Unbelievable Tips About Audit Report Opening Balances Not Audited Modified Basis Of Accounting

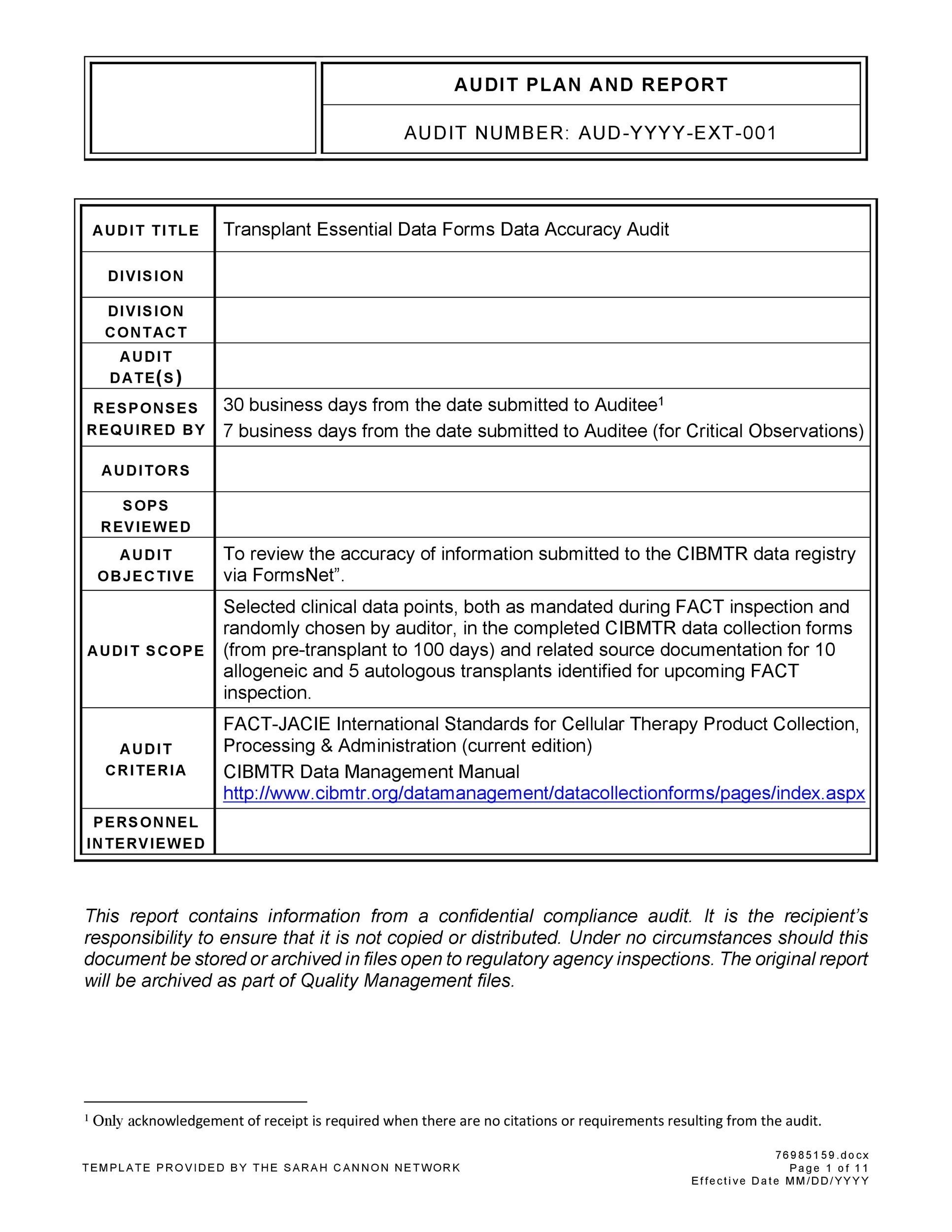

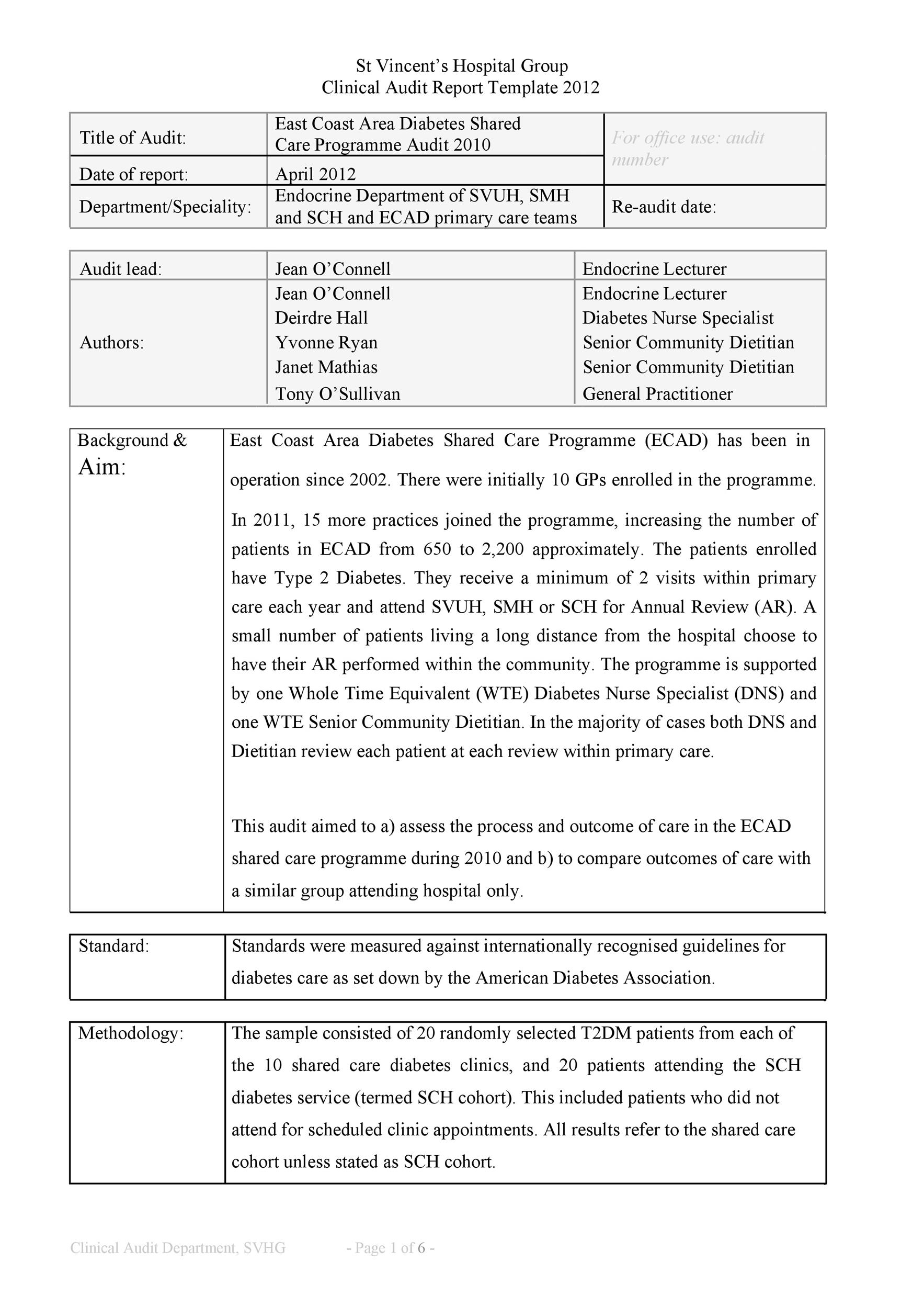

Isa 510 deals with the auditor’s responsibilities relating to opening balances in an initial audit engagement.

Audit report opening balances not audited. You cannot qualify your audit report just because the previous. The auditor should obtain appropriate evidence about whether the opening balances contain material misstatements that could affect the current period’s financial statements. Presumably, you will be auditing the opening balances in accordance with paras.

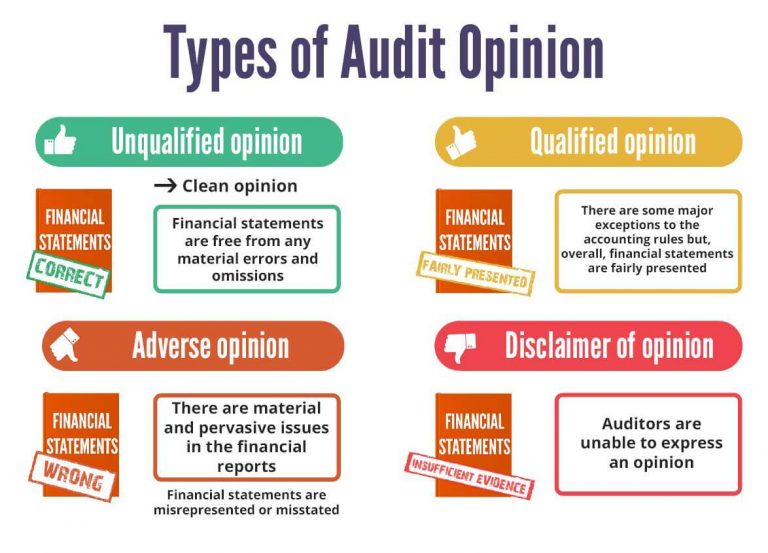

Auditing guidance statements are issued by the auditing & assurance standards board where the board wishes to provide guidance on procedural matters, guidance on entity. Unable to obtain sufficient appropriate audit evidence concerning opening balances, the auditor’s report should include: Or (ii) the financial statements for the prior period were audited by a predecessor auditor.

(a) establishes requirements and provides guidance regarding opening. Auditors are required to comply with the auditing standards contained in this ssa in. And accounting policies applied in the prior.

An other matter paragraph in the auditor’s report that the corresponding figures are unaudited. This international standard on auditing (isa) deals with the auditor’s responsibilities relating to opening balances in an initial audit engagement. Such a statement does not, however, relieve the auditor of the requirement.

If the auditor concludes that the. (i) the financial statements for the prior period were not audited; 9 & 10 of isa 510.

If auditor is unable to obtain sufficient appropriate evidence on the opening balances, express a qualified opinion or disclaim an opinion. Applying one or more of the following: Or (ii) the financial statements for the prior period were audited by a predecessor auditor.

In addition to financial statement. The completeness risk arises from the possibility that some. Opening balances do not contain material.

Opening balances purpose the purpose of this explanatory guide is to provide information to auditors who are required under australian auditing standards to modify their audit. Relating to opening balances in an initial audit engagement. (i) the financial statements for the prior period were not audited;

The purpose of this statement of auditing standards (sas) is to establish standards and provide guidance regarding auditors' consideration of opening balances taken from the. When auditing opening balances, auditors should pay attention to the following risks: Isa 510 scope.

Auditors are reminded, however, that they still have a requirement to obtain sufficient appropriate audit evidence that the opening balances do not contain misstatements that materially affect the current period’s financial statements. (a) a qualified opinion, for example: Opening balances are based upon the closing balances of the prior period and reflect the effects of: