Can’t-Miss Takeaways Of Info About Deferred Revenue Normal Balance Business Income Statements And Payment Summaries

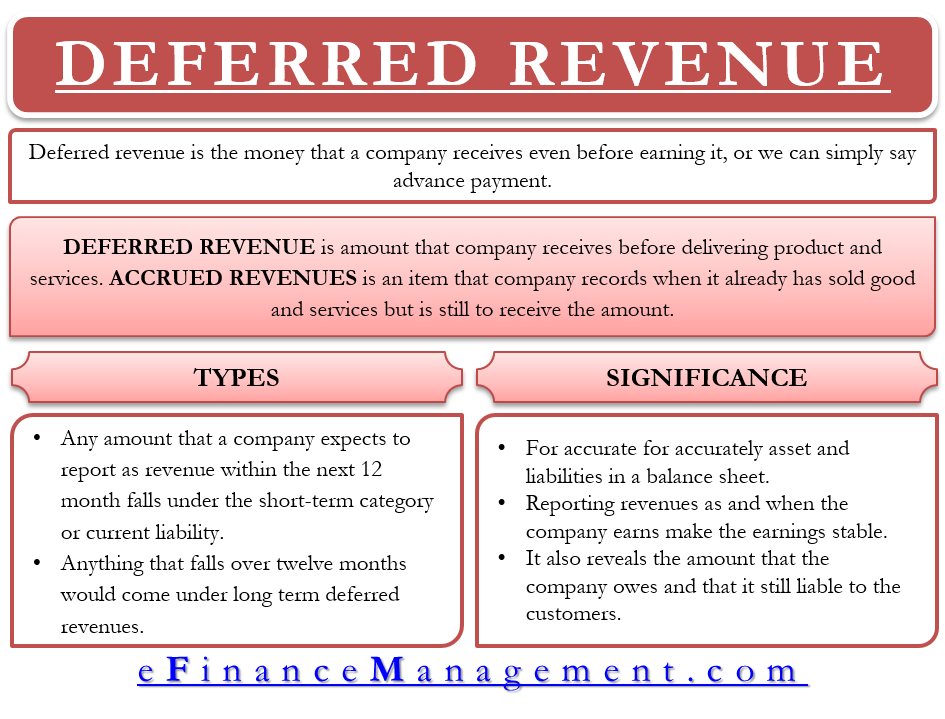

Current liabilities are expected to be repaid within one year unlike long term liabilities.

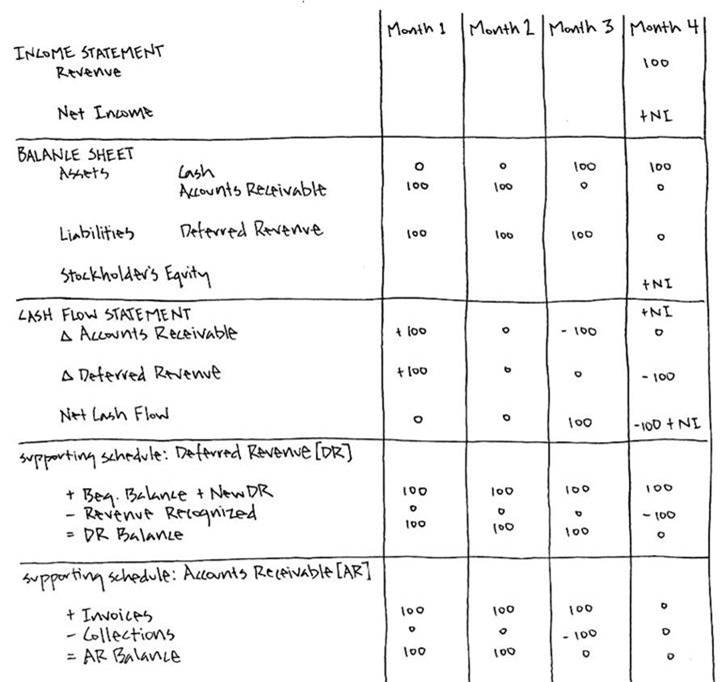

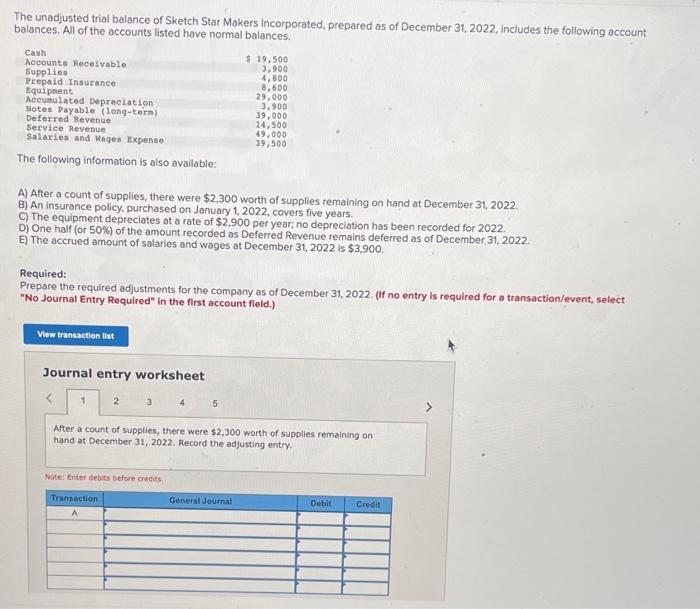

Deferred revenue normal balance. On the balance sheet, money received for the upcoming good or service is shown as a debit. It's common for businesses to receive payments up front, but such payments are recognized as liabilities on balance sheets because the recipients. On august 31, the company would record revenue.

You will record deferred revenue on your balance sheet. As the product or service is delivered over time, the deferred revenue liability on the balance sheet is decreased, and the amount of this decrease in the. On the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created.

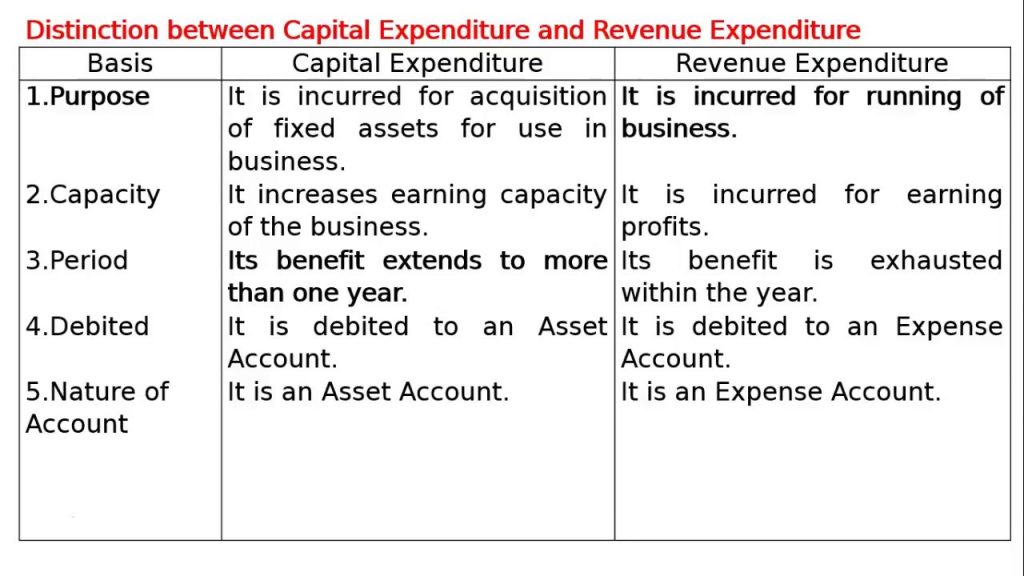

Balance sheet reconciliation. Money received for the future product or service is recorded as a debit to. One of the basic accounting terms is a normal balance.

Deferred revenue, often perceived as a complex topic in financial accounting, plays a critical role in accurate revenue recognition and balance sheet. It’s used to describe a balance that an account should have. Deferred revenue 2019 = 313 +.

What type of account is deferred revenue? What is a normal balance? Deferred revenue is recorded as such because it is money that has not yet been earned because the product or service in question has not yet been delivered.

Deferred revenue (also called unearned revenue) refers to money received by a company before it provides the related goods or services to the customer. For example, annual subscription payments you. On the balance sheet, the cash balance would go from $100,000 to $92,000, and the deferred revenue balance would go from $100,000 to $80,000.

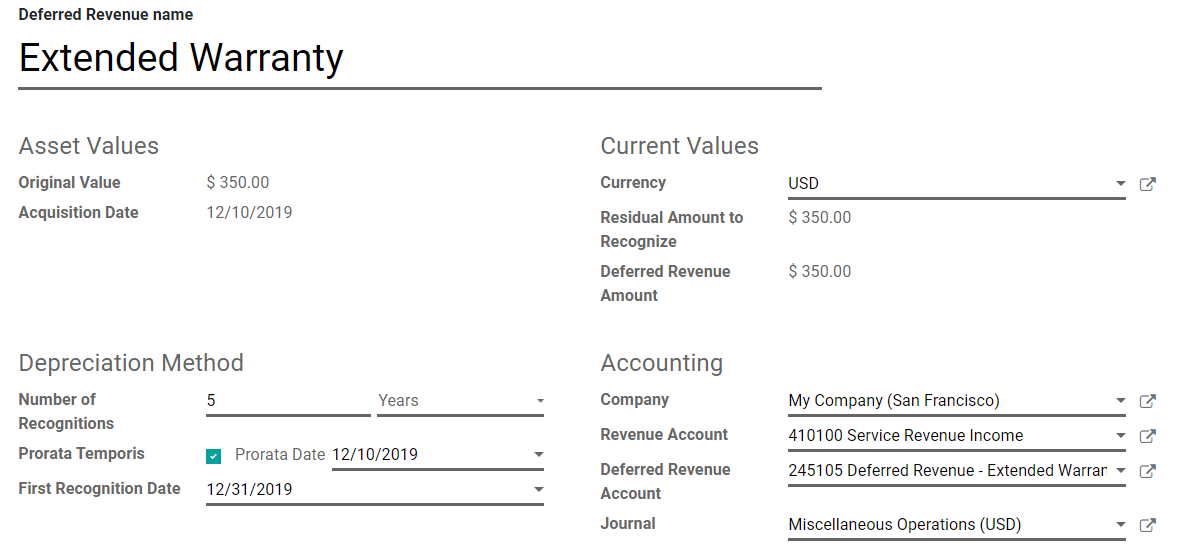

This account shows that the company received the payment from the customer for the goods. How to record deferred revenue. Top 4 examples of deferred revenue.

The remaining $150 sits on the balance sheet as deferred revenue until the software upgrades are fully delivered to the customer by the. Deferred revenue = deferred revenue (in current liabilities) + deferred revenue, noncurrent; The deferred revenue account is normally classified as a current liability on the balance sheet.

Deferred revenue = $150; Deferred revenue is an accounting concept that provides a snapshot of a business’s financial health and operational agility. You record deferred revenue as a short term or current liability on the balance sheet.

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)

:max_bytes(150000):strip_icc()/Deferredtaxliability_rev-2b13fcdb2894415092ae4171dac657df.jpg)