Looking Good Info About Income Tax On Balance Sheet Virgin Airlines Financial Statements

Income tax payable on a balance sheet equals the total tax due to be paid to government tax agencies within 12 months.

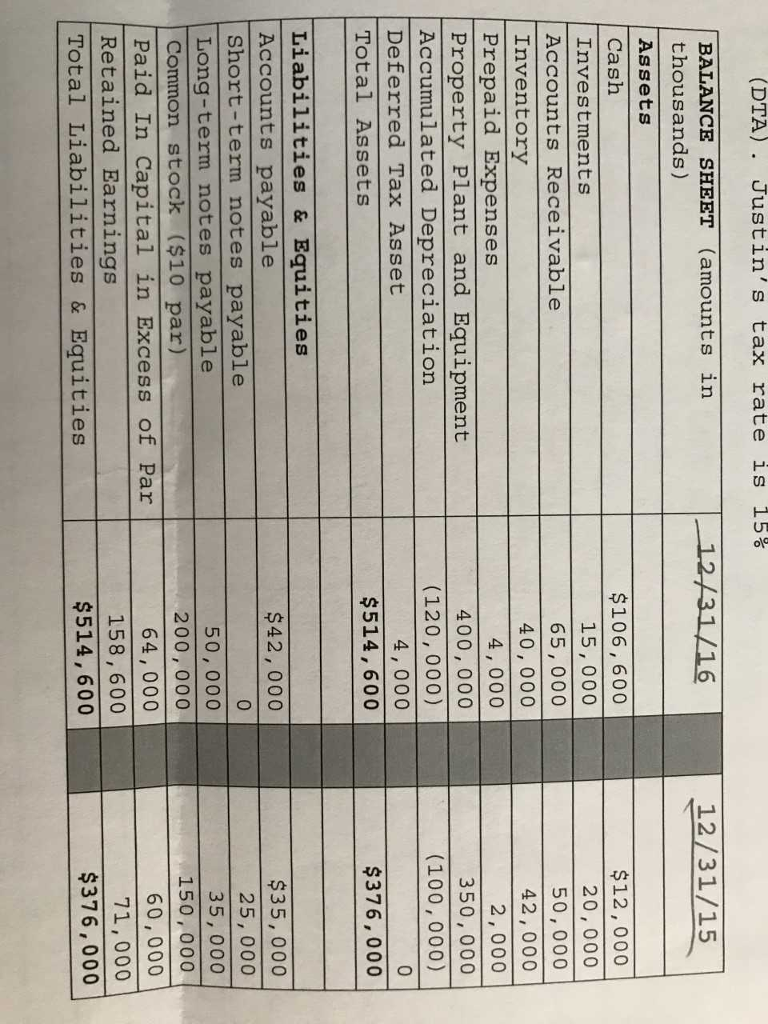

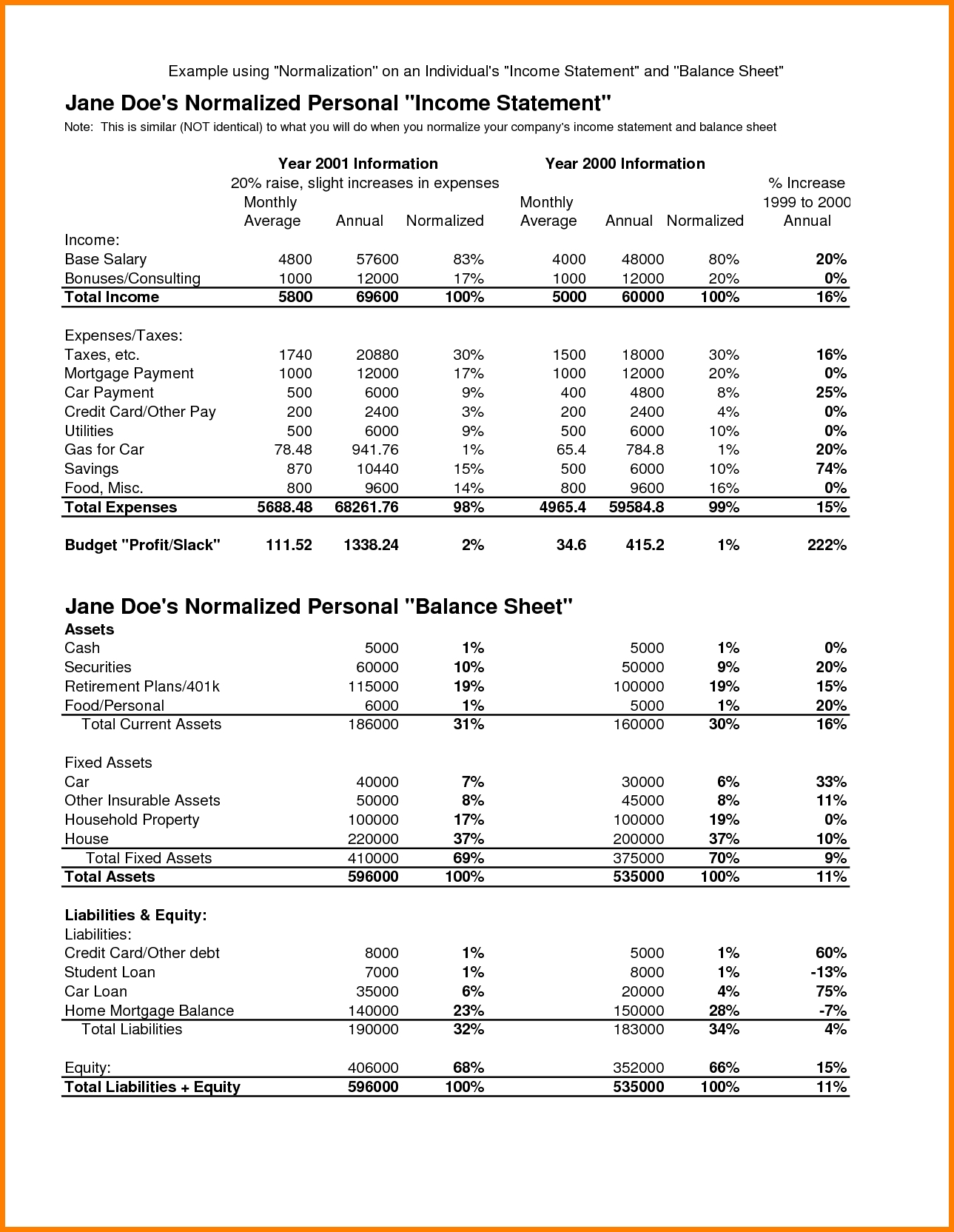

Income tax on balance sheet. A deferred income tax is a liability recorded on the balance sheet that results from a difference in income recognition between tax laws and accounting methods. 15 points for preparation income tax return: For example, if you have a mortgage on your balance sheet but no interest expenses, the irs might treat that as a red flag that the reporting is inconsistent.

Since businesses operate using the facilities provided by the government. Deferred tax liability is a liability that is due in the future. It is the amount firms have to pay to the government as part of their earnings.

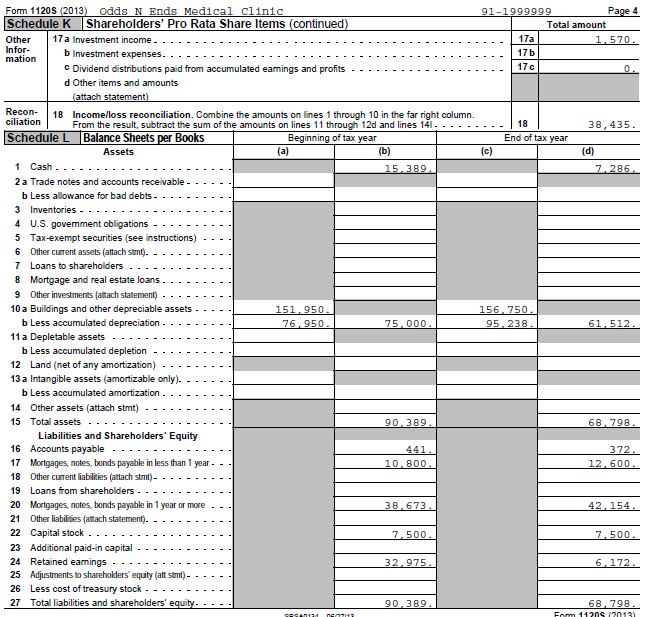

Balance sheet and profit and loss; It’s being used as an additional step of verifying the income and tax deductions you present. Proper filing of income tax return require proper maintenance of records.

Income tax return : Until it is paid, it remains as a liability. Why does the irs require a balance sheet if it doesn’t affect your income tax liability?

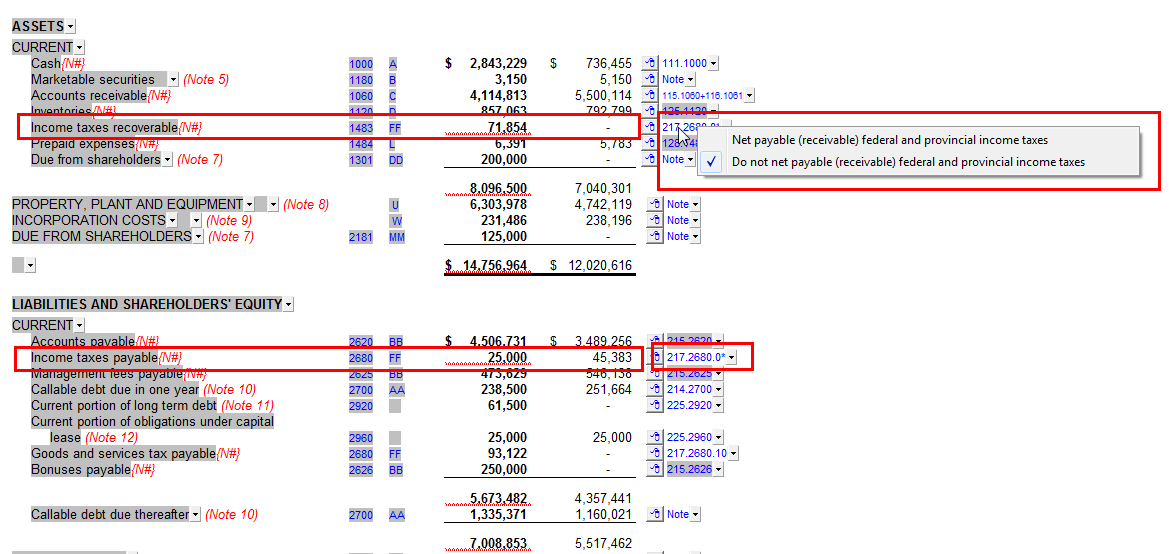

How to calculate income tax payable on the balance sheet As stated under ias 12.46, current tax liabilities are measured at the amount expected to be paid to taxation authorities, using the rates/laws that have been enacted or substantively enacted by the balance sheet date. Income taxes payable (a current liability on the balance sheet) for the amount of income taxes owed to the various governments as of the date of the balance sheet if a corporation has overpaid its income taxes and is entitled to a refund, the amount will be reported on the balance sheet as a current asset such as other receivables.

Deferred income tax: Income tax payable on a company’s balance sheet falls under the current liabilities portion of the balance sheet. Making of balance sheet and profit loss is utmost important.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)