Ace Tips About Accounts Payable Turnover Ratio Interpretation Sample Balance Sheet Excel Normal Profits

Download our free templates and follow us.

Accounts payable turnover ratio interpretation sample balance sheet excel. In this step, the accounts payable turnover ratio should be calculated by. Top excel templates for accounting try smartsheet for free by andy marker | december 29, 2015 in this article, you’ll find the most comprehensive list of free,. Learning how to calculate your accounts payable turnover ratio is also important, but the metric is useless if you don’t know how to interpret the results.

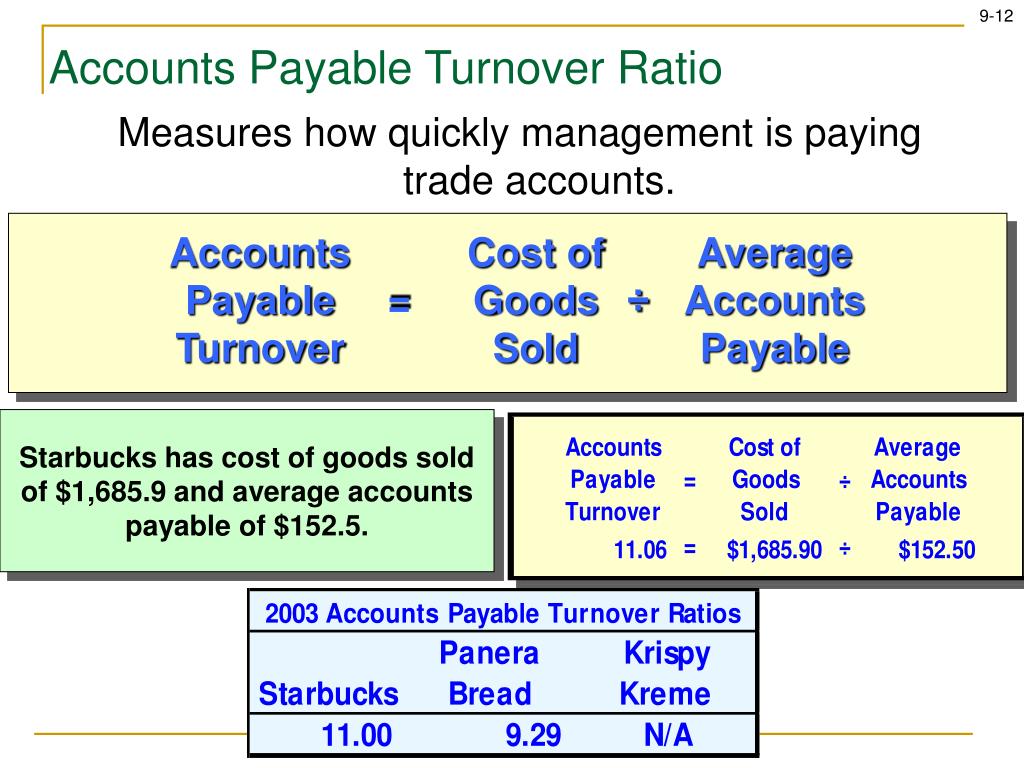

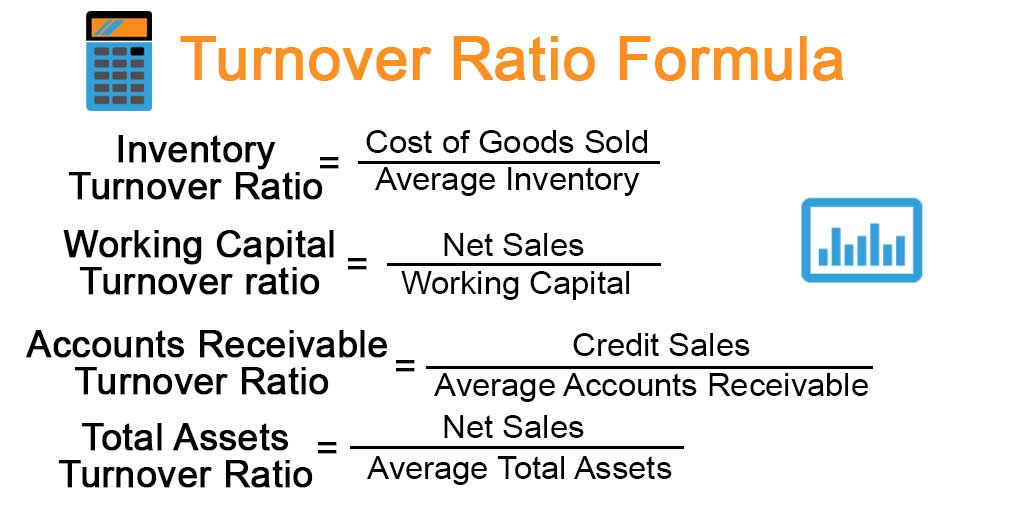

In some cases, cost of goods sold (cogs) is used in the numerator in place of net credit. The article will show you how to do ratio analysis in excel sheet format.

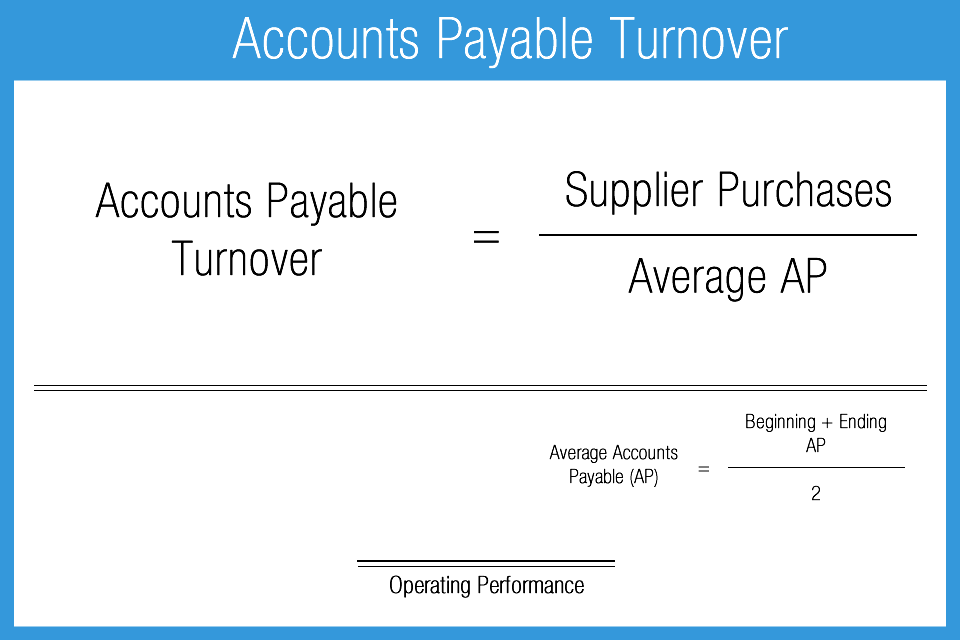

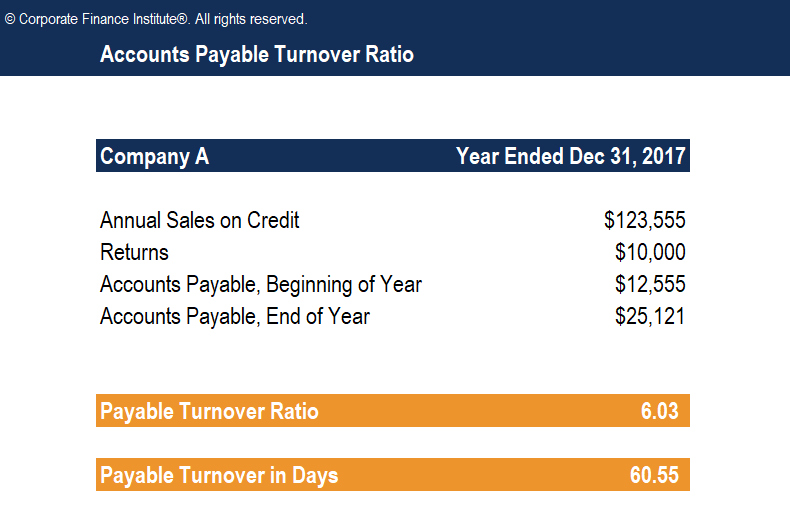

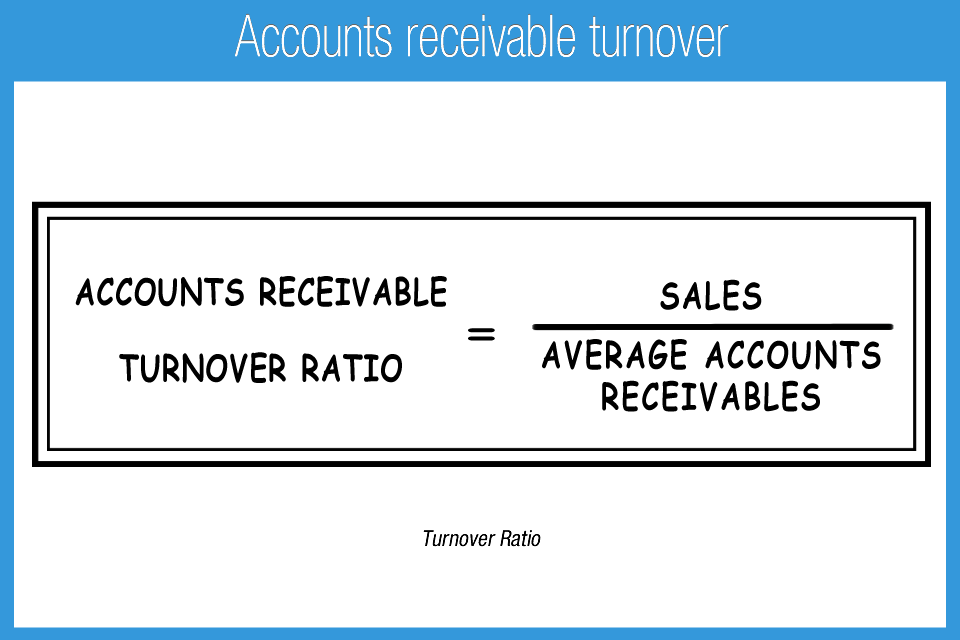

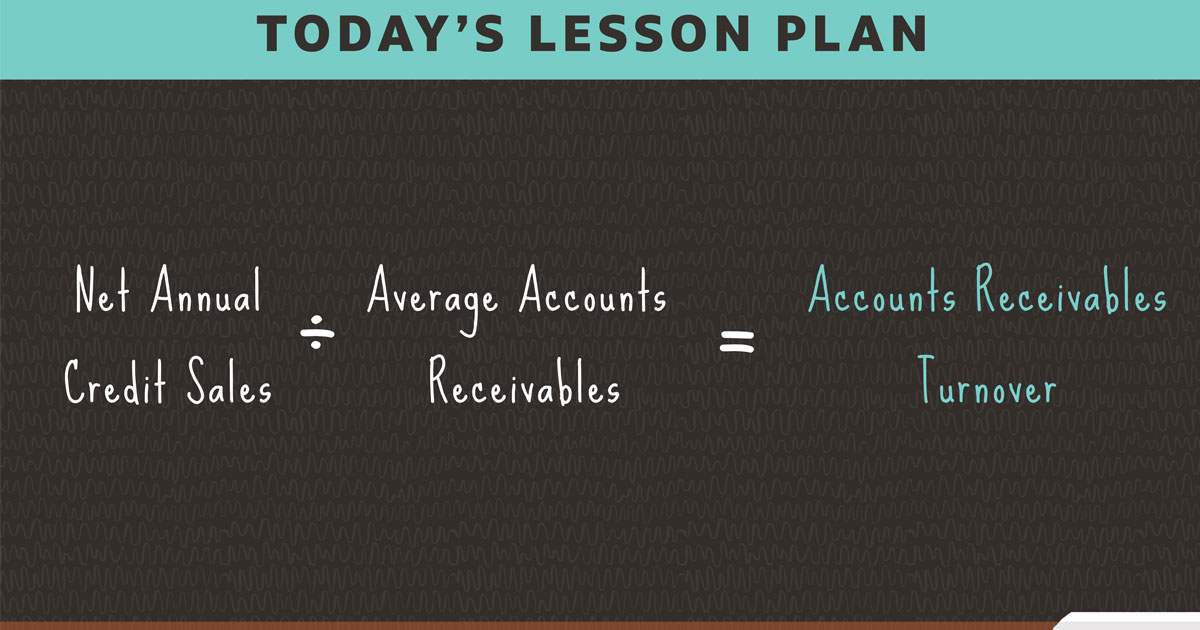

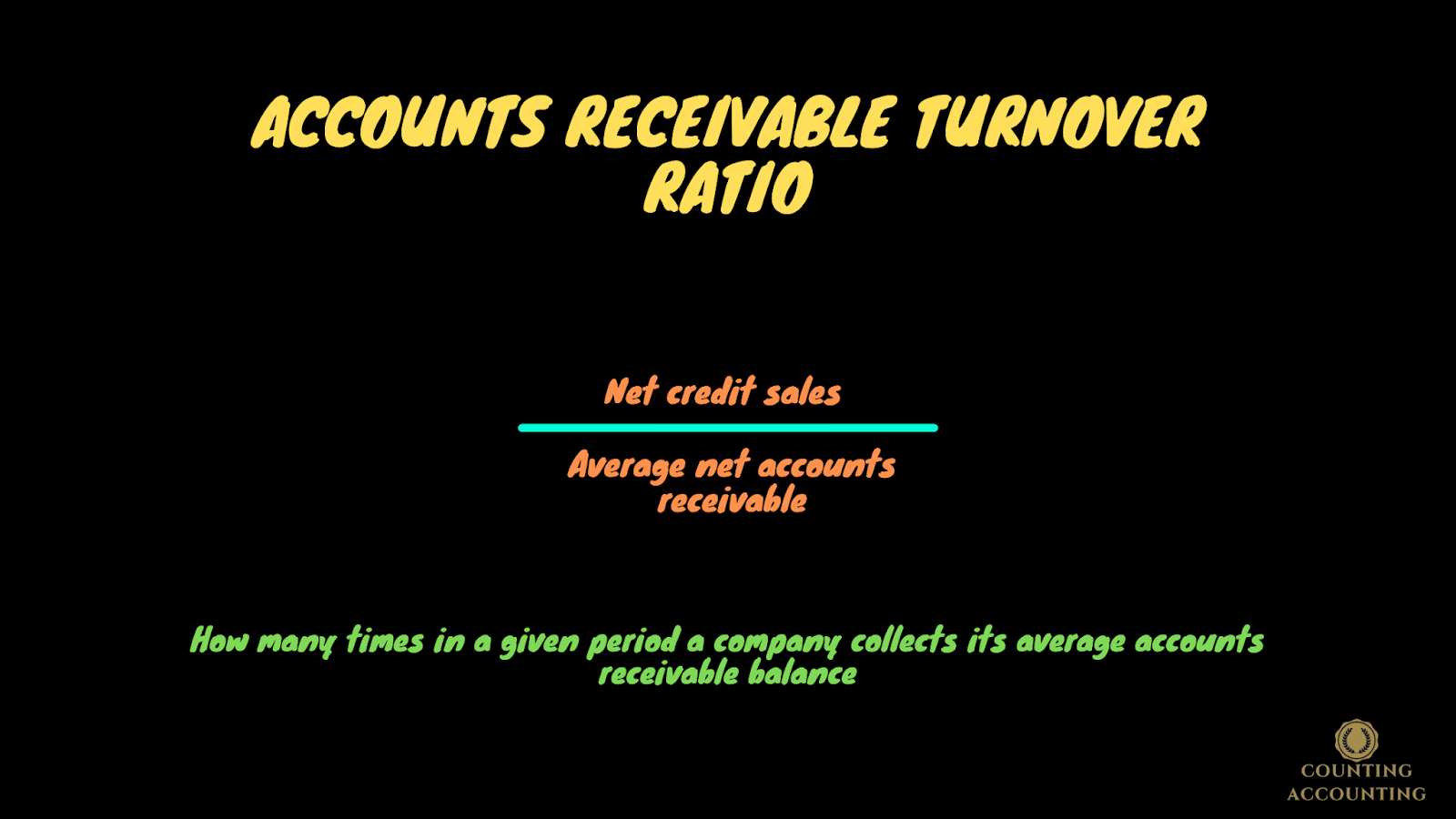

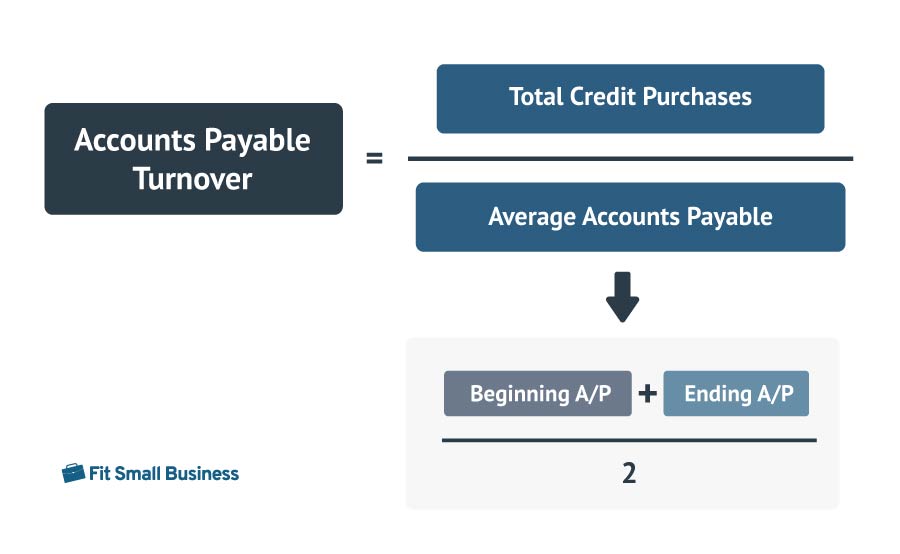

Accounts payable turnover ratio = supplier credit purchases / average. Accounts payable turnover ratio formula. The accounts payable turnover ratio is a liquidity ratio that shows a company’s ability to pay off its accounts payable by comparing net credit purchases to the average.

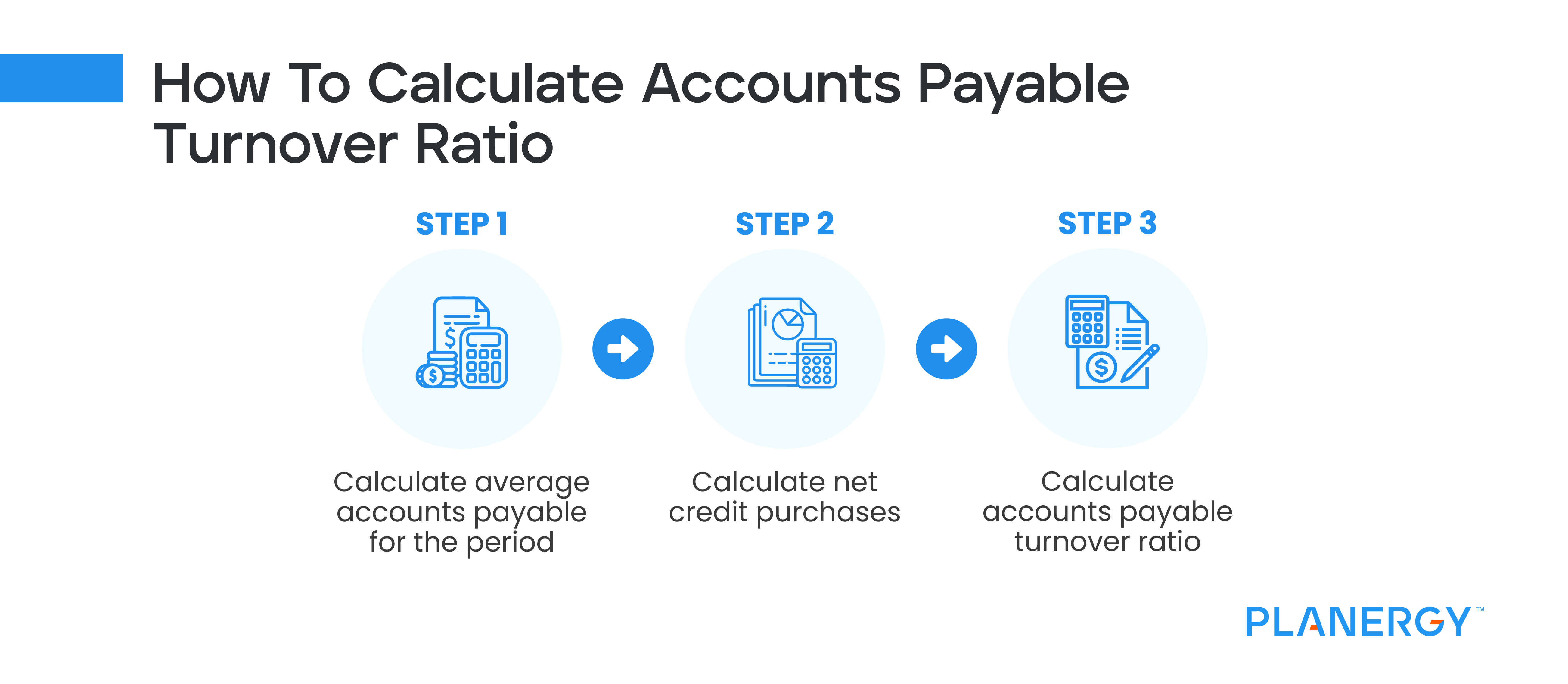

Average accounts payable = opening accounts payable + closing accounts payable /2. The payable turnover ratio is. A company totals $20 million in purchases in 2021.

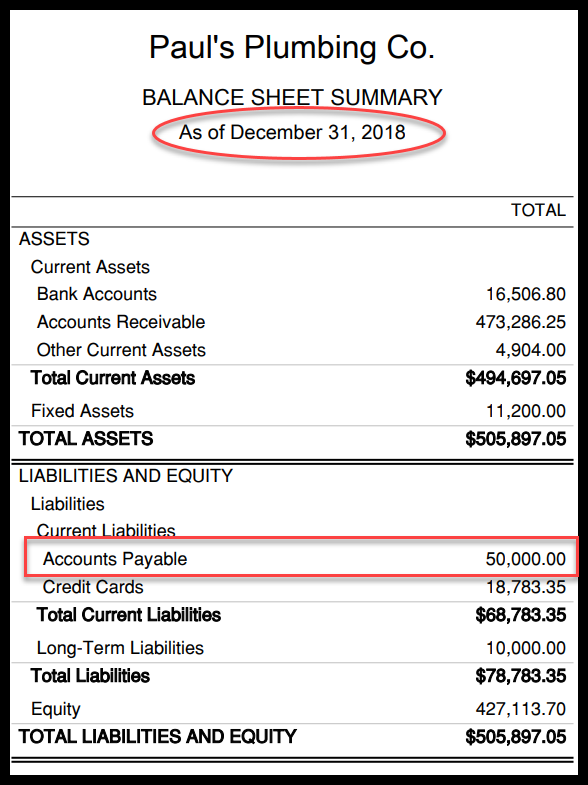

Example of the accounts payable turnover ratio the controller of abc company wants to determine the company's accounts payable turnover for the past. The company’s balance sheet presents accounts payable of $4 million in 2020 and $5 million in 2021. Definition balance sheet ratios are the ratios that analyze the company’s balance sheet which indicate how good the company’s condition in the market.

Payables turnover ratio = supplier credit purchases ÷ average accounts payable in short, the a/p turnover answers: The formula for the accounts payable turnover ratio is as follows: Accounts payable turnover ratio = code 2110 / (code 1520beginning + code 1520end) * 0.5.

The numerator is sourced from the income statement, while the denominator comes. We will also understand how to calculate t. Example of the accounts payable turnover ratio.

The accounts payable turnover ratio. Take a look at the following example. The accounts payable turnover ratio is (net credit purchases) / (average accounts payable).

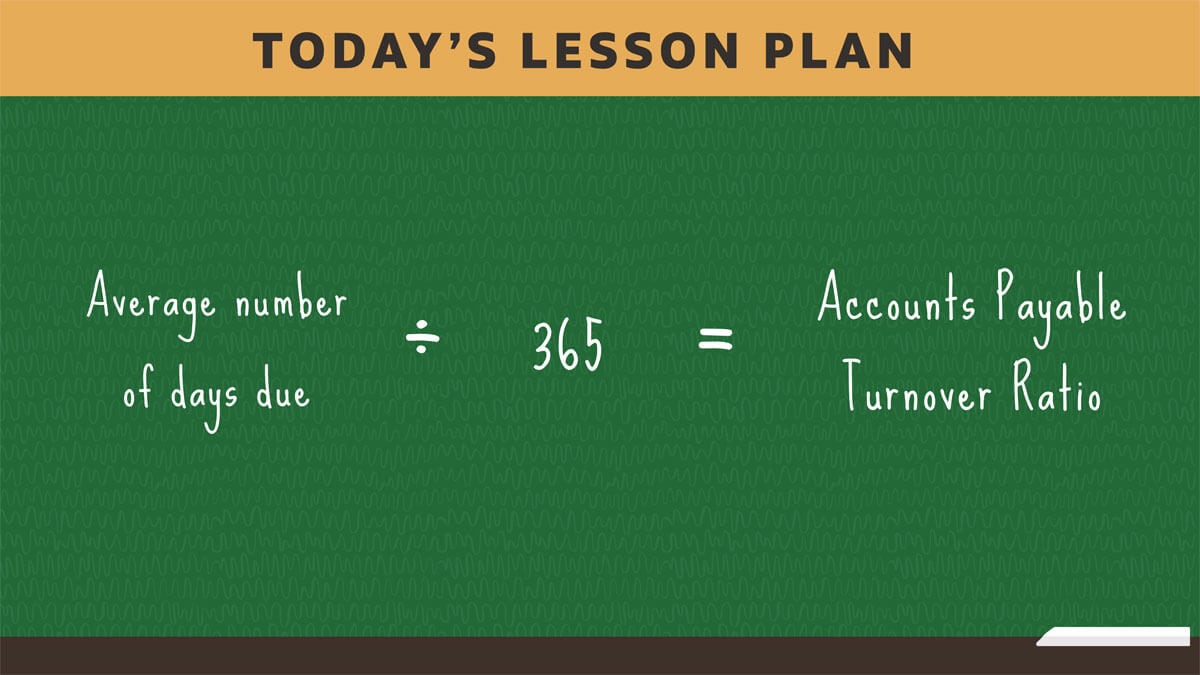

Let’s consider an example to illustrate the aptr calculation and interpretation: Accounts payable turnover in days = 365 / 1.46.

:max_bytes(150000):strip_icc()/Accountspayableturnoverratio_final-d17fff78f8f24fc9bb4b1fd8697d41f7.png)