Brilliant Tips About Statement Of Changes In Shareholders Equity Balance Sheet With Imaginary Figures Investment Income

Statement of changes in equity, often referred to as statement of retained earnings in u.s.

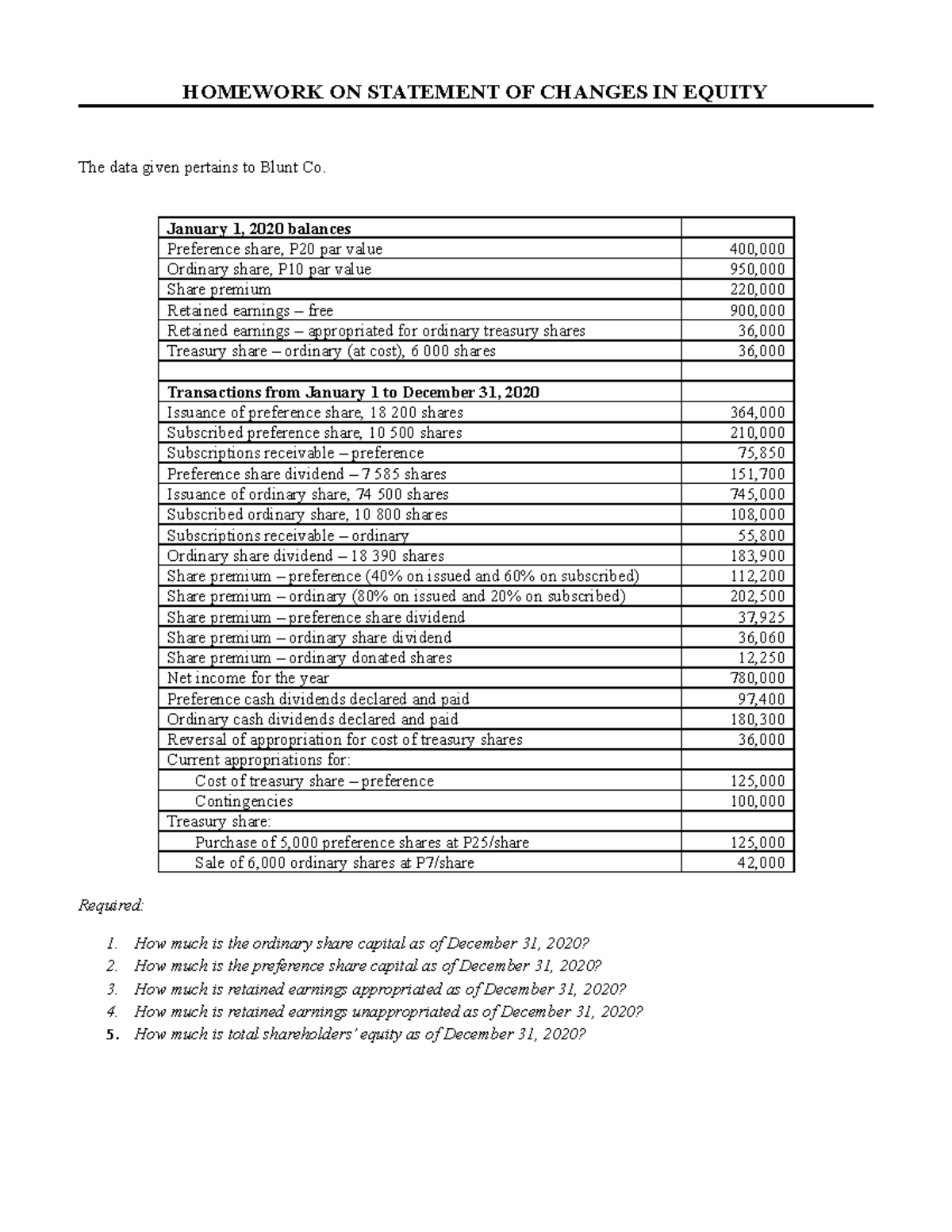

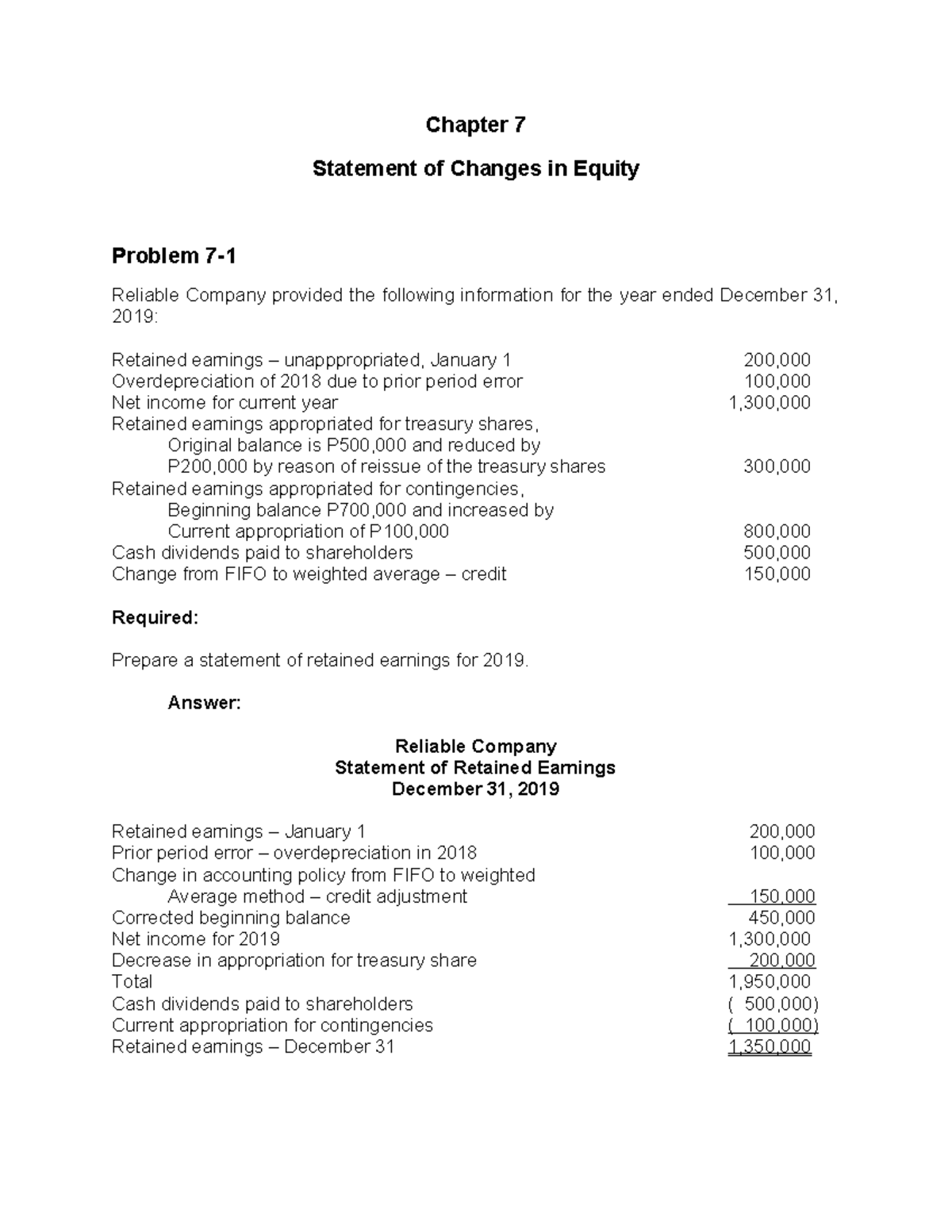

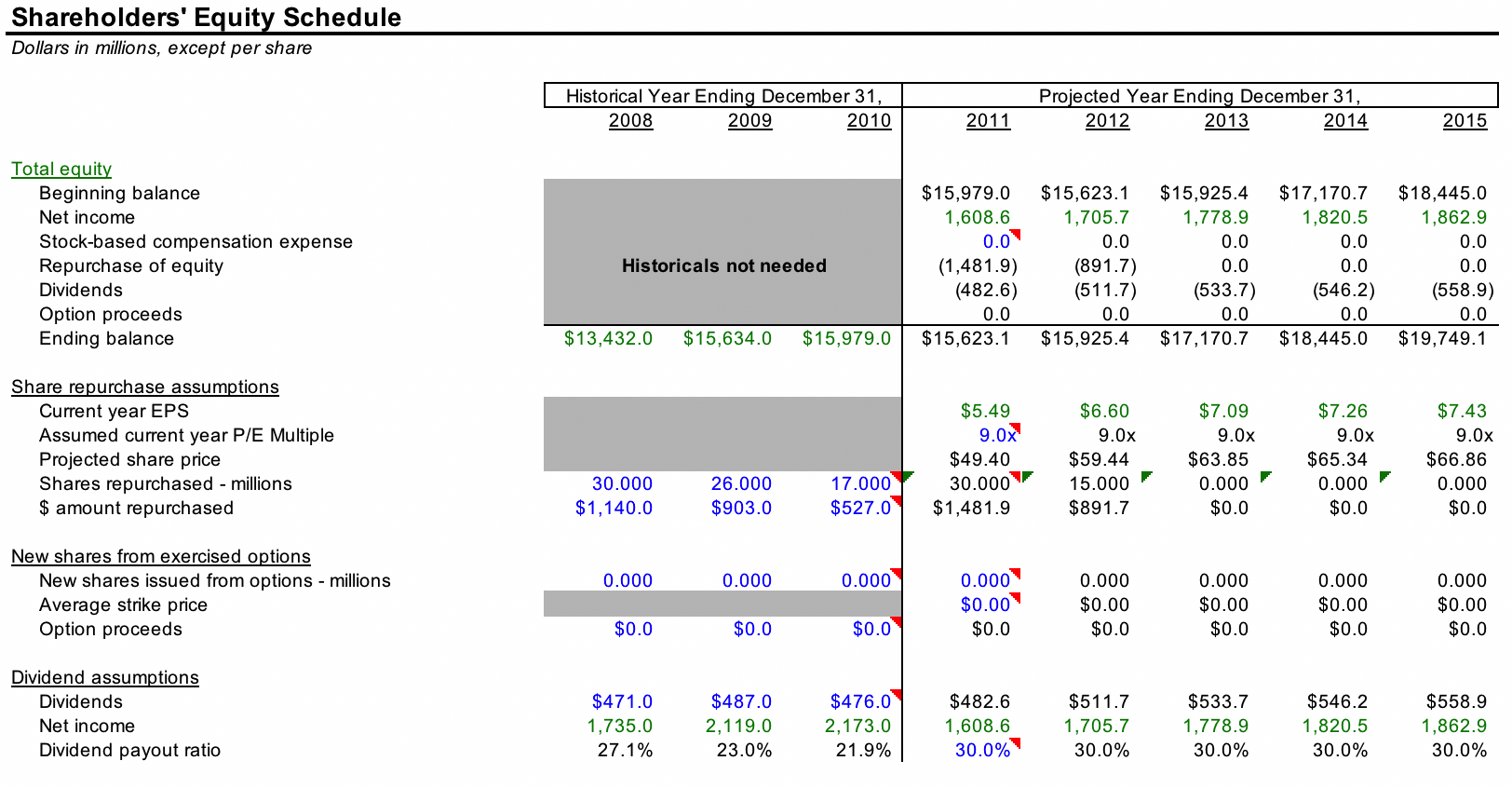

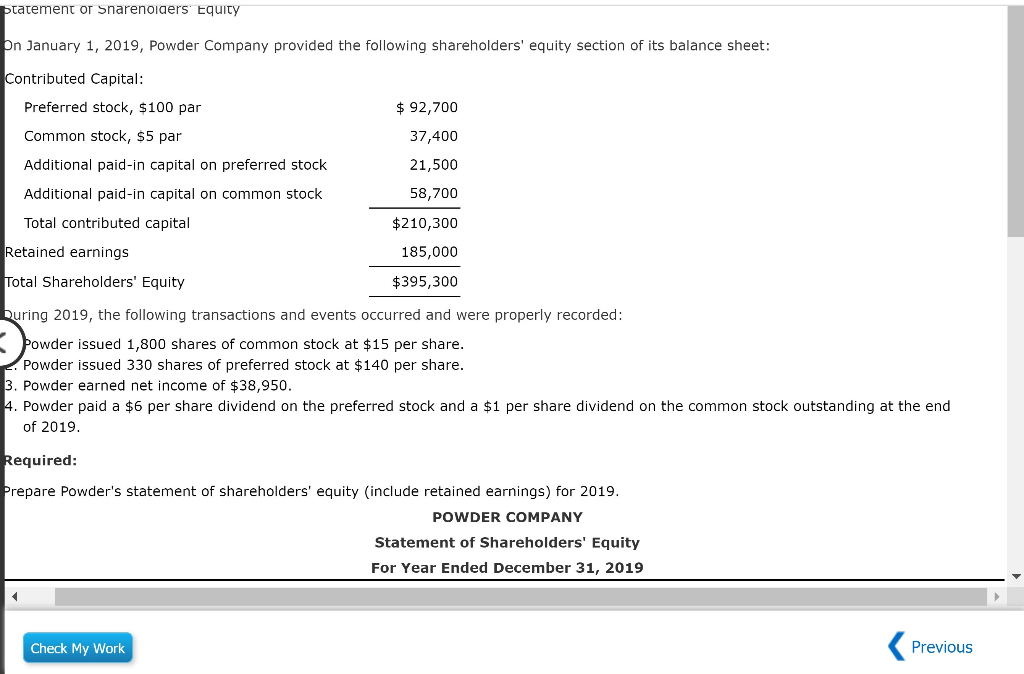

Statement of changes in shareholders equity balance sheet with imaginary figures. It explains the connection between a company’s income statement and balance sheet. The statement of changes in equity provides information about how the balances in share capital and retained earnings changed during the period. The statement of changes in equity reports the movement in shareholders’ equity of a company during a given financial period, such as a year.

Express differently, the statement of changes in equity reconciles the opening and closing balances of a company’s equity account of a specific accounting period. There are two types of changes in shareholders’ equity: A major objective of the accounting for shareholders' equity is the adequate disclosure of the sources from which the capital.

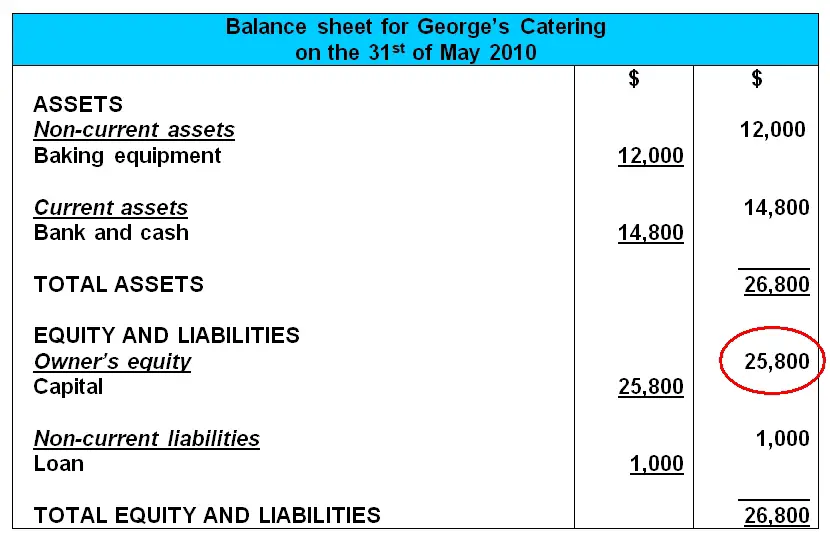

For details on capital increases/decreases, see the “equity” section. It captures the financial position of a company at a particular point in time. Share capital is a heading in the shareholders’ equity section of the balance sheet and represents how much shareholders have invested.

The statement of changes in equity highlights the changes during the period in the various components of shareholders' equity. Other reserves (see note 23) retained earnings. Gaap, details the change in owners’ equity over an accounting period by presenting the movement in reserves comprising the shareholders’ equity.

Therefore, it is included in a section of a company’s balance sheet and is an issuance of a financial document by businesses to indicate why and how of accounts. When shareholders buy shares, they are investing. Issued share capital, retained earnings and other components of equity.

Statement of changes in equity refers to the reconciliation of the opening and closing balances of equity in a company during a particular reporting period. Ending retained earnings = beginning retained earnings − dividends paid + net income this equation is necessary to use to find the profit before tax to use in the cash flow statement under operating activities when using the indirect method. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

It is a financial statement which summarises the transactions related to the shareholder’s equity over an accounting period. International accounting standards (ias) 1 suggests that shareholders' interests be subcategorised into three broad subdivisions: Equity attributable to shell plc shareholders.

It details the variations in retained earnings, dividends, share capital, and other factors contributing to the increases or decreases in the net book value of a company’s equity. Comprehensive income for the period — — 6,134. For information on dividend payments and capital transactions involving a change in ownership interest, see the “equity” section and the “key events” section.

The statement of changes in stockholders’ equity should distinguish equity attributable to the parent from equity attributable to noncontrolling interests. The general equation can be expressed as following: Share capital (see note 21) shares held in trust.

It also serves the purpose of reconciling the beginning and the ending balances of shareholders' equity, as shown in the statement of financial position. It provides transparency for investors to see changes in the cash flow specifically equity accounts and the activities that lead to such shift in the shareholder’s equity. A statement of changes in shareholders equity presents a summary of the changes in shareholders’ equity accounts over the reporting period.

:max_bytes(150000):strip_icc()/ScreenShot2021-05-03at11.03.30AM-985f846f70e347c69f0f288359e7beed.png)