Build A Tips About Interest Revenue On Balance Sheet Half Year Audit

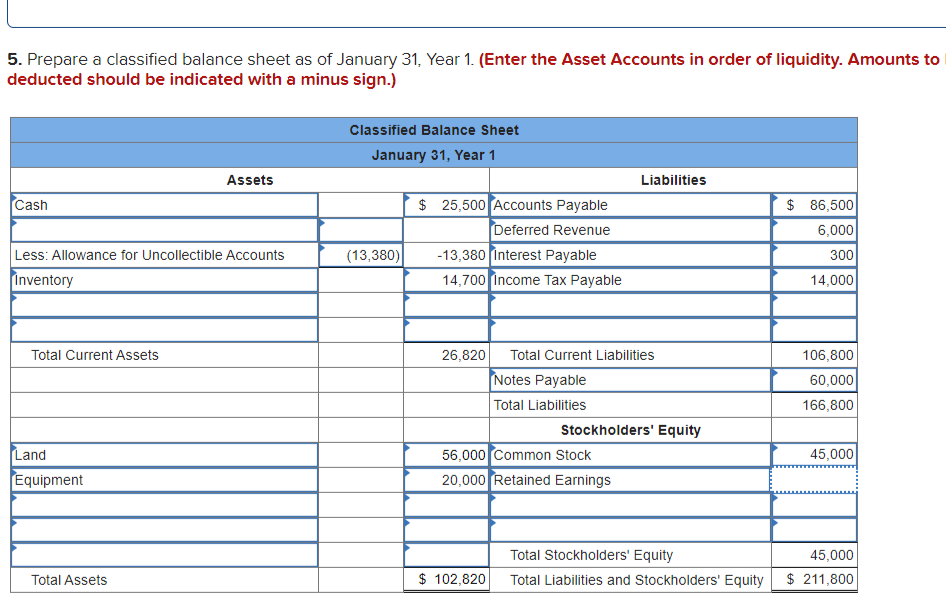

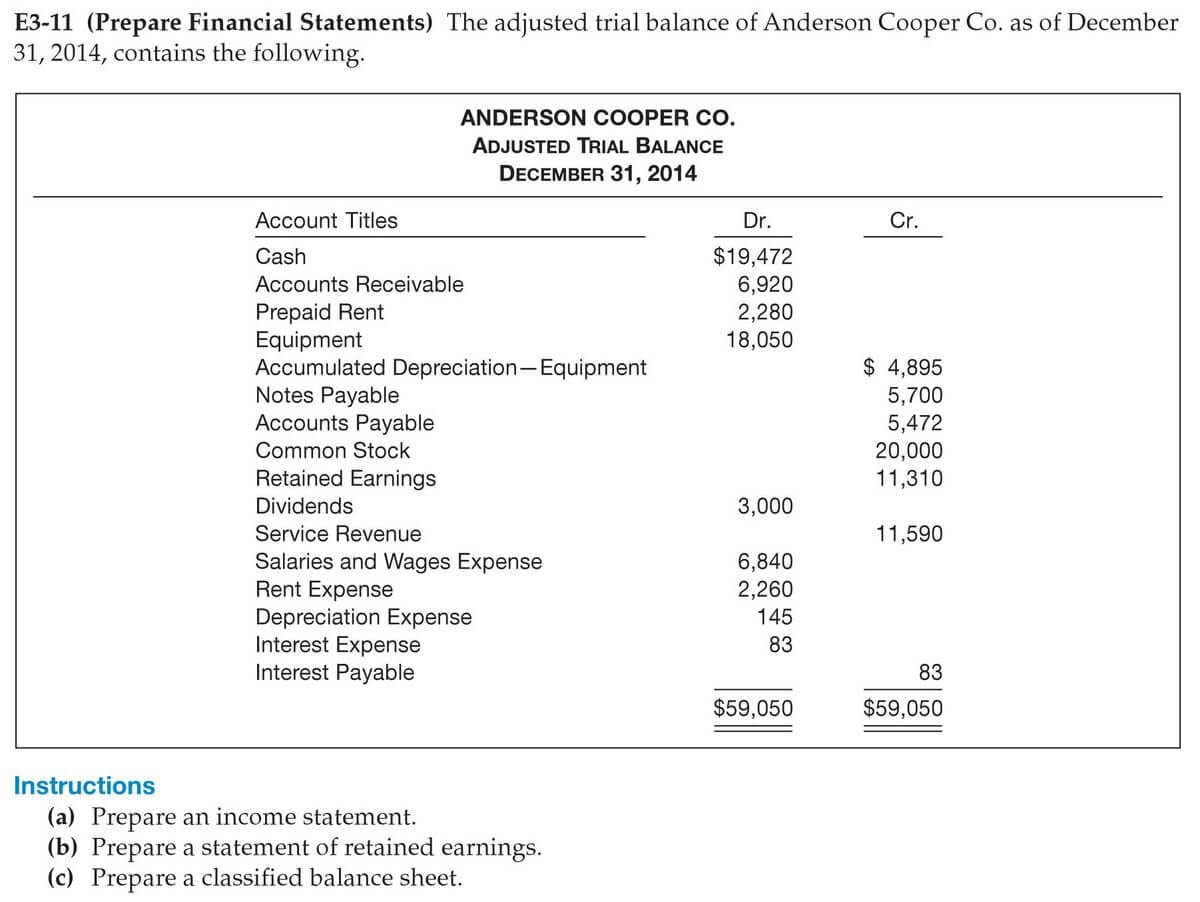

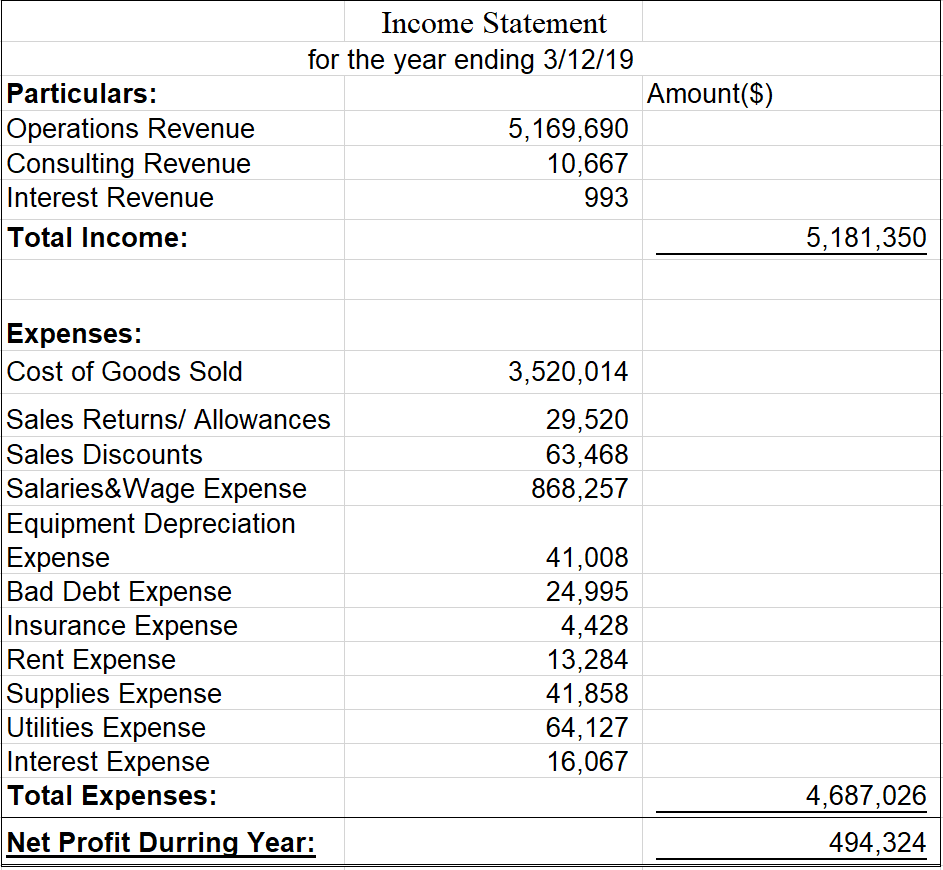

Impact on the financial statements:

Interest revenue on balance sheet. The committee decided not to add the issue to its agenda, which states that the ias 1.82 (a) line item must include, and include only, interest revenue calculated. Interest revenues definition under the accrual basis of accounting, the interest revenues account reports the interest earned by a company during the time period indicated in the. Where is accrued income reported in the balance sheet?

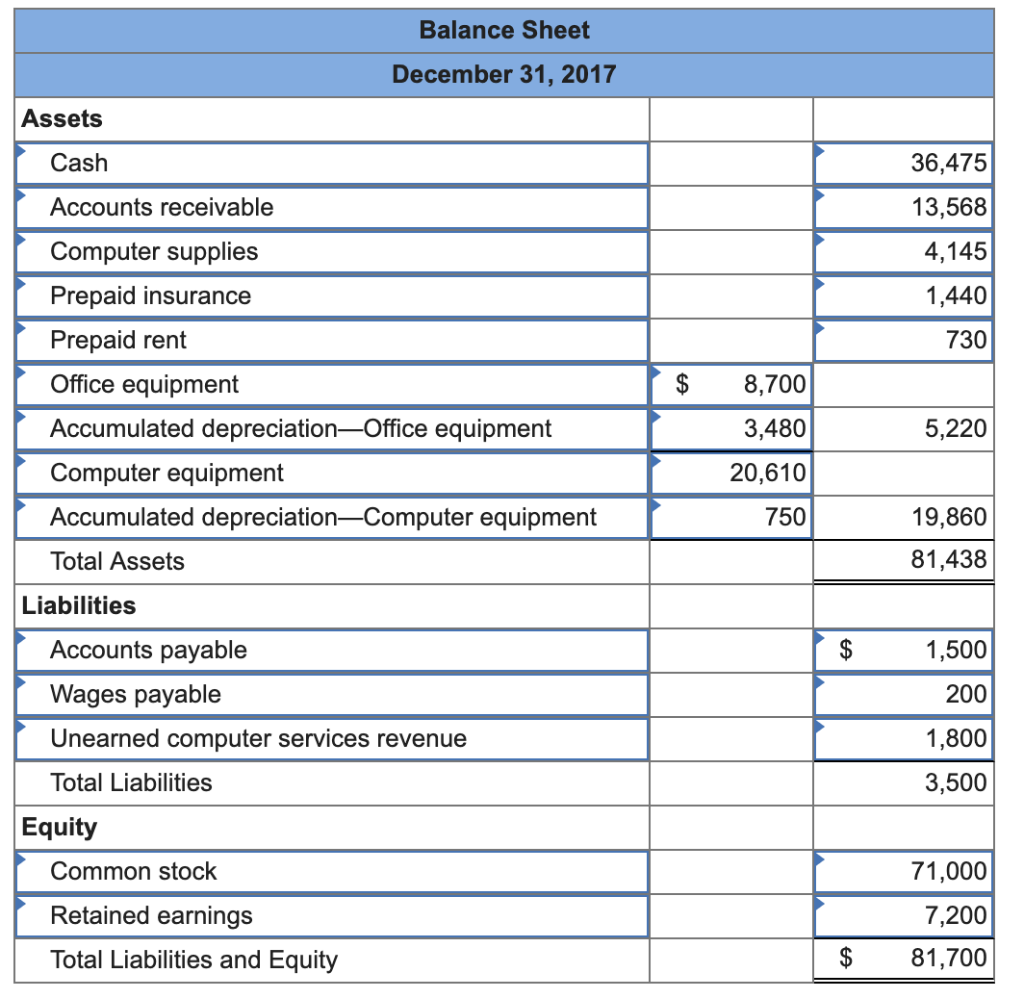

Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable. This financial statement is used. Revenue normally appears at the top of the income statement.however, it also has an impact on the balance sheet.

Interest receivable, on the other hand, is a balance sheet item that represents the amount of interest due to an entity from a third party. It is made up of credit lines and loans that the institution has on its. It reflects the interest income a business has earned but for which a customer or debtor.

It is presented on the organization’s income statement, showing the interest earned for the reporting period in question. Interest revenue has a different meaning depending on whether the accrual basis or cash basis of accounting is used. An income statement, or profit and loss.

Interest receivable is an asset account and will increase total assets by $140 on the balance sheet. Examples of the effect of revenue on the balance sheet examples of revenue include the sales of merchandise, service fee revenue, subscription revenue, advertising revenue,. When company b pays the interest at the end of the year, company a will then record a decrease in “interest receivable” and an increase in its cash account on the balance.

Your sales revenue formula is more directly relevant to your income statement than to your balance sheet. Under the accrual method, all accumulated. If a firm has to pay interest associated with a business debt account, this figure is also registered on the balance sheet.

Accrued income refers to amounts that have been earned, but the amounts have not yet. Interest revenue is the earnings that an entity receives from any investments it makes, or on debt it owns. Total interest earned was $57.5 billion for the bank from loans, all investments, and cash positions.

As long as it can be reasonably expected to be paid within a year, interest receivable is generally recorded as a current asset on the balance sheet. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. When this adjustment is made, the solvency analysis of rily's balance sheet reveals that the company is unable to fund net interest expenses from its core operating.

Net interest income totaled $44.6 billion and is the. As of september 30, 2023: Add “interest payable,” which is the.

A balance sheet provides a snapshot of a company’s financial performance at a given point in time. Current forecasts for 2024, before taking into account future balance sheet initiatives, indicate that first quantum could breach the prevailing net debt to ebitda ratio. A typical balance sheet consists of the core accounting equation, assets equal liabilities plus equity.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)