Cool Tips About Horizontal And Vertical Balance Sheet Working Trial Audit

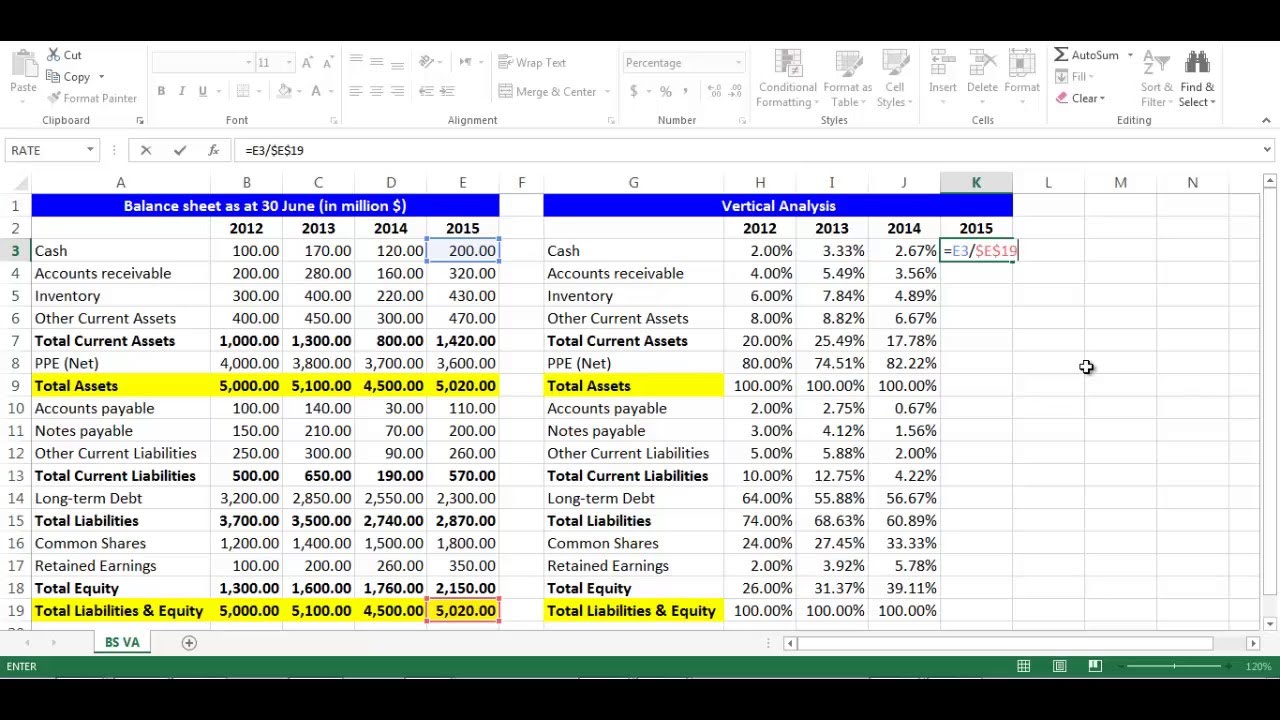

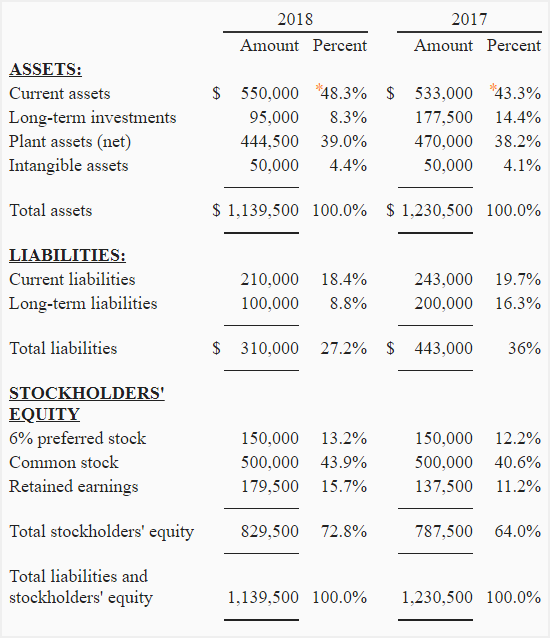

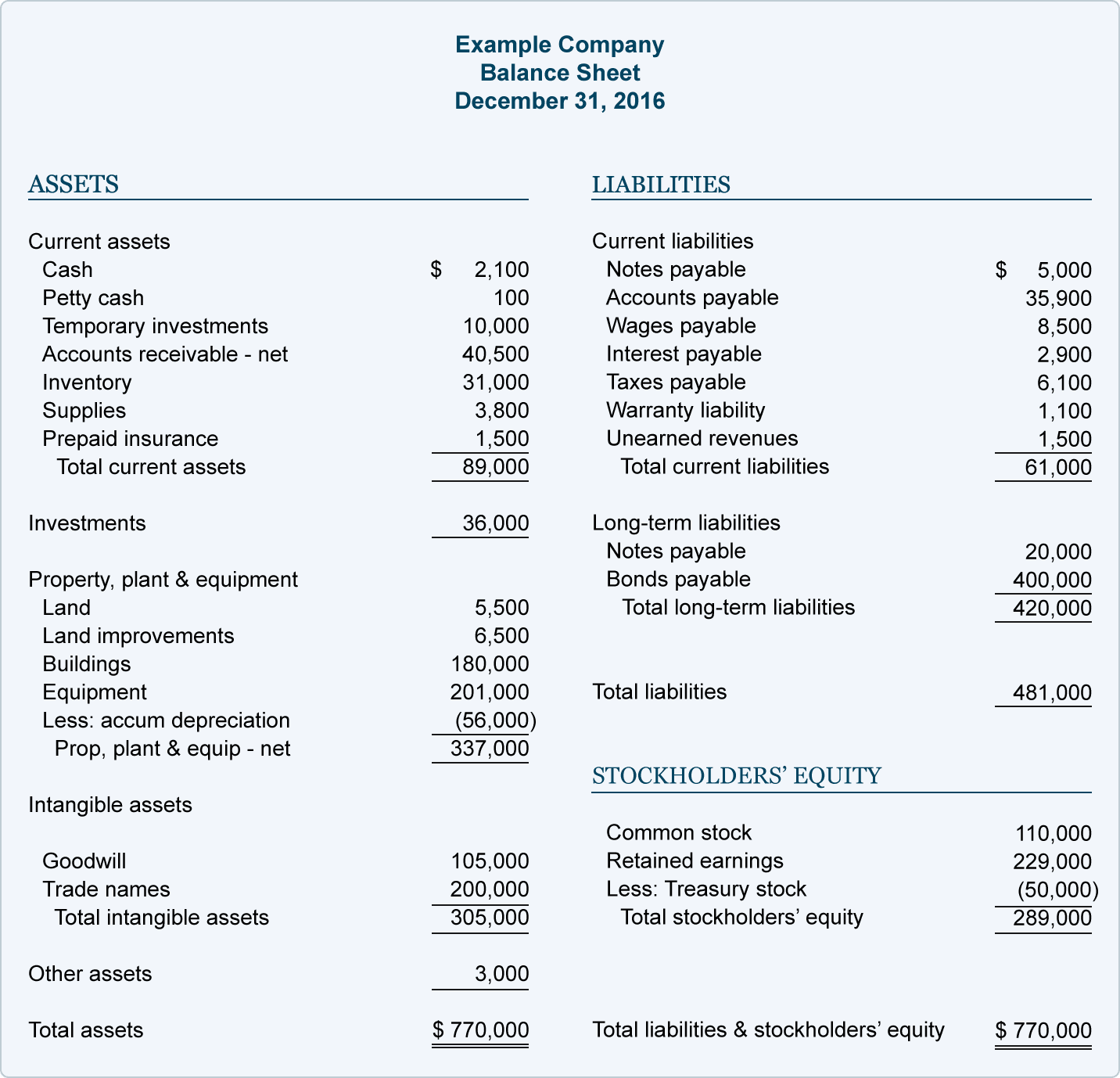

The following two examples of horizontal analysis use an abbreviated income statement and balance sheet information where 2019 represents the base year.

Horizontal and vertical balance sheet. It helps determine a companies’ growth and financial position versus competitors. The reason for performing it is the necessity to estimate the relative proportions of different assets and finance sources elements. Because horizontal analysis is conducted on financial statements across periods of time, start by gathering financial statements from different quarters or years.

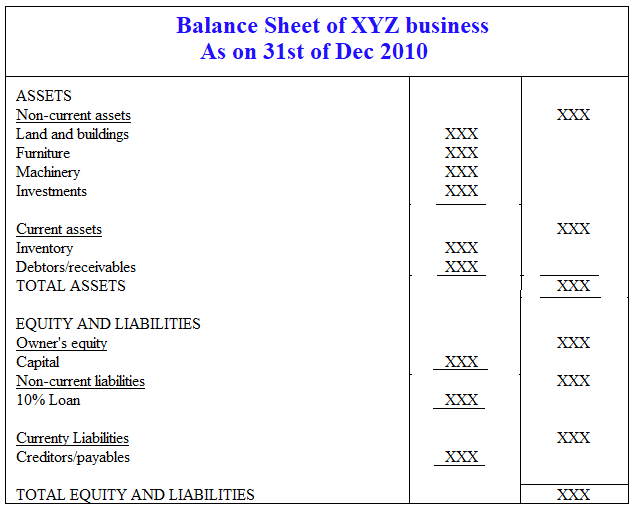

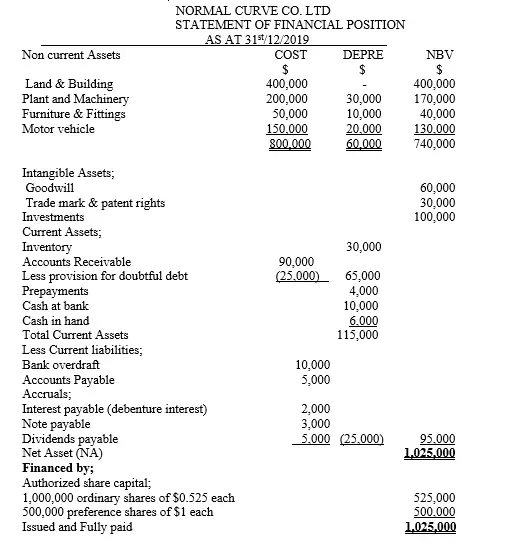

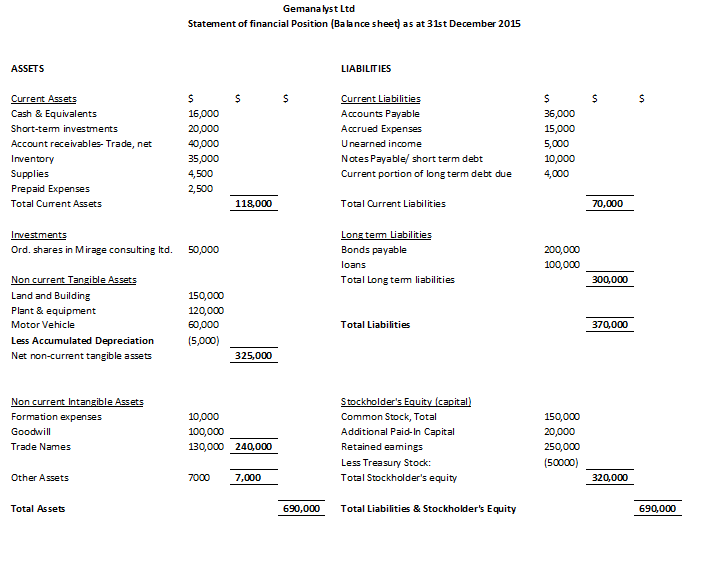

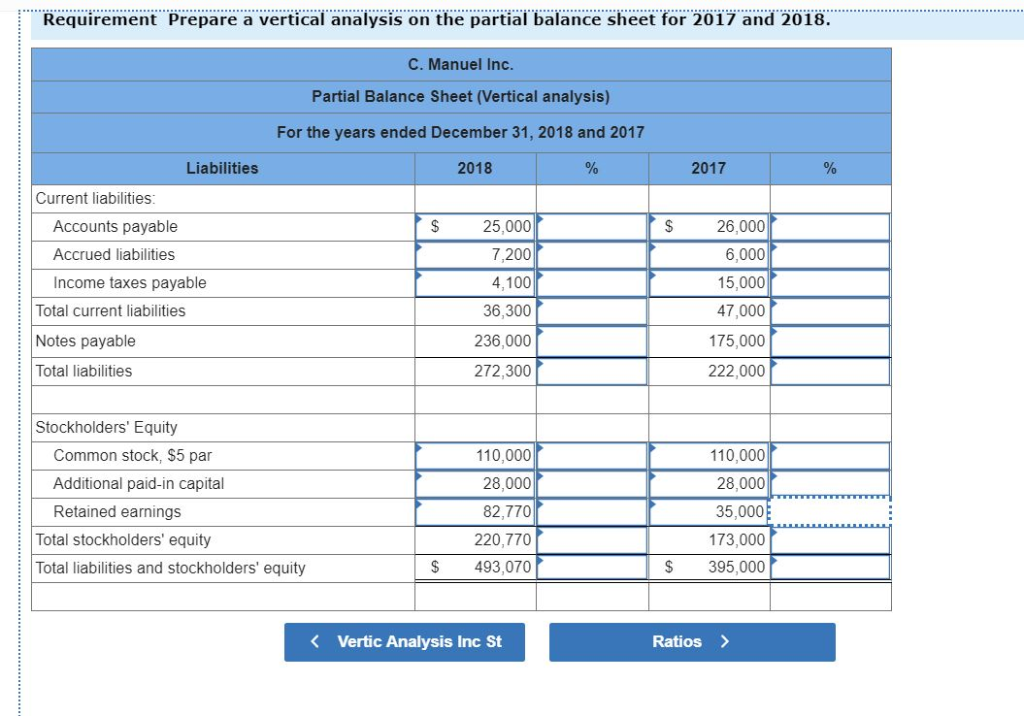

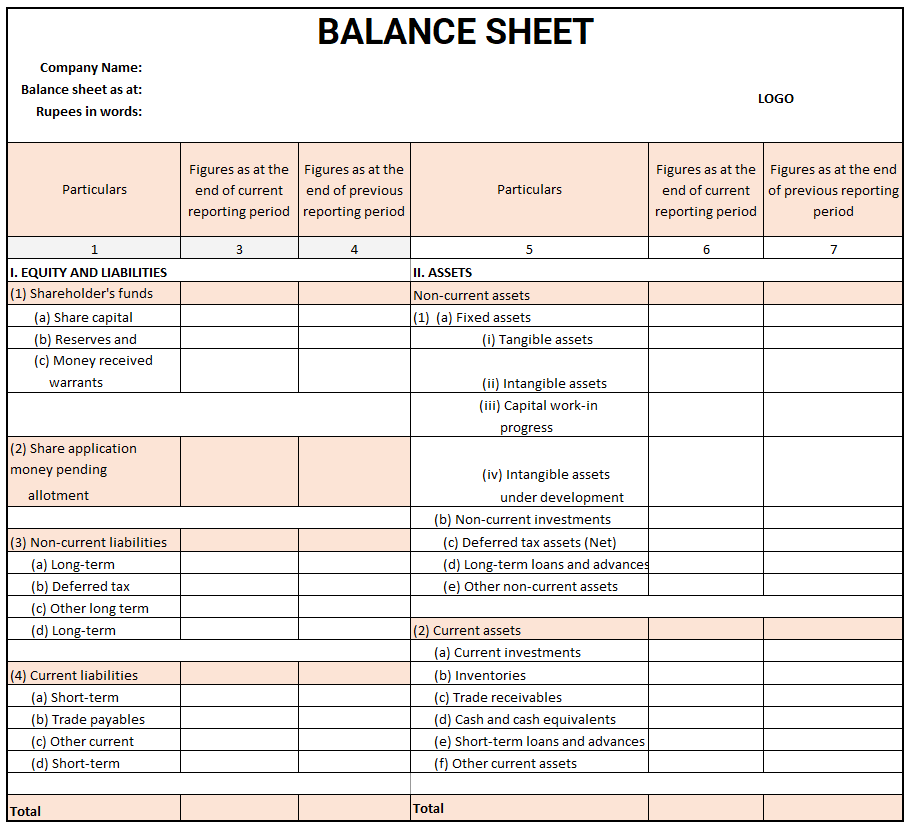

Vertical analysis of a balance sheet can be a powerful tool to understand your company’s performance or how two businesses compare. The same dollar change and percentage change calculations would be used for the income statement line items as well as the balance sheet line items. The only alternative to the vertical balance sheet format is the horizontal balance sheet, where assets appear in the first column and liabilities and shareholders' equity appear in the second column.

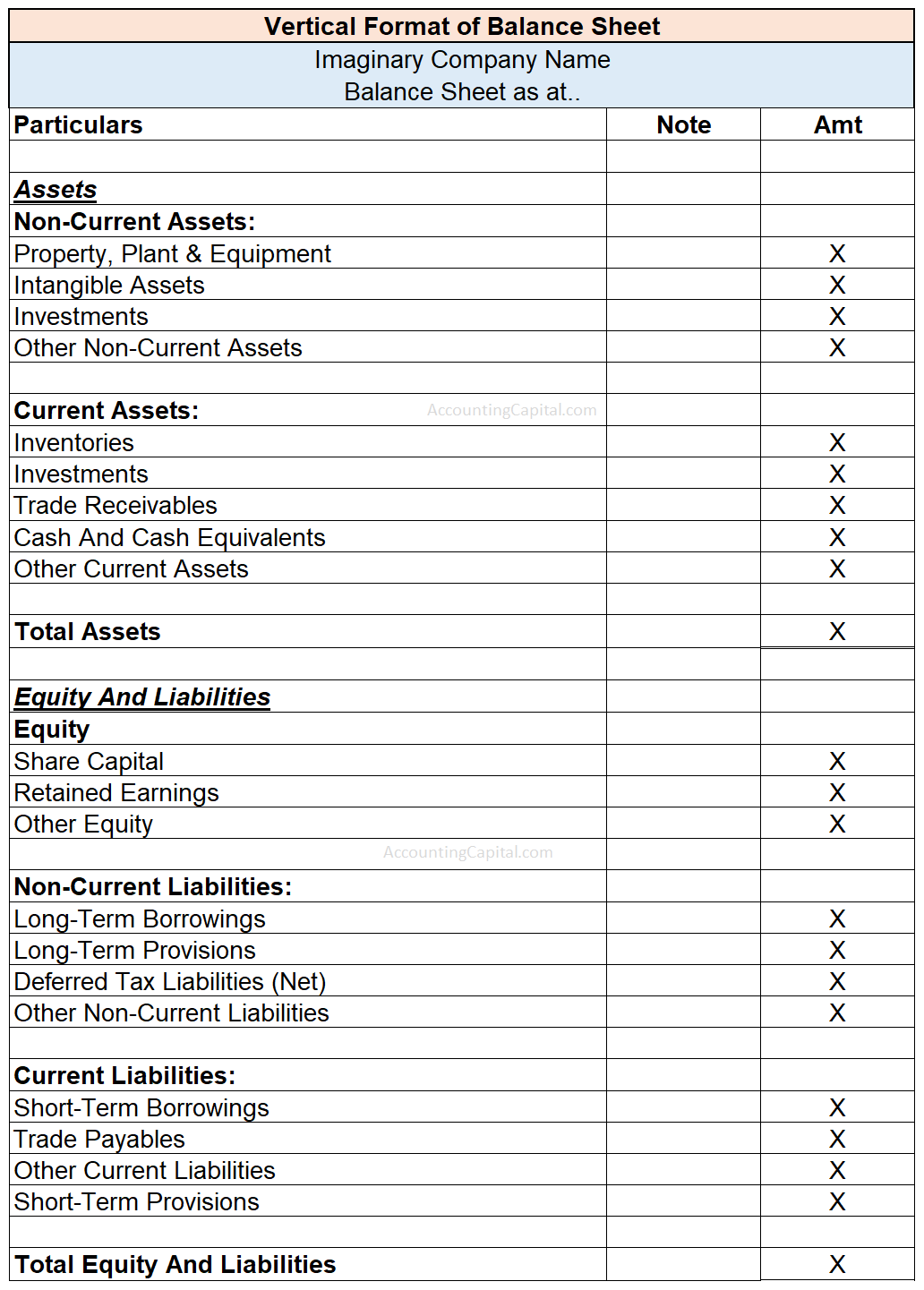

Table of content 1 suggested videos 2 balance sheet In the horizontal balance sheet, the assets and liabilities are shown side by side but in the vertical balance sheet, the assets and liabilities are shown from top to. The layout of this balance sheet format is as follows:

The income statement and balance sheet, to the financial results filed in a base period. How to perform horizontal analysis? Horizontal analysis measures a company’s operating performance by comparing its reported financial statements, i.e.

The difference between a vertical and horizontal balance sheet. Horizontal analysis allows financial statement users to easily spot trends and growth patterns. Horizontal analysis is the comparison of historical.

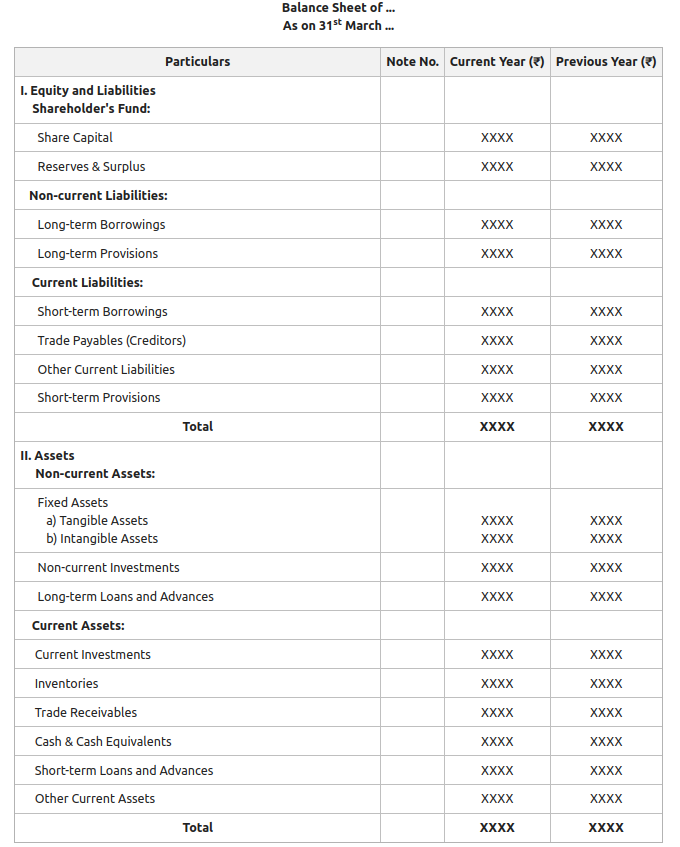

A vertical balance sheet is one in which the accounting report format or design is shown in a sole column of numbers, starting with resource or asset details, trailed by liability details, and finishing with investors’ value or shareholders’ equity details. Intro to company accounts horizontal form of balance sheet a company’s balance sheet is one of its most important financial statements. The vertical analysis of an income statement results in every income statement amount being restated as a percent of net sales.

For example, a company may compare sales from their current year to sales from the prior year. After gathering your statements, choose which line. November 15, 2023 what is a horizontal balance sheet?

The vertical analysis of a balance sheet results in every balance sheet amount being restated as a percent of total assets. Horizontal analysis is the comparison of historical financial information over various reporting periods. October 11, 2023 what is vertical analysis?

Vertical analysis is a method of financial statement analysis in. Mitchell grant updated march 28, 2022 reviewed by margaret james fact checked by suzanne kvilhaug what is vertical analysis? Menu icon a vertical stack of three evenly spaced horizontal lines.

All individual assets (or groups of assets if condensed form balance sheet is used) are shown as a percentage of total assets. A horizontal balance sheet uses extra columns to present more detail about the assets, liabilities, and equity of a business. A company will look at one period (usually a year) and compare it to another period.