-Equity-Calculator-960x724.jpg)