Beautiful Tips About Full Balance Sheet Ias 12 Practical Examples Tax Credit Mismatch 26as

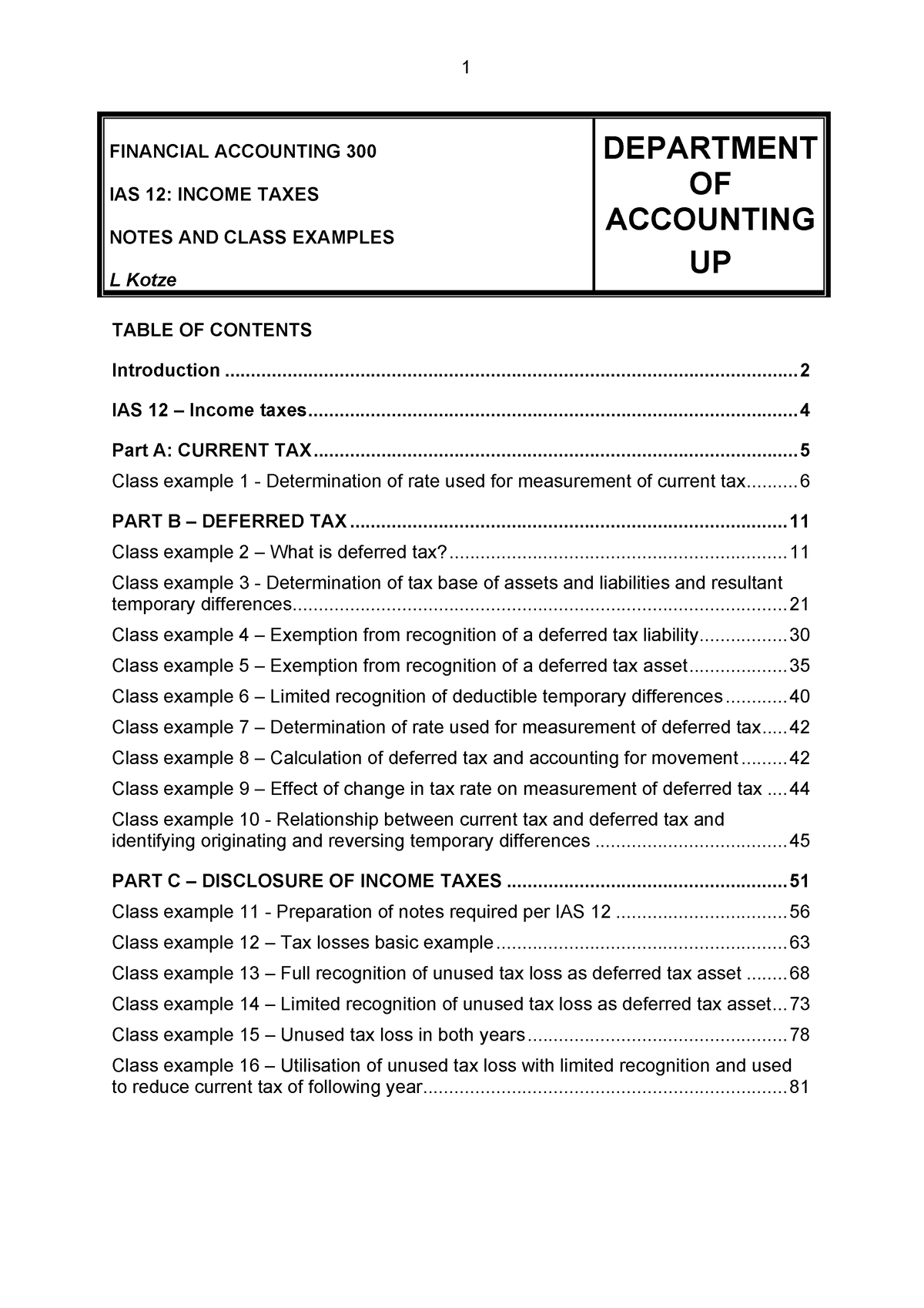

Significant differences from ifrs1 • ias 12, income taxes, provides that acquired deferred tax benefits recognised within the.

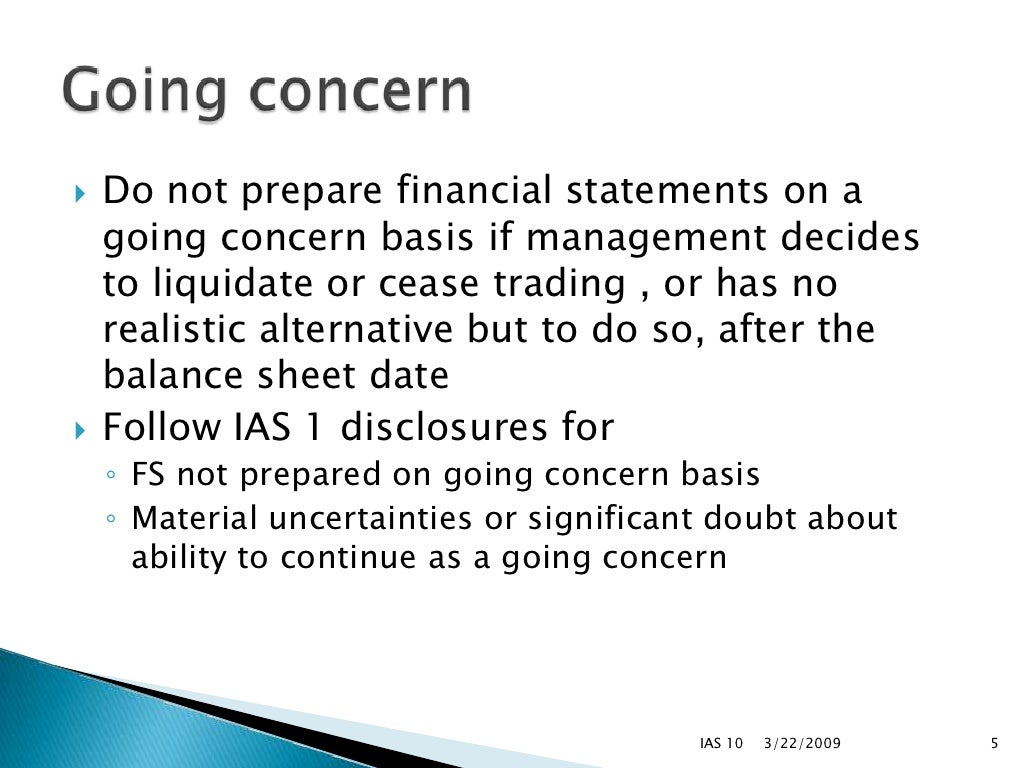

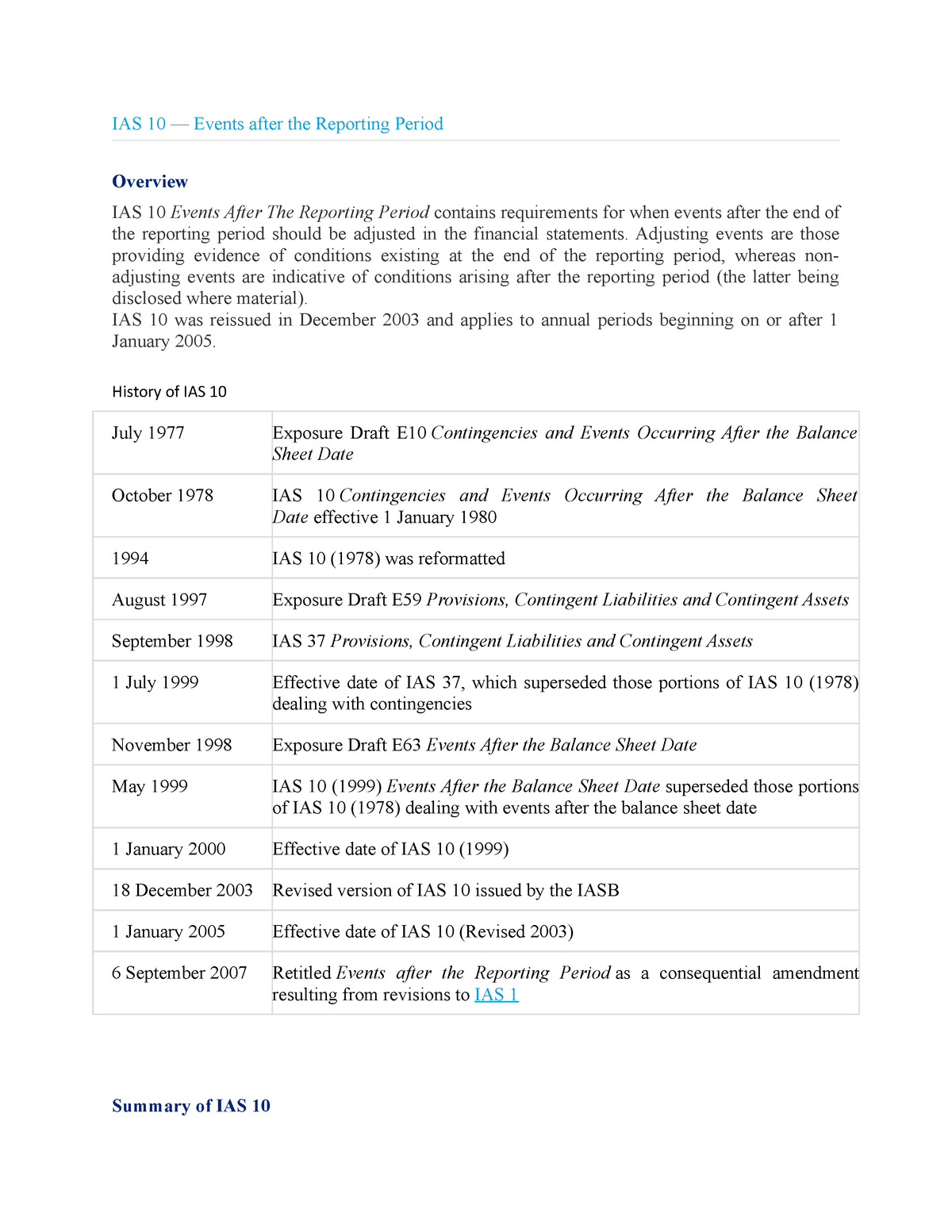

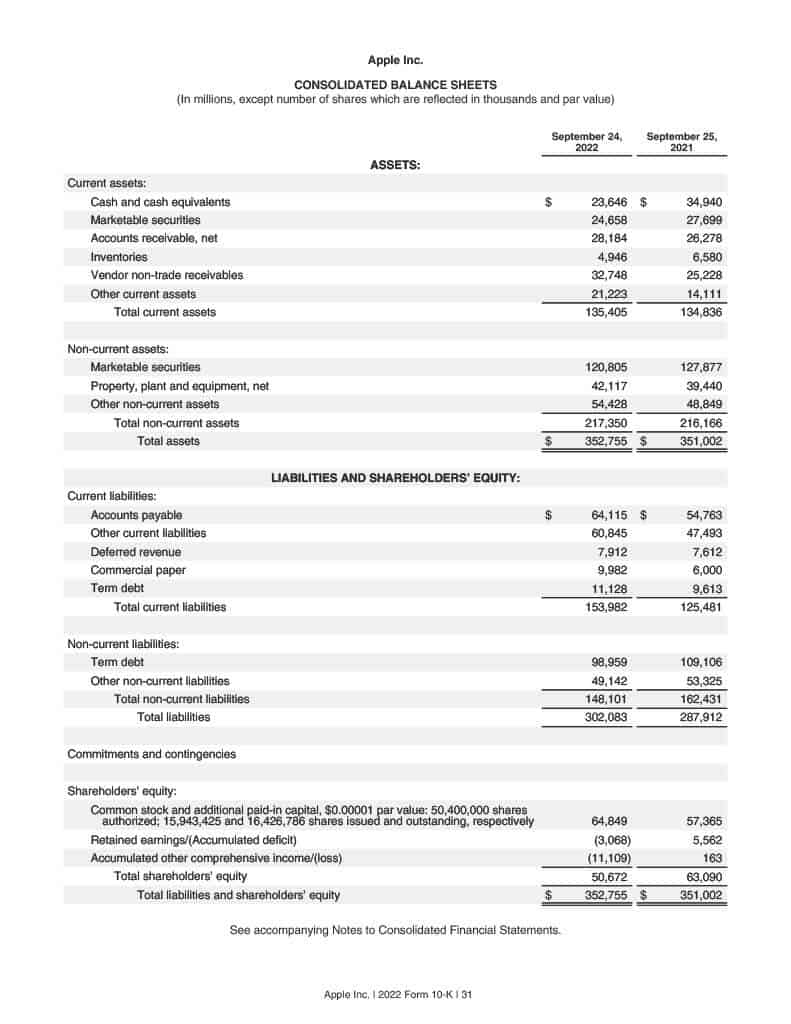

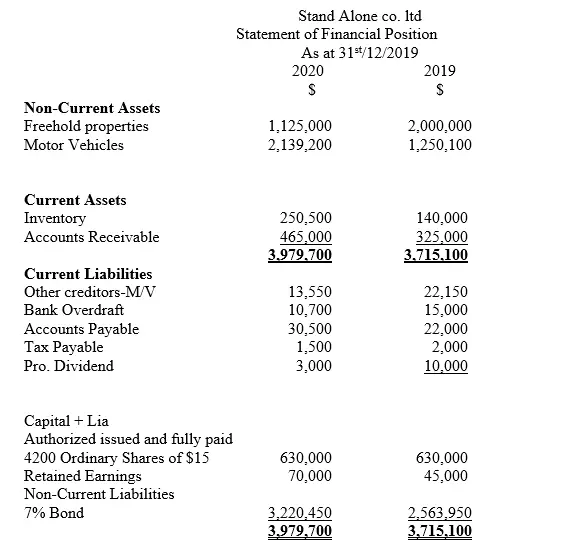

Full balance sheet ias 12 practical examples. Exemption for initial recognition of leases under ifrs 16; This course helps you understand what exactly deferred taxes are, when they arise, how current and future income taxes are recognised and. Ias 10 events after the balance sheet date replaced parts of ias 10 contingencies and events occurring after the balance sheet date (issued in june 1978) that were not.

Liability respectively in the balance sheet. (c) leases (see ifrs 16. The costs and benefits of the amendments to ias 12 (paras.

Notes to the ifrs example consolidated 12 financial statements Amendments to ias 12 income taxes. For example, some types of provisions are addressed in standards on:

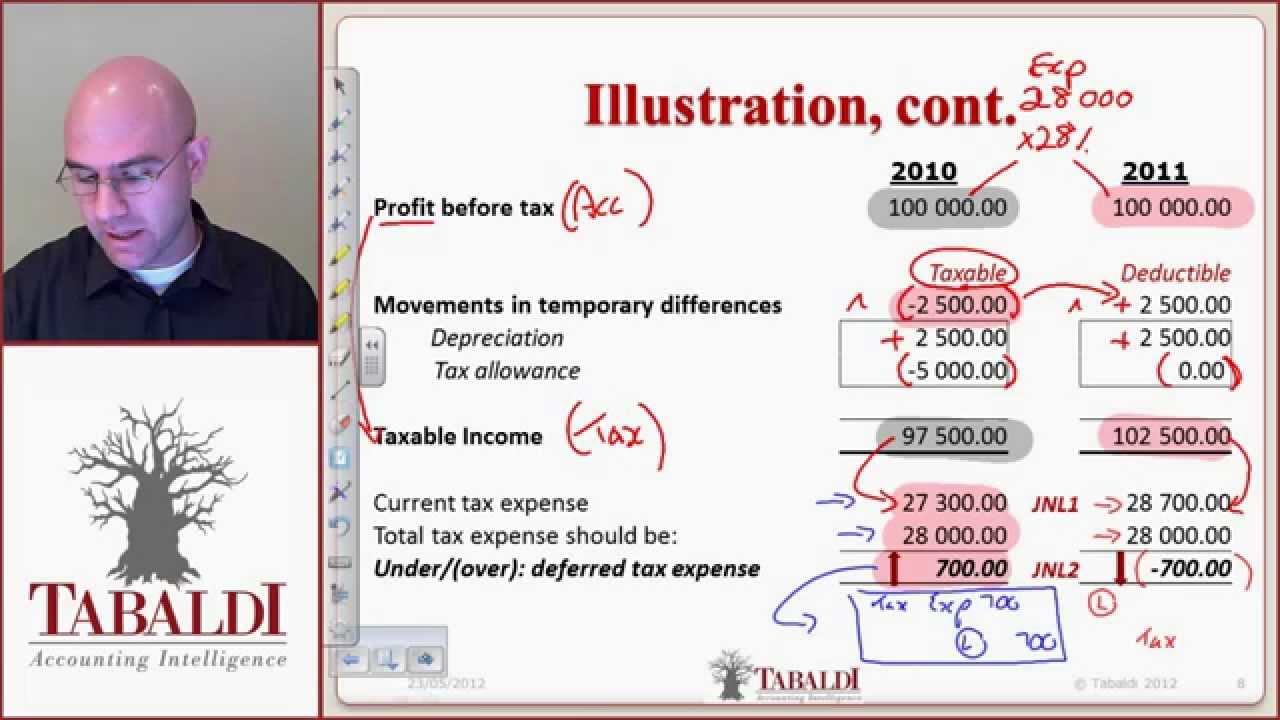

Illustrative examples on ias 12 income taxes you must log in to view this content and have a subscription package that includes this content. No, deferred taxes come into play. Ias 12 excel examples.

This revised ias 8 was part of the board’s initial agenda of technical projects. (a) [deleted] (b) income taxes (see ias 12. We explain and go through an example of.

However, i look at tax base of an asset as at something “what’s left in the tank” to deduct for tax purposes in the future. Amount, less any amount of the revenue that will not be taxable in future periods’ (ias 12.8). The iasb has amended ias 12, 'income taxes', to require companies to recognise deferred tax on particular transactions that, on initial recognition, give rise to equal amounts of.

First‑time adoption of ifrss (para. Income tax accounting is complex, and preparers and users find some. Assets for unrealised losses (amendments to ias 12) issued in january 2016 for the accompanying guidance listed below, see part b of this edition illustrative examples for.

Ias 12, income taxes, deals with taxes on income, both current tax and deferred tax.