Painstaking Lessons Of Tips About Business Plan Financial Projections Balance Sheet Layout Where Is Profit And Loss Posted In A

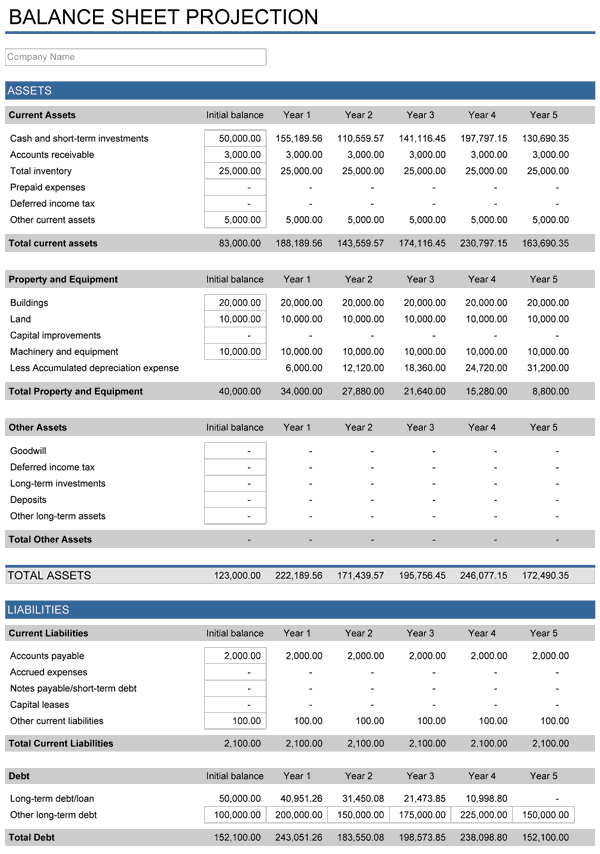

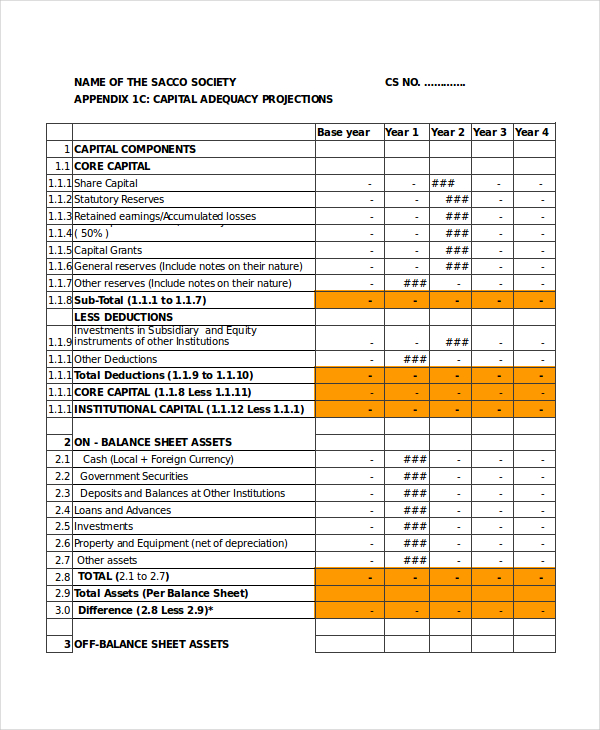

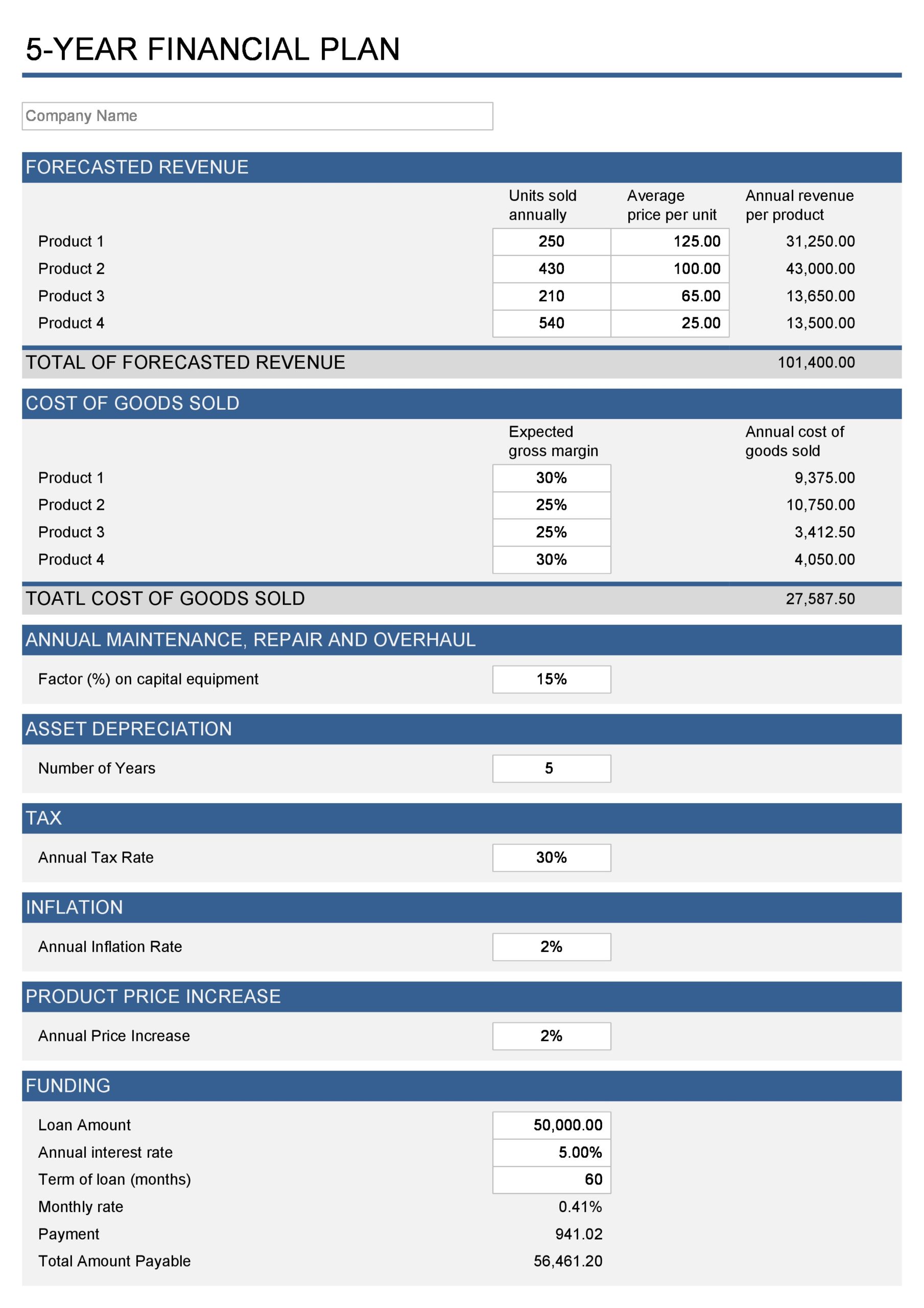

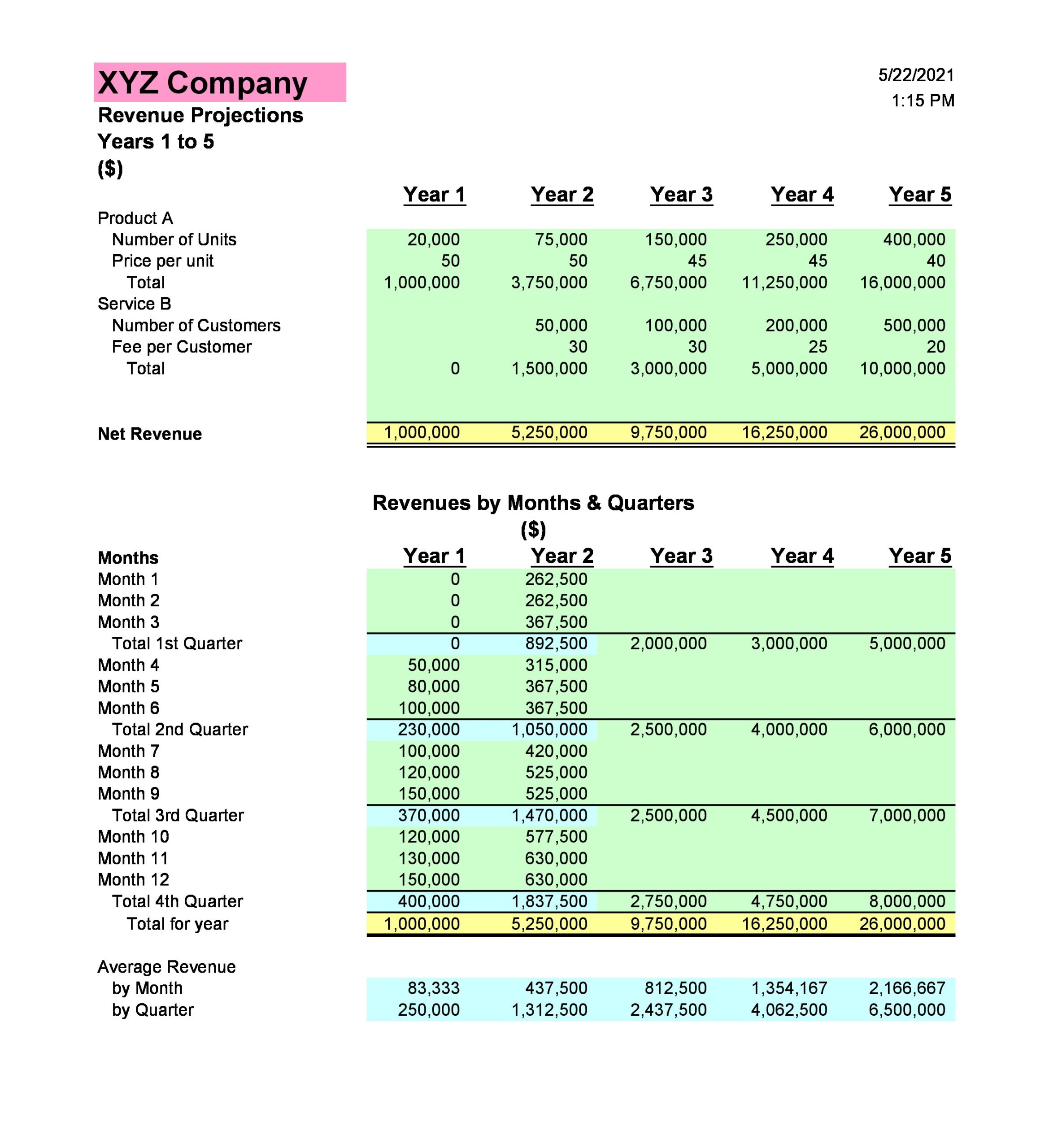

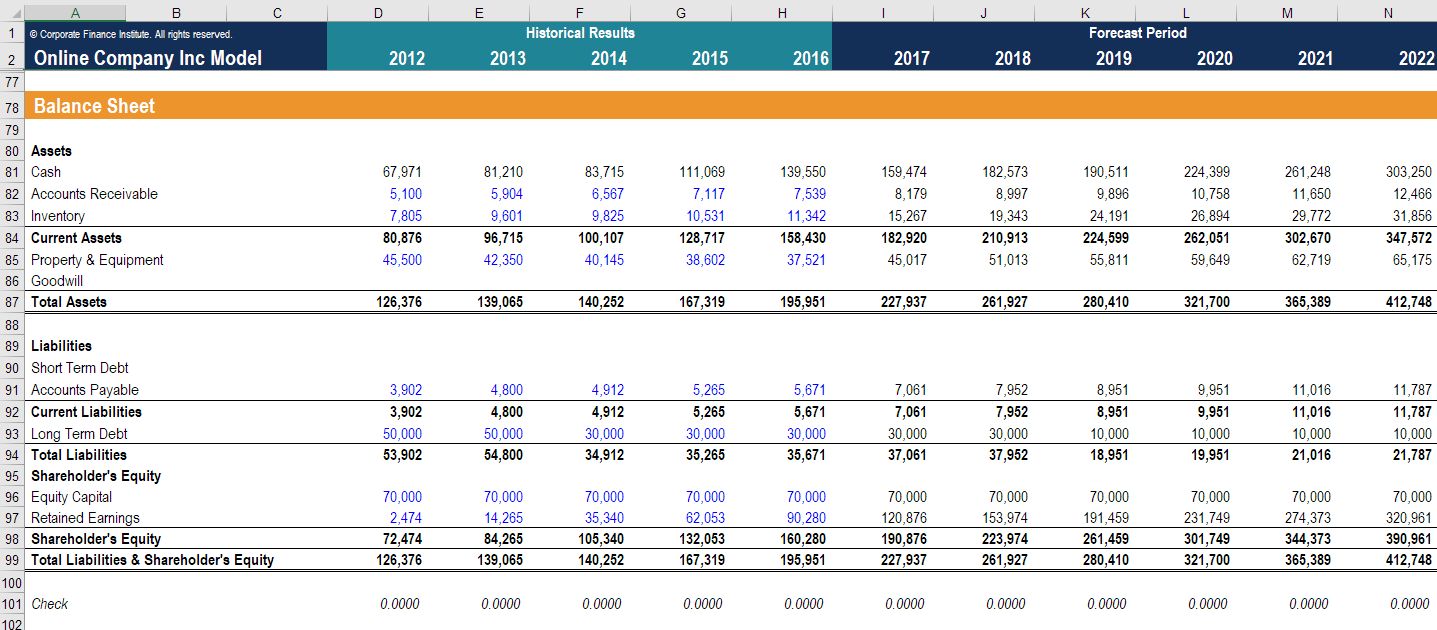

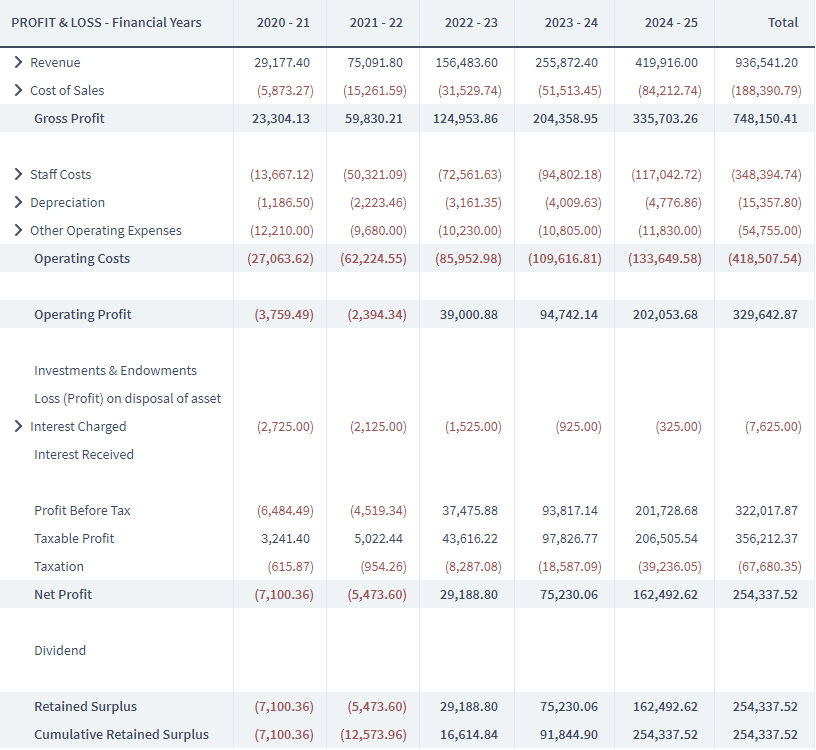

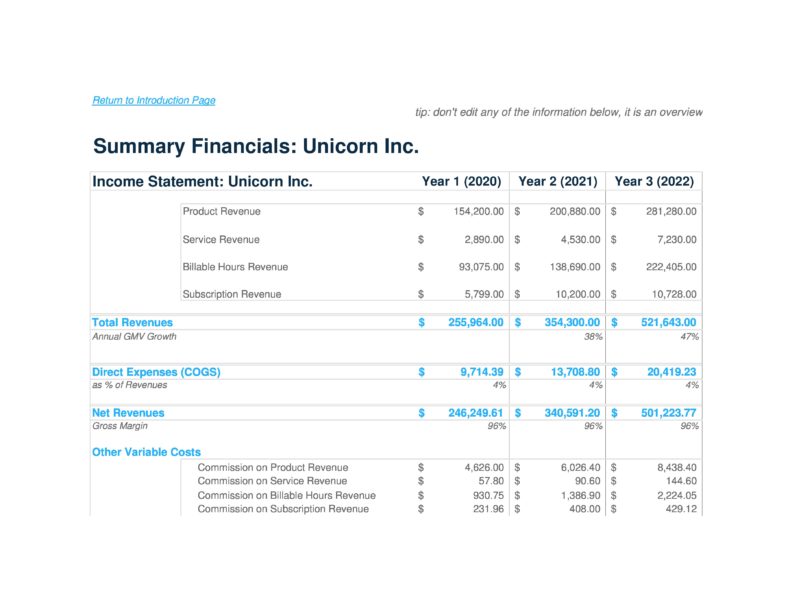

To them, the heart of your business plan is represented by the financial projections which must include income statements, balance sheets, and cash flow statements.

Business plan financial projections balance sheet layout. The balance sheet in the business plan financial projections outlines the capital structure of the company. Use the current totals in your balance sheet when making your financial projections, in doing so, you will make better predictions on where your business will be a few years in the future. These statements must convince your backers of two very important details:

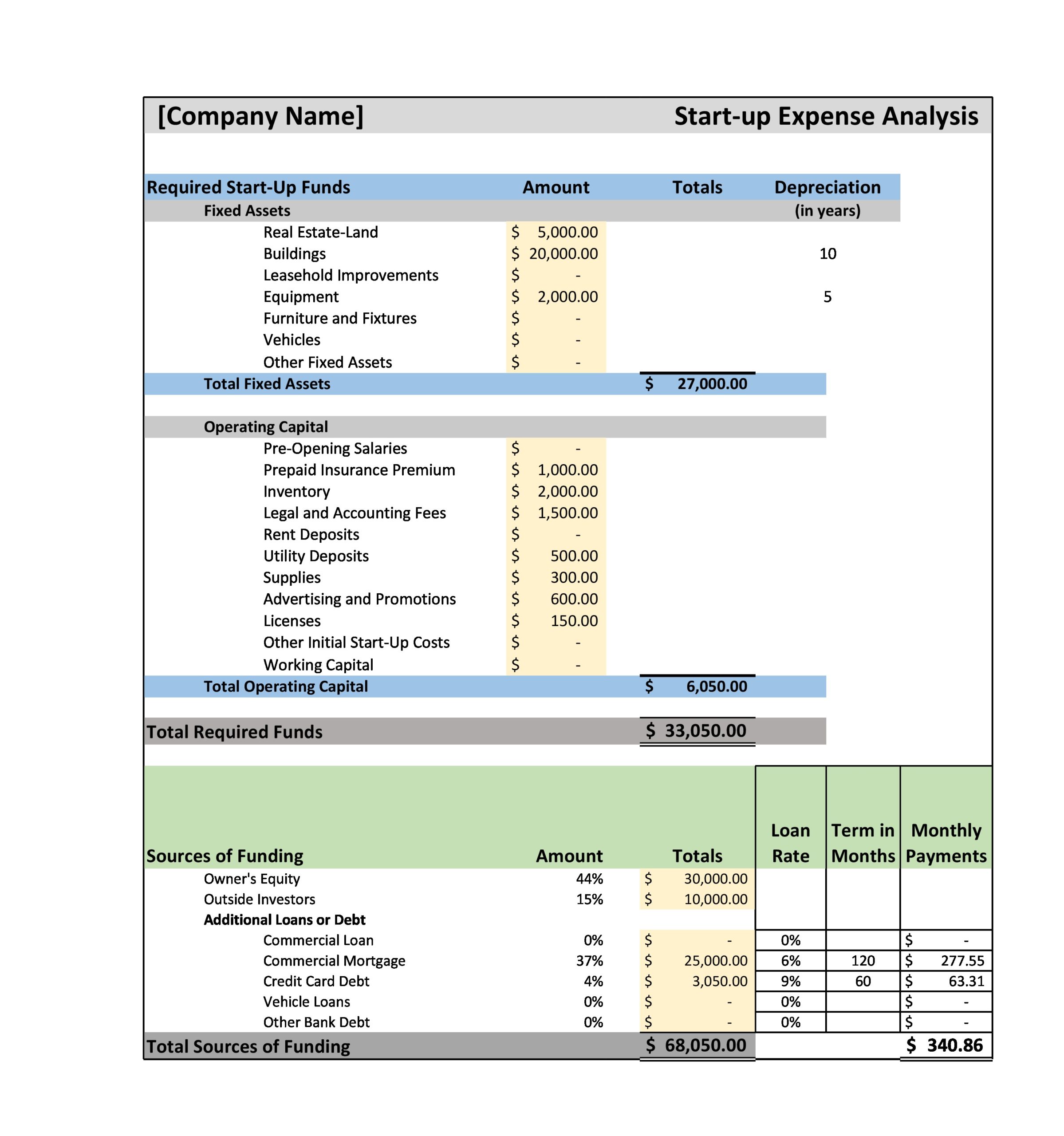

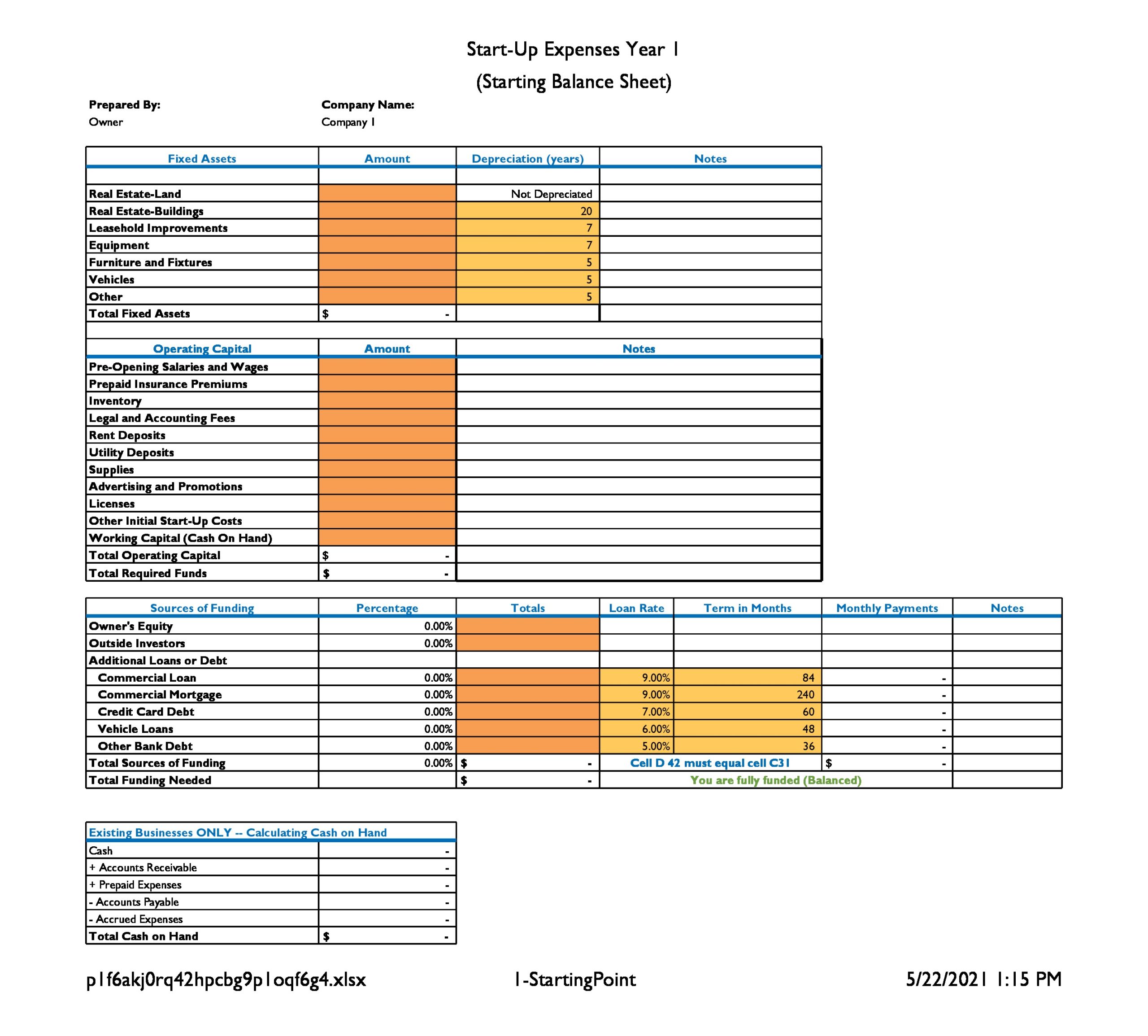

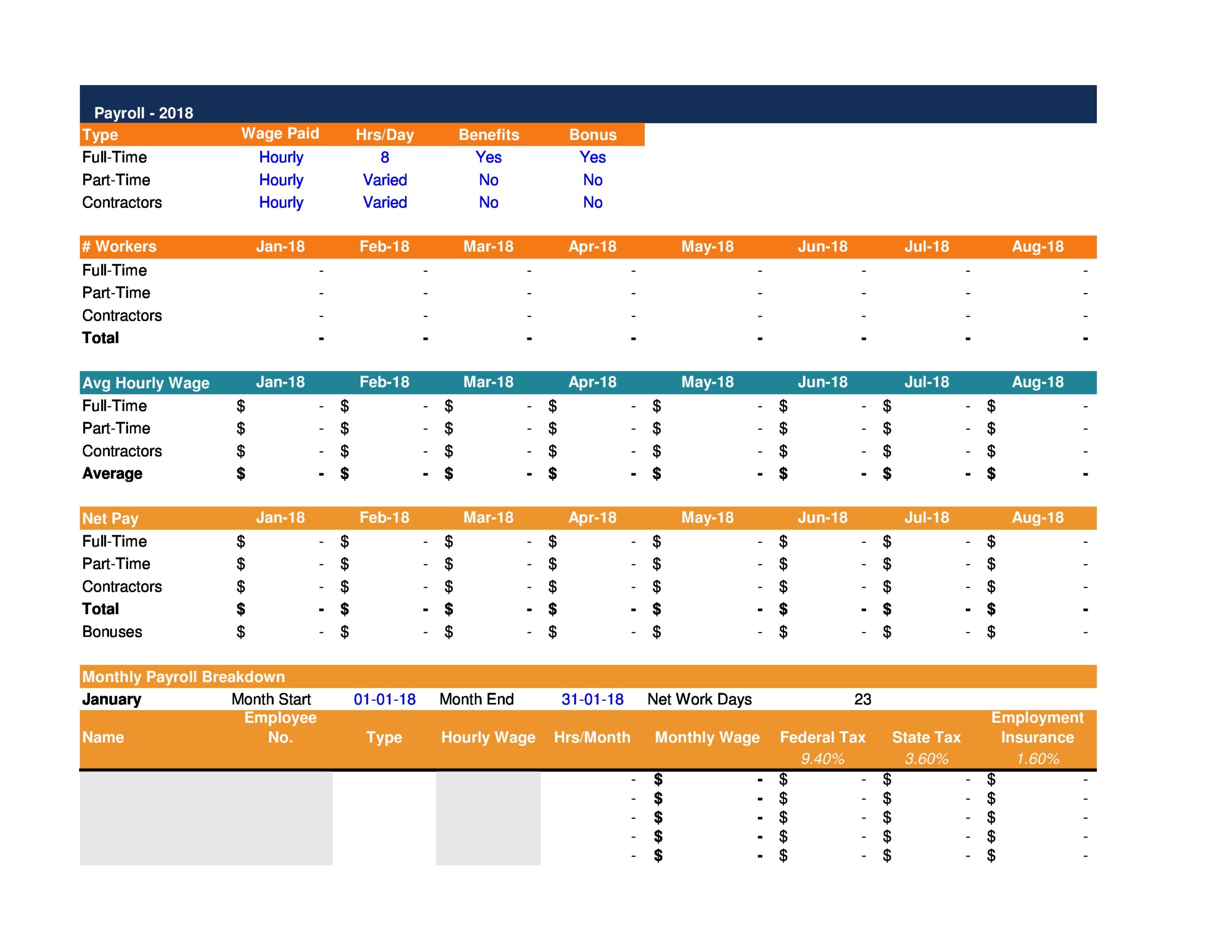

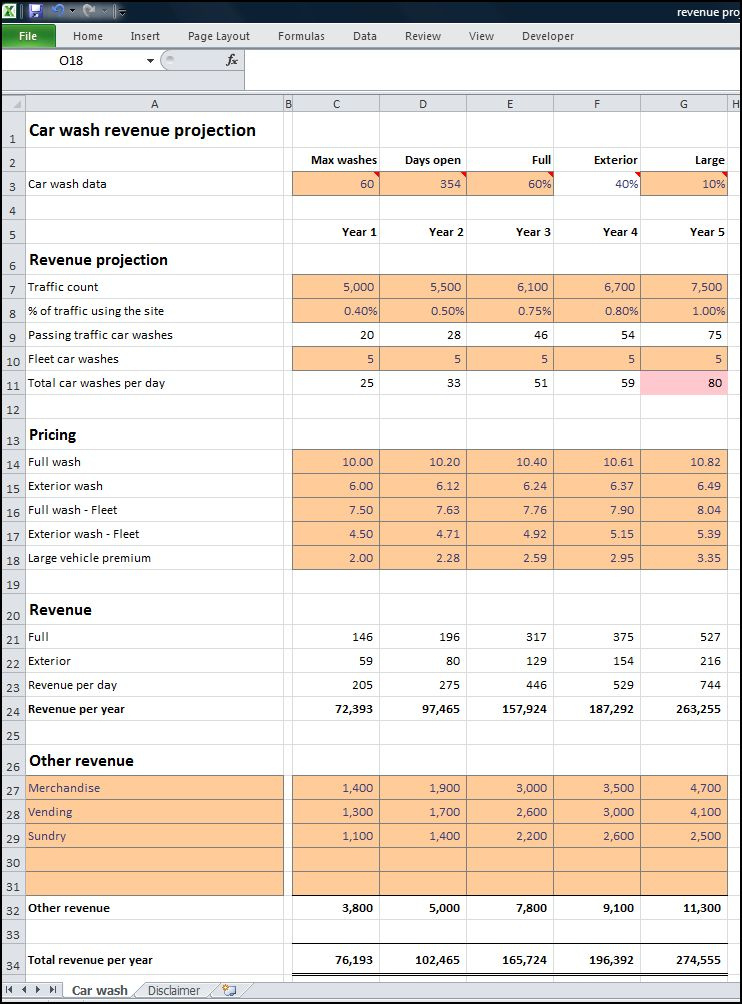

Balance sheet templates for a business plan. This financial projections template pulls together several different financial documents, including: Balance sheet forecasting is important for.

Now, let’s briefly discuss each. Assets = liabilities + owner’s equity. Detailed financial projection template:

The balance sheet projection is a forecast of your company’s future financial position. These projections are forecasts of your cash inflows and outlays, income and balance sheet. The business plan financial section for most businesses tends to concentrate on the income statement and fails to get to grips with the accounting balance sheet.

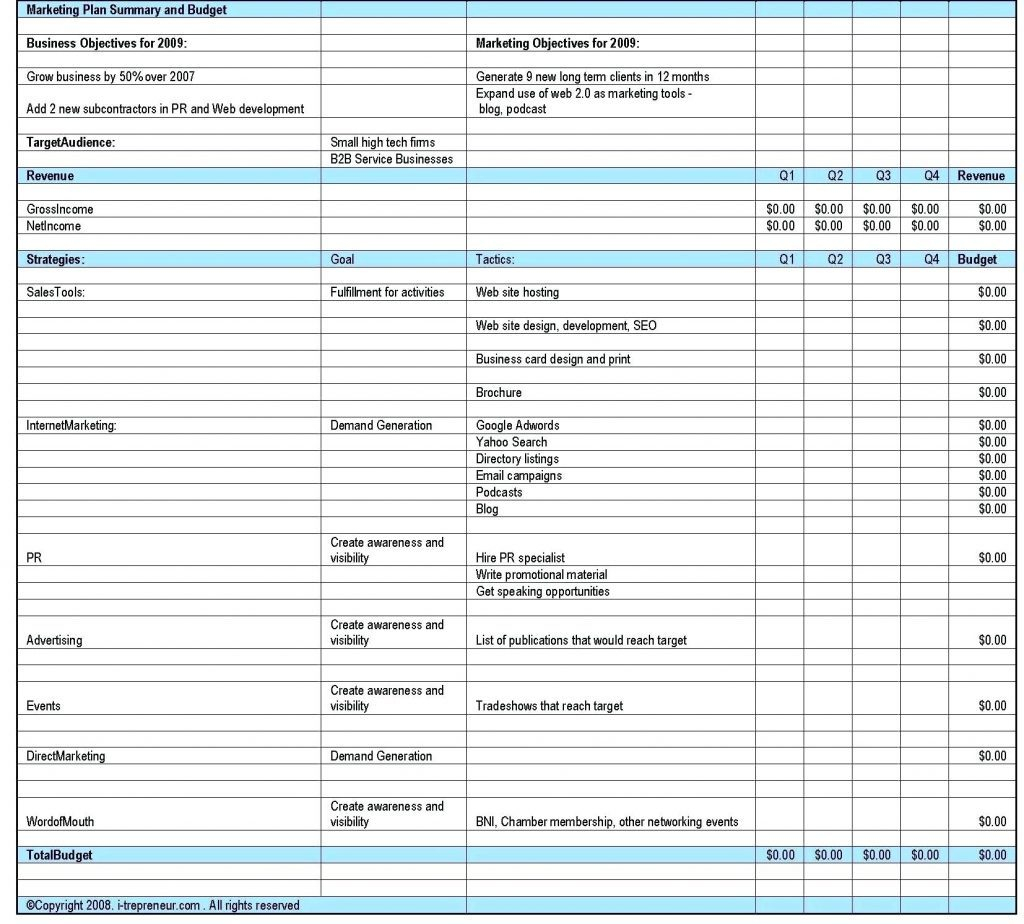

Use of the projected balance sheet forecast. Components of a business plan financial statement. Everything you need to create perfect business financial projections for startups.

They show bankers and investors how you will repay loans, what you intend to do with your money and how you will grow. When your business begins to turn a profit. Monthly and quarterly balance sheet template;

Your startup financial documents should include annual balance sheets that show the changing balance of assets, liabilities, and equity as the business progresses. The plan projections template is free, easy to set up and customize, and loaded with great features. This beautiful composition of numbers tells the reader what exactly your sources of revenue are and which expenses you spent your money on to arrive at the bottom line.

Projected balance this is another in a series of posts on standard business plan financials, continuing from last week. It also should include a brief explanation and analysis of these four statements. For existing businesses, draw on historical data to detail how your company expects metrics like revenue, expenses, profit, and cash flow to change over time.

The balance sheet shows your business’ financial status, listing its liabilities, equity, and assets balance for a certain time period. Cash flow, solvency, and liquidity. Your business will generate enough cash to.

A balance sheet is a financial breakdown of your business. Then it works out three others: