Formidable Tips About Loan Balance Sheet Profit & Loss

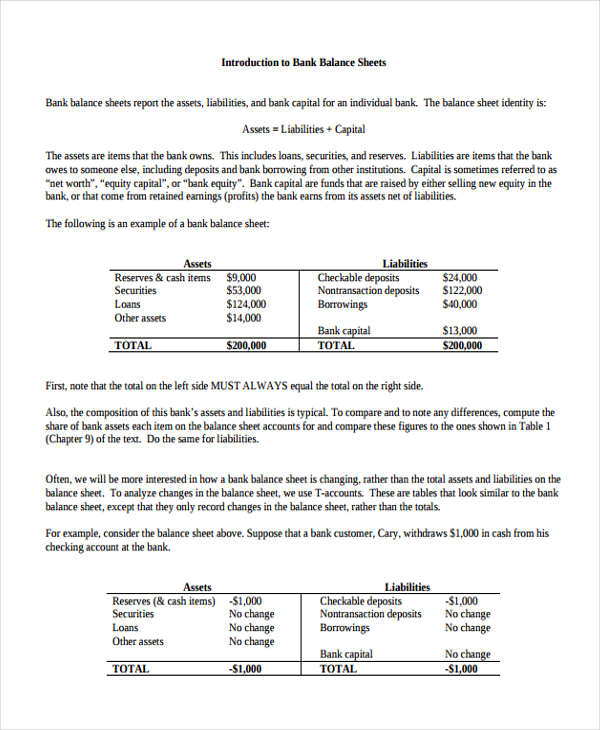

Different standards under ias dictate measurement, recognition, and disclosure of varying assets and liabilities of the balance sheet.

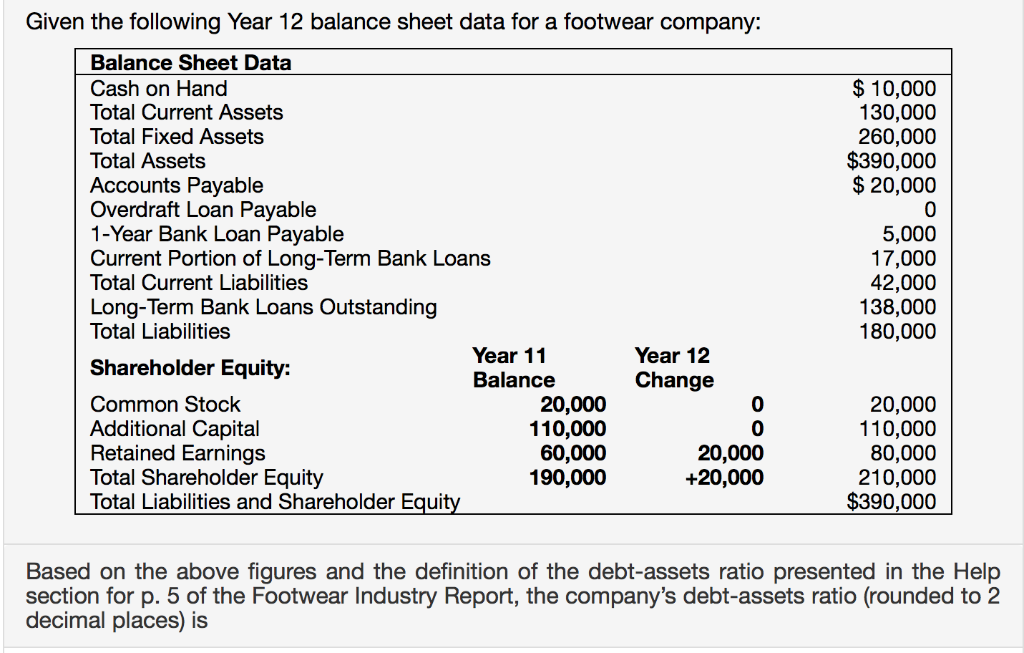

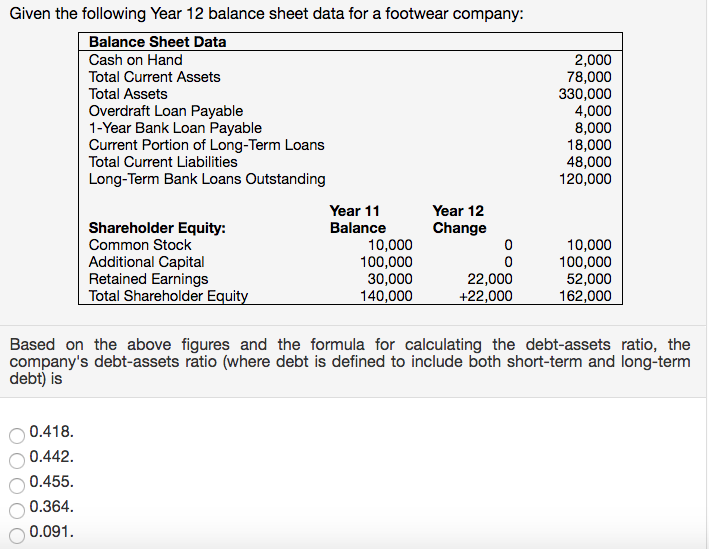

Loan balance sheet. The balance sheet reports two major categories or classifications of liabilities: See fsp 8.3 for additional information on the presentation of loans and receivables, including the presentation of loans from officers, employees, or. For example, assume you have a loan due on december 28.

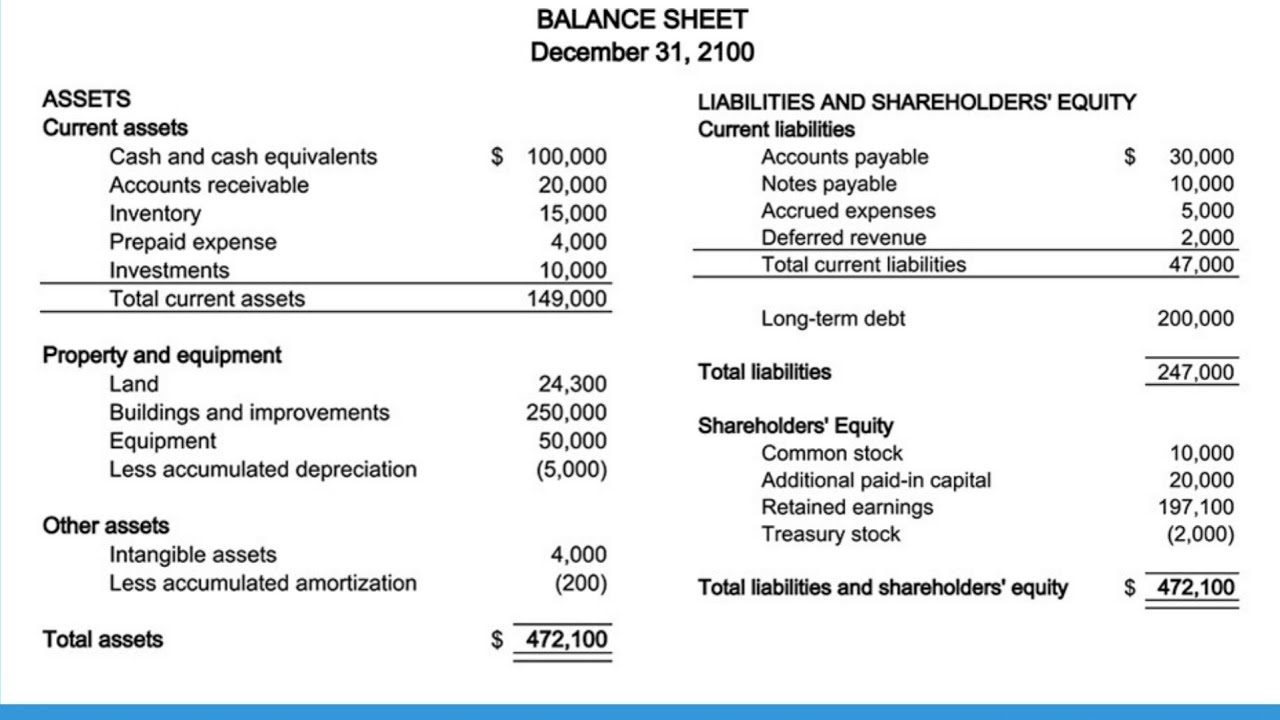

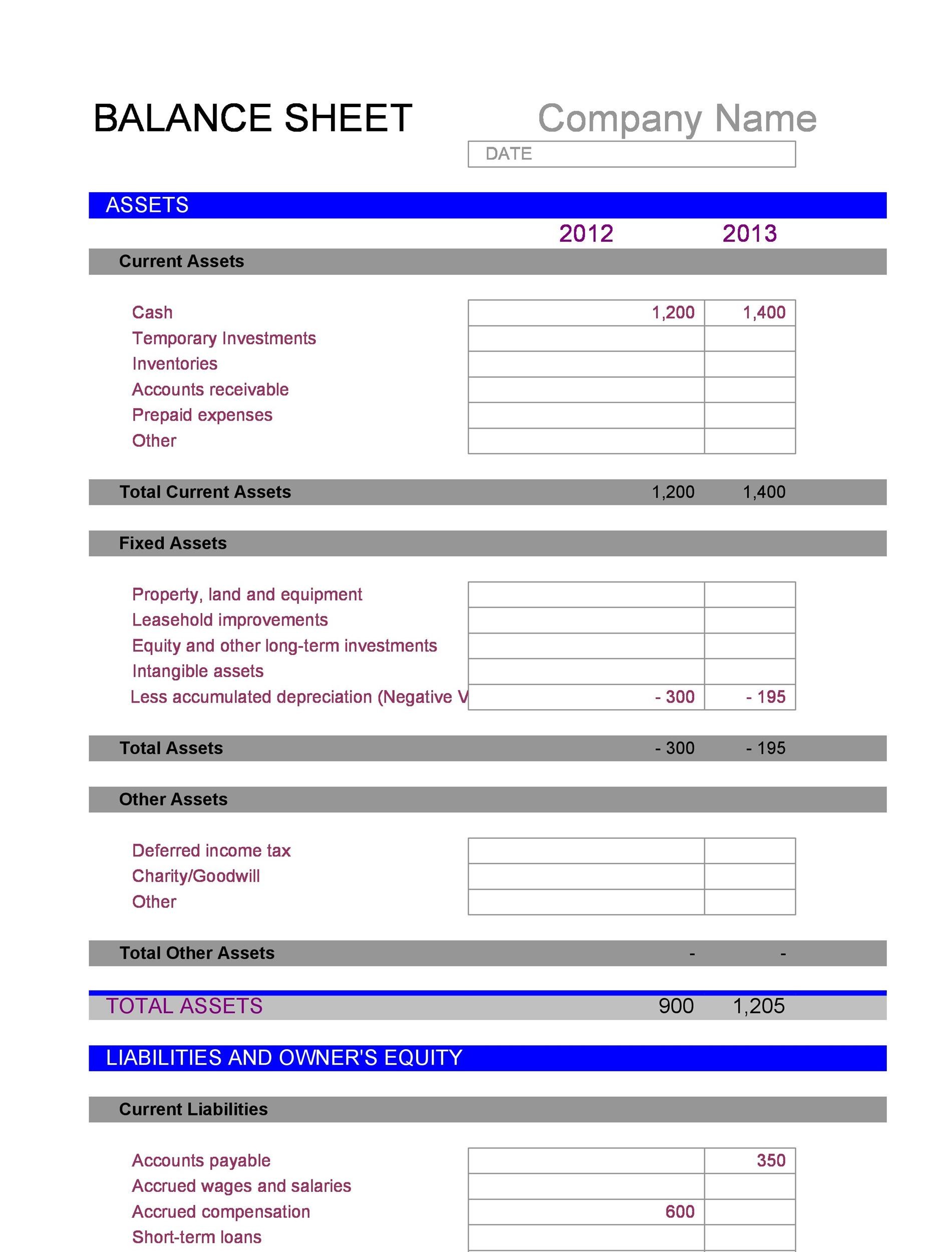

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. A balance sheet provides a summary of a business at a given point in time. Wed, february 21, 2024, 10:47 am est · 3 min read.

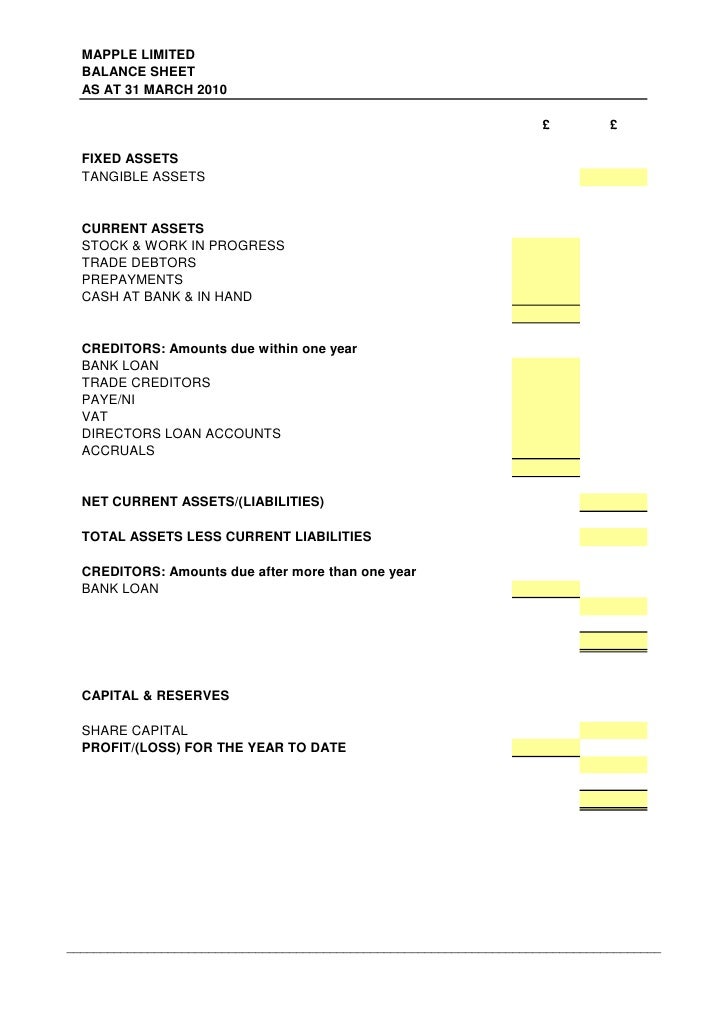

Learn what a balance sheet should include and how to create your own. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. For example, if a loan is expected to mature in less than 12 months and cannot be refinanced, then it might be classified.

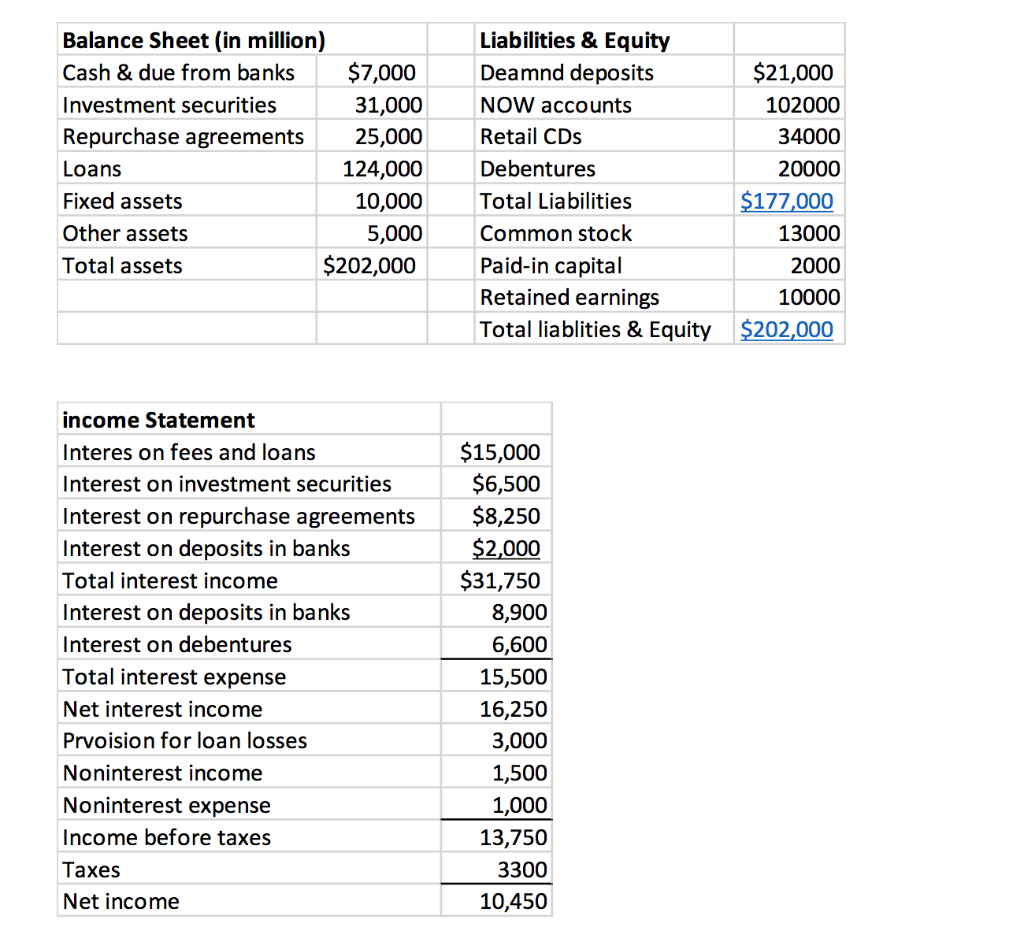

The debt financing is further segregated into bank loans, bonds. Common examples of these types of financings are mortgages and lease liabilities. Then, the number of payments is in cell b3 and loan amount in cell b4.

Assets = liabilities + owners’ equity. The balance sheet equation. Balance sheets are typically organized according to the following formula:

When you make that loan payment, you pay interest up to december 28. It can also be referred to as a statement of net worth or a statement of financial position. List the current portion of the loan payable and any accrued interest expense under the current liabilities section of.

The principal sum and the interest charges. Have you heard of balance sheet lending? 1 when to recognise a loan a loan is recognised on the balance sheet when the entity becomes party to a loan agreement.

Local job markets give hope that loan growth can remain at a decent level. A business can prepare the balance sheet in several ways, but. The loan balance sheet represents your loan balance, which depends on two key elements:

=pmt (b2/12,b3,b4) as you see here, the interest rate is in cell b2 and we divide that by 12 to obtain the monthly interest. Assets have declined by about $1.3 trillion since june 2022. Balance sheets serve two very different purposes depending on the audience reviewing them.

The report can be used by business owners, investors, creditors, and shareholders. Loan payables to be recognized in the balance sheets as at 30 june 20x1, 30 june 20x2 and 30 june 20x3. It is a financial arrangement where a lender provides funds to a borrower based on the value of the borrower’s assets and the strength of their overall financial position.