Nice Tips About Income Tax Paid Cash Flow Statement Indirect Method Example Problems

If you paid $30,000 during the last quarter and accrued a total $42,000 tax liability, you'd report.

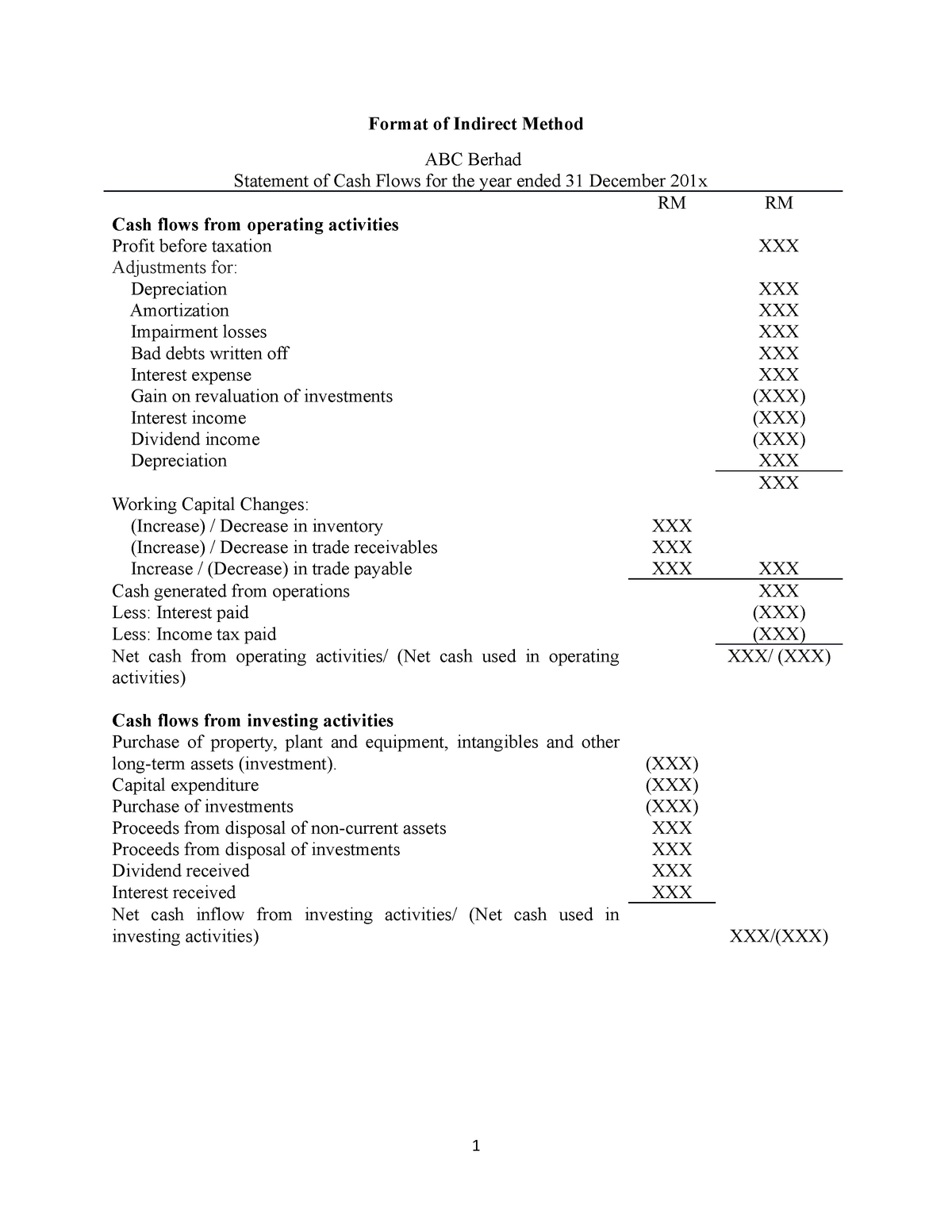

Income tax paid cash flow statement indirect method. Alternatively, the indirect method starts with profit before tax rather than a cash receipt. The indirect method is based on accrual accounting and is generally the best technique since most businesses use accrual accounting in their. Start with net income after tax from the income statement.

Direct method statement of cash flows. These adjustments include deducting realized gains and other adding back realized losses to the net income total. So we would take the net income, and work from there.

The indirect method for the preparation of the statement of cash flows involves the adjustment of net income with changes in balance sheet accounts to arrive at the amount of cash generated by operating activities. When the indirect method of presenting the statement of cash flows is used, the net profit or loss for the period is adjusted for the following items: In other words, changes in asset and liability accounts that affect cash balances throughout the year are added to or subtracted from net income at the end of the period to.

Begin with net income from the income statement. Add back noncash expenses, such as depreciation, amortization, and depletion. This step adjusts income statement items that are not cash transactions.

Operating, investing and financing will be the same. Cash flow from operating activities first, one calculates the operating cash flow: Such as depreciation, amortization, interest expenses, loss on sales of fixed assets and investment.

The statement of cash flows prepared using the indirect method adjusts net income for the changes in balance sheet accounts to calculate the cash from operating activities. Creating the cash flow statement using the indirect method is considered one of the most challenging exercises in finance since it requires thorough knowledge of accounting methodologies, the company’s business model, debt calculations, tax calculations, and the way in which these items fit together. Profit before interest and income taxes.

Preparation under indirect method operating activities the cash flow from operating activities are derived under two stages; Cash flows from operating activities. Our net income is $10,250, so we will start there and work up to our cash flow statement.

In this article, we look at the indirect method of preparing a statement of cash flows. Identify cash flows using the indirect method the indirect method adjusts net income (rather than adjusting individual items in the income statement) for (1) changes in current assets (other than cash) and current liabilities, and (2) items that were included in net income but did not affect cash. Steps of operating activities section of the cash flows statement by using indirect method:

Items that typically do so include: Cash flow from investing activities The statement of cash flows using the indirect method must separately disclose the cash flows for:

The advantage of the direct method over the indirect method is that it reveals operating cash receipts and payments. September 07, 2023 what is the cash flow statement indirect method? The cash flow statement indirect method is used by most corporations, begins with a net income total and adjusts the total to reflect only cash received from operating activities.